How To Check My Property Tax Online In Mumbai

Mumbai City PIN Code. 1Please refer your latest bill copy where Payment details like Account number and IFSC code given.

Mumbai Property Tax Payment Online 2020 2021 For All Wards Of Greater Mumbai Mcgm Portal Youtube

Mumbai Property Tax Payment Online 2020 2021 For All Wards Of Greater Mumbai Mcgm Portal Youtube

Your balance details by year.

How to check my property tax online in mumbai. You may also be asked to enter details such as owner number old assessment number and door number. Digital copies of select notices from the IRS. Mumbai Property Card Suburban http164100236141pcsqlDefault.

Follow the steps listed below to pay the Property tax in Mumbai The first step is to visit the BMC Website. Today this video shows that how you can check your property tax details paid or dues through onlineHow To Check Property Tax Details Through Online In 2018. You can call the IRS to check on the status of your refund.

It is with that motive. Fill the required details such as ward number floor nature and type of building carpet area zone user category year of construction FSI. Tax Receipts can be found on the current statement page or by clicking on the Property Tax Receipts button.

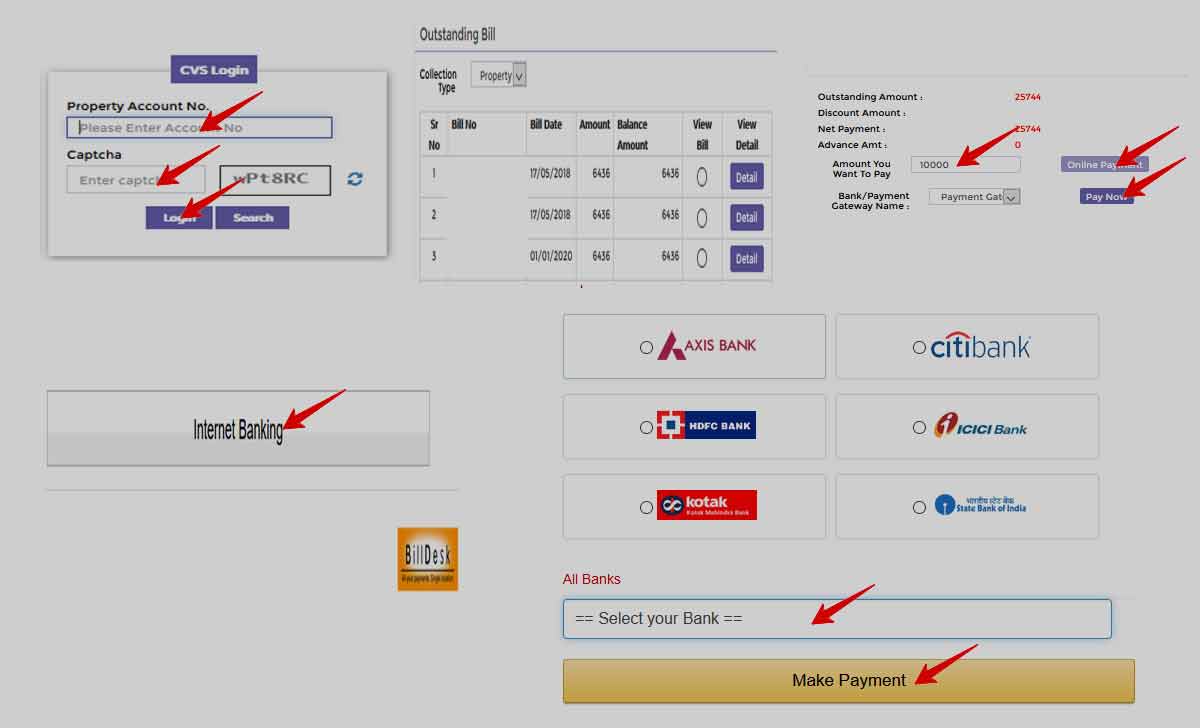

Collector dotmumbaicity atmaharashtra dotgov dotin. The link to the website is httpsportalmcgmgovin Once the page is displayed navigate to the top menu bar and click on Online Service. You can now check the due amount and the option pay online next to it.

The systems are updated once every 24 hours. Pay Property Tax Online. Check the due property tax first by entering information like Zone number division code bill number etc.

Your payment history and any scheduled or pending payments. 3SBI VAN is having more than 99 success rate. District Collector Office City.

Search using your property address and your tax reference number ie. Change in Billing Name. This is the fastest and easiest way to track your refund.

Go to the site of the municipal corporation. How to calculate BMC property tax online. 4If you add beneficaiary only once you can pay regularly in future.

Go to BMCs online Portal. Visit MCGM Portal Tax Calculator. You will be directed to a page where you need to enter the Asset Account Number.

Create or view your account. The property account number is generally mentioned in your old property tax receipt. Go to the page that allows you to pay property tax online.

Property taxpayers may use credit cards debit cards or e-Checks to pay their taxes. Here is how you can pay your property tax online at BMCs website. A drop-down menu will appear.

Click on the button pay online. Mumbai Property Card City httpprcmumbainicinjsppropertyNewjsp. How to pay property tax online in Mumbai 1Log on to wwwmcgmgovin 2 Click on Property Tax option in the left column 3 You will be redirected to a new page where you have to enter your Property Account number for log in.

Click Calculate and get the detailed property tax. Choose the method suitable for you among the options provided there. The amount you owe updated for the current calendar day.

Use the property tax reference number to pay your outstanding tax via the various payment options available. However IRS live phone assistance is extremely limited at this time. Use the Wheres My Refund tool or the IRS2Go mobile app to check your refund online.

NRIC FIN number or your property tax reference number. The Tax Office accepts full and partial payment of property taxes online. Pay Water Bills Online.

Type in the verification code shown in the image. Please click on Property Tax Details. Key information from your most recent tax return.

Click on Online Service option on top. Select Search for property. On that page enter assessment codes and area details as needed.

Payment plan details if you have one. You Will Be Able To Check Your Property Tax Bill Online In Mumbai Soon. Sunita Mishra May 23 2018 Shutterstock The richest municipal body in India is seen launching measures to increase its income significantly while providing ease of business.

2You can do NEFT or SBI VAN transfer by adding beneficiary details. You Will Be Able To Check Your Property Tax Bill Online In Mumbai Soon. Your Economic Impact Payments if any.

Read more »