Vermont Property Tax On Vehicles

Motor vehicles are subject to a 6 tax levied by the Vermont Department of Motor Vehicles and are therefore exempt from the local option rates above. Department of Motor Vehicles - 802 828-2000.

Vermont Car Insurance Guide Forbes Advisor

Vermont Car Insurance Guide Forbes Advisor

Selling price 78000 Sales tax due 1680 Total Due 79680 1CPI Vermont Department of Taxes TECHNICAL BULLETIN TAX.

Vermont property tax on vehicles. Vermont Department of Taxes Issuing 1099-Gs for Economic Recovery Grants and Taxable Refunds December 1 2020 Commissioner of Taxes Releases FY2022 Education Yield Letter. Register or Renew a Vehicle Find all of the resources you need to register and renew your vehicle in Vermont. Voter Services Register to vote and find other useful information.

If you have proof of payment of taxes to another state in your name on that vehicle we will deduct that amount from the taxes due to Vermont. Register or Renew a Vehicle Find all of the resources you need to register and renew your vehicle in Vermont. Eligibility for some benefits may depend.

Learn about the regulations for paying taxes and titling motor vehicles. Vermont Department of Motor Vehicles 120 State Street Montpelier VT 05603-0001. 44 rows Property Tax Adjustment Renter Rebate Claims Mar.

All other veterans are not exempt including veterans who may be 100 disabled. Vermont Property Tax Rates. Here is a list of current state tax rates.

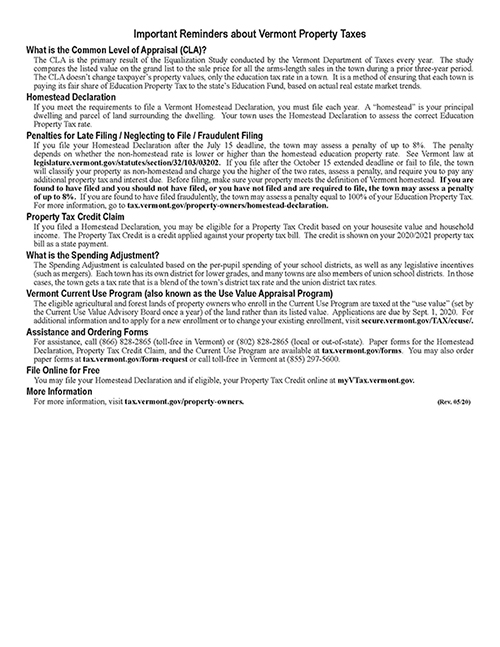

The homestead tax rate is set each year and adjusted based on the CLA described above and the spending per pupil. This value will be used to determine the amount of taxes due. A lease agreement or Vermont Dealer worksheet must be submitted with documents.

Short Term Vehicle Rentals. Vermont collects a 6 state sales tax rate on the purchase of all vehicles. Register or Renew a Vehicle Find all of the resources you need to register and renew your vehicle in Vermont.

Trucks 10099 lbs or less Trucks 10100 lbs or more - 2075 maximum 9. Veterans who meet these criteria are exempt from vehicle sales tax registration fees and license fees. Taxes for Individuals File and pay taxes online and find required forms.

Some products are subject to rates higher than those listed above. Leased Vehicles - see details. The registration application is received from a Vermont Dealer or a Vermont Dealer acting on behalf of the Lessor.

The major types of local taxes collected in Vermont include income property and sales taxes. If the individual purchases this vehicle at the end of the lease they will pay tax on the residuallease end value of the vehicle. Voter Services Register to vote and find other useful information.

Except in areas with a very high level of spending per pupil the homestead rate will. If the tax paid on an out-of-state registered vehicle was equal to or more than the Vermont tax rate no additional tax will be due. Taxes for Individuals File and pay taxes online and find required forms.

The State of Vermont offers special benefits for its military Service members and Veterans including property tax exemptions state employment preferences education and tuition assistance vehicle tags as well as hunting and fishing license privileges. Autos Cars. The State of Vermont requires collection of Purchase and Use Tax at the time of vehicle registration learn more about vehicle taxationYou are required to select the type of ownership of your vehicle at the time you register in Vermont learn about the types of vehicle ownership and when this designation is important.

Summary of Vermont Military and Veterans Benefits. In addition to taxes car purchases in Vermont may be subject to other fees like registration title and plate fees. Register or Renew a Vehicle Find all of the resources you need to register and renew your vehicle in Vermont.

Do Vermont vehicle taxes apply to trade-ins and rebates. Taxes for Individuals File and pay taxes online and find required forms. You can find these fees further down on the page.

Taxes for Individuals File and pay taxes online and find required forms. In Vermont all property is subject to education property tax to pay for the states schools. July 1 2008 as TB-43 REVISED.

For more information contact the Vermont Department of Motor Vehicles. For this purpose property is categorized as either nonresidential or homestead. If the taxes paid to the other state are less than the taxes due to the state of Vermont you will be required to pay the difference.

Voter Services Register to vote and find other useful information. By Vermont law property owners whose homes meet the definition of a Vermont homestead must file Form HS-122 Section A Homestead Declaration annually by April 18. Tax on Tracked Vehicles REFERENCE.

Voter Services Register to vote and find other useful information. These taxes are collected to provide essential state functions resources and programs to benefit both our taxpayers and Vermont at large. In Vermont rates on residential owner-occupied property are generally lower than those on other types of property.

32 VSA 9741 38 TB-52 ISSUED.

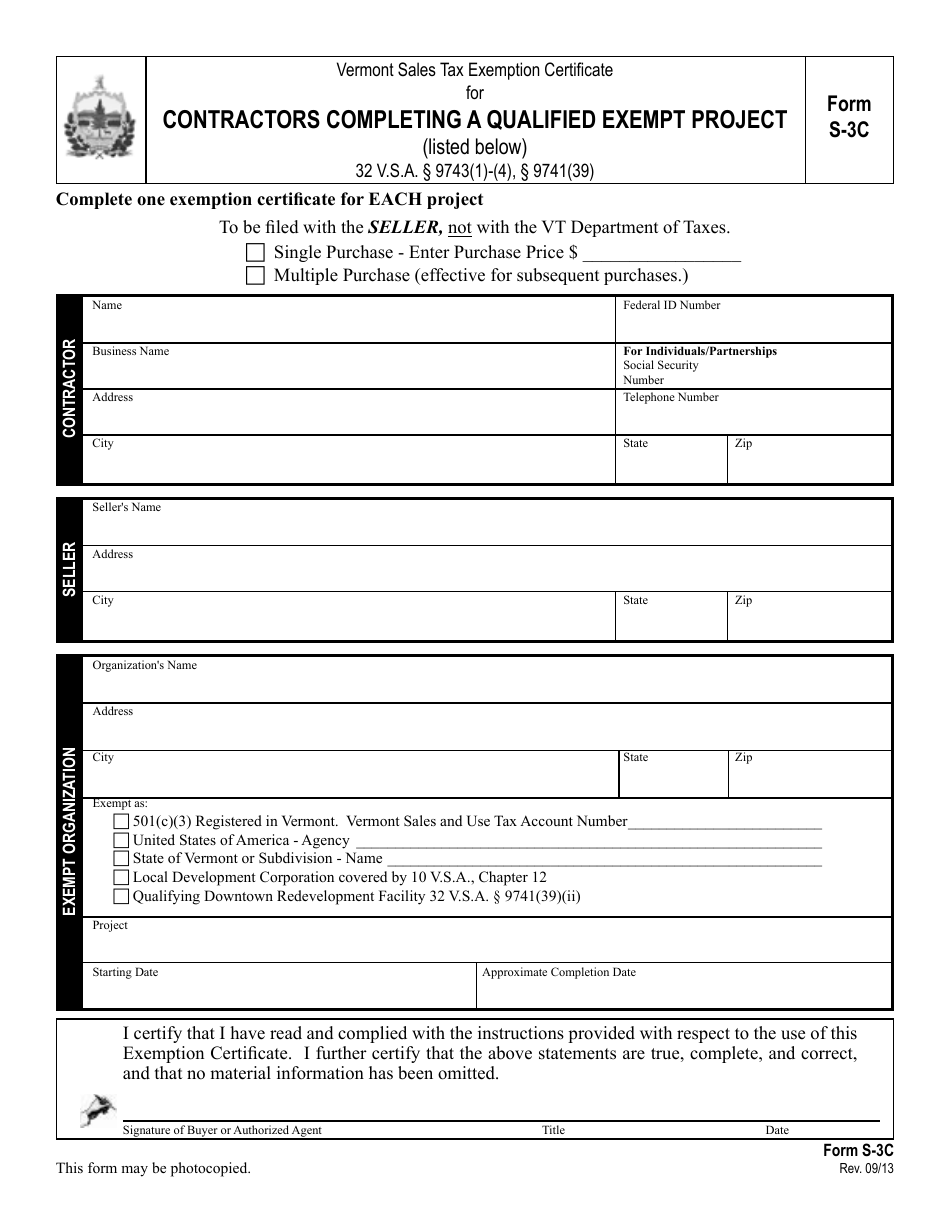

Vt Form S 3c Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Contractors Completing A Qualified Exempt Project Vermont Templateroller

Vt Form S 3c Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Contractors Completing A Qualified Exempt Project Vermont Templateroller

10 No 42 Vermont Best Places To Travel Amazing Travel Destinations Places To Travel

10 No 42 Vermont Best Places To Travel Amazing Travel Destinations Places To Travel

Half Of Vermont Towns Will See Increased Property Tax Rates Vtdigger

Half Of Vermont Towns Will See Increased Property Tax Rates Vtdigger

Half Of Vermont Towns Will See Increased Property Tax Rates Vtdigger

Half Of Vermont Towns Will See Increased Property Tax Rates Vtdigger

What S Vermont Doing To Improve Broadband Access Vermont Public Radio

What S Vermont Doing To Improve Broadband Access Vermont Public Radio

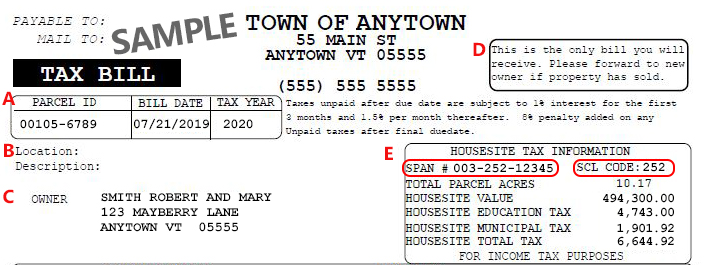

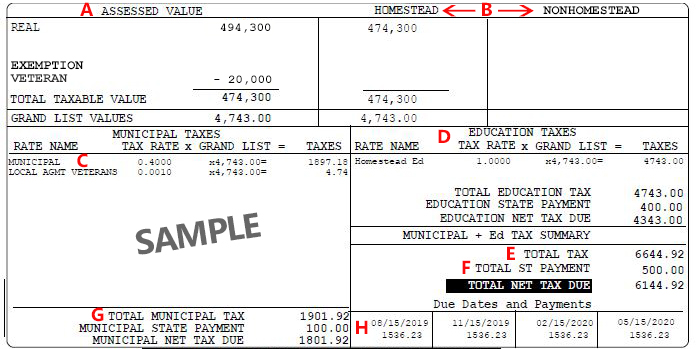

Understanding Your Property Tax Bill Department Of Taxes

Understanding Your Property Tax Bill Department Of Taxes

Understanding Your Property Tax Bill Department Of Taxes

Understanding Your Property Tax Bill Department Of Taxes

A View Of Jay Peak Resort Jay Vt Jay Peak Jay Peak Resort Places To Go

A View Of Jay Peak Resort Jay Vt Jay Peak Jay Peak Resort Places To Go

Pin On Vermont Mutual Insurance Company

Pin On Vermont Mutual Insurance Company

506 N Hill Rd Stowe Vt 05672 Realtor Com

506 N Hill Rd Stowe Vt 05672 Realtor Com

Understanding Your Property Tax Bill Department Of Taxes

Understanding Your Property Tax Bill Department Of Taxes

Vermont Do Not Resuscitate Form Templates Legal Forms Template Site

Vermont Do Not Resuscitate Form Templates Legal Forms Template Site

Vermont House Votes To Raise Property Taxes Give Relief To Schools Property Tax Veterans Services Vermont

Vermont House Votes To Raise Property Taxes Give Relief To Schools Property Tax Veterans Services Vermont

225 Pleasant St Chester Vt 05143 Mls 4826630 Zillow

225 Pleasant St Chester Vt 05143 Mls 4826630 Zillow

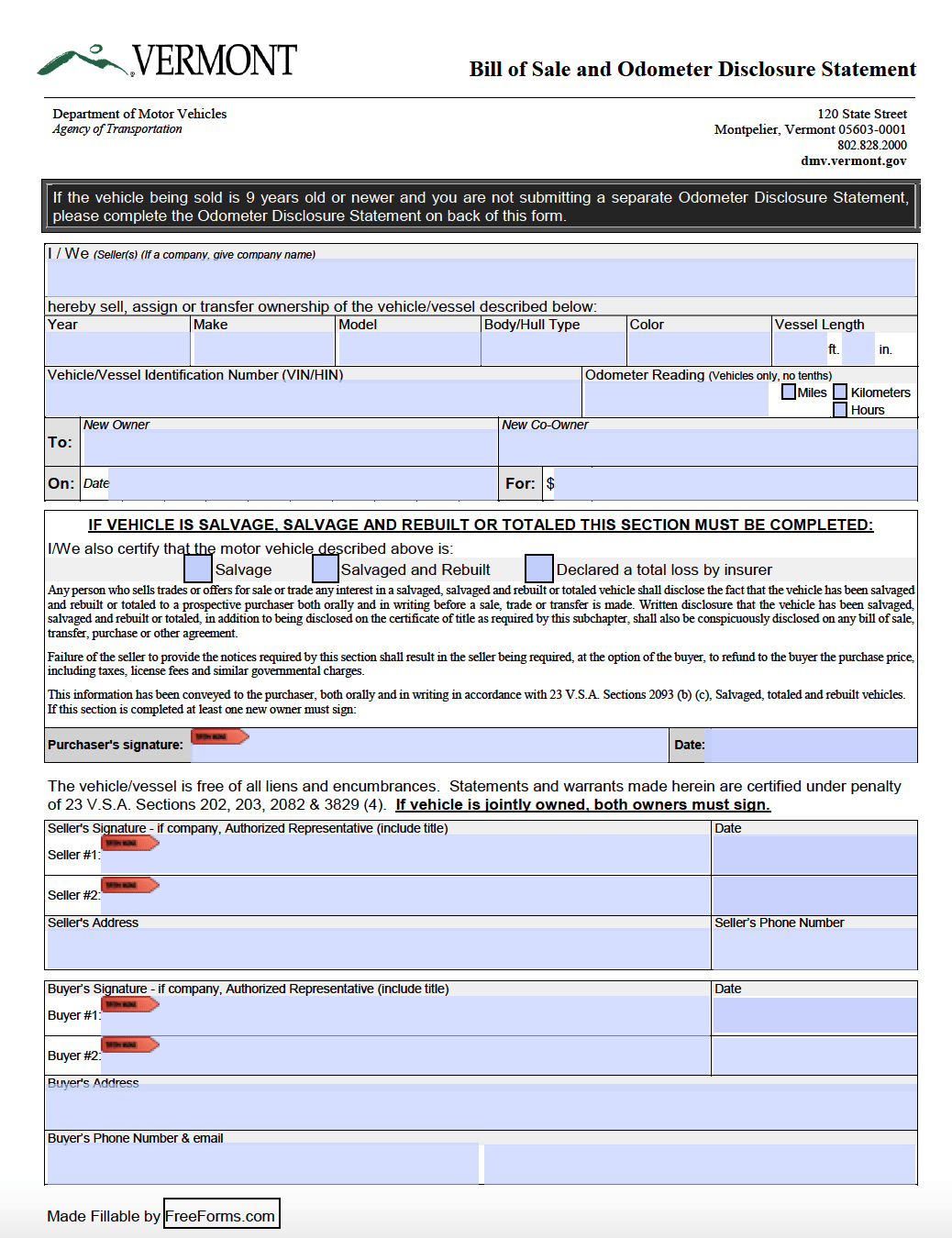

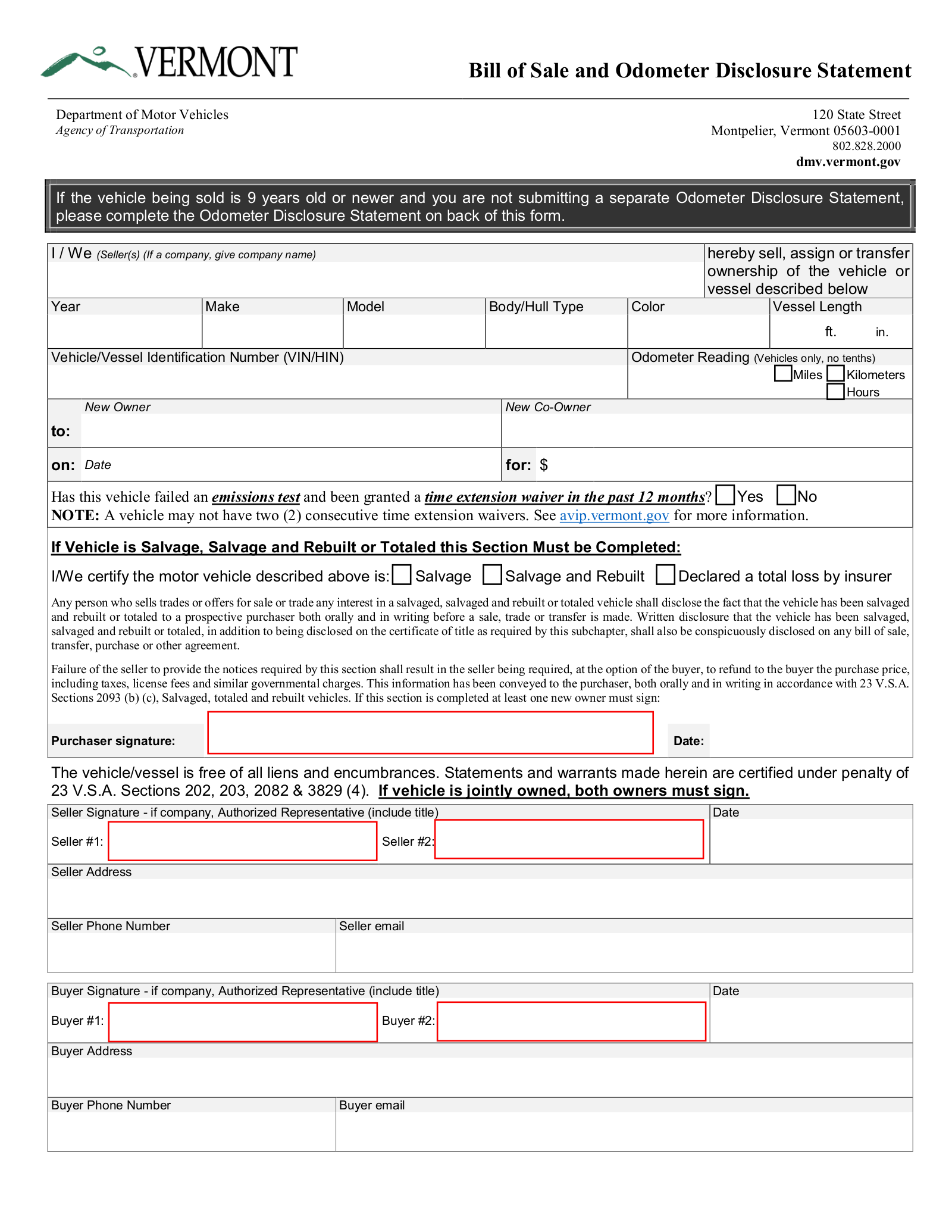

Free Vermont Bill Of Sale Forms Pdf

Free Vermont Bill Of Sale Forms Pdf

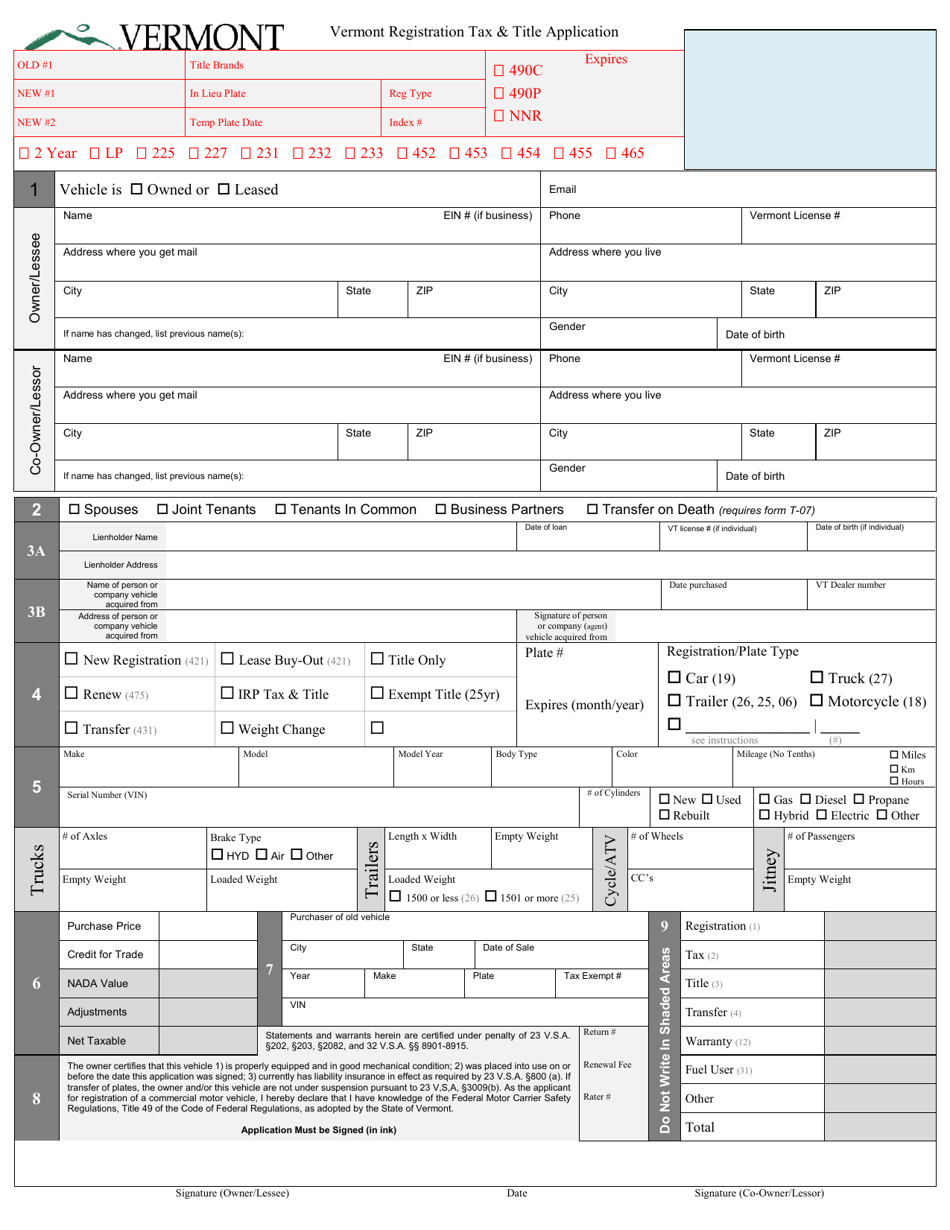

Form Vd 119 Download Fillable Pdf Or Fill Online Registration Tax Title Application Vermont Templateroller

Form Vd 119 Download Fillable Pdf Or Fill Online Registration Tax Title Application Vermont Templateroller

Vermont Motor Vehicle Bill Of Sale Form Vt 005 Eforms

Vermont Motor Vehicle Bill Of Sale Form Vt 005 Eforms

Vt Real Estate Vt Homes For Sale With 500 Acres Maple Sweet Vt

Vt Real Estate Vt Homes For Sale With 500 Acres Maple Sweet Vt

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home