Property Tax Reform In Jamaica

In 1957 Jamaica converted its property tax from one based on the capital value of land and all improvements to one based on just the unimproved value of land ie to a land value tax. In what may have influenced recommendations in the Planning Institute of Jamaicas recent Growth-Inducement Strategy and the new revenue measures in the Budget they recommended lowering of property tax and property-transfer rates including inheritance and elimination of stamp duty and tax on the transfer of securities.

Welcome To Jamaica Home Of The World S Best Performing Stock Market Stock Market Marketing Stock Exchange

Welcome To Jamaica Home Of The World S Best Performing Stock Market Stock Market Marketing Stock Exchange

Under the new property tax system the tax burden is more fairly shared among property owners.

Property tax reform in jamaica. In an effort to continue improving Tax Administration in Jamaica the Government through the Tax Administration Reform Project TaxARP implemented the Taxpayer Registration System to facilitate the registration and assignment of the Taxpayer Registration Number or TRN. Withholding Tax on Specified Services. Amounts to be paid remain the same as last year as there has been no increase in property tax rates.

Nigel Clarke in opening the 201920 budget debates at Gordon House in Kingston on March 7th. Betting Gaming and Lotteries. In particular the Government of Jamaica is committed to reforming the tax system to ensure that the system is simple efficient provides equity and fairness and stimulates economic growth whilst yielding adequate amounts of revenue.

General Consumption Tax GCT Special Consumption Tax SCT Guest Accommodation Room Tax GART and Telephone Call Tax TCT as well as payment of Property Tax have been extended to May 1 2015. Importance of Payment of Property Tax. Property owners are reminded that they have the option of paying.

It is used for. Property owners are reminded that they have the option of paying their property tax in half-yearly instalments on April 1 and October 1 or in quarterly instalments. Historically the tax system has been characterised by narrow tax bases distortionary waivers and non-standard incentives which assisted in creating an inequitable tax system with declining revenues ie.

Tax Administration Jamaica TAJ is again reminding property owners that although Property Tax for 2016-2017 becomes due April 1 persons have until the end of April to pay and avoid a 10 penalty which may be applied. Tax Administration Jamaica TAJ is advising property owners that the reduced property tax rates for fiscal year 2017-18 recently announced by the Minister of Finance and the Public Service in his address to Parliament have now been reconfigured on the administrations Property Tax System. TAJ to host Transfer Tax expert in Jamaica.

Due date for Filing Consumption Taxes and Property Tax Payments Extended. Tax on property with unimproved value 12000001 to 30000000 is 080. Stamp Duty.

The Government of Jamaica in collaboration with its multilateral partners have committed to a broader tax reform to be implemented over the medium term. Tax Administration Jamaica TAJ is advising that the due date for filing of Consumption Taxes to include. The legislation was piloted by Minster of Finance and the Public Service Dr.

Property taxes are collected in each parish by. Reduction in Transfer Tax payable on the transfer of chargeable property from 5 to 2 04 Increase in Transfer Tax Estate Threshold Increase in minimum estate value on which transfer tax is levied on the value of a deceased persons estate from JA100000 to JA10 million. Jamaicans on April 1 began experiencing the impact of several new tax measures as announced by Minister of Finance and the Public Service Dr.

Tax Compliance Certificate TCC Taxpayer Registration Number. The House of Representatives on Tuesday December 10 passed the Transfer Tax Amendment Act 2019 making permanent the two 201920 transfer tax revenue measures that were implemented in April. All properties with an unimproved value of up to J30000000 is charged a flat rate of J100000.

Properties with values exceeding J30000000 will attract an additional 075 for every additional dollar. Property taxes are used for financing property-related services in communities throughout Jamaica. Tax on property with unimproved value greater than 30000001 is 090.

May 10 2019. PROPERTY TAX REMAINS IN YOUR PARISH. Under the programme of Local Government Reform taxes collected for properties in each parish will remain in the parish and will be used by the Local Authorities Parish Councils to pay for property-related services.

Publications for Property Tax. Property Tax Payments and Queries. 01 Increase in GCT Threshold Increase in General Consumption Tax GCT.

Tax Administration Jamaica TAJ is advising all property owners that there is still time to make their Property Tax payments for the 201819 fiscal year without penalties being applied as is provided for in the law. The property tax regime has been reformed to expand the number of value bands to eight 8 with reduced tax rates ranging from a flat rate of 1000 on properties valued at 400000 or less up to high of 13 on properties valued over 30000000.

Https Www Jstor Org Stable Pdf Resrep18544 3 Pdf

Tiny Task 4 Gather All Tax Paperwork Metropolitan Organizing Organization Hacks Tiny Task Organization

Tiny Task 4 Gather All Tax Paperwork Metropolitan Organizing Organization Hacks Tiny Task Organization

Property Tax Administration In Practice A Case Study Of The Portmore Municipality Jamaica Semantic Scholar

Property Tax Administration In Practice A Case Study Of The Portmore Municipality Jamaica Semantic Scholar

This Is Your Opportunity To Be A Part Of The Newest Addition To Kingston S Skyline Join Us At Our Offices Friday Saturday And Sunda Jamaica Kingston Skyline

This Is Your Opportunity To Be A Part Of The Newest Addition To Kingston S Skyline Join Us At Our Offices Friday Saturday And Sunda Jamaica Kingston Skyline

Widcombe Estate Is A Gated 25 Acre Property With 32 Prime Lots For Sale In Phase 1 In The Hills Of Kingston 6 Conta Land For Sale House Styles Lots For Sale

Widcombe Estate Is A Gated 25 Acre Property With 32 Prime Lots For Sale In Phase 1 In The Hills Of Kingston 6 Conta Land For Sale House Styles Lots For Sale

Status Of Recent Tax Reform In Jamaica Benchmarking Tax

Status Of Recent Tax Reform In Jamaica Benchmarking Tax

Property Tax Administration In Practice A Case Study Of The Portmore Municipality Jamaica Semantic Scholar

Property Tax Administration In Practice A Case Study Of The Portmore Municipality Jamaica Semantic Scholar

Prime Commercial Real Estate For Sale On Balmoral Ave The Property Comprises A Newly Renovated Building Of 17 800 Sq House Commercial Real Estate House Styles

Prime Commercial Real Estate For Sale On Balmoral Ave The Property Comprises A Newly Renovated Building Of 17 800 Sq House Commercial Real Estate House Styles

Young People Retirees Can Use Tax Cuts To Acquire Property Loop News

Young People Retirees Can Use Tax Cuts To Acquire Property Loop News

Property Tax Administration In Practice A Case Study Of The Portmore Municipality Jamaica Semantic Scholar

Property Tax Administration In Practice A Case Study Of The Portmore Municipality Jamaica Semantic Scholar

Property Tax Administration In Practice A Case Study Of The Portmore Municipality Jamaica Semantic Scholar

Property Tax Administration In Practice A Case Study Of The Portmore Municipality Jamaica Semantic Scholar

Your Guide To Buying Property In Jamaica Caribbean Escape

Your Guide To Buying Property In Jamaica Caribbean Escape

Property Tax Administration In Practice A Case Study Of The Portmore Municipality Jamaica Semantic Scholar

Property Tax Administration In Practice A Case Study Of The Portmore Municipality Jamaica Semantic Scholar

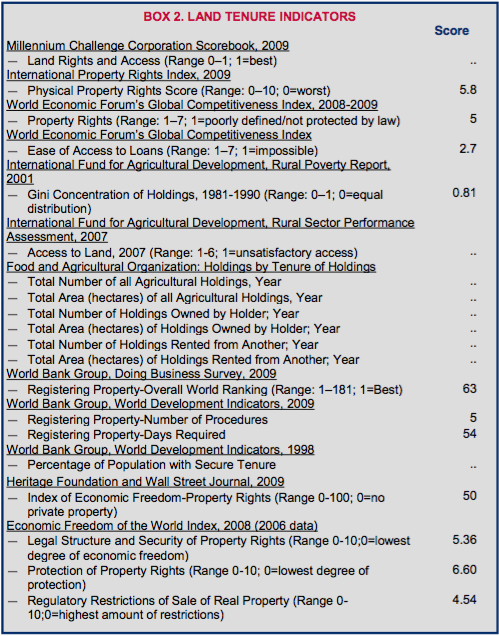

Pdf Property Transfer Tax And Stamp Duty

Pdf Property Transfer Tax And Stamp Duty

Young People Retirees Can Use Tax Cuts To Acquire Property Loop News

Young People Retirees Can Use Tax Cuts To Acquire Property Loop News

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home