Does North Carolina Have Property Tax On Vehicles

If the address on your vehicle registration is current you will receive a renewal notice that. Active duty non-resident military personnel may be exempt from North Carolina motor vehicle property tax.

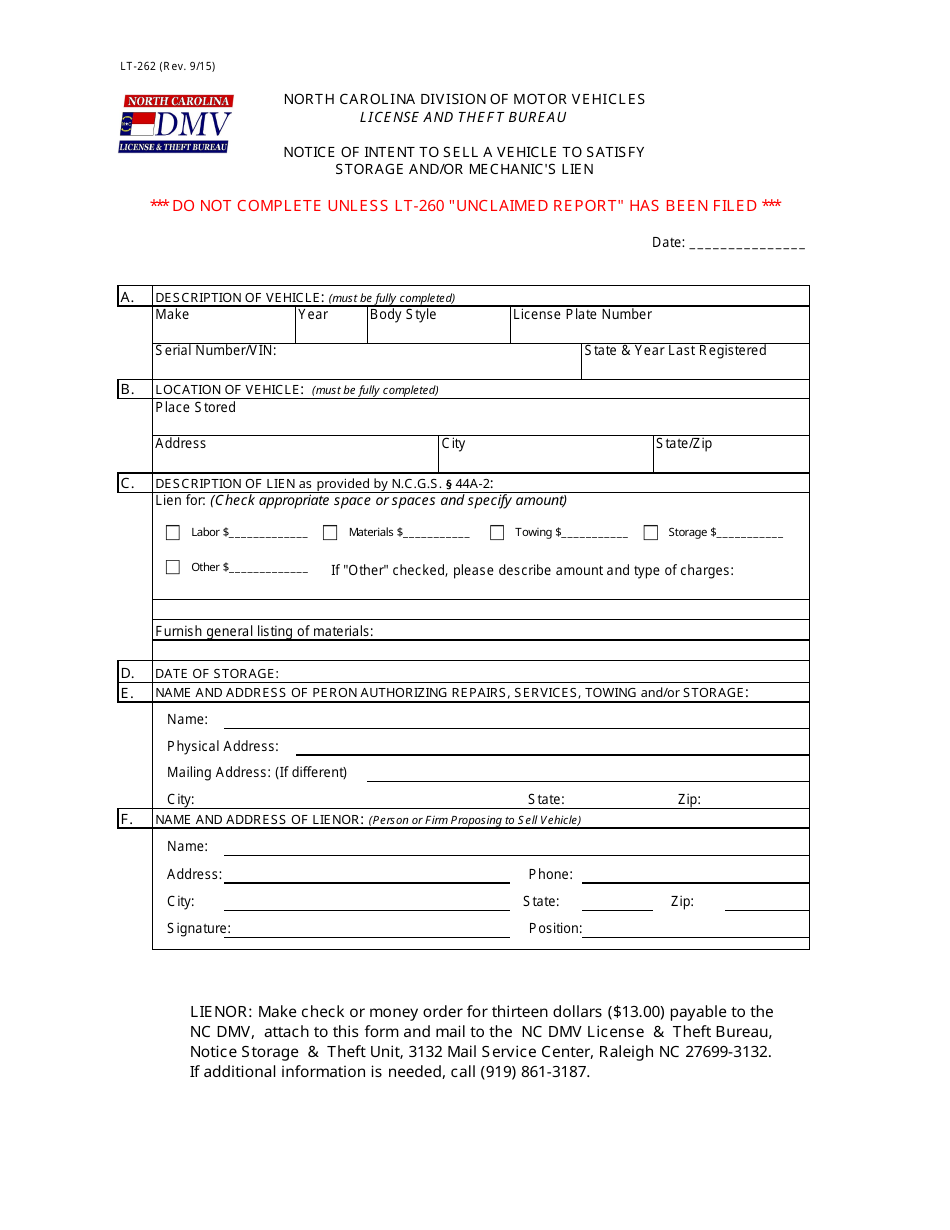

Form Lt 262 Download Printable Pdf Or Fill Online Notice Of Intent To Sell A Vehicle To Satisfy Storage And Or Mechanic S Lien North Carolina Templateroller

Form Lt 262 Download Printable Pdf Or Fill Online Notice Of Intent To Sell A Vehicle To Satisfy Storage And Or Mechanic S Lien North Carolina Templateroller

Division of Motor Vehicles collects as defined by law on behalf of counties Revenue from the highway-use tax goes to the North Carolina Highway Trust Fund and the North Carolinas General.

Does north carolina have property tax on vehicles. Contact your county tax department for more. In the state of North Carolina the traditional sales tax paid on automobiles is supplemented by an annual vehicle property tax payment which is derived from the current value of the car. North Carolina Property Tax.

The amount of the tax varies widely depending on millage rates but the DMV offers a. Residents receive an annual vehicle tax and registration statement from the state. But the effective rate statewide comes to 0855 percent and costs the typical Tarheel a little under 1500 a year.

Vehicle Property Tax North Carolina charges an annual personal property tax on cars. The state requires the counties to assess and collect property taxes on cars registered with the Department of Motor Vehicles or DMV. The first step towards understanding North Carolinas tax code is knowing the basics.

These states include North Carolina Idaho Washington Virginia Colorado Michigan Wyoming Georgia Missouri and Nebraska. How much this tax will cost you depends on where you live since vehicle property tax rates vary. North Carolinas vehicle Tag and Tax Together program was designed to collect vehicle property taxes along with registration renewals and to conveniently pay them together.

Below are all the effective tax rates for each county in North Carolina. The property owner must be a veteran of any branch of the US Armed Forces with an honorable discharge AND. Long-term lease or rental.

North Carolina generally collects whats known as the highway-use tax instead of sales tax on vehicles whenever a title is transferred. If you purchase or register a vehicle in North Carolina property taxes are added to the registration fee. According to the Sierra Club just since the start of 2017 six states Indiana South Carolina Kansas Tennessee New Hampshire and Montana have.

While each state has its own method for calculating property taxes. Your county vehicle property tax due may be higher or lower depending on other factors. 2 Next Enter Vehicle Address.

North Carolina policy states that all vehicles will be taxed at 100 percent of their appraised value. Say Thanks by clicking the thumb icon in a post. 105-1871 a 3 as a lease or rental made under a written agreement to lease or rent one or more vehicles to the same person for a period of at least 365 continuous days and that is not a vehicle subscription.

The calculator should not be used to determine your actual tax bill. To qualify for the disabled veteran homestead property tax relief under North Carolina law a person must meet the following criteria. You can enter this expense under Deductions and Credits in the section Cars and Other Things That You Own.

To qualify for an exemption you must present a copy of your Leave Earnings Statement LES to the county tax office. Non-business personal property is exempt from taxes in the Tar Heel State with the exception of automobiles. This calculator is designed to estimate the county vehicle property tax for your vehicle.

The property owner must have a permanent total service connected disability of 100 OR. If you do not claim North Carolina as your home of record the Service Members Civil Relief Act SCRA provides that the property tax may be released if you furnish to our office a current Leave and Earnings Statement LES. Click the tabs below to explore.

The North Carolina Department of Motor Vehicles DMV is responsible for the bulk of the processes that are undertaken in order to ensure that every vehicle owner in the state has the. Property taxes are assessed at the local level so youll need to consult local rates to know for sure what youll be paying. Vehicles are also subject to property taxes which the NC.

Eleven states now charge owners of EVs including plug-in hybrids and in some cases hybrid electric vehicles some form of an annual tax or fee at registration. Enter the Vehicles NC. In North Carolina you can deduct the Vehicle Property Tax you paid on your vehicles.

Below we have highlighted a number of tax rates ranks and measures detailing North Carolinas income tax business tax sales tax and property tax systems. How does North Carolina rank.

The States With The Lowest Car Tax The Motley Fool

The States With The Lowest Car Tax The Motley Fool

Nc Vehicle Registration Renewal And Titling Information Complete Guide

Nc Vehicle Registration Renewal And Titling Information Complete Guide

Best Cheap Car Insurance North Carolina Nc 2021 Forbes Advisor

Best Cheap Car Insurance North Carolina Nc 2021 Forbes Advisor

Free North Carolina Last Will And Testament Templates Pdf Docx Formswift Last Will And Testament Will And Testament Personal Financial Statement

Free North Carolina Last Will And Testament Templates Pdf Docx Formswift Last Will And Testament Will And Testament Personal Financial Statement

A Commercial Pilot Who Worked As An Assistant Hunting And Fishing Guide And Transporter In Alaska Since The 1980s Has Been Income Tax Tax Lawyer Types Of Taxes

A Commercial Pilot Who Worked As An Assistant Hunting And Fishing Guide And Transporter In Alaska Since The 1980s Has Been Income Tax Tax Lawyer Types Of Taxes

Http Www Rpmgo Com Selling A Car With A Lost Title Selling A Car With A Lost Title Buy Used Cars Cheap Cars For Sale Buy And Sell Cars

Http Www Rpmgo Com Selling A Car With A Lost Title Selling A Car With A Lost Title Buy Used Cars Cheap Cars For Sale Buy And Sell Cars

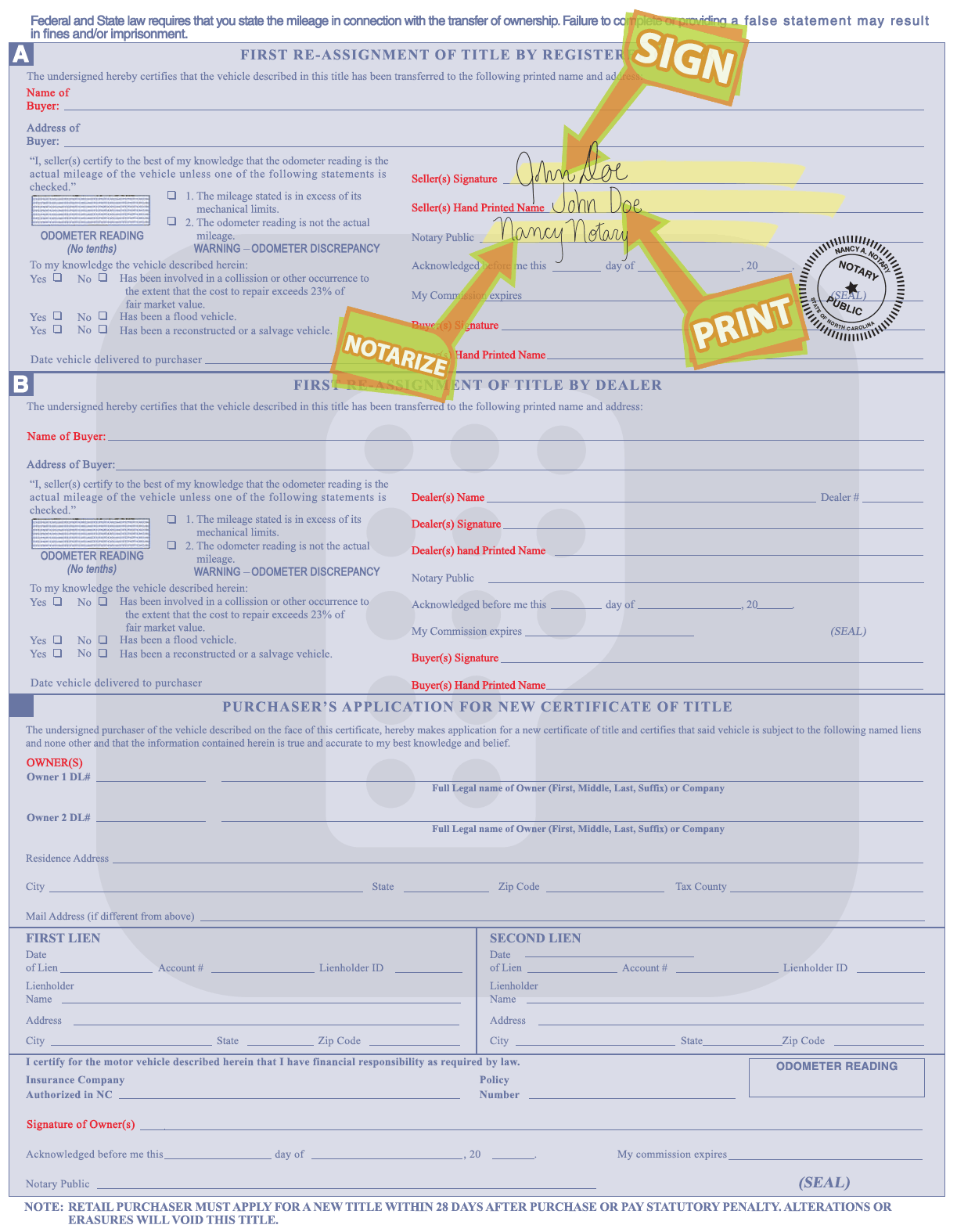

How To Sell A Car In North Carolina Following Regulations From Nc Dmv

How To Sell A Car In North Carolina Following Regulations From Nc Dmv

North Carolina Title Processing Information Donate A Car 2 Charity

North Carolina Title Processing Information Donate A Car 2 Charity

Https Www Ncdot Gov About Us How We Operate Finance Budget Nc First Documents Nc First Brief Edition 8 Pdf

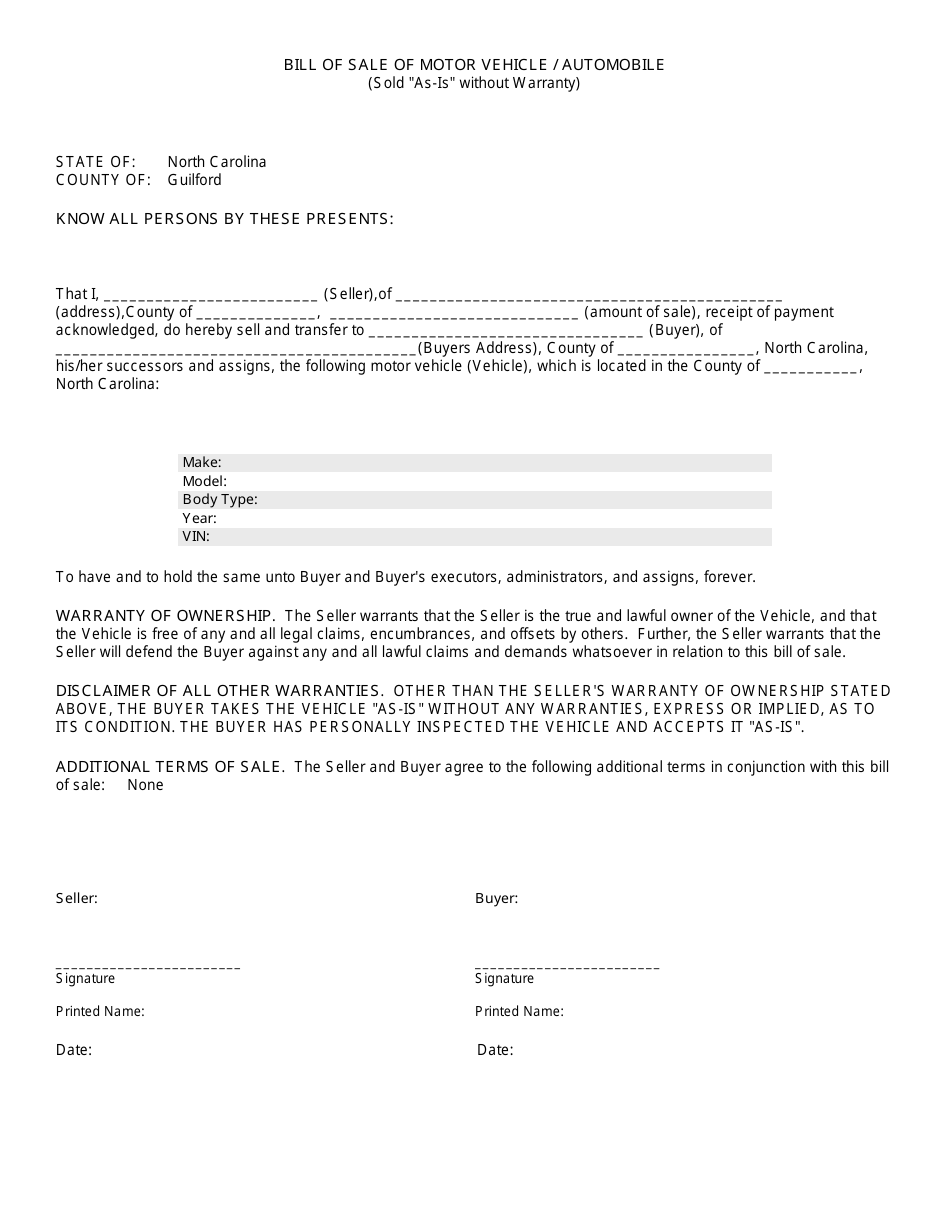

Guilford County North Carolina Bill Of Sale Of Motor Vehicle Automobile Download Printable Pdf Templateroller

Guilford County North Carolina Bill Of Sale Of Motor Vehicle Automobile Download Printable Pdf Templateroller

Motor Vehicles Information Tax Department Tax Department North Carolina

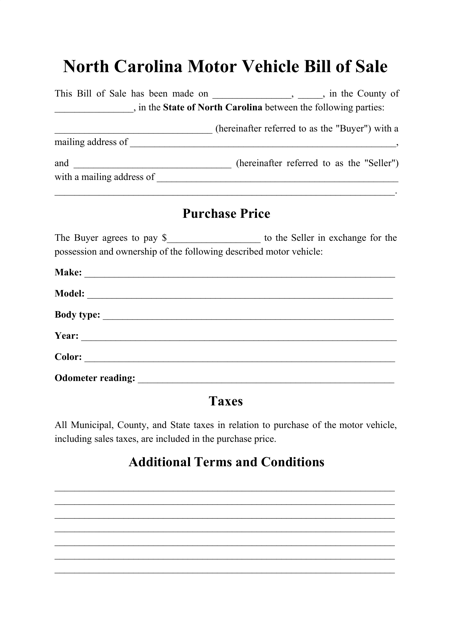

Free North Carolina Bill Of Sale Forms Fill Pdf Online Print Templateroller

Free North Carolina Bill Of Sale Forms Fill Pdf Online Print Templateroller

North Carolina Nc Car Sales Tax Everything You Need To Know

North Carolina Nc Car Sales Tax Everything You Need To Know

Free North Carolina Bill Of Sale Form Pdf Template Legaltemplates

Free North Carolina Bill Of Sale Form Pdf Template Legaltemplates

Free North Carolina Bill Of Sale Forms Pdf

Free North Carolina Bill Of Sale Forms Pdf

Best Cheap Car Insurance North Carolina Nc 2021 Forbes Advisor

Best Cheap Car Insurance North Carolina Nc 2021 Forbes Advisor

North Carolina Registration Card Page 5 Line 17qq Com

North Carolina Registration Card Page 5 Line 17qq Com

New 2021 Polaris General Xp 4 1000 Deluxe Utility Vehicles In Asheville Nc Matte Military Tan N A

New 2021 Polaris General Xp 4 1000 Deluxe Utility Vehicles In Asheville Nc Matte Military Tan N A

.png)

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home