How To Calculate Property Yield Rate

Using the current example the net rental yield equals 114000 - 8400 - 58119 1000000 47. Property value 600000 and expected rent 500 a week.

5000 100000 005 x 100 5.

How to calculate property yield rate. Compute net rental yield by dividing the buildings net income by the purchase price. Divide the annual return 9600 by the amount of the total investment or 110000. Then multiply this number by 100.

Deduct the propertys ongoing costs and costs of vacancy ie lost rent from the propertys annual rental. How do you calculate yield. Divide that by the 250000 sales price.

Capital Value 25 Million. 22518 divided by the property value of 300000 equals a rental yield of 75 percent. Yield 6.

Annual rental income 5000. Moving on investors should also be aware that property yield figures can also be manipulated to show alternative capital values that more accurately reflect the investment risk. Gross Yield Theres obviously a significant distinction between these two terms.

Yield capitalization is used in the valuation of income-producing real property to assess the future value of a property taking into account future circumstances. Assuming a capitalization rate of 20 30000 divided by that percentage is 150000. Purchase price 100000.

To calculate the propertys ROI. Gross rental yield To calculate take the Annual rental income Weekly rent x 52 weeks and divide by the Property value. Capital Value 150000 6 x 100.

An income of 27360 minus the cost of 4842 works out to 22518 in rental income after expenses. Covenant Strength its Effect on Property Yield. In order to create a successful investment in commercial real estate the best route is to thoroughly evaluate the property.

Calculating the gross yield of a property is pretty simple. You have a capitalization rate of2 or 20. Now lets say that it cost you 300000 to purchase the property.

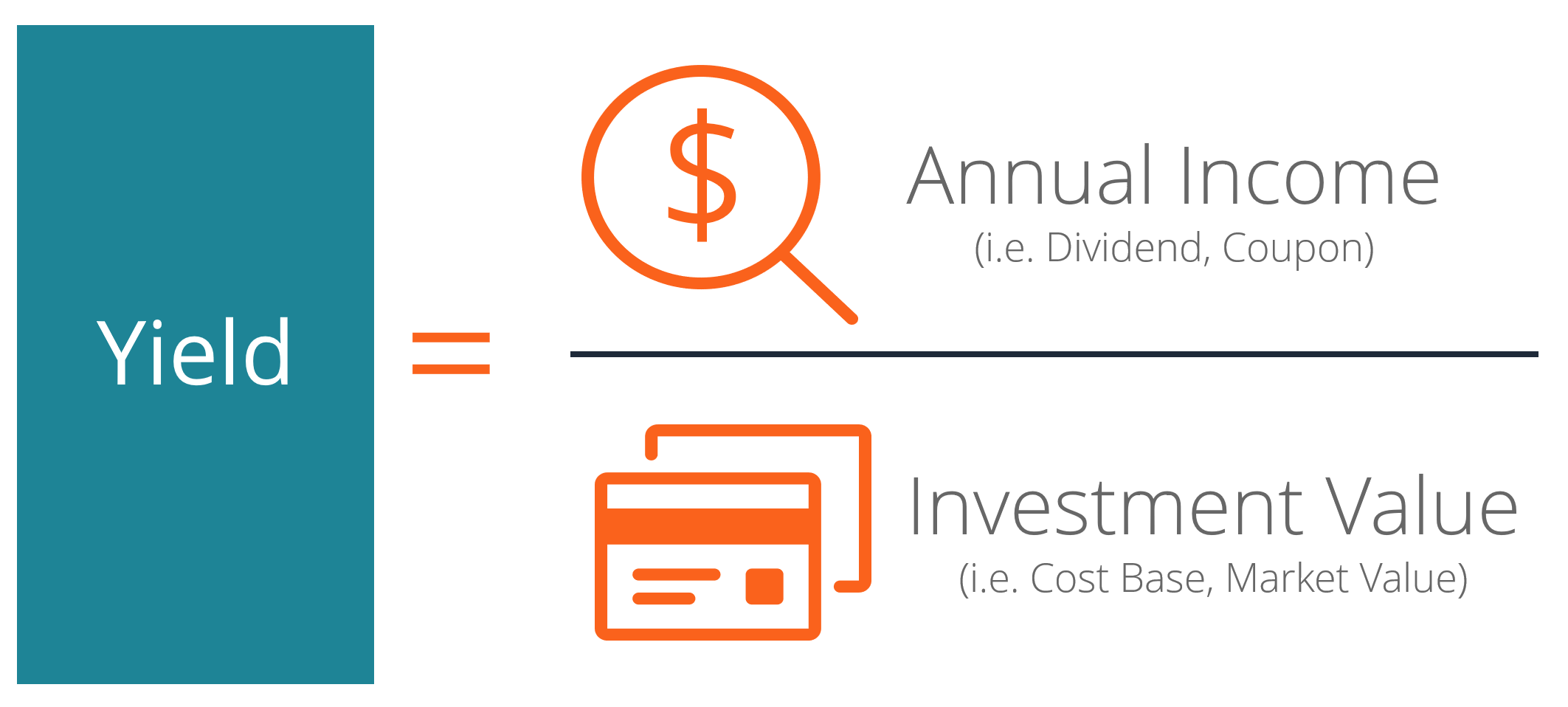

It is a percentage figure that reflects the annual rental income compared to the value of the property. Calculating your gross yield. Equity multiple cash on cash return and internal rate of return are just a few of the metrics used to calculate investment yield on a commercial real estate property.

Calculating the PropertyCapital Value. The net income is equal to net rental revenue minus operating costs minus mortgage expenses. You then multiply this by 100 to give you the percentage.

To calculate the gross rental yield of a property divide your annual rental income by the property value and multiply that figure by 100. The internal rate of return IRR is the discount rate providing a net value of zero for a future series of cash flows. Many future factors can affect.

And then finally you multiply the result of the second step by 100. Many Metrics One Investment Yield. Divide the result of the first step by the propertys value.

The property value can be the amount you bought it for or its current market value. You calculate a commercial property rental yield by dividing the annual income by the propertys value and then multiplying that figure by 100. Youve determined that the propertys NOI after deducting applicable expenses is 50000.

Its the annual rental income divided by the purchase price. The IRR and net present value NPV are used when selecting investments. Add up all the fees and expenses of owning the property Sum up the annual rent you will receive from the property subtract the total expenses from the annual rent Divide it by the value of the property Multiply by 100.

ROI 9600 110000 0087 or 87.

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home