Pay Property Tax Online Kentucky

Please go online to pay your bill and you will be transferred to a secure web page powered by Paymentus Corporation our bill payment partner. If you have obtained insurance within the last 45 days your.

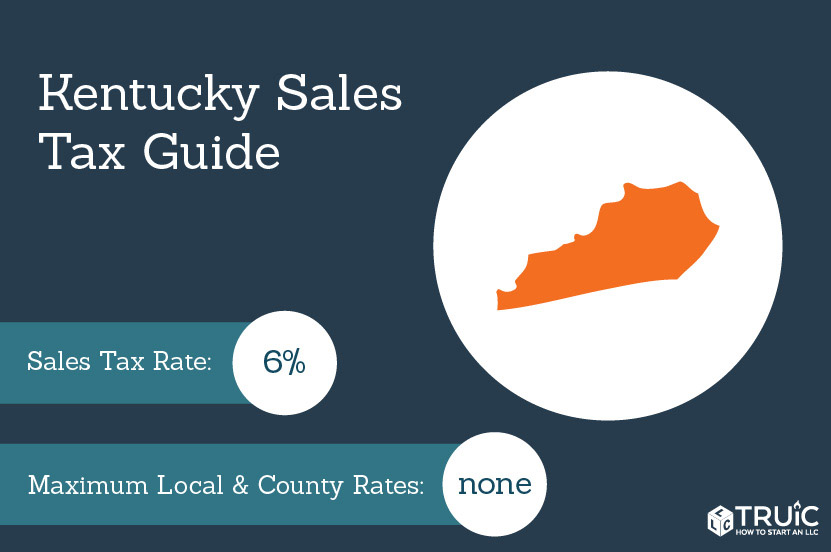

Kentucky Sales Tax Small Business Guide How To Start An Llc

Kentucky Sales Tax Small Business Guide How To Start An Llc

It is levied at six percent and shall be paid on every motor vehicle used in Kentucky.

Pay property tax online kentucky. Motor Vehicle Usage Tax Motor Vehicle Usage Tax is collected when a vehicle is transferred from one party to another. Kentucky Department of Revenue. These options are convenient safe and secure.

You must have a registered KYU account to file taxes electronically. Kentuckys E-filing and E-payment systems do not currently support Internet Explorer 80. If you have lost or misplaced your bill call our main office 859-252-1771 during normal working hours or e-mail us anytime.

Online Options Available eCheck provides quick and easy electronic transfer of funds from your existing bank account for payment. Pay Your Taxes Online. Pay by Electronic Check.

Explanation of the Property Tax Process. Unpaid 2020 Tax Bills Delinquent. Click the button above to pay your taxes.

Pay by Credit Card. THE SHERIFFS OFFICE IS LOCATED AT 3000 CONRAD LANE IN BURLINGTON KENTUCKY. Make property tax payments online via the Kenton County Online Records website.

Boone County Property Tax Bills are collected by Boone County Sheriff Michael A. The new Originating IDs for the Commonwealth of KY payment services are First Premier Bank ODFI ID 1522077581 and JP Morgan Chase ODFI ID 9006402001. For online payments information Once ready to check out you will be able to make payment of all parcels at one-time online either by eCheck or creditdebit card.

Pike County Sheriffs Office. Tax Payment Solution TPS - Register for EFT payments and pay EFT Debits online. A 200 fee is charged for this method.

You will need your Assessors Identification Number AIN to search and retrieve payment information. Dont ignore your debt. The vehicles renewed must have unexpired registrations.

The Sheriffs Office is open Monday Friday from 800 am. There is no cost to you for electronic check eCheck payments. The owner of the vehicles cannot have overdue property taxes on any other vehicles they own.

Users who have upgraded their Internet Browser to this system will experience screen layout problems when using Kentuckys filing and payment systems. Motor Vehicle Property Tax Motor Vehicle Property Tax is an annual tax assessed on motor vehicles and motor boats. Pacific Time on the delinquency date.

Property Valuation Administrators PVAs in each county must list value and assess the property tax on motor vehicles and motor boats as of January 1 st of each year. Payment Plans for Qualified Applicants. You are given a confirmation of your payment and all.

Details as to each option are offered below. ECheck Funds are automatically deducted from you bank account - pending verification of valid account information and availability of funds. KRS 1322201aThe person who owns a motor vehicle on January 1 st of the year is responsible for paying the property taxes for that vehicle for the year.

Payments can be made electronically with credit card or check. Paypal You can also mail your payments to. Ouisville Metro Revenue Commission offers various electronic payme nt options for paying your local business license taxes.

Pay your taxes online using your checking account or creditdebit card. In an effort to assist property owners understand the administration of the property tax in Kentucky this website will provide you with information that explains the various components of the property tax system. Vehicles must be currently insured with a company that is registered with the Kentucky Department of Insurance to be eligible to renew online.

Payment shall be made to the motor vehicle owners County Clerk. If you dont make acceptable payment arrangements andor dont make the payments you agreed to the Department of Revenue will take action to collect the money you owe. Or you may Register for Electronic Funds Transfer EFT payments and pay EFT Debits online.

If you have any questions call the Department of Revenue at 502 564-4581. FAQs Online Sales Tax Filing User Caution. Call toll free 855-288-6481 and you will be linked to a secure automated telephone payment system powered by our bill payment partner Paymentus.

To use this service you will need a Kentuckygov user account. Enter the bill number and account number listed in the top-left corner of your property tax bill. Please be aware that the Originating ID has changed for the Commonwealth of KY payment services.

Then click login when the tax master screen is prompted. The Department of Revenue will always attempt to work with you in order to pay your debt but you must contact us. If carriers need to amend taxes for KYU they will need to contact the Division of Motor Carriers to do so.

If you already have one you can login. Leased vehicles cannot be renewed online. You can make online payments 24 hours a day 7 days a week until 1159 pm.

Depending on the type of payment you select you will be charged the following convenience fees. If filing a paper return with payment make the check or money order payable to Kentucky State Treasurer and mail to.

Property Tax Department Of Revenue

Property Tax Department Of Revenue

Kentucky Usda Rural Development Fee Reduction Fha Mortgage Mortgage Loans Kentucky

Kentucky Usda Rural Development Fee Reduction Fha Mortgage Mortgage Loans Kentucky

Erlanger Kentucky City Of Erlanger Heritage Bank Employee Health City

Erlanger Kentucky City Of Erlanger Heritage Bank Employee Health City

Kentucky Usda Rural Development Loans Usda Rural Kentucky

Kentucky Usda Rural Development Loans Usda Rural Kentucky

Tumblr Usda Usda Loan Home Loans

Tumblr Usda Usda Loan Home Loans

100 Financing Zero Down Payment Financing Kentucky Mortgages Home Loans For Ky First Time Buyers Louisville Ky M Closing Costs Mortgage Fees Mortgage Lenders

100 Financing Zero Down Payment Financing Kentucky Mortgages Home Loans For Ky First Time Buyers Louisville Ky M Closing Costs Mortgage Fees Mortgage Lenders

100 Financing Zero Down Payment Kentucky Mortgage Home Loans For Kentucky First Time Home Buyers What C Va Mortgage Loans Mortgage Loans Bad Credit Mortgage

100 Financing Zero Down Payment Kentucky Mortgage Home Loans For Kentucky First Time Home Buyers What C Va Mortgage Loans Mortgage Loans Bad Credit Mortgage

100 Financing Zero Down Payment Kentucky Mortgage Home Loans For Kentucky First Time Home Buyers What Are Closing C Mortgage Loans Loan Mortgage Loan Officer

100 Financing Zero Down Payment Kentucky Mortgage Home Loans For Kentucky First Time Home Buyers What Are Closing C Mortgage Loans Loan Mortgage Loan Officer

Kentucky Fha Mortgage Qualifying Guidelines Fha Mortgage Fha Fha Loans

Kentucky Fha Mortgage Qualifying Guidelines Fha Mortgage Fha Fha Loans

What Is A Kentucky Usda Rural Home Loan Best Mortgage Lenders Usda Loan Best Mortgage Rates Today

What Is A Kentucky Usda Rural Home Loan Best Mortgage Lenders Usda Loan Best Mortgage Rates Today

![]() Property Tax Department Of Revenue

Property Tax Department Of Revenue

Rental Property Roi And Cap Rate Calculator And Comparison Etsy Rental Property Management Rental Property Real Estate Investing

Rental Property Roi And Cap Rate Calculator And Comparison Etsy Rental Property Management Rental Property Real Estate Investing

A Complete Guide To Closing Costs In Kentucky Closing Costs Mortgage Loans Fha Loans

A Complete Guide To Closing Costs In Kentucky Closing Costs Mortgage Loans Fha Loans

Nicholas County Kentucky Property Tax Lists 1800 1811 With Indexes To Deed Books A B 2 And C Property Tax Index Kentucky

Nicholas County Kentucky Property Tax Lists 1800 1811 With Indexes To Deed Books A B 2 And C Property Tax Index Kentucky

Credit Scores Required For A Kentucky Mortgage Loan Approval In 2021 Credit Score Mortgage Infographic Mortgage Lenders

Credit Scores Required For A Kentucky Mortgage Loan Approval In 2021 Credit Score Mortgage Infographic Mortgage Lenders

Kentucky Fha Hud Homes For 100 Down Hud Homes Fha Kentucky

Kentucky Fha Hud Homes For 100 Down Hud Homes Fha Kentucky

Pin By Kirunda Group Corp On Real Estate Investing Being A Landlord Real Estate Investing Investing

Pin By Kirunda Group Corp On Real Estate Investing Being A Landlord Real Estate Investing Investing

Down Payment Assistance Kentucky 2021 Kentucky Housing Corporation Khc In 2021 Kentucky First Time Home Buyers Down Payment

Down Payment Assistance Kentucky 2021 Kentucky Housing Corporation Khc In 2021 Kentucky First Time Home Buyers Down Payment

What Is The Minimum Credit Score For A Kentucky Fha Mortgage Home Loan Approval Fha Mortgage Credit Score Mortgage Loans

What Is The Minimum Credit Score For A Kentucky Fha Mortgage Home Loan Approval Fha Mortgage Credit Score Mortgage Loans

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home