How To Value A Commercial Property Based On Rental Income Uk

Gross rents for the building are 780000 per year and the appraiser says the GRM for the area is 8. For example a property that generates 100000 in gross rental income each year multiplied by a holding period of 10 years would place the value of the property at 1 million.

Best Approaches To Commercial Real Estate Valuation

Best Approaches To Commercial Real Estate Valuation

The profits method of property valuation is typically applied to commercial property valuations where the major value component is driven by the profitability of the businesses that occupy the buildings and not simply the land or buildings themselves.

How to value a commercial property based on rental income uk. Value Gross Rental Income x Gross Rent Multiplier. To calculate the property value just reverse the formula. Gross Rent Multiplier Value of Property Gross Rental Income.

Property Value Annual Gross Rents x Gross Rent Multiplier 1280000 160000 x 8 GRM In this example using a GRM of 8 a property that generates 160000 per year in gross rental income would be valued at roughly 128 million. If you let out a property on terms that are not commercial such as to a friend or a relative for a reduced rent expenses incurred can only be deducted up to the amount of the rent received for. The GRM also helps you check the rent to value ratio of your commercial property in.

Commercial Property Valuation Using the Profits Method. Capital Value Annual Rental Income Yield x 100. Value of Property Gross Rental Income Gross Rent Multiplier.

About the Rent Calculator. Apply a market rent for. In mathematical terms the formula is as follows.

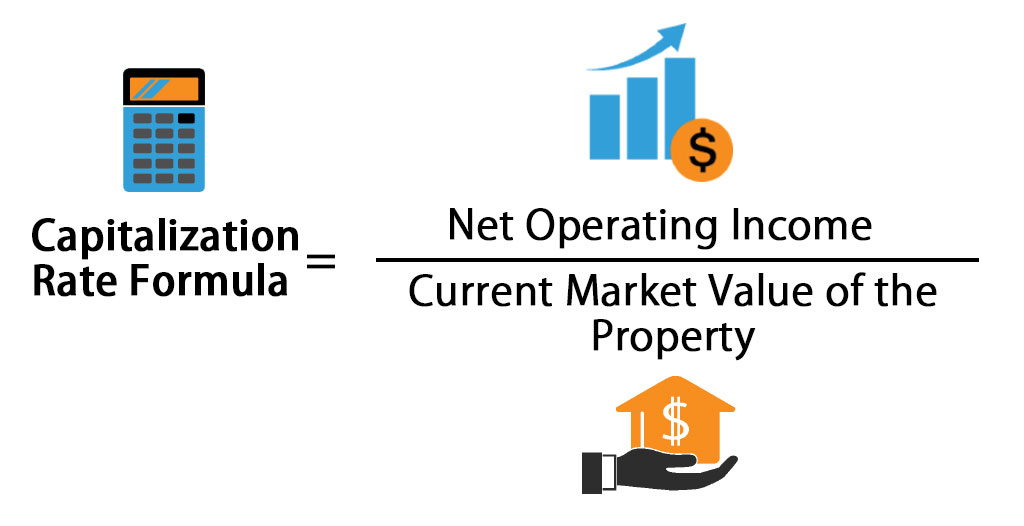

The value is established here by estimating the propertys income using the capitalization rate commonly referred to as merely the cap rate. Multiply the GRM ratio by the gross rents for the complex. Value Gross Rental Income x Gross Rent Multiplier.

In mathematical terms the formula is as follows. Gross scheduled income the number of units times their annual rent based on 100 occupancy. Now divide that net operating income by the capitalization rate to get the current value result.

The final step is to then divide the NOI by the average yield rate the amount investors can hope to get as a return at the end of the year. Rental yield gives you an indication of a propertys return on investment from rent. Our team of data scientists have created the most advanced way to find how much rent to charge for any house or flat in the UK.

If it is a new-build property the value will be based on the expected annual income. The GRM calculation of value. Value of Commercial Property Annual Gross Rents x Gross Rent Multiplier GRM.

You calculate a commercial property rental yield by dividing the annual income by the propertys value and then multiplying that figure by 100. Calculate the value of the commercial property based on gross rents. Determine the capitalization rate from a recent comparable sold property.

For commercial property this can range between six and 12 per cent depending on the property type age and location. The cap rate is the net operating income of the property divided by its current market value or sales price. For example a property that generates 65000 in gross rental income each year multiplied by a holding period of 10 years would place the value of the property at 06 million.

A six-unit apartment project might yield 30000 net profit from rentals. Gross rent multiplier or GRM measures the ratio between a rental propertys gross scheduled income and its stated price. Property Value Annual Gross Rents X Gross Rent Multiplier GRM 640000 80000 X 8 GRM In this example - using a GRM of 8 - a property that generates 80000 a year in gross rental income has a value of 640000.

Lets say your comparable sold for 250000. Calculating the Property Value Using GRM. If a commercial property is being let for say one hundred and fifty thousand pounds per annum and an approximate yield across nearly identical properties is identified at around 6 per cent this would mean that.

Using a huge range of data points you can now find average rent by postcode in just a few seconds. Similar property yields in the area and general market trends. The rental yield is calculated by dividing the net rental income by the value of your property.

It is a percentage figure that reflects the annual rental income compared to the value of the property. Look up online average GRM for your area and building type. Landlords can set the right rental price first time and tenants can check what theyre likely to have to pay for a particular property with our totally independent Rent.

So if you own a property worth 250000 and the net rental income is 12500 your rental yield is. 12500 250000 005 or 5 per year Find out more about becoming a landlord. Situations where the profits method of valuation would be appropriate include.

Rent Or Own Property Infographic Energy Investments Investment Tips Infographic

Rent Or Own Property Infographic Energy Investments Investment Tips Infographic

Airbnb Property Cash Flow Rental Property Investment Real Estate Investing Investing Apps

Airbnb Property Cash Flow Rental Property Investment Real Estate Investing Investing Apps

Maximize Your Rental Income Today Commercial Real Estate Association Management San Diego Real Estate

Maximize Your Rental Income Today Commercial Real Estate Association Management San Diego Real Estate

Commercial Property Valuations In Birmingham Oulsnam Estate Agents Properties For Sale Uk Property Valuation Estate Agent Commercial Property

Commercial Property Valuations In Birmingham Oulsnam Estate Agents Properties For Sale Uk Property Valuation Estate Agent Commercial Property

To Be A Landlord Is The Smartest Way To Grow The Wealth From Your Own Proper Being A Landlord Real Estate Investing Rental Property Rental Property Management

To Be A Landlord Is The Smartest Way To Grow The Wealth From Your Own Proper Being A Landlord Real Estate Investing Rental Property Rental Property Management

Renting Property In The Uk Infographic Rent Infographic About Uk Infographic

Renting Property In The Uk Infographic Rent Infographic About Uk Infographic

Rental Property Spreadsheet Template For 25 Properties Business Rental Property Management Property Management Marketing Property Management

Rental Property Spreadsheet Template For 25 Properties Business Rental Property Management Property Management Marketing Property Management

I Pinimg Com Originals A3 82 75 A3827518a06f68d

I Pinimg Com Originals A3 82 75 A3827518a06f68d

How To Lease Commercial Real Estate The Ultimate Guide

How To Lease Commercial Real Estate The Ultimate Guide

Commercial Property Conversions Paperback 2018 By Mark Homer Author Glenn Delve Author Commercial Property Investment Property Commercial

Commercial Property Conversions Paperback 2018 By Mark Homer Author Glenn Delve Author Commercial Property Investment Property Commercial

Why Choose Commercial Property For Rent In Gurgaon Commercial Property Commercial Property For Rent Property For Rent

Why Choose Commercial Property For Rent In Gurgaon Commercial Property Commercial Property For Rent Property For Rent

If You Are In The Process Of Buying A Commercial Property Or Considering Doing So At Some Point In Time You Will Pr Being A Landlord Mortgage Mortgage Payoff

If You Are In The Process Of Buying A Commercial Property Or Considering Doing So At Some Point In Time You Will Pr Being A Landlord Mortgage Mortgage Payoff

How To Save Tax On Rental Income In India Tax Deductions On Rent

How To Save Tax On Rental Income In India Tax Deductions On Rent

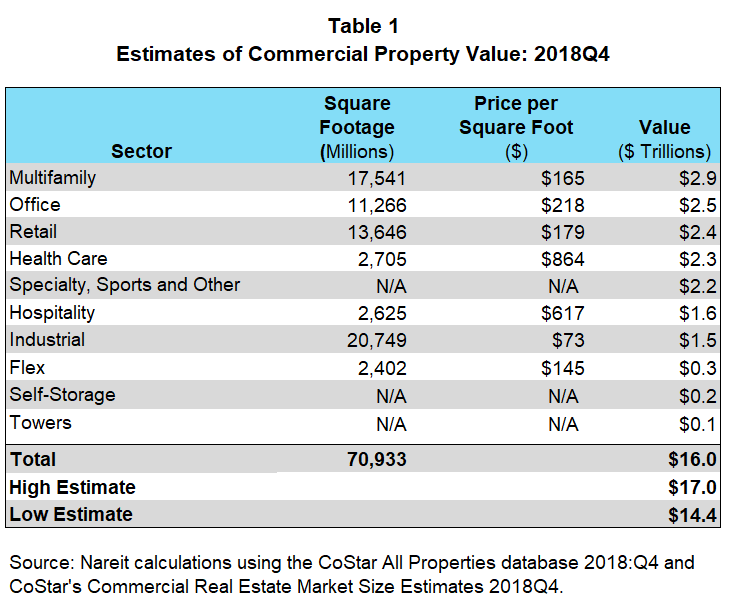

Estimating The Size Of The Commercial Real Estate Market In The U S Nareit

Estimating The Size Of The Commercial Real Estate Market In The U S Nareit

Pinterest Real Estate Rentals Real Estate Investing Rental Property Real Estate Tips

Pinterest Real Estate Rentals Real Estate Investing Rental Property Real Estate Tips

How To Easily Determine The Market Value Of Commercial Property Phoenix Partners Chartered Surveyor

How To Easily Determine The Market Value Of Commercial Property Phoenix Partners Chartered Surveyor

The Perks Of Investing In Commercial Property Commercial Real Estate Investing Real Estate Prices Commercial Real Estate

The Perks Of Investing In Commercial Property Commercial Real Estate Investing Real Estate Prices Commercial Real Estate

Capitalization Rate Formula Calculator Excel Template

Capitalization Rate Formula Calculator Excel Template

How Do I Use The Gross Rent Multiplier In Commercial Real Estate Argus Software Solutions For Commercial Real Estate

How Do I Use The Gross Rent Multiplier In Commercial Real Estate Argus Software Solutions For Commercial Real Estate

Labels: commercial, property, value

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home