How To Calculate Income Tax Rebate On Hra

The exemption on HRA is calculated as per 2A of Income Tax Rules. This minimum of above is allowed as income tax exemption on house rent allowance.

Hra Exemption Calculator Income Tax Income Tax Return Tax Refund

Hra Exemption Calculator Income Tax Income Tax Return Tax Refund

Documents HRA exemptions can be availed only on submission of rent receipts or the rent agreement with the house owner.

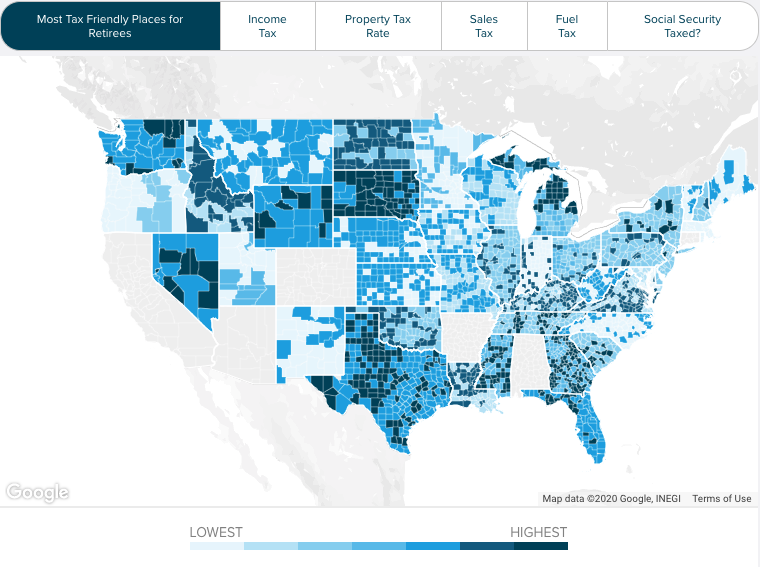

How to calculate income tax rebate on hra. You can efile income tax return on your income from salary house property capital gains business profession and income from other sources. It shows that of Rs 84000 actually received as HRA Rs 82800 gets tax exemption and only the balance of Rs 1200 gets added to the employees income on which a tax of Rs 240 20 per cent slab gets payable. 50 of basic salary for those living in metro cities.

Further you can also file TDS returns generate Form-16 use our Tax Calculator software claim HRA check refund status and generate rent receipts for Income Tax. Our calculator can easily help you figure out your HRA exemption. In order to calculate the HRA the salary is defined as the sum of the basic salary dearness allowances and any other commissions.

The remainder of your HRA is added back to your taxable salary. Actual rent paid minus 10 of salary. The rent that you have actually paid reduced by 10 of the salary.

The actual amount received as HRA from the employer. The amount of HRA exempted as per income tax rules and the amount treated as income is calculated using this HRA income tax calculator. The HRA calculation for tax benefit depends upon either of the below-enlisted provisions.

Actual house rent paid by you minus 10 of your basic salary. 50 of the basic salary in case the place of residence of the tax payer is in a metro location. The income tax act of India allows its citizens to take full rebate on HRA received.

The House Rent Allowance HRA amount allotted by the employer 50 of the employees basic salary if she is staying in a metro city 40 for non-metro cities. Keep in mind that if the employee stays in his house or does not pay the rent of the house then the amount received as HRA in his salary comes under the tax net. 50 of your basic salary if you live in a metro or 40 of your basic salary if you live in a non-metro.

But in some cases many people will fail to get full rebate on their HRA received. The different Sections of the Income Tax Act help the salaried individuals and the self-employed people and professionals to make their rent expenditures cheaper and more desirable. Some components of your salary can be tax exempt without the need of investing in any tax saving instruments.

Total taxable income is calculated by subtracting HRA from total revenue. The House Rent Allowance HRA exemption calculator is the simplest method to find your rent exemption. The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail.

For cities other than a metro the entitlement is 40 of the salary. 40 of basic salary for those living in non-metro cities.

40 of the basic salary in case the place of residence of the tax payer is in a non-metro location. House Rent Allowance. Americans who qualify for a new tax break on their 2020 unemployment benefits but who already filed their returns can expect to receive an automatic refund in.

Salaries of the employees of both private and public sector organizations are composed of a number of minor. While all efforts are made to provide accurate results this online HRA exemption calculator. The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card bank and other financial accounts.

Actual House Rent Allowance HRA received from your employer. Actual HRA received from employer For those living in metro cities. One of them is House Rent Allowance commonly referred to as HRA and to find out the amount of HRA which can be exempt from tax use our calculator.

Any individual can take the benefit of the HRA rebate. The calculator explanatively shows the various conditions based on which taxable HRA is determined. As per Rule 2A the least of the following is exempted from salary under Section 10 13A and does not form part of the taxable income.

The actual rent paid by the employee subtracted from 10 of herhis basic salary. HRA or House Rent allowance also provides for tax exemptions. This happens because of the ignorance of the rule pertaining to the rebate on HOUSE RENT ALLOWANCE.

If an employee does not receive a commission or a dearness allowance then the HRA will be around 40 - 50 of hisher basic salary. HRA is an allowance given to the employee. What is the HRA House Rent Allowance.

Read more »