Does North Carolina Have A Property Tax Discount For Seniors

105-2771C Disabled Veteran Exclusion. Some North Carolina homeowners are eligible for a property tax deferment program.

Solar Panels For Hvac Incentive Residential Solar Tax Credits

Solar Panels For Hvac Incentive Residential Solar Tax Credits

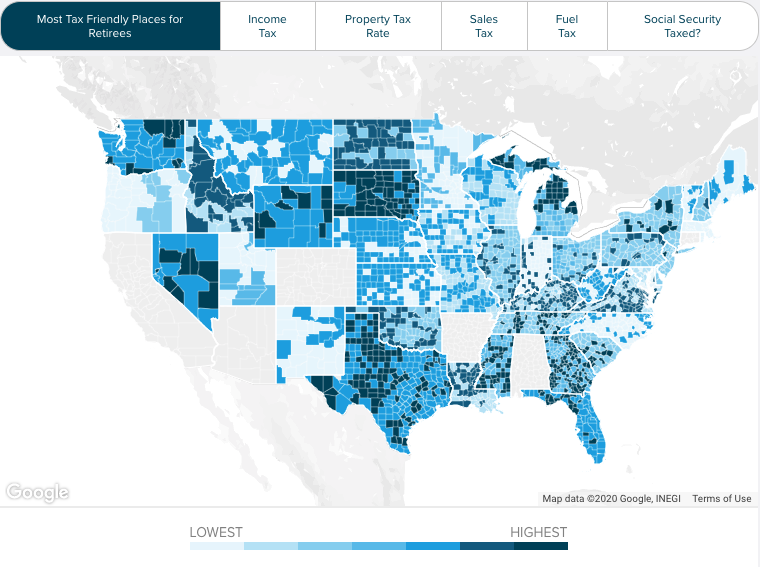

So what exactly are North Carolinas taxes for retirees like.

Does north carolina have a property tax discount for seniors. The program allows residents 65 years or older to have 50000 of their homes value exempt from property tax. Florida offers more deducations for. The state also has low property taxes and sales taxes near the national average.

Property taxes are quite possibly the most widely unpopular taxes in. Applicant must be at least 65 years of age or totally and permanently disabled on or before January 1 of the current year. The tax amount above the ceiling is deferred until a disqualifying event occurstypically when the home changes hands.

A disabled veteran is defined as a veteran whose character of service at separation was honorable or under honorable conditions and who has a total and permanent service-connected disability or who received. Their income can not exceed 29500. The benefit is known as homestead tax exemption and provides that the first 50000 of the fair market value of the dwelling place including mobile homes on leased land shall be exempt from municipal county school and special assessment real property taxes.

North Carolina excludes from property taxes a portion of the appraised value of a permanent residence owned and occupied by North Carolina residents who are at least 65 years of age OR who are certified as totally and permanently disabled AND whose income does not exceed 31500. Read on to learn more about what to expect. A set of North Carolina homestead exemption rules provide property tax relief to seniors and people with disabilities.

While the freeze is in place the taxable value of the property cant go up though the property tax rate can increase. 105-2771B Circuit Breaker Tax Deferment Program. Circuit breaker tax deferral for elderly or disabled.

Applicant must be a North Carolina Resident. North Carolina Property Tax Exemptions. This tax break can come in very handy for seniors who have yet to sell their family home and are looking for ways to save up before making the move to an independent living community.

Must own and occupy the permanent residence. Seniors with significant income from sources other than Social Security will have a larger tax bill in North Carolina. I represent a rural area sort of poor.

If you are aged 65 or over and have an annual income limit of 30200 or below you may be eligible to apply for this benefit. Property Tax Reduction for qualifying Senior Citizens and persons permanently disabled. North Carolina excludes from property taxes a portion of the appraised value of a permanent residence owned and occupied by North Carolina residents aged 65 or older or totally and permanently disabled whose 2020 income does not exceed 31500 annually.

The qualifications for the Homestead Exclusion are as follows. The senior must have income under 30576 at time of writing -- 38220 for a two-owner house -- and have lived there at least two years. The surviving spouse must be 50 years of age or older.

It places a ceiling on how much tax the owners must pay. Hopefully you will be able to benefit from the senior citizen discounts in your state. North Carolina excludes from property taxes the greater of 25000 or 50 percent of the appraised value of a permanent residence owned and occupied by a qualifying owner.

States offer property tax breaks to seniors in a variety of ways but the three most common methods are property tax deferral programs circuit-breaker programs and homestead exemption or credit programs. The senior property tax exemption is just 8000 in Cook County Illinois and this is actually an increase up from 5000 in 2018. Here is a list of senior citizen discounts in all 50 US states.

It does not tax Social Security retirement benefits. A senior property tax exemption reduces the amount seniors have to pay in taxes on properties they own. Income limit for 2021 -- limit is adjusted annually based on any cost of living adjustments to Social Security Benefits.

Twenty-four states and the District of Columbia offer property tax deferral programs for senior homeowners who qualify. Its true that North Carolina is not the most tax friendly state in the country. North Carolina excludes from property taxes the first 45000 of assessed value for specific real property or a manufactured home which is occupied as a permanent residence by a qualifying owner.

North Carolina is moderately tax-friendly for retirees. And Cook County does things a bit differently so its technically not an exemption but its a bit of a tax break all the same. North Carolinas Retirement Tax Friendliness.

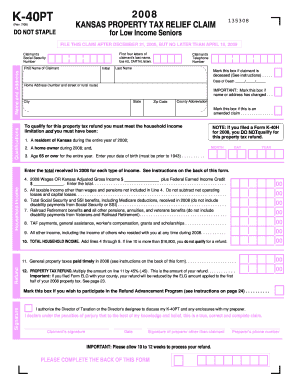

The AV-9 application is for property tax relief under North Carolina General Statute 105-2771 Elderly or Disabled Exclusion. If you are totally and permanently disabled or age 65 and over and you make.

Read more »