Kansas Property Tax Benefit For Seniors

To claim a homestead refund you must have been a Kansas resident all of last year and had an income of 36300 or less. Qualifications for Property Tax Relief for Low Income Seniors K-40PT.

Real Estate And Personal Property Tax Johnson County Kansas

Real Estate And Personal Property Tax Johnson County Kansas

You must also meet one of the following three requirements.

Kansas property tax benefit for seniors. Retired from regular gainful employment due to a disability. Tax Credits for Older Adults One of the most significant tax breaks available to older adults is the Tax Credit for the Elderly and Disabled. At least 61 years of age or older.

The amount of credit you can receive will depend on circumstances as set by the program such as your homes assessed value. An individual that is a Kansas resident that lives in Kansas for all of 2019 who owned and occupied a home in Kansas during 2019 who was aged 65 years or older for all of 2019 born before January 1 1954 and who had a household income of 20300 or less in 2019 shall qualify. KANSAS PROPERTY TAX RELIEF CLAIM.

The online price of items or services purchased. Home value is less than 350000. The Kansas Property Tax Payment application allows taxpayers the opportunity to make property tax payments on their desktop or mobile device.

Examples of senior property tax exemptions by state. The refund is 75 of the 2019 general property tax paid or to be paid - as shown of the 2020 real estate tax statement for the residence in which the claimant lived in 2020. How do I apply.

She wants the state to expand its Homestead Refund program which provides seniors and disabled veterans a refund based on a portion of their property taxes. SAFESR is also referred to as Kansas Property Tax Relief for Low Income Seniors. You were born before Jan.

For Low Income Seniors. It reduced the brackets to two and as of 2015 the low rate is 27 percent and the high rate is 46 percent. As noted these exemptions are generally reserved for those who are age 65 or older.

Property Taxes - The state taxes property at 100 percent fair-market value. Tom Holland D-Baldwin City introduced. Benefits requirements and rates for 2021 October 22 2020 - 20 min read Before Making A 20 Mortgage Down Payment.

Property tax exemption program for senior citizens and people with disabilities. Who qualifies for a SAFESR refund. A group of state senators is pushing property tax relief for seniors and veterans with disabilities.

To claim either within the program follow the steps below. SAFESR is also referred to as Kansas Property Tax Relief for Low Income Seniors. This tax credit can wipe out some if not all of your tax liability if you end up owing the IRS.

Home owner during the tax year. You must have been totally and permanently disabled or blind during the entire year regardless of your age. The Property Tax Relief claim K-40PT allows a refund of property tax for low income senior citizens that own their home.

The refund is 75 of the property taxes actually and timely paid on real or personal property used as their principal residence. The state also offers property tax refunds to low-income seniors. Your First Name Initial Last Name Mailing Address Number and Street including Rural Route City Town or Post Office State Zip Code County Abbreviation.

To qualify the total household income. This online service is provided by Kansasgov a third-party working under a contract awarded and administered by the Information Network of Kansas INK. Age over 65 for the entire tax year.

This program provides you a refund of some of the property tax you paid on your home if you are a qualifying older adult. Combined service-connected evaluation rating of 80 or higher. SAFESR is a property tax refund program administered under the provisions of the Kansas Homestead Act property tax refund.

Must be a Kansas resident the entire tax year. SAFESR is also referred to as Kansas Property Tax Relief for Low Income Seniors. You must be age 65 or.

The SAFE Senior program also called Kansas Property Tax Relief for Low Income Seniors refunds 75 of all property taxes paid. The refund is 75 of the 2019 general property tax paid or to be paid - as shown of the 2020 real estate tax statement for the residence in which the claimant lived in 2020. I ncome Tax Reductions - In 2013 Kansas began reducing its income tax rates.

Of course there are qualifying rules for all these tax breaks and the first of these is your age. To qualify for this property tax refund you must meet the household income limitation. SAFESR is a property tax refund program administered under the provisions of the Kansas Homestead Act property tax refund.

Total household income is less than 20700 for the tax year. Only one spouse must typically be 65 or over if youre married and you own your property jointly. It is available to homeowners who are at least 65 years old for the entirety of the year and who had total household income of 20300 or less and a home worth 350000 or less.

The assessed value is the amount used to determine how much property tax you pay.

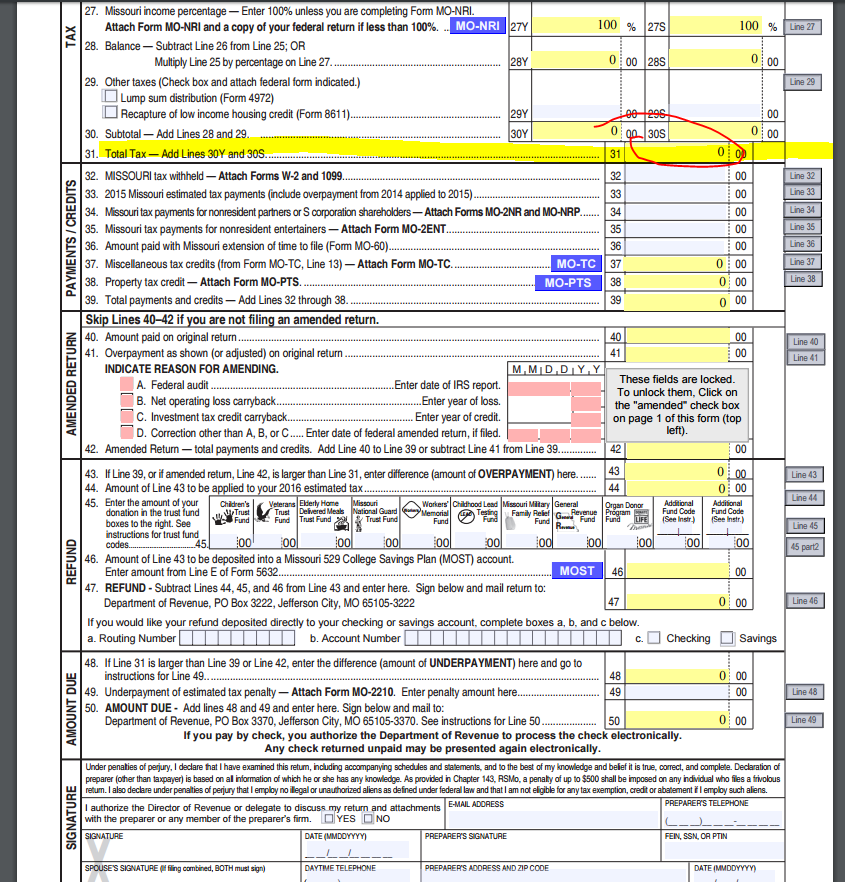

I Live In Kansas But Work In Missouri Dimov Tax Cpa Services

I Live In Kansas But Work In Missouri Dimov Tax Cpa Services

Mo Kansas City Earnings Tax Form Rd 109 Drake18

Mo Kansas City Earnings Tax Form Rd 109 Drake18

Kansas Estate Tax Everything You Need To Know Smartasset

Kansas Estate Tax Everything You Need To Know Smartasset

Should You Be Charging Sales Tax On Your Online Store Retirement Income Income Tax Tax Free States

Should You Be Charging Sales Tax On Your Online Store Retirement Income Income Tax Tax Free States

Ks Homestead Claim And Food Sales Tax Credit

Kansas Retirement Tax Friendliness Smartasset

Kansas Retirement Tax Friendliness Smartasset

Kansas Property Tax Calculator Smartasset

Kansas Property Tax Calculator Smartasset

Governor Announces Extension To 2020 State Tax Deadline

Governor Announces Extension To 2020 State Tax Deadline

Taxes By State A Map Of The U S Best Places To Retire Retirement Locations Map

Taxes By State A Map Of The U S Best Places To Retire Retirement Locations Map

Kansas Department Of Revenue Business Tax Home Page

Kansas Department Of Revenue Business Tax Home Page

Real Estate And Personal Property Tax Johnson County Kansas

Real Estate And Personal Property Tax Johnson County Kansas

Pin On For My Real Estate Clients Kansas City

Pin On For My Real Estate Clients Kansas City

The 9 States With The Highest Property Taxes Property Investment Advice Investment Property Investing

The 9 States With The Highest Property Taxes Property Investment Advice Investment Property Investing

Our Free Home Buying Guide For Veterans Is Now Available Online Navigating The Crazy World Of Va Loa Credit Repair Credit Repair Companies Credit Card Website

Our Free Home Buying Guide For Veterans Is Now Available Online Navigating The Crazy World Of Va Loa Credit Repair Credit Repair Companies Credit Card Website

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home