Home Buyers Tax Credit Ontario

It is designed to help recover closing costs such as legal expenses inspections and land transfer taxes. Canadian homeowners have several home tax deductions that they can claim.

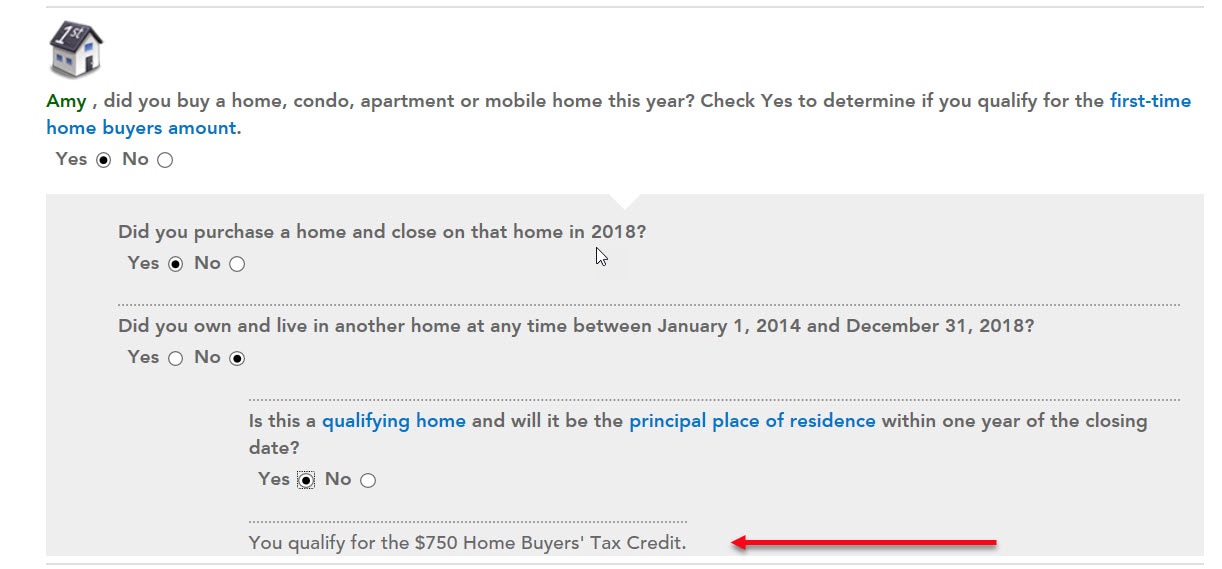

First Time Home Buyers Tax Credit Hbtc H R Block Canada

First Time Home Buyers Tax Credit Hbtc H R Block Canada

From the list of search results select Payments Profile then select Go.

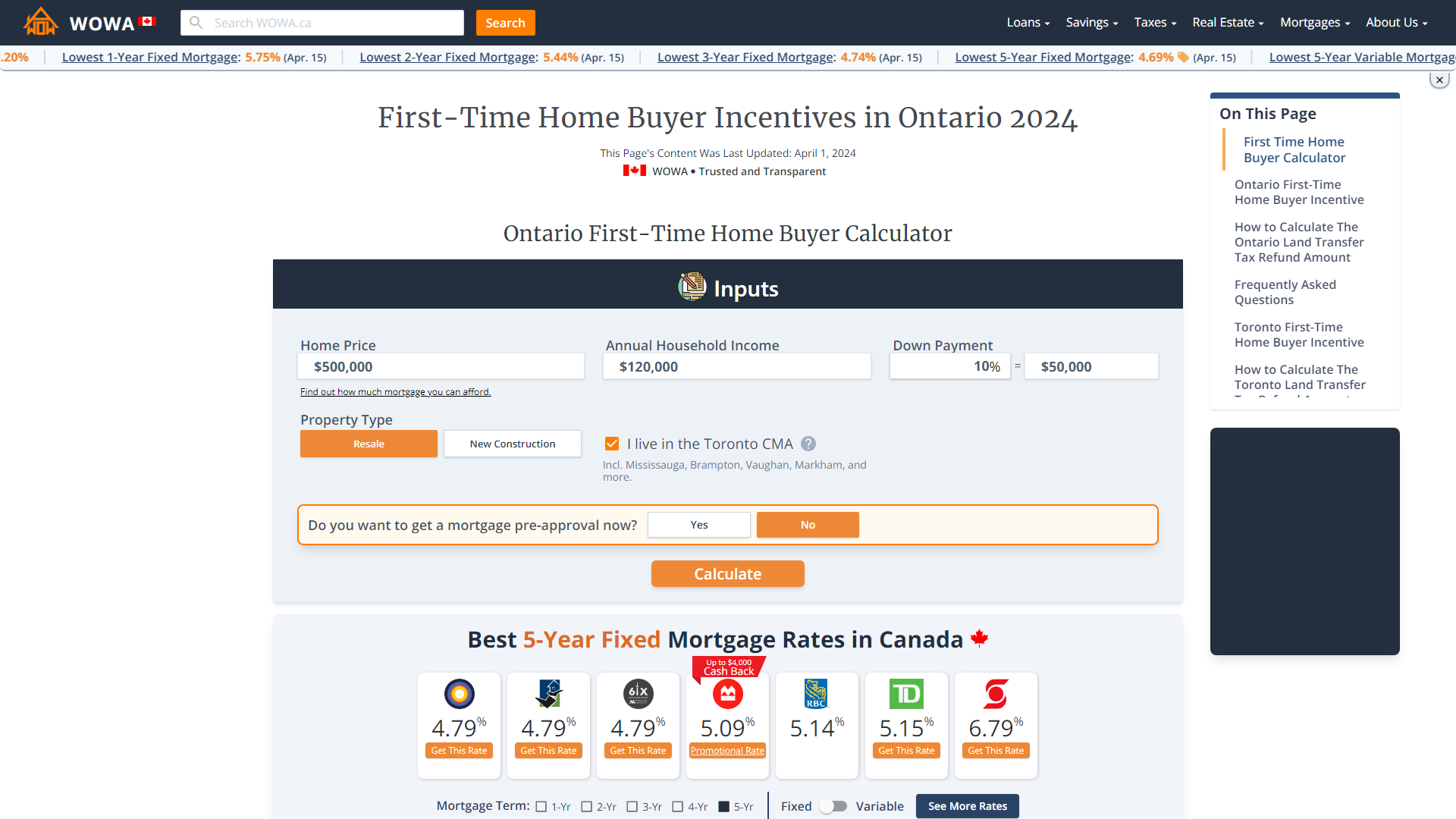

Home buyers tax credit ontario. If you are an individual who purchased a new or substantially renovated mobile home including a modular home or a new or substantially renovated floating home for use as your or your relations primary place of residence you may be eligible for a new housing rebate for some of the GSTHST paid. 11805 A non-refundable tax credit was enacted as part of the 2009 Federal Budget based on an amount of 5000 for first-time home buyers. You could net up to 750.

In the Find window type Payments. This means eligible buyers will not have to pay a land transfer tax on homes up to 227000 In order to qualify the land must be owner occupied. You or your spouse or common-law partner acquired a qualifying home.

You can claim 5000 for the purchase of a qualifying home in the year if both of the following apply. You are buying a home within Canada You will occupy the home within one year of the purchase date. Ensure that the correct checkbox s are marked and click Continue until you reach the First Time Home Buyers Credit screen.

The First-Time Home Buyers Tax Credit was first introduced in 2009 and is available to all. The Home Buyers Amount HBA is a non-refundable credit that allows first-time purchasers of homes and purchasers with disabilities to claim up to 5000 in the year when they purchase a home. You or your spouse.

In the upper-right area of TurboTax select Find. To claim the Ontario first time home buyer rebate the purchaser must be 18 years or older and must NOT have owned a home or interest in a home anywhere. Home Buyers Plan HBP.

This new non-refundable tax credit is based on a percentage of 5000. First-time home buyers in Ontario are eligible for a maximum 4000 land transfer tax rebate on the Ontario land transfer tax. You are a first-time home.

You did not live in another home owned by you or your spouse or common-law partner in the year of acquisition or in any of the four preceding years first-time home buyer. Go to the Home Buyers Amount webpage to see if you are eligible. Use this form to apply for the Ontario Land Transfer Tax Rebate.

First-time buyers can claim up to 5000 for the purchase of a qualifying home on their personal tax return on the year of purchase. You will answer Yes for your name or your spouse or both should you choose to split the credit. To be eligible for the Home Buyers Tax Credit you must meet both of these criteria.

HOW TO RECEIVE IT Homebuyers register electronically or on paper to claim an immediate refund when registering the land transfer and paying the tax. The First-time Home Buyers Tax Credit was introduced as part of Canadas Economic Action Plan to assist Canadians in purchasing their first home. As a first time home buyer in Ontario you are eligible to receive the Ontario First Time Home Buyers Land Transfer Tax Credit a tax credit up to 2000.

Select the checkbox for First Time Home Buyers Amount then select Continue. This is an Ontario tax credit for the first time home buyer rebate and is available as long as the eligibility requirements are fully satisfied. Income Tax Act s.

The Home Buyers Amount offers a 5000 non-refundable income tax credit amount on a qualifying home acquired during the year. For buyers in Toronto the government will credit you 750 when you buy your first home. If youre buying a home for the first time claiming the first-time homebuyer credit can land you a total tax rebate of 750.

You or your spouse or common-law partner purchased a qualifying home. While 750 isnt a life-changing amount of money it can make buying your first home a little bit easier. You can apply for the first time home buyer tax credit if you meet the following criteria.

Ontario First Time Home Buyers When you pay land transfer tax on your home purchase as a first-time home buyer in Ontario you will be eligible to receive a rebate on a portion of the amount up to 4000. First-time home buyers tax credit If you are buying a home for the first time you can claim a non-refundable tax credit of up to 750. The amount of the credit is 5000.

You cannot have owned property anywhere in the world previously to qualify. The First-Time Home Buyers Tax Credit is a 5000 non-refundable tax credit. The Home Buyers Tax Credit at current taxation rates works out to a rebate of 750 for all first-time buyers.

For an eligible individual the credit will provide up to 750 in federal tax relief. HOME BUYERS TAX CREDIT The First Time Home Buyer Tax Credit is a non-refundable tax credit that helps homeowners recover closing costs such as legal expenses and inspections.

Ontario First Time Home Buyer Incentives Wowa Ca

Ontario First Time Home Buyer Incentives Wowa Ca

4 Benefits First Time Home Buyers Should Take Advantage Of Northwood Mortgage Ltd

4 Benefits First Time Home Buyers Should Take Advantage Of Northwood Mortgage Ltd

First Time Home Buyers Tax Credit Cibc

First Time Home Buyers Tax Credit Cibc

Can First Time Home Buyers Get A Tax Credit

Can First Time Home Buyers Get A Tax Credit

First Time Homebuyer These Rebates Credits Can Save You Money Huffpost Canada Business

First Time Homebuyer These Rebates Credits Can Save You Money Huffpost Canada Business

:strip_icc()/tips-for-buying-your-first-home-d7a39189c9dd4bc39e6de466a343450b.png) 9 Basic Steps To Buy Your First Home

9 Basic Steps To Buy Your First Home

Tax Guide For Canadians Buying U S Real Estate Madan Ca

Biden Looks To Give A Big Boost To Homebuyers And Builders

Biden Looks To Give A Big Boost To Homebuyers And Builders

10 Reasons To Move To Delaware Home Buying Tips Delaware Moving

10 Reasons To Move To Delaware Home Buying Tips Delaware Moving

What If My Co Purchaser And I Don T Both Qualify As First Time Homebuyers Ratehub Ca

What If My Co Purchaser And I Don T Both Qualify As First Time Homebuyers Ratehub Ca

First Time Home Buyer Alberta Grab These 15 Government Grants Rebates Tax Credits Before They Re Gone Show Me The Green

First Time Home Buyer Alberta Grab These 15 Government Grants Rebates Tax Credits Before They Re Gone Show Me The Green

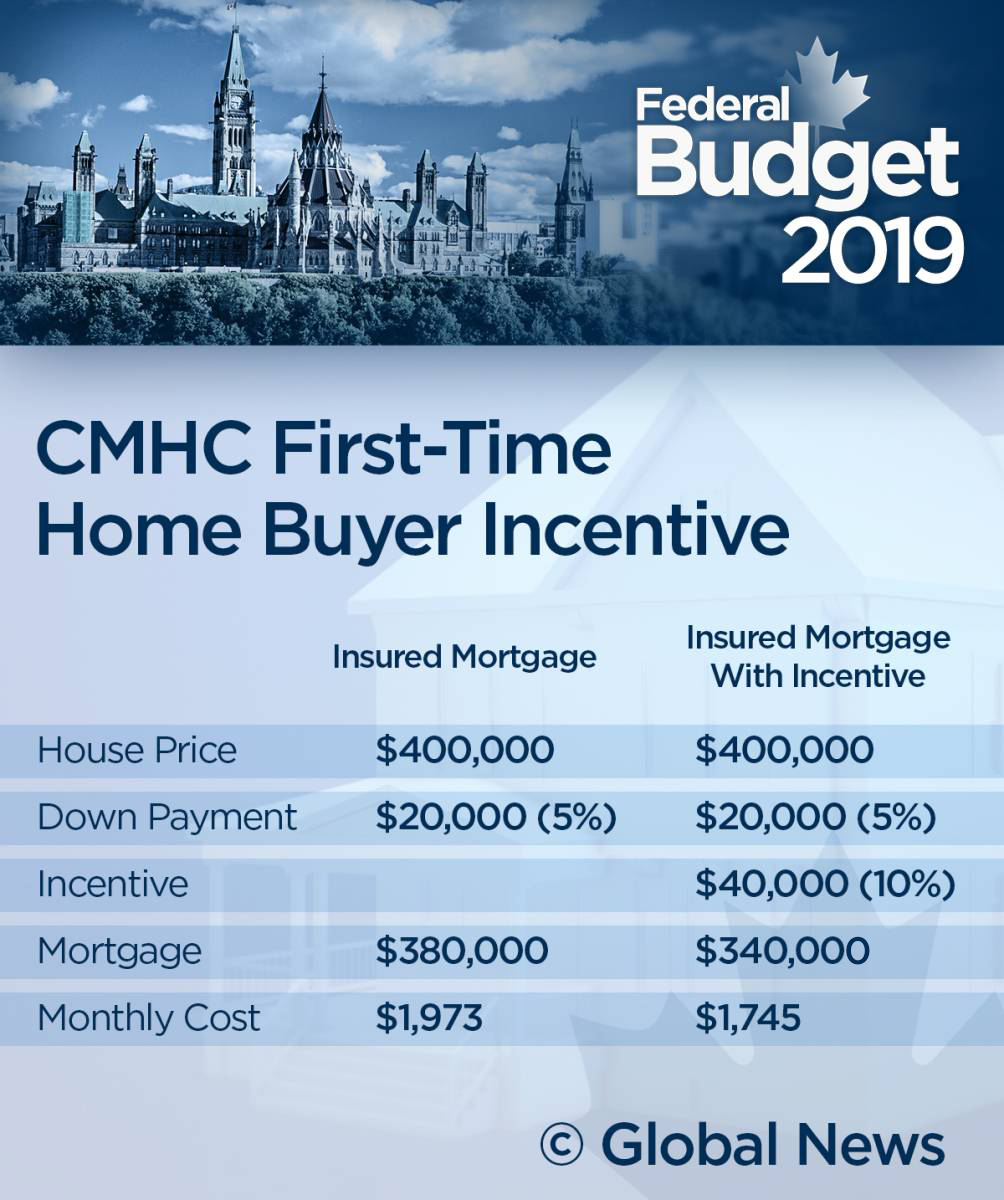

Homebuyers To Get New Mortgage Incentive Home Buyer S Plan Boost Under 2019 Budget National Globalnews Ca

Homebuyers To Get New Mortgage Incentive Home Buyer S Plan Boost Under 2019 Budget National Globalnews Ca

Tax Credits Rebates For First Time Home Buyers In Toronto First Time Home Buyers Moving To Toronto Real Estate Tips

Tax Credits Rebates For First Time Home Buyers In Toronto First Time Home Buyers Moving To Toronto Real Estate Tips

The Homeowners Guide To Tax Credits And Rebates

The Homeowners Guide To Tax Credits And Rebates

Where Do I Claim The Home Buyers Amount

Where Do I Claim The Home Buyers Amount

Repayments To The Home Buyers Plan Hbp Repayment H R Block Canada

Repayments To The Home Buyers Plan Hbp Repayment H R Block Canada

Lihtc Infographic Low Income Housing Infographic Tax Credits

Lihtc Infographic Low Income Housing Infographic Tax Credits

First Time Home Buyers Tax Credit Loans Canada

First Time Home Buyers Tax Credit Loans Canada

Dsha Launches New Homeownership Website State Of Delaware News

Dsha Launches New Homeownership Website State Of Delaware News

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home