Property Tax Exemption For Seniors In Michigan

Twenty-four states and the District of Columbia offer property tax deferral programs for senior homeowners who qualify. Additional senior deduction eliminated Maximum impact of 98 per senior Only affected taxpayers age 65 or older Homestead property tax credit changes Eliminated for those with income above 50000 or with homes with a taxable value of 135000 or more Business income both losses and gains excluded from household resources.

Grand Rapids Will Spend Money On Affordable Housing But Is It Enough Grand Rapids Spending Money Affordable Housing

Grand Rapids Will Spend Money On Affordable Housing But Is It Enough Grand Rapids Spending Money Affordable Housing

Of course there are qualifying rules for all these tax breaks and the first of these is your age.

Property tax exemption for seniors in michigan. To be considered for an exemption on your property taxes the applicant is required to submit the following to the Board of Review. In short Michigan is a tax-friendly destination for retirees. Look for the link labeled Information for Senior citizens and Retirees last listed under the area titled TAX TIME RESOURCES May 2006 There also exists a poverty exemption from ordinary property ad valorem taxes.

161 of 2013 a property tax exemption for. Lansing The Michigan House on Thursday approved a 3575 million tax cut plan that would expand the states personal exemption for all filers and create a new 100 tax credit for seniors. A property tax exemption for real property owned and used as a homestead by a disabled veteran or the disabled veterans un-remarried surviving spouse.

Industrial Facilities Exemption A property tax exemption to manufacturers for renovation and expansion of aging facilities building of new facilities and establishment of high tech facilities. A Senior Exemption provides property tax savings by reducing the equalized assessed value of an eligible property. Once this exemption is applied the Assessors Office auto-renews it for you each year.

PA 78 allows local municipalities to be reimbursed for real and personal property taxes lost due to the exemption for eligible senior citizen and disabled housing facilities under MCL 2117d. Listed below are property tax exemptions credits and information that may be beneficial to active military personnel as well as veterans. A completed Michigan Department of Treasury Form 5737 Application for MCL 2117u Poverty Exemption Registered proof of ownership Deed land contract probate court order divorce judgment etc.

11 rows Many senior citizens qualify for a tax break called a homestead tax credit. Only one spouse must typically be 65 or over if youre married and you own your property jointly. Sales taxes are somewhat below average while property taxes are above average.

You should complete the Michigan Homestead Property Tax Credit Claim MI-1040CR to see if. It does not tax Social Security and it provides a sizable deduction for seniors on other types of retirement income. Under 7d municipalities receive a payment in lieu of taxes PILT from the Michigan Department of Treasury.

As noted these exemptions are generally reserved for those who are age 65 or older. Property Tax Exemption for Disabled Veterans Information on PA. Most homeowners are eligible for this exemption if they meet the requirements for the Homeowner Exemption and were 65 years of age or older during calendar year 2020.

It can be secured by petitioning the local property tax Board of Review in March of each year. The minimum age requirement for senior property tax exemptions is generally between the ages of 61 to 65. The exemption is provided in one year increments and is not renewable from year-to-year.

Michigans homestead property tax credit is how the State of Michigan can help you pay some of your property taxes if you are a qualified Michigan homeowner or renter and meet the requirements. States offer property tax breaks to seniors in a variety of ways but the three most common methods are property tax deferral programs circuit-breaker programs and homestead exemption or credit programs. Click on the link below to find out more information.

How To Calculate Michigan Property Taxes On Your Investment Properties

How To Calculate Michigan Property Taxes On Your Investment Properties

State Tax Treatment Of Homestead And Non Homestead Residential Property

State Tax Treatment Of Homestead And Non Homestead Residential Property

Michigan Retirement Tax Friendliness Smartasset

Michigan Retirement Tax Friendliness Smartasset

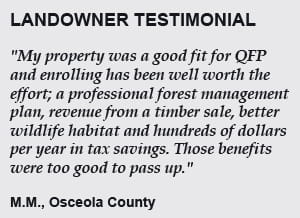

Mdard Is Your Forest Working For You

Mdard Is Your Forest Working For You

Https Www Michigan Gov Documents Treasury Amar Adopted 9 18 17 With Hyperlinks 601914 7 Pdf

Https Www Michigan Gov Documents 2383 4285 7 Pdf

School Aid Budget In Pictures School Fund Student Plan School

School Aid Budget In Pictures School Fund Student Plan School

Report Knocks Oregon Property Tax System Property Tax Knock Knock Oregon

Report Knocks Oregon Property Tax System Property Tax Knock Knock Oregon

Michigan Retirement Tax Friendliness Smartasset

Michigan Retirement Tax Friendliness Smartasset

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Michigan Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Michigan Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Michigan Property Taxes What Is A Homestead Exemption

Michigan Property Taxes What Is A Homestead Exemption

Tax Breaks For Owning A Home Distressed Property Waterfront Property Remax

Tax Breaks For Owning A Home Distressed Property Waterfront Property Remax

What Is The Disability Property Tax Exemption Millionacres

What Is The Disability Property Tax Exemption Millionacres

Mortgage Affordability Mortgage Subtraction Finance

Mortgage Affordability Mortgage Subtraction Finance

Download Policy Brief Template 40 In 2021 Word Families Words Word Template

Download Policy Brief Template 40 In 2021 Word Families Words Word Template

States With The Highest And Lowest Property Taxes Property Tax Tax States

States With The Highest And Lowest Property Taxes Property Tax Tax States

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home