Does Vermont Have Property Tax On Cars

Wine Liquor Tax. These taxes are collected to provide essential state functions resources and programs to benefit both our taxpayers and Vermont at large.

10 No 42 Vermont Best Places To Travel Amazing Travel Destinations Places To Travel

10 No 42 Vermont Best Places To Travel Amazing Travel Destinations Places To Travel

Auto car 1 Year.

Does vermont have property tax on cars. In Vermont all property is subject to education property tax to pay for the states schools. Whether or not you have to pay an annual property tax on your vehicle depends on the state the vehicle is registered and used in. If the vehicle is currently registeredtitled to you or your spouse or party to a civil union out-of-state tax is based on NADA clean trade-in book value and is due unless exempt.

Vermont has one of the highest average property tax rates in the country with only seven states levying higher property taxes. If you believe that the vehicles value is less than book value you may submit a Vermont Dealer Appraisal Form. How does Vermont rank.

Car tax is paid based on the state where the car is first registered so if you live in California and buy a car in Oregon you will have to pay when you register the car. Here is a list of current state tax rates. The major types of local taxes collected in Vermont include income property and sales taxes.

A 9 rooms and meals tax also on rental cars A 5 tax on dividends and interest with a 24004800 exemption plus additional exemptions. As of 2020 New York has a car tax rate of 4 percent plus local taxes whereas next-door neighbor Massachusetts has a state car tax rate of 625 percent with some local rates much higher. 802 828-3379 Fax Number.

Vehicle Classification Renew for Gas or Diesel Electric Other Fuel. 66 Transport 34 Education. The first step towards understanding Vermonts tax code is knowing the basics.

Other taxes and fees applicable to Vermont car purchases. Its also called an ad valorem tax. Property taxes that vary by town.

When you purchase a new or used car be prepared to pay a number of different taxes. The median property tax in Vermont is 344400 per year for a home worth the median value of 21630000. Motor Vehicle Purchase Use Tax.

Individuals can deduct personal property taxes paid during the year as an itemized deduction on Schedule A of their federal tax returns at least up to a point. By Vermont law property owners whose homes meet the definition of a Vermont homestead must file Form HS-122 Section A Homestead Declaration annually by April 18. Meals Rooms Tax.

Counties in Vermont collect an average of 159 of a propertys assesed fair market value as property tax per year. However the state has an effective vehicle tax rate of 26 according to a property tax report published earlier this year by WalletHub which calculated taxes on a 25000 vehicle. Click the tabs below to explore.

For this purpose property is categorized as either nonresidential or homestead. Vermont has 19 special sales tax jurisdictions with local sales taxes in addition to the state sales tax Vermont has a higher state sales tax than 654 of states Counties and cities in Vermont are allowed to charge an additional local sales tax on top of the Vermont state sales tax with 10 cities charging the additional 1 local sales tax. Vermont taxes vehicle purchases after rebates or incentives are applied to the price which means that the buyer in this scenario will only pay taxes on the vehicle as if it cost 9000.

Taxes on the self-employed above a certain threshold by 2021 the business profits tax will be 75 and the business. Within states that have different car tax rates for different cities you pay the car tax rate based on your home address. Knowing how much sales tax to pay when purchasing a vehicle is also helpful to know when asking for financing from a lender.

16 of value in excess of 275mm. Below we have highlighted a number of tax rates ranks and measures detailing Vermonts income tax business tax sales tax and property tax systems. 6 of price less trade-in value.

New Hampshire does collect. The tax is imposed on movable property such as automobiles or boats and its assessed annually. Office of Veterans Affairs 118 State Street Montpelier Vermont 05620-4401.

Hotels Restaurants Bars 191. Jitney Up to 7 Passengers. Like many other belongings treated as personal property vehicles are subject to a handful of taxes.

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

States With The Highest And Lowest Property Taxes Property Tax Tax States

States With The Highest And Lowest Property Taxes Property Tax Tax States

Vermont Property Tax Calculator Smartasset

Vermont Property Tax Calculator Smartasset

Half Of Vermont Towns Will See Increased Property Tax Rates Vtdigger

Half Of Vermont Towns Will See Increased Property Tax Rates Vtdigger

Tdoay S Burlington Free Press Www Burlingtonfreepress Com Burlington Public School Public

Tdoay S Burlington Free Press Www Burlingtonfreepress Com Burlington Public School Public

New Hampshire Property Tax Calculator Smartasset

New Hampshire Property Tax Calculator Smartasset

Vermont Property Tax Calculator Smartasset

Vermont Property Tax Calculator Smartasset

Vermont Property Tax Calculator Smartasset

Vermont Property Tax Calculator Smartasset

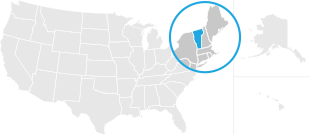

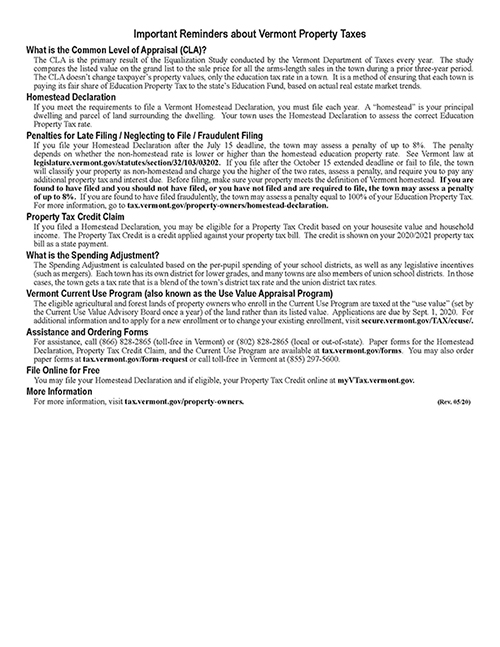

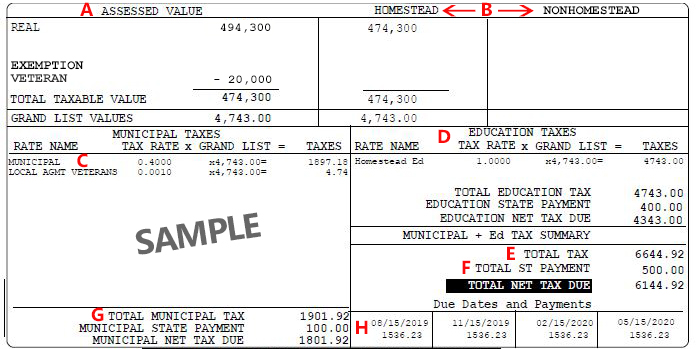

Understanding Your Property Tax Bill Department Of Taxes

Understanding Your Property Tax Bill Department Of Taxes

Half Of Vermont Towns Will See Increased Property Tax Rates Vtdigger

Half Of Vermont Towns Will See Increased Property Tax Rates Vtdigger

Pin On Vermont Mutual Insurance Company

Pin On Vermont Mutual Insurance Company

Brattleboro Vt 05301 Ev Charging Station Map Ev Charging Stations Station Map Ev Charging

Brattleboro Vt 05301 Ev Charging Station Map Ev Charging Stations Station Map Ev Charging

Vermont Do Not Resuscitate Form Templates Legal Forms Template Site

Vermont Do Not Resuscitate Form Templates Legal Forms Template Site

Vermont Vermont Zip Code Map Map

Vermont Vermont Zip Code Map Map

Understanding Your Property Tax Bill Department Of Taxes

Understanding Your Property Tax Bill Department Of Taxes

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Understanding Your Property Tax Bill Department Of Taxes

Understanding Your Property Tax Bill Department Of Taxes

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home