Texas Property Tax Value Increase Limit

Or The 2015 appraised value of 100000 plus 10 Mr. The legislation the state adopted last year requires most local taxing entities to seek voter approval through an election if they want to increase property tax revenue the size of the pie by.

Texas Property Tax Travis Central Appraisal District

Texas Property Tax Travis Central Appraisal District

What does a capped value mean as it relates to Texas taxes.

Texas property tax value increase limit. Some people believe this to mean that market values for a residential homestead in Texas cannot be increased more than 10 in any one year. SB 2 limits local government to 35 per year annual revenue growth excluding the value of new development without a vote of the people. With the Reformed Property Tax Code of Texas the annual increase will be limited.

Property taxes cant go up too much without voter approval. Jones value for property tax purposes will be the lesser of. Technically a Texas homesteads assessed value is limited to the lesser of either its market value or the sum of the market value of any new improvements and 110 of the appraised value of the preceding year.

Applying for a Homestead exemption caps the maximum increase on taxes a residential property owner can receive since the latest reappraisal to 10. Community colleges hospital districts and small taxing units with rates of 25 cents per 100 of taxable value or less will need voter approval to increase a. Further artificially limiting the appraisal value of a home through a government overreach program sets a dangerous precedent.

Or the sum of. Leaders from San Antonio and other Texas cities requested a property value freeze because of the shutdown but that. Texas property owners facing tax increase in the midst of Covid-19 shutdown.

The appraised value can go up a maximum of 10 each year until it reaches the full market value although there are exceptions to this rule. 140000 the market value of the home. Under normal circumstances a new Texas law says a city cant.

However some legislators want to lower the current 10 appraisal cap rate to 3 or 5 under the guise of limiting the property tax bill of a residential homestead. Therefore the maximum increase is 10 times the number of years since the property was last appraised. Jones appraised value for 2016 will be 110000 100000 x 10 100000.

The 10 increase is cumulative. Texas Governor Greg Abbott was in favor of this limit. To transfer the school district tax ceiling you may request a certificate from the chief appraiser in the last appraisal district in which you received the tax ceiling.

The market value of the property. Senate Bill 2 the Texas Property Tax Reform and Transparency Act of 2019 is 153 pages long. If local government want to.

The law wont lower your taxes but it will slow. Its now a law but its also a cliché of sorts. Just how much is too much is a matter of legal debate.

The market value may increase by any percentage over the previous year but the cap makes sure that you are not taxed on an increase of more than 10. Tax Code Section 2323a sets a limit on the amount of annual increase to the appraised value of a residence homestead to not exceed the lesser of. It wasnt the number the governor wanted but apparently it was the closest he can get to his original plan.

Texas real estate is in demand and the increase in value is what makes property in our state such a great investment. As confirmed by the Legislative Budget Board LBB the loophole reads when seeking to raise property taxes above the 35 percent threshold in response to a disaster with the exception of a draught and the governor has declared any part of the area in which the taxing unit is located as a disaster area an election is not required under this section to approve the tax rate adopted by the. If you move to another home and the taxes on the new homestead would normally be 1000 in the first year the new tax ceiling would be 250 or 25 percent of 1000.

This is how Texas lawmakers avoided true property tax reform and instead gave us fluff and stuff. In fact he wished for a 25 cap but it was amended to 35 which was approved by the House. Play Texas House Passes Cap On Rate Of Property Tax Increases Texas House Passes Cap On Rate Of Property Tax Increases May 1 2019.

In June Texas Gov. Texas House Passes Cap On Rate Of Property Tax Increases If the bill becomes law cities and counties would be limited to a 35 annual tax rate increase without the need for voter approval. Greg Abbott signed into law a bill that will limit local governments from raising their property tax revenue more than 35 year-over-yearexcluding new construction and debt obligationswithout triggering an election.

I Notwithstanding Subsections a and b of this section the Legislature by general law may limit the maximum appraised value of a residence homestead for ad valorem tax purposes in a tax year to the lesser of the most recent market value of the residence homestead as determined by the appraisal entity or 110 percent or a greater percentage of the appraised value of the residence homestead for the. The homeowners property tax is based on the county appraisal districts appraised value of the home.

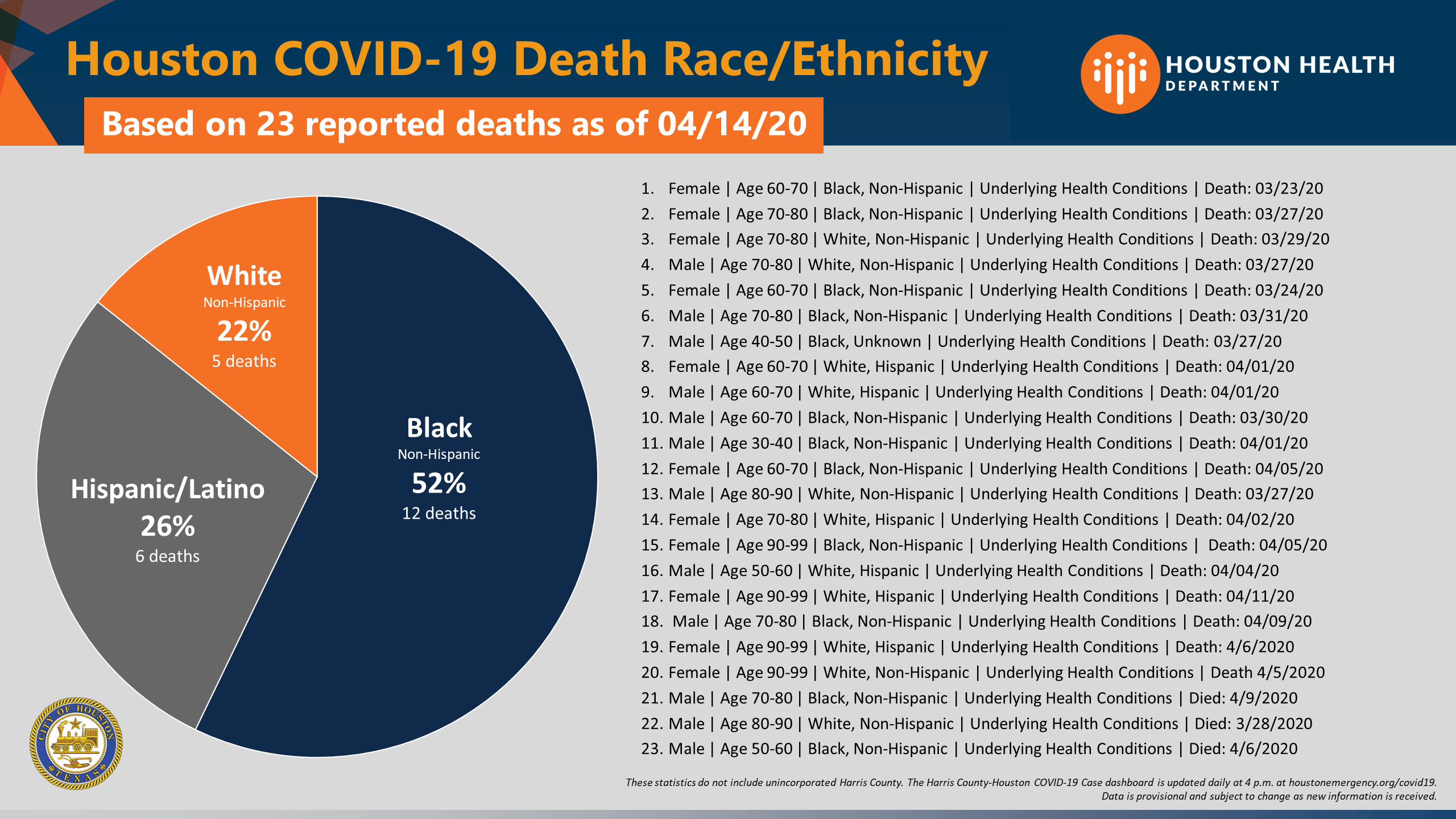

Understanding The Property Tax Protest Industry Of Houston

Understanding The Property Tax Protest Industry Of Houston

Montgomery County Approves 10 Percent Homestead Exemption Community Impact Newspaper

Montgomery County Approves 10 Percent Homestead Exemption Community Impact Newspaper

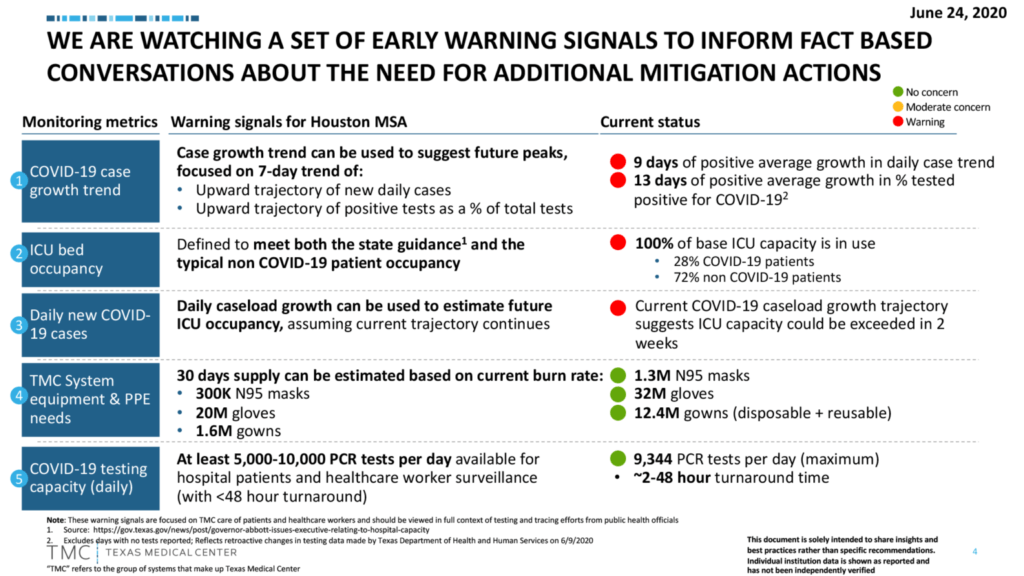

Coronavirus A Texas Medical Center Continuing Update Tmc News

Coronavirus A Texas Medical Center Continuing Update Tmc News

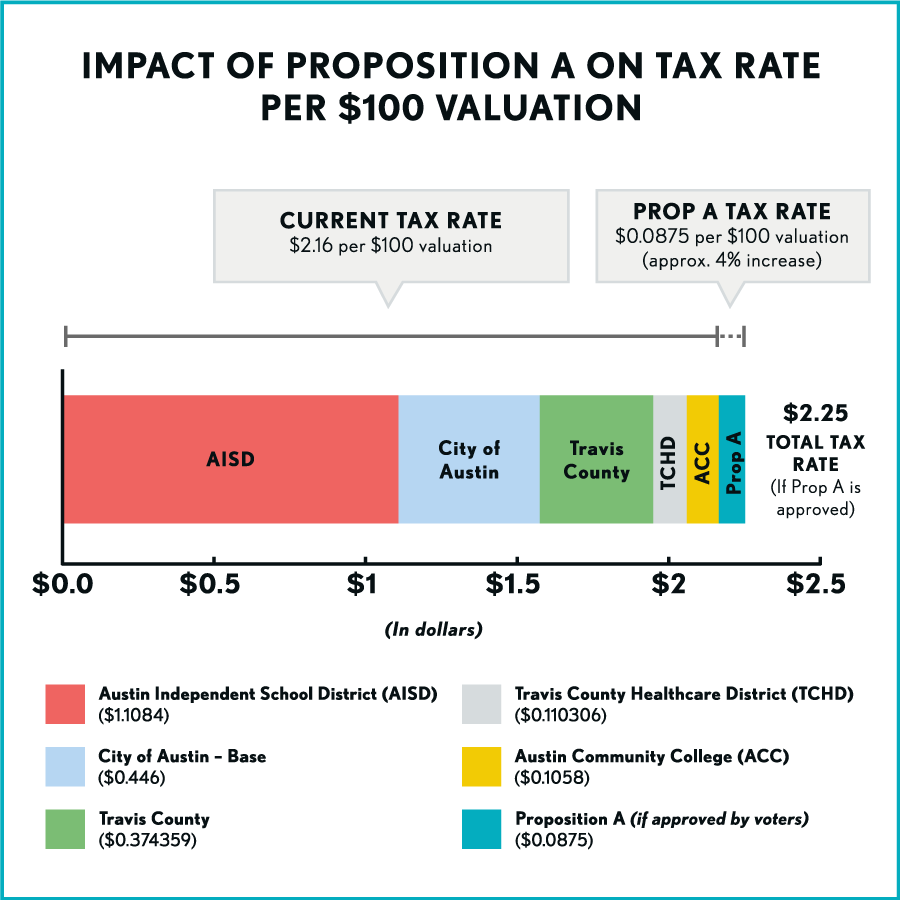

2020 Mobility Elections Proposition A Austintexas Gov

2020 Mobility Elections Proposition A Austintexas Gov

Best Cheap Car Insurance In Texas For 2021 Forbes Advisor

Best Cheap Car Insurance In Texas For 2021 Forbes Advisor

Tarrant County Tx Property Tax Calculator Smartasset

Tarrant County Tx Property Tax Calculator Smartasset

Coronavirus A Texas Medical Center Continuing Update Tmc News

Coronavirus A Texas Medical Center Continuing Update Tmc News

What Property Owners Need To Know About Homestead Savings Runnels County Appraisal District Official Website

Taxation Plano Economic Development Tx Official Website

Pin On Mortgage Rates And Information

Pin On Mortgage Rates And Information

Why Are Texas Property Taxes So High Home Tax Solutions

Why Are Texas Property Taxes So High Home Tax Solutions

Where Are The Fastest Growing Real Estate Markets In America Real Estate Prices Real Estate Real Estate Marketing

Where Are The Fastest Growing Real Estate Markets In America Real Estate Prices Real Estate Real Estate Marketing

Landmark Wildlife Management Wildlife Exemption

Understanding The Property Tax Protest Industry Of Houston

Understanding The Property Tax Protest Industry Of Houston

Spring Forward The Difference An Hour Makes Infographic Texas Key Real Estate Keeping Current Real Estate Marketing Real Estate Articles Selling Rea

Spring Forward The Difference An Hour Makes Infographic Texas Key Real Estate Keeping Current Real Estate Marketing Real Estate Articles Selling Rea

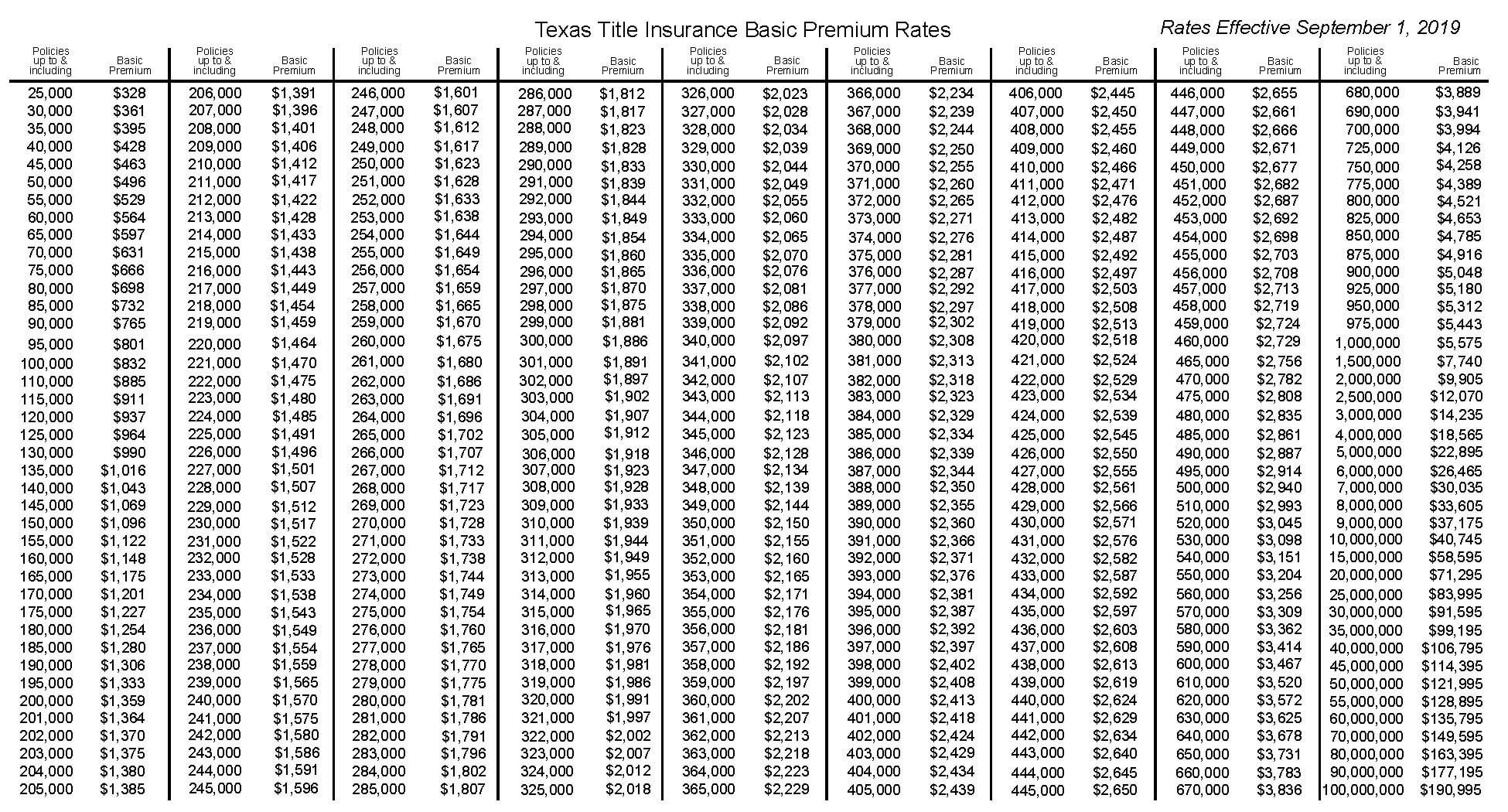

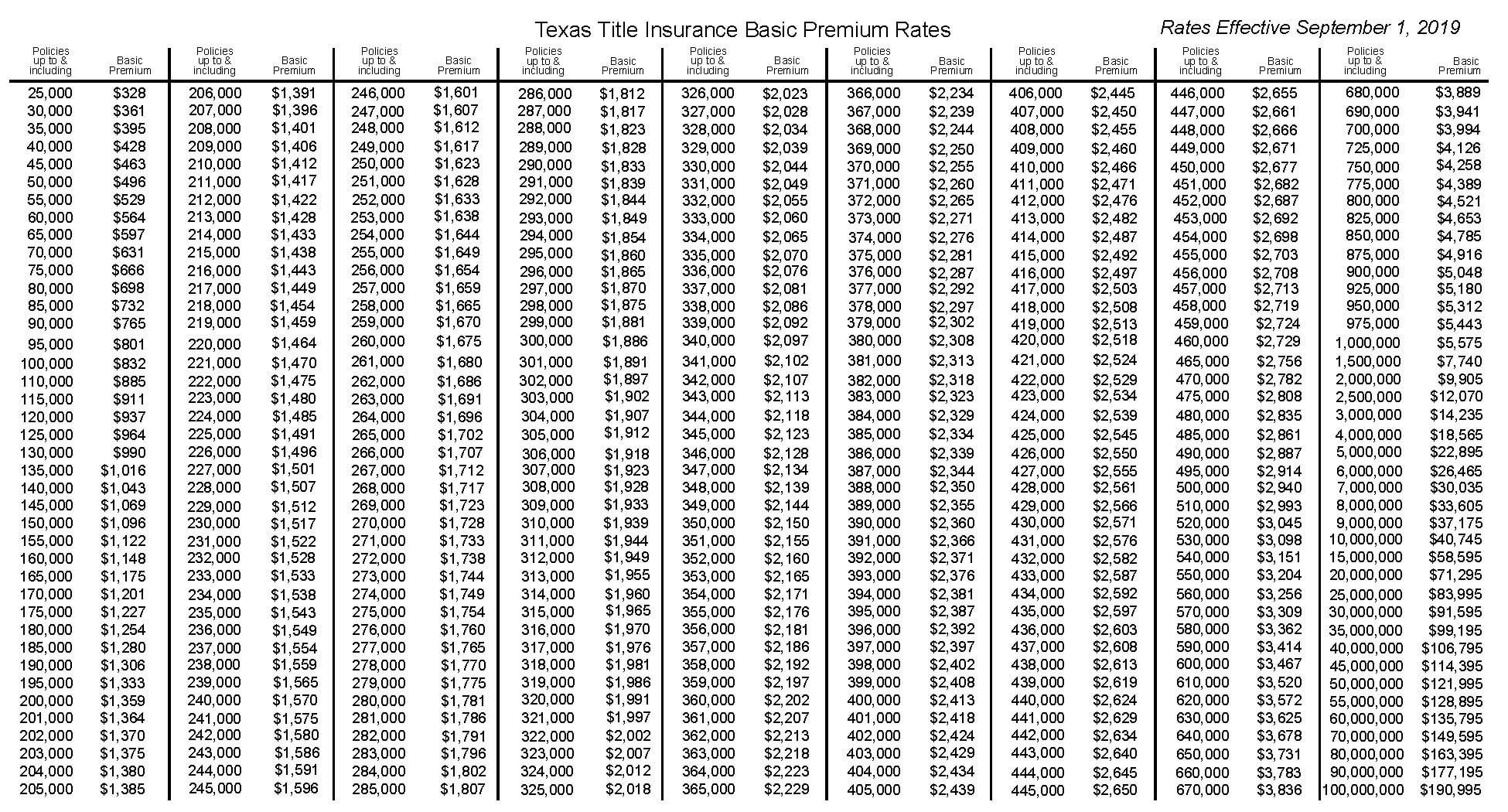

Title Insurance Rate Change Effective September 1 2019 Reminder Republic Title

Title Insurance Rate Change Effective September 1 2019 Reminder Republic Title

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Property Taxes In Texas What Homeowners Should Know

Property Taxes In Texas What Homeowners Should Know

Good Morning Realtor To Start Your Day Share This To Your Wall 5 Reasons To Hire A Lead Generation Real Estate Real Estate Professionals Atlanta Real Estate

Good Morning Realtor To Start Your Day Share This To Your Wall 5 Reasons To Hire A Lead Generation Real Estate Real Estate Professionals Atlanta Real Estate

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home