Personal Property Tax Missouri Leased Vehicle

View entire discussion 3 comments 569. Motor Vehicle Trailer ATV and Watercraft Tax Calculator.

Leasing companies are responsible for reporting these vehicles to the Assessors Office because they are the owners of the vehicles.

Personal property tax missouri leased vehicle. As an example a residence with a market value of 50000 would be assessed at 19 which would place its assessed value at 9500. Leased Vehicles Leased vehicles should not be reported on an individuals Personal Property Assessment Form. Personal Property Tax - A Yearly Tax Personal property tax is paid to Jackson County by December 31 of every year on every vehicle you owned on January 1.

Leasing companies are responsible for reporting these vehicles to the Assessors office because they are the titled owners of the vehicles. A personal property tax account will be opened for you so that you will receive important mailings which will be sent periodically. The leasing company will be billed for personal property tax directly.

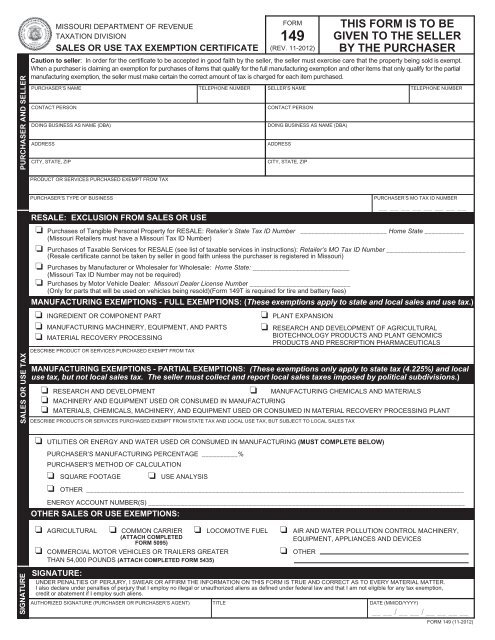

You pay tax on the sale price of the unit less any trade-in or rebate. After the assessed value is calculated the tax levy is applied. TAXABLE In the state of Missouri any lessor or renter who has paid tax on any previous purchase lease or rental of vehicle will not be required to collect tax on any subsequent lease rental sub-lease or.

Individual Consumer Use Tax. Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local option use tax information. The assessed value of your vehicles and other property is listed on your tax bill.

Missouri vehicle sales tax and County personal property tax are 2 different types of tax. A Leased Motor Vehicle Trailer Registering a Leased Motor Vehicle or Trailer If the leaserental company wants to register the leased vehicle the following is required in addition to the requirements for titling. The Internal Revenue Service requires that these deductible ad valorem taxes be based on the value of the car and be charged by the state every year.

You pay the personal property tax every year. In order to do so the leasing company must have the correct garaging address of the vehicle. If you have a leased vehicle.

An automobile with a market value of 10000 would be assessed at 33 13 or 3333. The assessed value of your vehicles and other property is listed on your tax bill. Personal Property Tax Assessed Value100 x Levy Rate.

If you pay personal property tax on a leased vehicle you can deduct that expense on your federal tax return. If you have questions about whether your vehicle was taxed or the value please contact the Leasing Section at 314-615-5102. Either a Statement of Non-Assessment if you were not leasing.

Home Motor Vehicle SalesUse Taxcalc. After your account has been opened you will visit the Collectors office where you will receive your tax waiver. Your personal property tax is calculated by dividing the assessed value of the property by 100 and then multiplying that value by the levy rate for your area.

Your personal property tax is calculated by dividing the assessed value of the property by 100 and then multiplying that value by the tax rate for your area. No state registration license to operate any motor vehicle in this state shall be issued unless the application for license of a motor vehicle or trailer is accompanied by a tax receipt for the tax year which immediately precedes the year in which the vehicles or trailers registration is due and which reflects that all taxes including delinquent taxes from prior years have been paid. 2019 Withholding Tax and.

To renew the license plates on a leased vehicle one of the following documents will need to be presented to the Department of Revenue. The Department collects taxes when an applicant applies for title on a motor vehicle trailer all-terrain vehicle boat or outboard motor unit regardless of the purchase date. For additional information click on the links below.

2 points 6 years ago. Leased vehicles should NOT be reported on an Individual Personal Property Assessment Form. Personal Property Tax Assessed Value100 Tax Rate.

Missouri Sales Tax - A One-Time Tax Sales Tax is paid to the State usually at the Department of Motor Vehicles when the vehicle is first purchased. You dont have sales tax you will have a use tax which usually the dealer puts in your payment. Original personal property tax receipt or statement of non- assessment for the previous year in the leasing companys name.

Do You Have To Pay A Vehicle Tax Here S Some Good News The Motley Fool

Do You Have To Pay A Vehicle Tax Here S Some Good News The Motley Fool

Free Missouri Power Of Attorney Form To Download Professional And Printable Templates Samples Charts For Power Of Attorney Form Power Of Attorney Attorneys

Free Missouri Power Of Attorney Form To Download Professional And Printable Templates Samples Charts For Power Of Attorney Form Power Of Attorney Attorneys

Real Estate Power Of Attorney Form Power Of Attorney Form Connecticut Real Estate Power Of Attorney

Real Estate Power Of Attorney Form Power Of Attorney Form Connecticut Real Estate Power Of Attorney

Georgia Real Estate Property Power Of Attorney Form Power Of Attorney Form Power Of Attorney Maryland Real Estate

Georgia Real Estate Property Power Of Attorney Form Power Of Attorney Form Power Of Attorney Maryland Real Estate

Https Www Jacksongov Org Documentcenter View 118 Business Personal Property Tax Exemption 2021 Application Pdf

Https Dor Mo Gov Forms Missouri Titling Manual Pdf

Free Missouri Bill Of Sale Forms Pdf

Free Missouri Bill Of Sale Forms Pdf

Missouri Car Registration Everything You Need To Know

Missouri Car Registration Everything You Need To Know

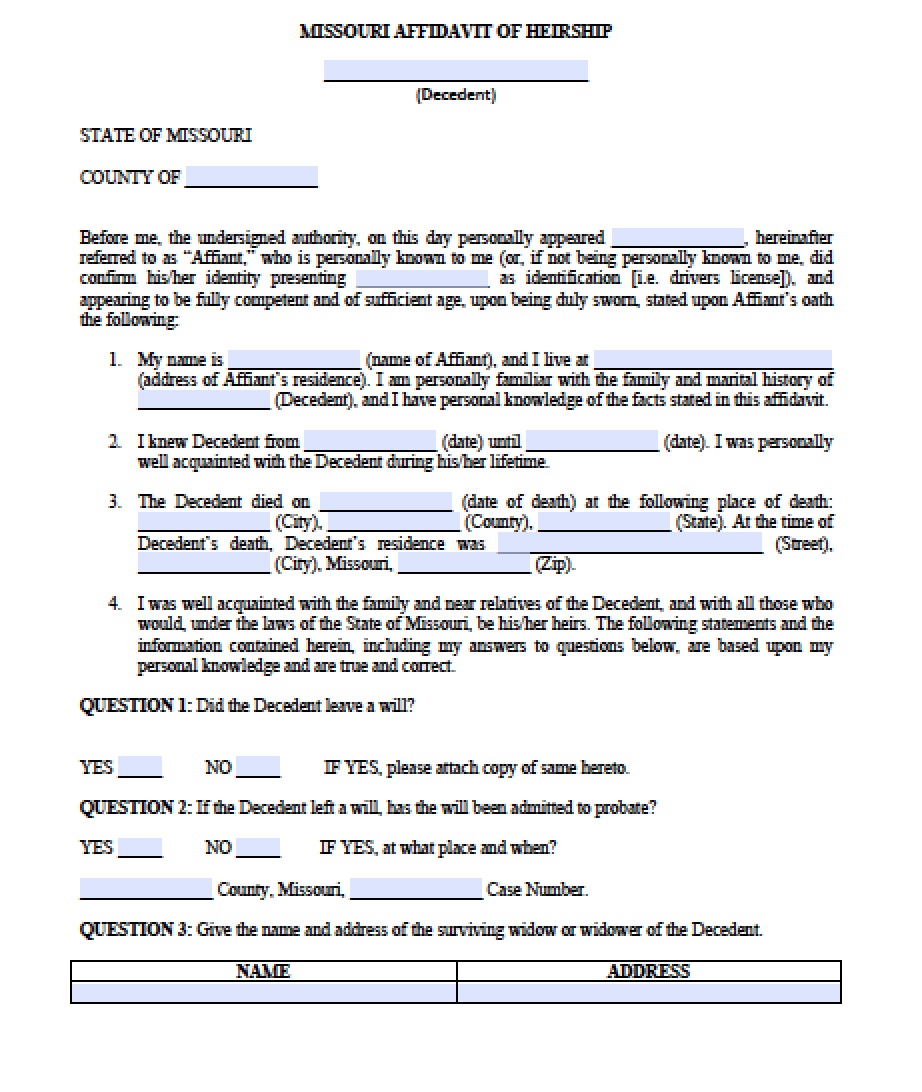

Free Missouri Affidavit Of Heirship Form Pdf Word

Free Missouri Affidavit Of Heirship Form Pdf Word

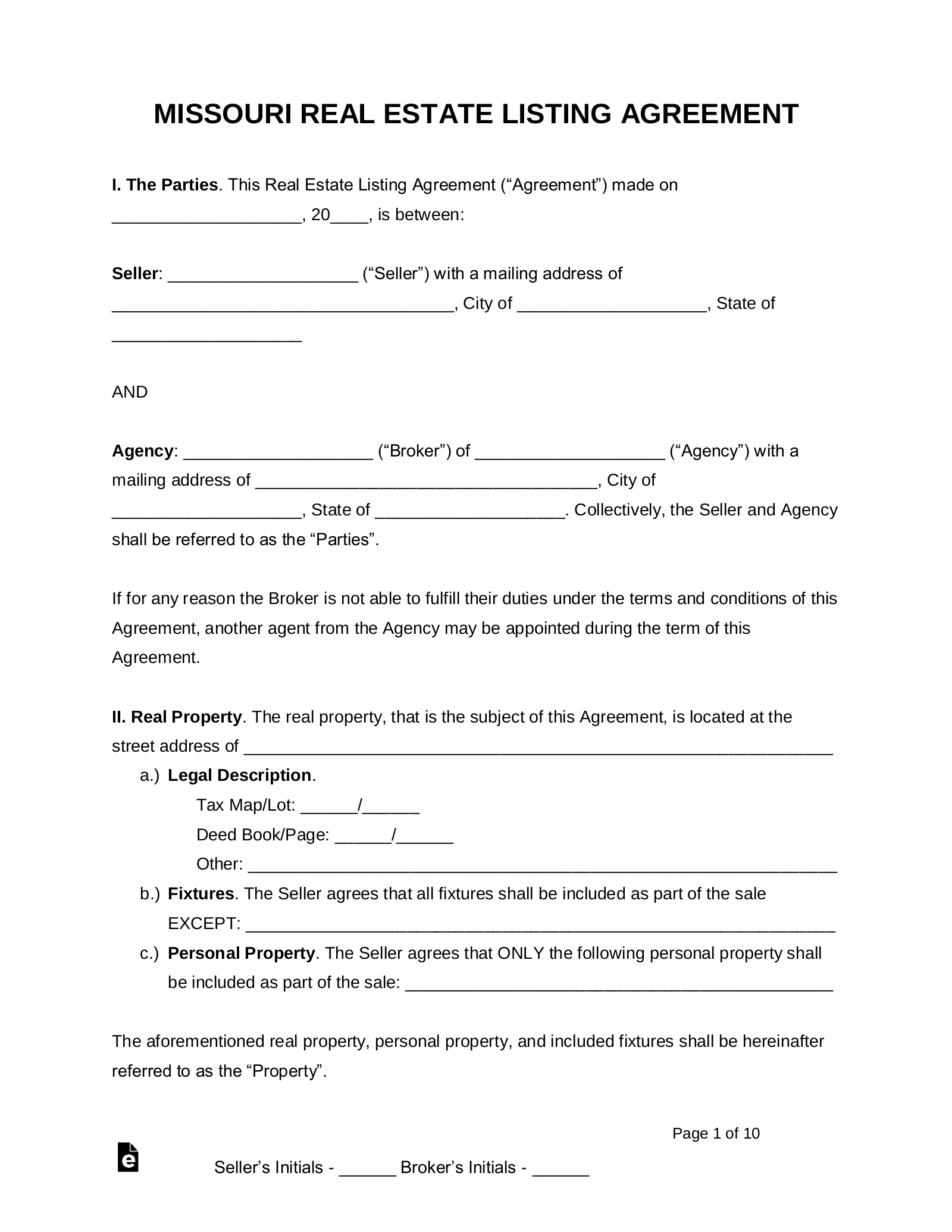

Free Missouri Real Estate Agent Listing Agreement Pdf Word Eforms

Free Missouri Real Estate Agent Listing Agreement Pdf Word Eforms

Https Dor Mo Gov Forms Missouri Titling Manual Pdf

Free Missouri Revocable Living Trust Form Pdf Word Eforms

Free Missouri Revocable Living Trust Form Pdf Word Eforms

Chapter 100 Sales Tax Exemption Personal Property Department Of Economic Development

Chapter 100 Sales Tax Exemption Personal Property Department Of Economic Development

Maryland Residential Lease Agreement Download Free Printable Legal Rent And Lease Template Form In Different Edi Lease Agreement Being A Landlord For Sale Sign

Maryland Residential Lease Agreement Download Free Printable Legal Rent And Lease Template Form In Different Edi Lease Agreement Being A Landlord For Sale Sign

Memory Jogger List Template Why It Is Not The Best Time For Memory Jogger List Template You Are The Father List Template Memories

Memory Jogger List Template Why It Is Not The Best Time For Memory Jogger List Template You Are The Father List Template Memories

What Happens If You Don T Pay Your Personal Property Tax

What Happens If You Don T Pay Your Personal Property Tax

Https Dor Mo Gov Forms 426 Pdf

Personal Property Faqs Millercounty

Personal Property Faqs Millercounty

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home