What Can Seniors Claim On Taxes Ontario

Refundable tax credit offers up to 2500 for eligible home reno expenses. However you can claim salaries and wages for care in such facilities if the care recipient qualifies for the disability tax credit see Salaries and wages.

Cerb Extension Can Retirees Get The 2 000 Cra Crb Canada Pension Plan The Motley Fool Saving For Retirement

Cerb Extension Can Retirees Get The 2 000 Cra Crb Canada Pension Plan The Motley Fool Saving For Retirement

When you turn 65 youll qualify for the Ontario Drug Benefit program.

What can seniors claim on taxes ontario. If youre 65 years of age or older and living in Ontario you may be eligible for the Ontario Healthy Homes Renovation Tax Credit. Age amount You can claim this credit if you were 65 or older on Dec. The Ontario government proposed a temporary home improvement tax credit for seniors in its 2020 Ontario budget.

In this case the dependant must be. Health benefits for seniors in Ontario extend to prescription medications as well. The definition of dependant for this credit is different than for the Eligible Dependant Amount credit.

To be eligible you must. As a senior you may be eligible for benefits and credits when you file your return such as the. The maximum claim is.

This program lists over 4000 medications the province will pay for. The maximum credit is 2500. The credit would allow seniors to stay in their homes for longer during the Covid-19 pandemic.

The Seniors Home Safety Tax Credit would be a fully refundable tax credit for the 2021 tax year worth. As an Ontario senior you can claim the refundable Ontario seniors public transit tax credit to help with the costs of public transit costs. The Ontario Senior Homeowners Property Tax Grant helps low-to-moderate income seniors with the cost of their property taxes.

The Seniors Home Safety Tax Credit is worth 25 of up to 10000 in eligible expenses for a seniors principal residence in Ontario. Generally you cannot claim the entire amount you paid for a retirement home or a home for seniors. What is a nursing home.

Goods and services tax harmonized sales tax credit. 31 2013 and your net income is less than 80256. How to claim it The Seniors Home Safety Tax Credit is a refundable personal income tax credit.

If you owe money this year you may be able to claim. You can claim a 1845 BPA tax credit if your net income is above 214368. This is a refundable tax credit for seniors of all income levels.

Youll pay an annual deductible of 100. Families who have a senior living with them who renovated to accommodate the safety and accessibility of the senior can also claim it. Related provincial or territorial benefits and credits.

Be a resident of Ontario as on December 31 2018 Be 65 years of age at the beginning of the year for. Every province has its personal amount on which it exempts provincial tax. Money-saving credits and helpful tips for seniors this 2020 tax season and beyond Wednesday April 14 2021 Marion Goard Financial Health House and Home When it comes to filing your income tax return making sure you claim potential benefits and credits is important as often it can help put more money back into your pocket.

If at any time in the taxation year in question you andor your spouse maintained a home for a disabled or elderly relative over the age of 18 you may be eligible to claim the Canada Caregiver Credit.

Registration Of Ngo How To Raise Money Donation Tax Deduction Tax Deductions

Registration Of Ngo How To Raise Money Donation Tax Deduction Tax Deductions

Claiming Your Dependant S Medical Expenses H R Block Canada

Claiming Your Dependant S Medical Expenses H R Block Canada

Gross Vs Net Income Financial Infographic From Accc Learn More About Personal Finances To Better Manage Your Net Income Debt Relief Programs Personal Finance

Gross Vs Net Income Financial Infographic From Accc Learn More About Personal Finances To Better Manage Your Net Income Debt Relief Programs Personal Finance

6 Overlooked Tax Deductions And Credits That Could Score You A Big Return National Globalnews Ca

6 Overlooked Tax Deductions And Credits That Could Score You A Big Return National Globalnews Ca

2020 Tax Deduction Finder Problem Solver Tax Deductions Tax Appointment Tax Organization

2020 Tax Deduction Finder Problem Solver Tax Deductions Tax Appointment Tax Organization

What Are Tax Deductible Car Expenses Gofar

What Are Tax Deductible Car Expenses Gofar

Are Health Insurance Premiums Tax Deductible

Are Health Insurance Premiums Tax Deductible

Irs Releases New Not Quite Postcard Sized Form 1040 For 2018 Plus New Schedules Tax Forms Irs Tax Forms Income Tax

Irs Releases New Not Quite Postcard Sized Form 1040 For 2018 Plus New Schedules Tax Forms Irs Tax Forms Income Tax

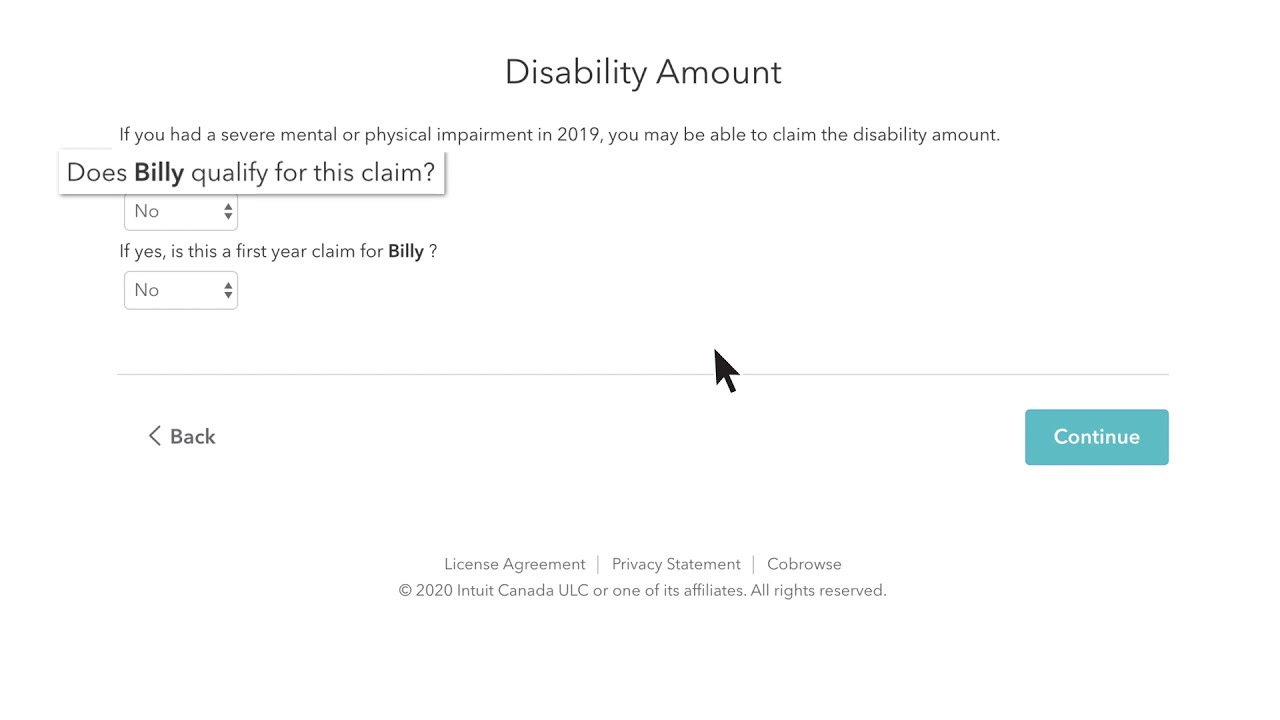

A Guide To The Disability Tax Credit 2021 Turbotax Canada Tips

A Guide To The Disability Tax Credit 2021 Turbotax Canada Tips

10 Tax Deductions For Seniors You Might Not Know About

10 Tax Deductions For Seniors You Might Not Know About

How To Prepare For An Irs Audit Infographic Tax Relief Center In 2020 Irs Federal Taxes Audit

How To Prepare For An Irs Audit Infographic Tax Relief Center In 2020 Irs Federal Taxes Audit

Tax Benefits Of Home Loan Repayment Home Loans Income Tax Loan

Tax Benefits Of Home Loan Repayment Home Loans Income Tax Loan

Pin On Starting A Home Business

Pin On Starting A Home Business

Tax Deductions And Credits For Household Expenses Smartasset

Tax Deductions And Credits For Household Expenses Smartasset

List Of Tax Deductions And Tax Credits That You Can Claim On Your Tax Return Canada Kelowna Accountants Tax Deductions Tax Credits Tax Return

List Of Tax Deductions And Tax Credits That You Can Claim On Your Tax Return Canada Kelowna Accountants Tax Deductions Tax Credits Tax Return

How Can I Reduce My Taxes In Canada

17 Things You Can T Claim In Your Tax Return Platinum Accounting Taxation

17 Things You Can T Claim In Your Tax Return Platinum Accounting Taxation

Tax Deductions And Tax Credits What S The Difference Canadian Taxpayers Have Until April 30th 2020 To File Their 2019 Tax Deductions Tax Credits Tax Refund

Tax Deductions And Tax Credits What S The Difference Canadian Taxpayers Have Until April 30th 2020 To File Their 2019 Tax Deductions Tax Credits Tax Refund

Alberta And Quebec Sr Ed Tax Credits Canadian Sred Solutions Tax Credits Quebec Seniors

Alberta And Quebec Sr Ed Tax Credits Canadian Sred Solutions Tax Credits Quebec Seniors

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home