New York Property Tax Late Payment Penalty

025 discount on the last three quarters if you wait until October to pay the entire amount due for the year. The following security code is necessary to prevent unauthorized use of this web site.

Is It A Good Idea To Prepay Property Taxes Embrace Home Loans

Is It A Good Idea To Prepay Property Taxes Embrace Home Loans

A trade group that represents brands such as.

New york property tax late payment penalty. 2 days agoNow Albany property owners can delay payment of their 2021 tax bills without penalty until May 31 which is 120 days beyond the usual due date. Interest Charges City School District late tax payments are subject to interest charges of 2 per month or any part thereof from the first due date up until May 20 2021. See forms and instructions to find the form you need to file.

This rate has not changed since it was instituted in 1983. Property Business Excise Tax Professionals Forms Select Tax Bills and Payments Data and Lot Information Dividing Merging Lots Assessments Tax Rates Guides. The property tax bills recently sent out by DOF are due on July 1 2020.

Theres no waiting on hold or being transferred and you wont need to get your client on the phone when you have a signed completed E-ZRep Form TR-2000 Tax Information Access and Transaction Authorization information TR. BOYLE TITLE OF BILL. Calculate late filing and late payment penalties and interest.

Struggling New York City hotels want Mayor Bill de Blasio to forgive the 18 interest they must pay when they are late on their property-tax bills. If a property buyer or seller files their RPTT documents late but pays their tax in full within 30 days of transfer a late penalty will not be charged for the late filing. You should file all tax returns that are due regardless of whether or not you can make a full payment with the return.

Paying extra in taxes. Late filinglate payment File a past due return. To provide targeted relief on late property taxes to Suffolk County property owners suffering.

Penalty and Interest Calculator. Payments made after May 20 2021 are subject to an additional 5 penalty at time of payment. Even if you believe we have sent a notice in error it is best that you contact us to correct our records.

Overdue Balances Late Payments It is very important to contact the Department of Finance if you receive a letter asking for information. An act to amend the real property tax law in relation to waiving any interest penalties or other charges for late payment of property taxes due to the COVID-19 pandemic in Suffolk county PURPOSE OR GENERAL IDEA OF BILL. The interest rate applicable to late property tax payments under Real Property Tax Law 924-a is one percent 1 per month or portion thereof.

Interest Rates July 2020. 05 on the full amount of your yearly property tax if you pay the full years worth of tax shown on your bill by the July due date or grace period due date. Payments made within 5 days of the due.

If you have already filed an extension request or a late tax return and have followed the procedures detailed in either Effect of IRS Deadline Extension for 2020 Personal Income Tax Returns on Penalties for NYC Individual UBT Filers or 2019 Business Tax Return Filing Information and the COVID-19 Outbreak there is no need to file a new request or return. Interest rates on unpaid property taxes remain at 7 for properties with an Assessed Value under 250000 and 18 for properties with an Assessed Value over 250000 through June 30 2020. Struggling New York City hotels want Mayor Bill de Blasio to forgive the 18 interest they must pay when they are late on their property-tax bills.

Accordingly 2020 personal income tax returns originally due on April 15 2021 and related payments of tax will not be subject to any failure to file failure to pay late payment or underpayment penalties or interest if filed and paid by May 17 2021. The late payment penalty is calculated only on the unpaid tax. Interest rates in jurisdictions which are not subject to RPTL 924-a may differ.

The New York City Council recently passed legislation that reduces the late payment interest rate for property taxes due on July 1 2020 for eligible property owners who have been impacted by COVID-19. Did you know you can request a penalty waiver for your client right from your Tax Professional Online Services account. Enter the security code displayed below and then select Continue.

Final Gop Tax Plan Summary Tax Strategies Under Tcja 2017

Final Gop Tax Plan Summary Tax Strategies Under Tcja 2017

Final Gop Tax Plan Summary Tax Strategies Under Tcja 2017

Final Gop Tax Plan Summary Tax Strategies Under Tcja 2017

Thank You For Your Lovely Note We So Appreciate You Taking The Time To Share Your Experience At The Accounting An Accounting Financial Tips Financial Modeling

Thank You For Your Lovely Note We So Appreciate You Taking The Time To Share Your Experience At The Accounting An Accounting Financial Tips Financial Modeling

Income Tax E Assessment And Artificial Intelligence How Realistic It Is Income Tax Income Assessment

Income Tax E Assessment And Artificial Intelligence How Realistic It Is Income Tax Income Assessment

Final Gop Tax Plan Summary Tax Strategies Under Tcja 2017

Final Gop Tax Plan Summary Tax Strategies Under Tcja 2017

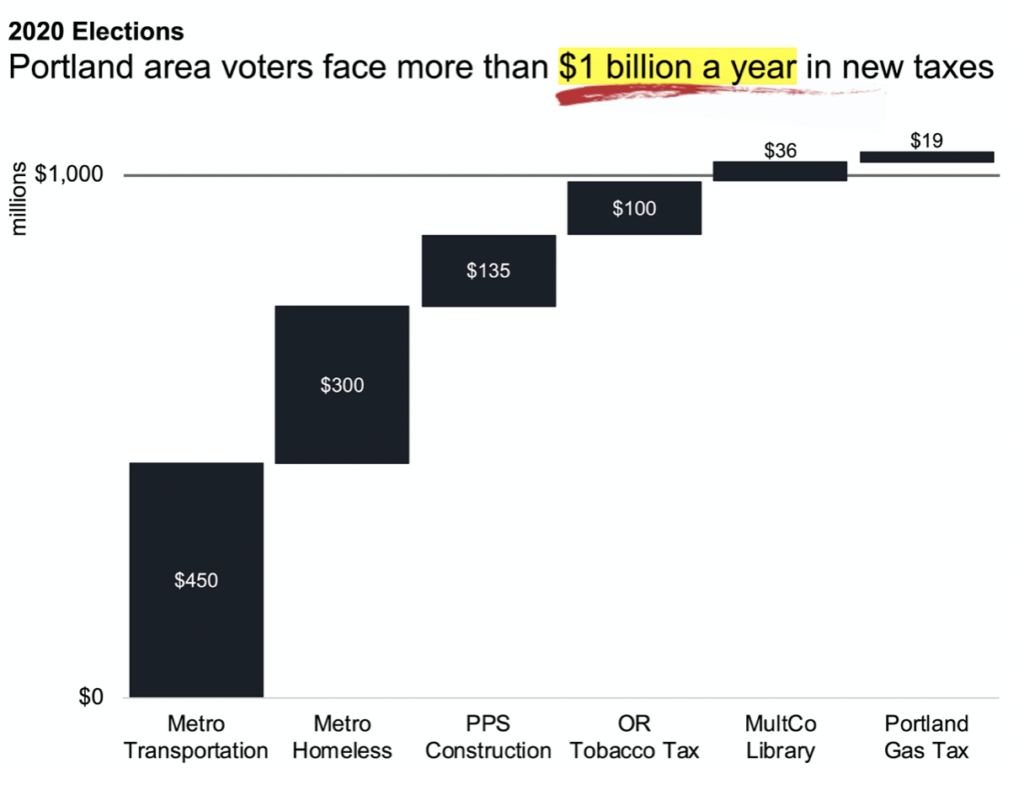

Tax And Budget Archives Cascade Policy Institute

Tax And Budget Archives Cascade Policy Institute

Pin On Los Angeles Tax Attorney

Pin On Los Angeles Tax Attorney

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg) What Tax Breaks Are Afforded To A Qualifying Widow

What Tax Breaks Are Afforded To A Qualifying Widow

Smaller Income Tax Refunds Bring Anger Confusion Over Trump Tax Overhaul Npr

Smaller Income Tax Refunds Bring Anger Confusion Over Trump Tax Overhaul Npr

Salt Tax Deduction 2020 Changes What Changed Millionacres

Salt Tax Deduction 2020 Changes What Changed Millionacres

Taxes 2020 When To File What Changes To Expect With Deductions Tax Breaks Chicago Sun Times

Taxes 2020 When To File What Changes To Expect With Deductions Tax Breaks Chicago Sun Times

Biden Tax Plan And 2020 Year End Planning Opportunities

Biden Tax Plan And 2020 Year End Planning Opportunities

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

Tax Day 2021 Deadline The Last Day You Can File And How To Get An Extension Cnet

Tax Day 2021 Deadline The Last Day You Can File And How To Get An Extension Cnet

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Final Gop Tax Plan Summary Tax Strategies Under Tcja 2017

Final Gop Tax Plan Summary Tax Strategies Under Tcja 2017

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home