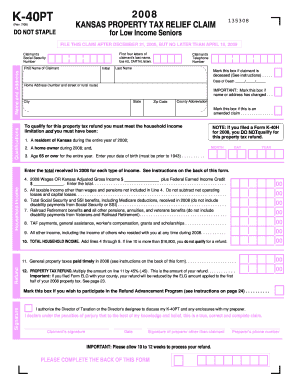

Kansas Property Tax Relief For Low Income Seniors

New legislation has passed changing the income threshold for Kitsap County to 48574 beginning in 2020. Or mail a paper K -40PT to the Kansas Department of Revenue anytime between January 1 and April 1 5 2019.

Your First Name.

Kansas property tax relief for low income seniors. The Kansas Safe Senior exemption is designed to support low-income senior citizens in Kansas. Age over 65 for the entire tax year. 7-20 DO NOT STAPLE.

KANSAS PROPERTY TAX RELIEF CLAIM for Low Income Seniors K-40P Rev. Qualifications for Property Tax Relief for Low Income Seniors K-40PT. Home value is less than 350000.

Must be a Kansas resident the entire tax year. Your First Name Initial Last Name. Claimants Social Security Number.

KANSAS PROPERTY TAX RELIEF CLAIM for Low Income Seniors K-40PT Rev. 7-20 DO NOT STAPLE 2020 KANSAS PROPERTY TAX RELIEF CLAIM 135320 for Low Income Seniors FILE THIS CLAIM AFTER DECEMBER 31 2020 BUT NO LATER THAN APRIL 15 2021 Qualifications Name and Address Claimants Social Security Number Claimants Telephone Number First four letters of. First four letters of claimants last name.

Kansas offers low income seniors a 75 refund of their property tax. Claimants Social Security. Home owner during the tax year.

For Low Income Seniors. The Washington State Legislature has made major changes to the property tax exemption program beginning in 2020. Senior Citizens Utility Tax and KCKS City Sales Tax Refund Programs are in effect through March 31 2021.

SAFESR is a property tax refund program administered under the provisions of the Kansas Homestead Act property tax refund. The SAFE Senior program also called Kansas Property Tax Relief for Low Income Seniors refunds 75 of all property taxes paid. Total household income is less than 20700 for the tax year.

Use ALL CAPITAL letters. If you havequestions about these refunds contact our Tax Assistance Center or your local county clerks office. How to buy a house with low income in 2021.

SAFESR is also referred to as Kansas Property Tax Relief for Low Income Seniors. KANSAS PROPERTY TAX RELIEF CLAIM. 7-19 T DO NOT STAPLE.

The refund is 75 of the 2019 general property tax paid or to be paid - as shown of the 2020 real estate tax statement for the residence in which the claimant lived in 2020. SAFESR is a property tax refund program administered under the provisions of the Kansas Homestead Act property tax refund. Name and Address Your First Name.

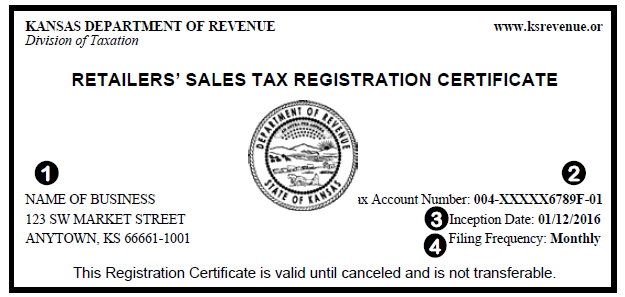

It is available to homeowners who are at least 65 years old for the entirety of the year and who had total household income of 20300 or less and a home worth 350000 or less. Use ALL CAPITAL letters. Complete a Kansas Property Tax Relief Claim for Low Income Seniors Form K-40PT electronically at.

A group of state senators is pushing property tax relief for seniors and veterans with disabilities. FILE THIS CLAIM AFTER DECEMBER 31 2020 BUT NO LATER THAN APRIL 15 2021. SAFESR Property Tax Refund.

SAFESR is also referred to as Kansas Property Tax Relief for Low Income Seniors. DO NOT STAPLE. To qualify you must be 65 or older and have a household income of 19500 or less.

Tom Holland D-Baldwin City introduced. FILE THIS CLAIM AFTER DECEMBER 31 2016 BUT NO LATER THAN APRIL 15 2017. First four letters of claimants last name.

If you are 60 or older or are retired because of physical disability meet equity requirement living in the home for more than nine months in a calendar year and have annual household disposable income of 67411 or less for the previous year you may qualify for deferral of your property tax liability. Filing for the Homestead Property and Safe Senior Tax Refunds is. FILE THIS CLAIM AFTER DECEMBER 31 2019 BUT NO LATER THAN APRIL 15 2020.

First four letters of. How to claim your senior property tax relief. 1 Low Credit Low Income Or High Debt.

Safe Seniors Kansas Property Tax Relief for Low Income Seniors Print Save Email This program provides you a refund of some of the property tax you paid on your home if. The refund is 75 of the 2019 general property tax paid or to be paid - as shown of the 2020 real estate tax statement for the residence in which the claimant lived in 2020. It offers a refund of up to 75 of your property tax payments from the last tax year as well as consideration for future tax amounts.

Additionally if Kansas is your permanent residence and you have a 50 or more disability rating as a result of military service you may receive property tax relief based on your income. How to raise your credit score fast. Use ALL CAPITAL letters.

Claimants Social Security Number. K-40PT Property Tax Relief Claim for Low Income Seniors Rev. The income limits will now be indexed at 65 of the median household income for Kitsap County.

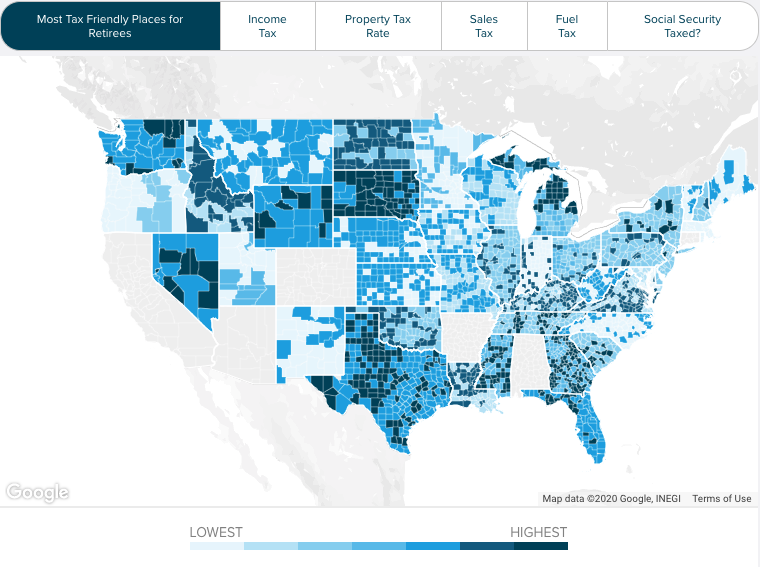

Center For State And Local Finance Georgia State University

/gettyimages-1197184592-2048x2048-22e8a8e779514a43a8347a0b583c1813.jpg)

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home