Pay New Hampshire Property Tax

Taxes on the self-employed above a certain threshold by 2021 the business profits tax will be 75 and the business enterprise tax will be 5. This bill is mailed out near the end of May and is usually due July 1st every year.

Pin By Jessica B On Affordable States Low Tax Property Tax States Tax

Pin By Jessica B On Affordable States Low Tax Property Tax States Tax

The Tax Year runs from April 1st through March 31st of the following year.

Pay new hampshire property tax. Dial 1-800-615-9507 or payview your property tax bill online by following the instructions. In New Hampshireshort-term rentals. A 9 tax is assessed upon patrons of hotels and restaurants on rooms and meals costing 36 or more.

1st Installment covers April 1st- September 30th. New Hampshire provides a property tax rebate for some homeowners. In order to pay any of the tax assessments listed you will need to have a Notice of Assessment NOA from with Department with an Assessment Number listed on it.

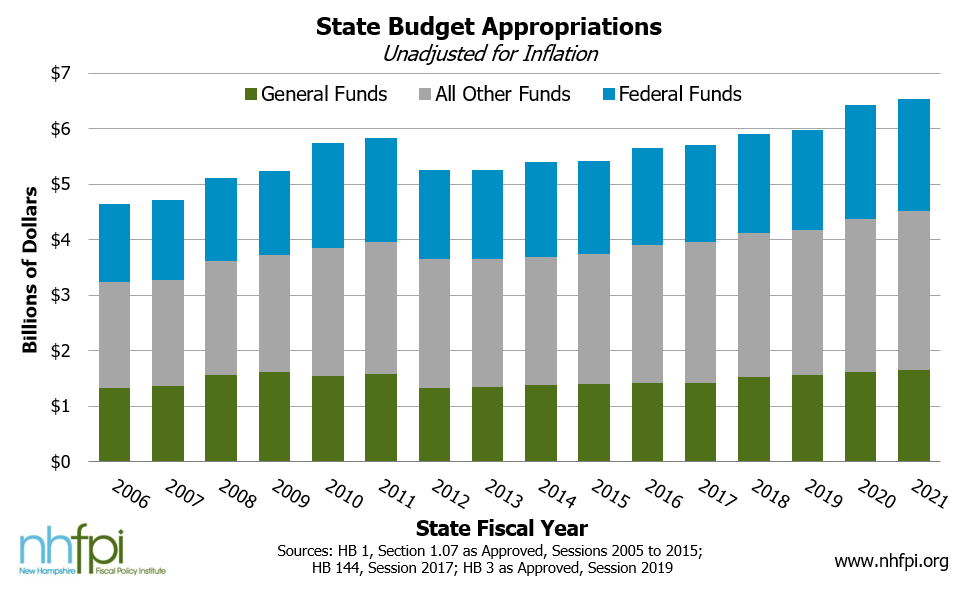

Earlier this month the Commonwealth Office of Administration and Finance released a revised FY21 tax revenue estimate which has seen a decrease to 27592 billion an 11 decrease from consensus revenue. The guest pays the room tax you are responsible for collecting the tax and paying it to the proper tax authorities. The buyer cant deduct this transfer tax from their federal income tax but they can roll.

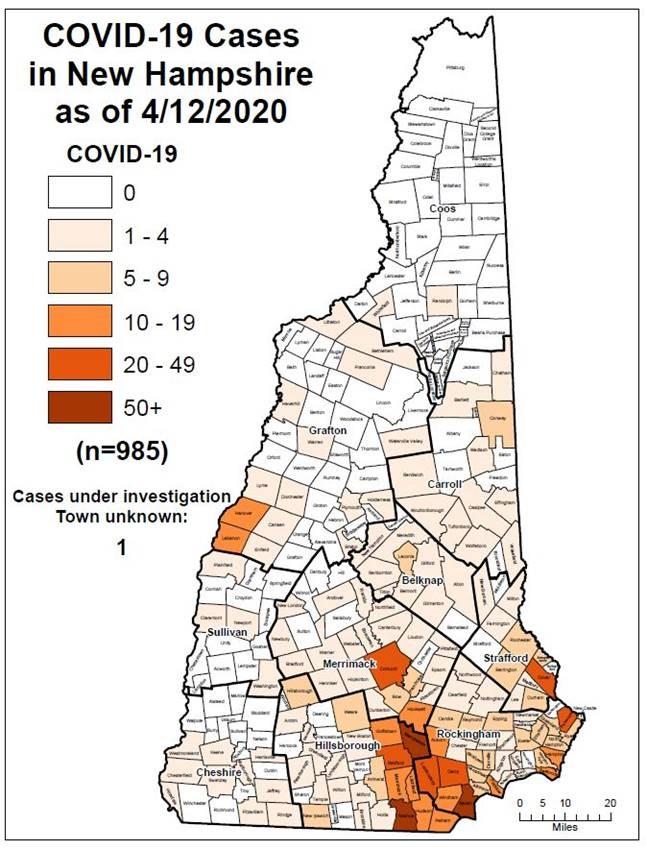

Closed Holidays and Election days. Homeowners in southeast New Hampshires Rockingham County pay some of the highest annual property taxes of anywhere in the state. Motor vehicle fees other than the Motor Vehicle Rental Tax are administered by the NH Department of Safety.

There is also the option to pay Lien fees. New Hampshire Property Tax Credits and Exemptions for Veterans Spouses and Surviving Spouses. The first bill is mailed in May and is due the first business day in July.

The State of New Hampshire has a number of property tax credits for Veterans Spouses and Surviving Spouses there is a short description of theses exemptions below. This means a senior who owns a home can expect to pay about 2050 in annual property taxes for every 100000 in home value. Thats the fourth-highest average effective property tax rate in the country.

Property Tax bills are generated and mailed twice a year. The median annual property tax payment in Rockingham County is 6293. The second bill is mailed in October or November and is due within 30 days after the mailing.

New Hampshire does collect. Failure to pay taxes penalties or interest when due or assessed or to comply with the tax laws may result in the following actions. 603-367-9931 ext 310 or ext 305.

Property taxes that vary by town. The final bill is calculated using the new tax rate multiplied by your propertys assessed value as of April 1st less any payments made on the first bill. The result is that New Hampshire charges an average property tax rate of 205.

The State of New Hampshire Department of Revenue Administration sets the tax rate for the year in the fall. A 9 rooms and meals tax also on rental cars A 5 tax on dividends and interest with a 24004800 exemption plus additional exemptions. This states transfer tax is 075 of the sale paid by both buying and selling parties for a total aggregate of 15.

A 9 tax is also assessed on motor vehicle rentals. In all the average effective property tax rate in New Hampshire is 205. Taxes on short-term rentals can be known as rooms tax lodging tax occupancy tax bed tax tourist tax and more.

New Hampshires real estate transfer tax is very straightforward. Due to unforeseen circumstances this website is. Liens may be placed upon your real estate personal property and property interests including bank accounts accounts receivable security interests and similar items.

OVER THE COUNTER PAYMENTS accepted are cash personal check business check or money. As the state does not charge sales tax or receive any income from personal income tax all the funding requirements must be met by property tax revenue. You can now pay your property tax bill using an electronic check ACH or credit card by touch tone telephone IVR or online 24 hours a day 7 days a week.

It serves as the primary source of revenue to support local services like schools and parks as well as the state school system. Taxpayer Assistance - Collection of Taxes. The breakdown between the counties in the state is as follows.

On average homeowners in New Hampshire pay 205 of their homes value in property tax every year. After much consideration and review the tax deadline for the State of New Hampshire will remain April 15 2021. Thats over 500 more than the state average and is nearly triple the the national average which sits at 2578.

New Hampshire residents who previously worked in-person in Massachusetts are continuing to have their taxes withheld by their employers. Monday Tuesday Wednesday Thursday 800 am. We feel any extension to the April 15 2021 due date even by one month risks causing confusion and does not offer meaningful relief to taxpayers who will still need to complete their 2020 tax return in order to calculate the estimated tax payment that continues to be due on April 15 2021.

All property taxes are administered by municipal tax collectors please contact.

Read more »