New Hampshire Disabled Veterans Property Tax Exemption

Be it Enacted by the Senate and House of Representatives in General Court convened. Provide this office a certification from the US.

Military Retirees Retirement Military Retirement Military

Military Retirees Retirement Military Retirement Military

RSA 7227 Exemption for the Blind.

New hampshire disabled veterans property tax exemption. The widow of a veteran who was killed in action may be eligible for a tax credit of between 700 and 2000 on real estate or personal property. Applicant must apply with a copy of DD214 or equivalent declaring proof of service. Veterans Credits and Exemptions.

To qualify for the Disabled Veterans Credit RSA 7235 you must. The town denied his request relying on New Hampshire Department of Revenue guidance stating that the VA had to help purchase the home not adapt it. AN ACT allowing municipalities to adopt a property tax exemption for certain disabled veterans.

Depending on what city or town you live in New Hampshire offers qualified Veterans a tax credit for up to 750 annually and if you are a 100 permanently and totally disabled Veteran as determined by the Veterans Benefit Administration you will be eligible for up to 4000. Taxpayers are able to access a list of various questions pertaining to veterans tax credits and veterans exemptions administered by the New Hampshire Department of Revenue Administration. A Credit of 150 from real estate tax bill.

Was honorably separated or discharged under conditions other than dishonorable from military service. In 2017 he applied to the town for an exemption from property taxes pursuant to RSA 7236-a. Department of Veterans Affairs VA that the applicant is rated 100 totally and permanently disabled from a service connected injury.

Honorable discharge from service. A veteran qualifies for the exemption if he or she. JavaScript must be enabled for some features to display properly.

A resident of New Hampshire for 1 year prior to April 1st. In the Year of Our Lord Two Thousand Eighteen. A disabled veteran in New Hampshire may receive a full property tax exemption on hisher primary residence if the veteran is 100 percent disabled has lost two or more limbs or is.

Summary of New Hampshire Military and Veterans Benefits. RSA 7237-a Exemption for Improvements to Assist Persons with Disabilities. There are four separate tax exemptions and credits available to military veterans and spouses.

List of documents verifying military service PDF Owner of the property on April 1st of application year. The State of New Hampshire offers special benefits for its military Service members and Veterans including property tax exemptions war. 34 rows A disabled veteran in New Hampshire may receive a full property tax exemption on hisher.

There is a 701 tax credit on the home of a. Va-rated disabled veterans in Vermont who are rated at least 50 disabled may qualify for a property tax exemption of at least 10000 on a primary residence. Disabled Veterans or Widow of Disabled Veteran RSA 7235 Any person who has been honorably discharged from the military service and who has a total and permanent service-connected disability or the surviving spouse of such a person shall receive a yearly tax credit of 2000 of property taxes on his or her residential property.

The surviving spouse of a veteran who died as a. The Veterans Tax Credit under RSA 7228 is a standard credit of 50 with a. Elderly and Other Exemptions Veterans Tax Credits Educational and Other Property Exemptions.

RSA 7228 Standard and Optional Veterans Tax Credit. New Hampshire also provides an optional veterans tax credit of between 51 and up to 750 at the time of this writing. To qualify for the Veterans Credit you must be.

New Hampshire exempts the homestead of veterans with a 100 permanent service-connected disability from property taxes. RSA 72-37-b Exemption for Deaf or Severely Hearing Imparied Persons. RSA 7227-b Exemption for the Disabled.

The actual amount of the exemption may not exceed 40000 and there may be different levels of exemption. STATE OF NEW HAMPSHIRE. A disabled veteran in New Hampshire may receive a full property tax exemption on hisher primary residence if the veteran is 100 percent disabled has lost two.

Either credit is subtracted each year from the veterans residential property tax burden.

Https Mchb Tvisdata Hrsa Gov Narratives Overview D59e97a5 7c3c 4f40 Bbce 0eaa5d8c721c

New Hampshire Military And Veterans Benefits The Official Army Benefits Website

New Hampshire Military And Veterans Benefits The Official Army Benefits Website

Https Www Nhla Org Assets Customcontent 23 Property Tax Pamphlet Final Nov 2011 Pdf

New Hampshire Retirement Tax Friendliness Smartasset

New Hampshire Retirement Tax Friendliness Smartasset

New Hampshire Veterans Benefits Military Benefits

New Hampshire Veterans Benefits Military Benefits

Sign In Property Tax Real Estate Infographic Infographic

Sign In Property Tax Real Estate Infographic Infographic

New Hampshire Military And Veterans Benefits The Official Army Benefits Website

New Hampshire Military And Veterans Benefits The Official Army Benefits Website

Https Www Windhamnh Gov Documentcenter View 6970 Exemption Tax Credit Extension Release

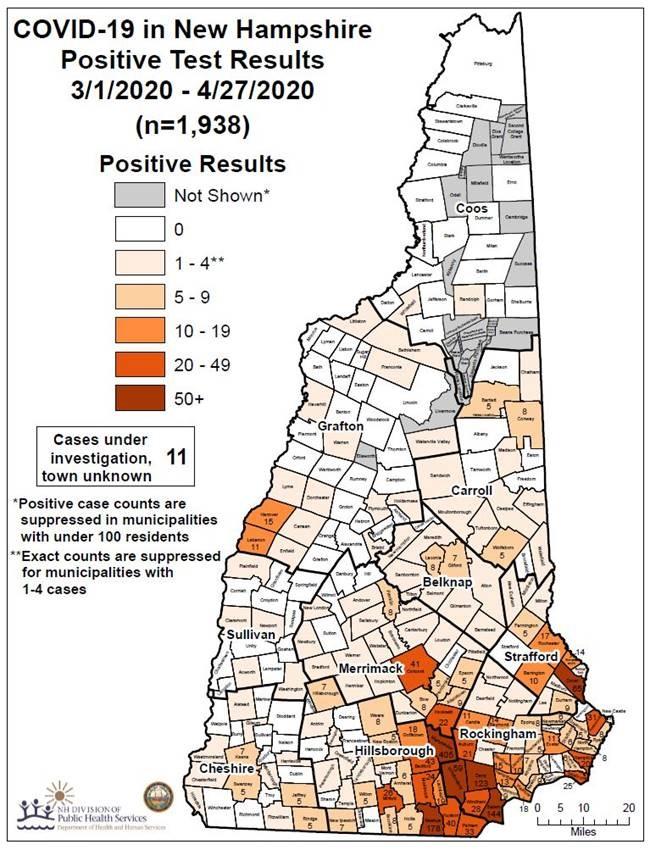

Coronavirus Blog Earlier Updates April 16 April 30 New Hampshire Public Radio

Coronavirus Blog Earlier Updates April 16 April 30 New Hampshire Public Radio

New Hampshire Property Tax Exemptions For Veterans Property Walls

New Hampshire Property Tax Exemptions For Veterans Property Walls

Real Estate Tax Relief In New Hampshire Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Real Estate Tax Relief In New Hampshire Leone Mcdonnell Roberts Professional Association Certified Public Accountants

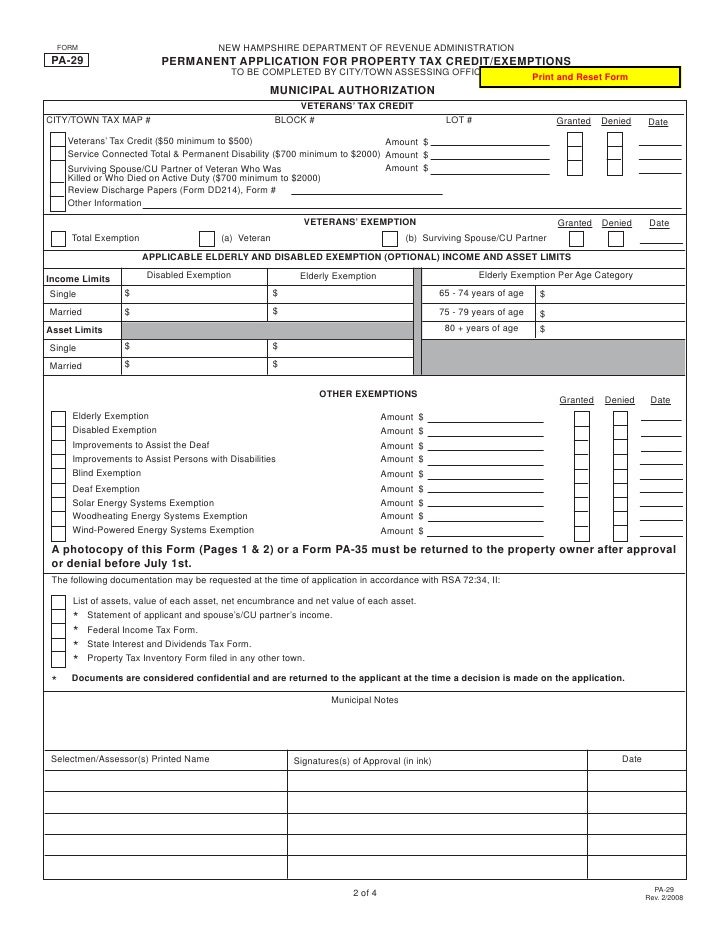

Permanent Application For Property Tax Credit Exemptions

Permanent Application For Property Tax Credit Exemptions

New Hampshire Property Tax Exemptions For Veterans Property Walls

New Hampshire Property Tax Exemptions For Veterans Property Walls

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home