Motor Vehicle Property Tax Exemption For Disabled Veterans Amendment

Chapter 60A Section 1 disabled veterans do not need to pay excise tax for one passenger vehicle or pick-up truck. See all Texas Veterans Benefits.

Disabled Veterans Property Tax Exemptions By State

Disabled Veterans Property Tax Exemptions By State

Department of Veterans Affairs is responsible for determining a veterans disability rating.

Motor vehicle property tax exemption for disabled veterans amendment. Disabled Veterans Vehicles to be Exempt from Property Taxes If Constitutional Amendment Two Passes October 10 2020 October 9 2020 Jacob Taylor Virginia proposed Constitutional Amendment 2 asks whether or not permanently and totally disabled veterans receiving 100 percent of disability income should be exempt from paying personal property taxes on their. The decision to enact that change is squarely up to Virginians casting their ballots in the upcoming November general elections. Any such motor vehicle owned by a married person may qualify if either spouse is a veteran who is one hundred percent disabled pursuant to this subdivision.

Those over the age of 65 may also qualify for additional property tax exemption programs. According to the Virginia Department of Elections a yes vote means the Constitution of Virginia will be amended to exempt one automobile or pickup truck that. The Tax Amendment Exempting Disabled Veterans from the Motor Vehicle Property Tax was originally introduced during the 2019 Legislative Session by Rep.

Whereas appearing on the November 3 2020 ballot will be a proposed amendment to the states tax laws exempting veterans with a 100 service-connected permanent and total disability from state and local property taxes on one automobile or pickup truck. Virginia proposed Constitutional Amendment 2 asks whether or not permanently and totally disabled veterans receiving 100 percent of disability income should be exempt from paying personal property taxes on their motor vehicle. This amendment would add to the list of property that is not subject to state or local taxation one motor vehicle owned and used primarily by or for a veteran of the United States armed forces or.

May 11 2020. Under the proposed amendment the veterans car or truck would be exempt from taxation beginning on the date the veteran gets the vehicle or on Jan. Virginia proposed Constitutional Amendment 2 asks whether or not permanently and totally disabled veterans receiving 100 percent of disability income should be exempt from paying personal property taxes on their motor vehicle.

Armed Forces or the Virginia National Guard. Honorably discharged veterans with a 100 disability rating certified by the Department of Veterans Affairs may be eligible for expanded Homestead tax relief up to 50 thousand of the assessed value of their primary residential home from property. Texas veterans with VA disability ratings between 10 and 100 may qualify for property tax exemptions starting at 5000 for 10-29 disability and ending at a full exemption for those VA-rated as 100 disabled.

All title transfers and exemption claims on motor vehicles and other equipment is regularly audited by the Ohio Department of Taxation in accordance with Ohio Revised Code RC 450509 B 2 c and 573913 to verify if the sales tax liability has been satisfied. The Motor Vehicle Property Tax Exemption for Disabled Veterans Amendment exempts totally-disabled veterans from property taxes on one vehicle effective Jan 1 2021. Article X of the Constitution of Virginia and Virginia Code 581-3668 was amended to establish the exemption from taxation for one motor vehicle that is owned and used primarily by or for a veteran of the US.

It must be owned by the veteran and used for non-commercial purposes. 1 2021 whichever is later. Ohio Homestead Property Tax Exemption For Disabled Veterans.

This exemption shall be applicable on the date the motor vehicle is acquired or the effective date of this subdivision whichever is later but shall not be applicable for any period of time prior to the effective date. It does not matter if the veteran has obtained DV plates but heshe must be approved for them. A veterans disability rating is determined by the United.

This amendment would exempt disabled veterans from property taxes for motor vehicles. The Virginia Department of Elections website said The motor vehicle would be. With the amendment passed it will give veterans who have a 100 service-connected permanent and total disability tax exemption for one vehicle.

Eileen Filler-Corn and is also supported by Delegate Dan Helmer. The second amendment which has officially been passed by voters is the Motor Vehicle Property Tax Exemption for Disabled Veterans Amendment which exempts totally-disabled veterans from.

Disabled Veterans Personal Property Tax Exemption Virginia Property Walls

Disabled Veterans Personal Property Tax Exemption Virginia Property Walls

Https Www Michigan Gov Documents Taxes Little Traverse Bay 206889 7 Pdf

Disabled Veterans Personal Property Tax Exemption Virginia Property Walls

Disabled Veterans Personal Property Tax Exemption Virginia Property Walls

Disabled Veterans Personal Property Tax Exemption Virginia Property Walls

Disabled Veterans Personal Property Tax Exemption Virginia Property Walls

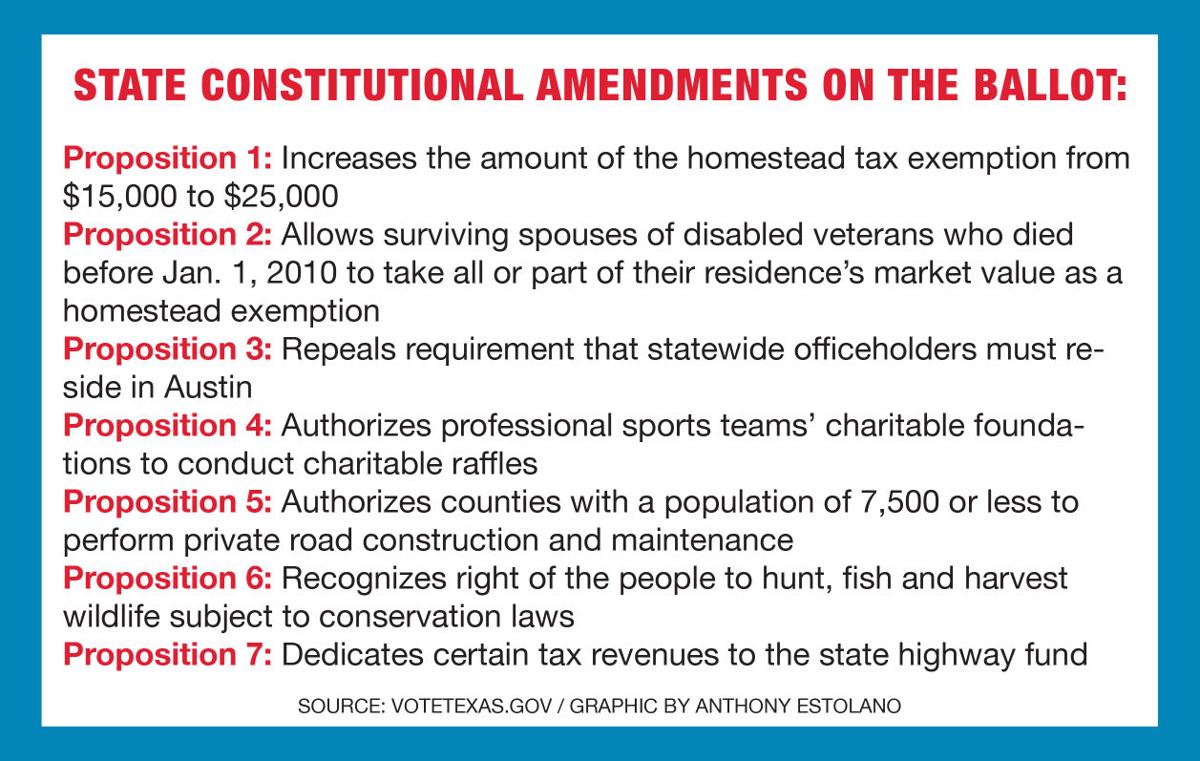

Texas Amendments On Ballot Tuesday News Dailytoreador Com

Texas Amendments On Ballot Tuesday News Dailytoreador Com

Disabled Veterans Personal Property Tax Exemption Virginia Property Walls

Disabled Veterans Personal Property Tax Exemption Virginia Property Walls

Disabled Veterans Personal Property Tax Exemption Virginia Property Walls

Amendment 6 Should Spouses Of Disabled Veterans Get A Tax Discount News Yoursun Com

Amendment 6 Should Spouses Of Disabled Veterans Get A Tax Discount News Yoursun Com

Https Kingwilliamcounty Us Documentcenter View 716 Disabledvetinfo Bidid

Louisiana Amendment 6 Homestead Exemption Special Assessment Income Limit Arklatexhomepage

Louisiana Amendment 6 Homestead Exemption Special Assessment Income Limit Arklatexhomepage

Vehicle Sales Tax Exemption Benefits Certain Disabled Individuals

Vehicle Sales Tax Exemption Benefits Certain Disabled Individuals

Real Estate Tax Exemption Virginia Department Of Veterans Services

Real Estate Tax Exemption Virginia Department Of Veterans Services

Https Www Michigan Gov Documents Taxes Bay Mills 206873 7 Pdf

What To Expect On Decision Day Ins And Outs Of Following A Major Election The Blaze

What To Expect On Decision Day Ins And Outs Of Following A Major Election The Blaze

Resolution Supporting Passage Of The Tax Amendment Exempting Disabled Veterans From The Motor Vehicle Property Tax Arlington Democrats

Resolution Supporting Passage Of The Tax Amendment Exempting Disabled Veterans From The Motor Vehicle Property Tax Arlington Democrats

Virginians Will Vote On 2 Proposed Constitutional Amendments

Virginians Will Vote On 2 Proposed Constitutional Amendments

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home