Property Plant And Equipment Us Gaap

And intangible assets including goodwill. IFRS allows another model - the revaluation model - which is based on fair value on the date of evaluation less any subsequent accumulated depreciation and impairment losses.

Ias 1 Presentation Of Financial Statements Positive Cash Flow Cash Flow Statement Financial Statement

Ias 1 Presentation Of Financial Statements Positive Cash Flow Cash Flow Statement Financial Statement

Large property plant and equipment items often comprise multiple parts with varying useful lives or consumption patterns.

Property plant and equipment us gaap. Cost includes A A all costs necessary to make the asset ready for intended use 3. This Exposure Draft of a proposed Accounting Standards Update of Topic 360 is issued by the Board for public comment. During the construction period-- certain interest costs are also capitalized Subsequent measurement of property plant and equipment 1.

In GAAP there is only one way to initially record a fixed asset and that is the cost method. The guidance related to accounting for property plant and equipment in US. A category of assets commonly referred to as other assets.

GAAP is included in the Financial Accounting Standards Boards Accounting Standards Codification ASC Topic 360 Property Plant and Equipment. A consensus of the FASB Emerging Issues Task Force. It provides examples of journal entries for asset purchases and disposals as well as application of alternative methods for depreciation.

Unlike US GAAP IFRS requires companies to separately depreciate those parts that are significant. Generally disclosure of additions to and disposals of property plant and equipment is not required although the statement of cash flows may provide this info. IFRS for property plant and equipment.

Property plant and equipment sometimes referred to as fixed assets tangible long lived assets or plant assets are tangible property used in a productive capacity that will benefit the reporting entity for a period exceeding one year. Property plant and equipment PPE are long-term assets vital to business operations and not easily converted into cash. The FR Property and Equipment PE section is responsible for ensuring property and equipment is recorded correctly and presented fairly in all material respects in.

Accumulated depreciation and the depreciation charge need only be disclosed in total. Property Plant and Equipment Topic 360 Derecognition of in Substance Real Estate a Scope Clarification. Business Combinations Business Combinations SEC Reporting Considerations Carve-Out Transactions Comparing IFRS Standards and US.

In IFRS the guidance related to accounting for property plant. The entire disclosure for long-lived physical asset used in. Property plant and equipment.

Property plant and equipment PP. GAAP Consolidation Identifying a Controlling Financial Interest Contingencies Loss Recoveries and Guarantees Contracts on an Entitys Own Equity Convertible Debt Before Adoption of ASU 2020-06 Current Expected Credit Losses Debt. Under US GAAP fixed assets such as property plant and equipment are valued using the cost model ie the historical value of the asset less any accumulated depreciation.

We would like to show you a description here but the site wont allow us. Up to 5 cash back The predominant standard that defines the accounting and reporting for Property Plant and Equipment PPE is IAS 16. While the objective is conceptually simple implementing the component approach can be challenging.

US GAAP guidance for PPE was formed from several standards issued over many years until they were combined in the Codification. However except for the areas of software oil and gas and mining assets IFRS and US GAAP use nearly identical. For each class of property plant and equipment a company must disclose the measurement bases the depreciation method the useful lives or equivalently the depreciation rate used the gross carrying amount and the accumulated depreciation at the beginning and end of the period and a reconciliation of the carrying amount at the beginning and end of the period.

Written comments should be addressed to. Impairment or Disposal of Tangible Assets Disclosure. GAAP accounting for the following.

Property plant and equipment and investment property. In the area of fixed assets and the resultant depreciation there are some major differences between the GAAP rules codified in ASC Topic 360 and the IFRS rules in IAS 16. Measured at cost 2.

Property Plant and Equipment Initial measurement of property plant and equipment 1. Tabular disclosure for impairment of long-lived assets held and used by an entity which includes a description of the impaired long-lived asset and facts and circumstances leading to the impairment aggregate amount of the impairment loss and where the loss is located in the income statement methods for determining fair value and the. This course reviews US.

19 rows Property Plant and Equipment.

Property Plant And Equipment Page 1 Line 17qq Com

Property Plant And Equipment Page 1 Line 17qq Com

Property Plant And Equipment Schedule Template Excel Schedule Template Finance Career Financial Analysis

Property Plant And Equipment Schedule Template Excel Schedule Template Finance Career Financial Analysis

Acquisition And Disposition Of Property Plant And Equipment

Acquisition And Disposition Of Property Plant And Equipment

Property Plant And Equipment Page 1 Line 17qq Com

Property Plant And Equipment Page 1 Line 17qq Com

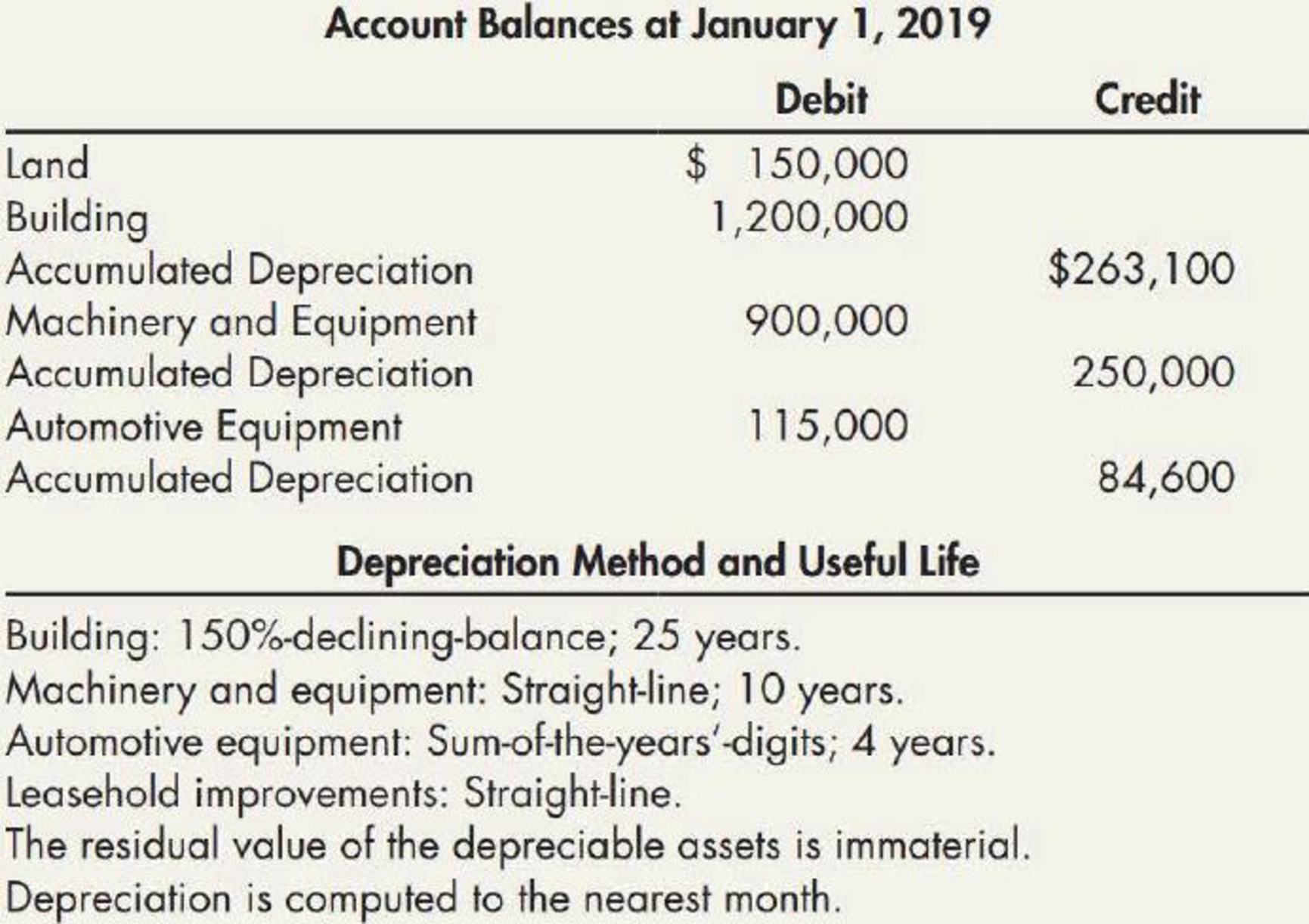

Information For Blake Corporation S Property Plant And Equipment For 2019 Is Transactions During 2019 And Other Information Were As Follows A On January 2 2019 Blake Purchased A New Car For 10 000

Information For Blake Corporation S Property Plant And Equipment For 2019 Is Transactions During 2019 And Other Information Were As Follows A On January 2 2019 Blake Purchased A New Car For 10 000

Acquisition And Disposition Of Property Plant And Equipment

Acquisition And Disposition Of Property Plant And Equipment

Property Plant And Equipment Page 1 Line 17qq Com

Property Plant And Equipment Page 1 Line 17qq Com

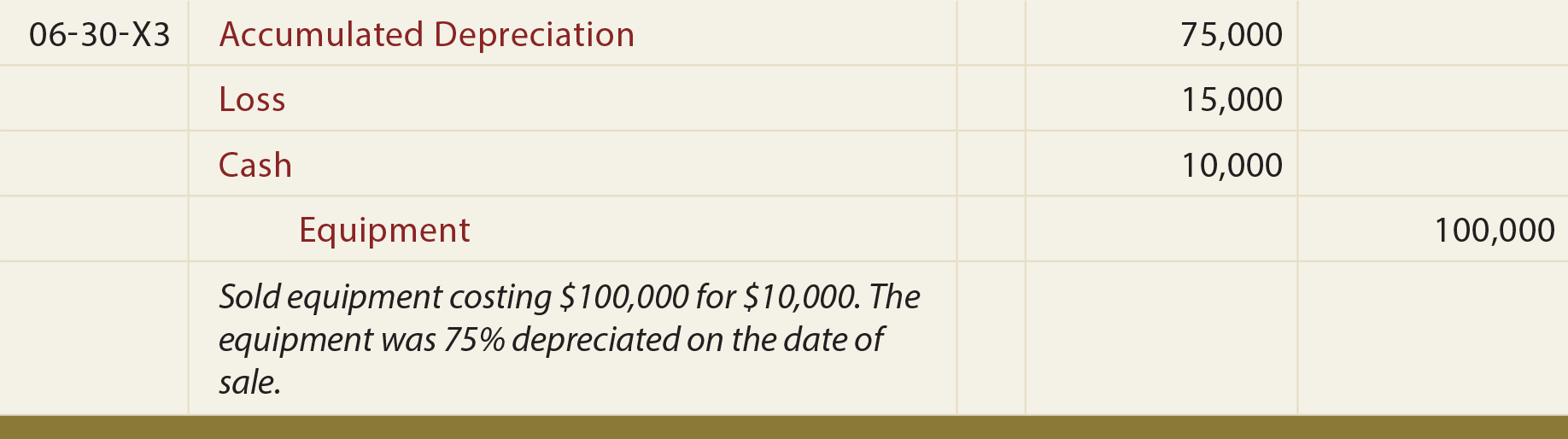

Disposal Of Pp E Principlesofaccounting Com

Disposal Of Pp E Principlesofaccounting Com

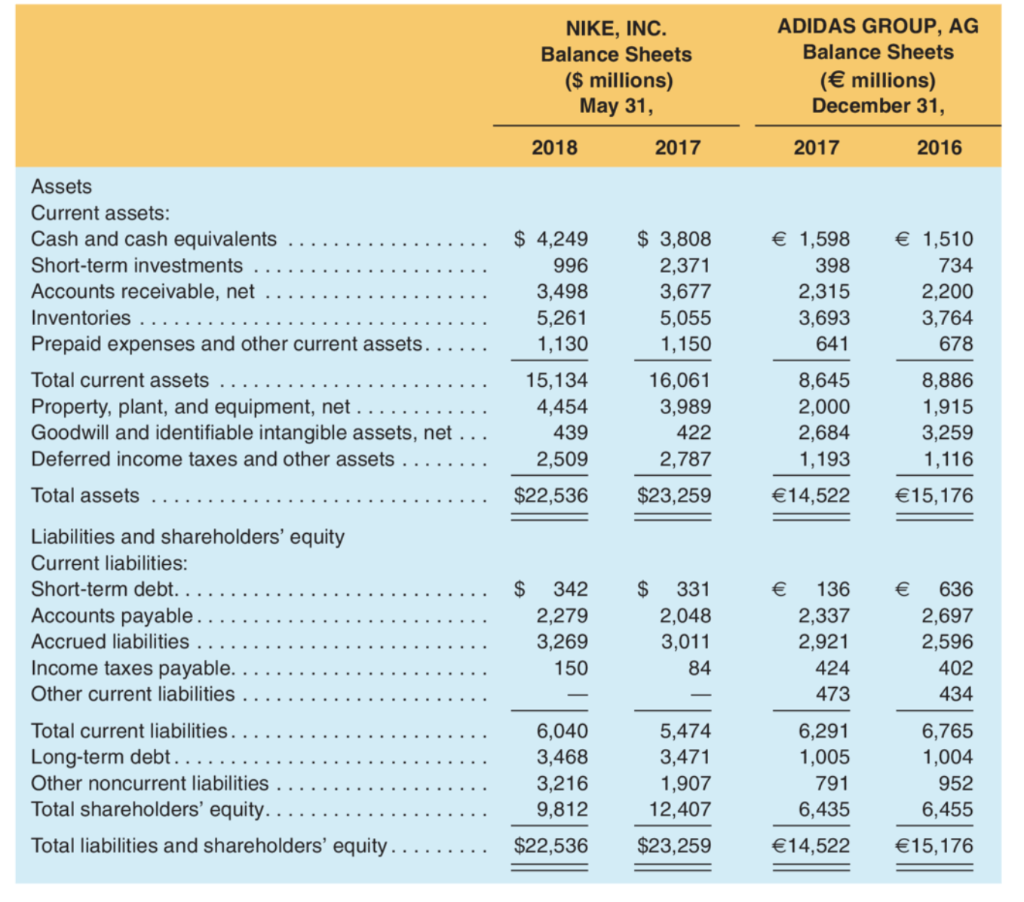

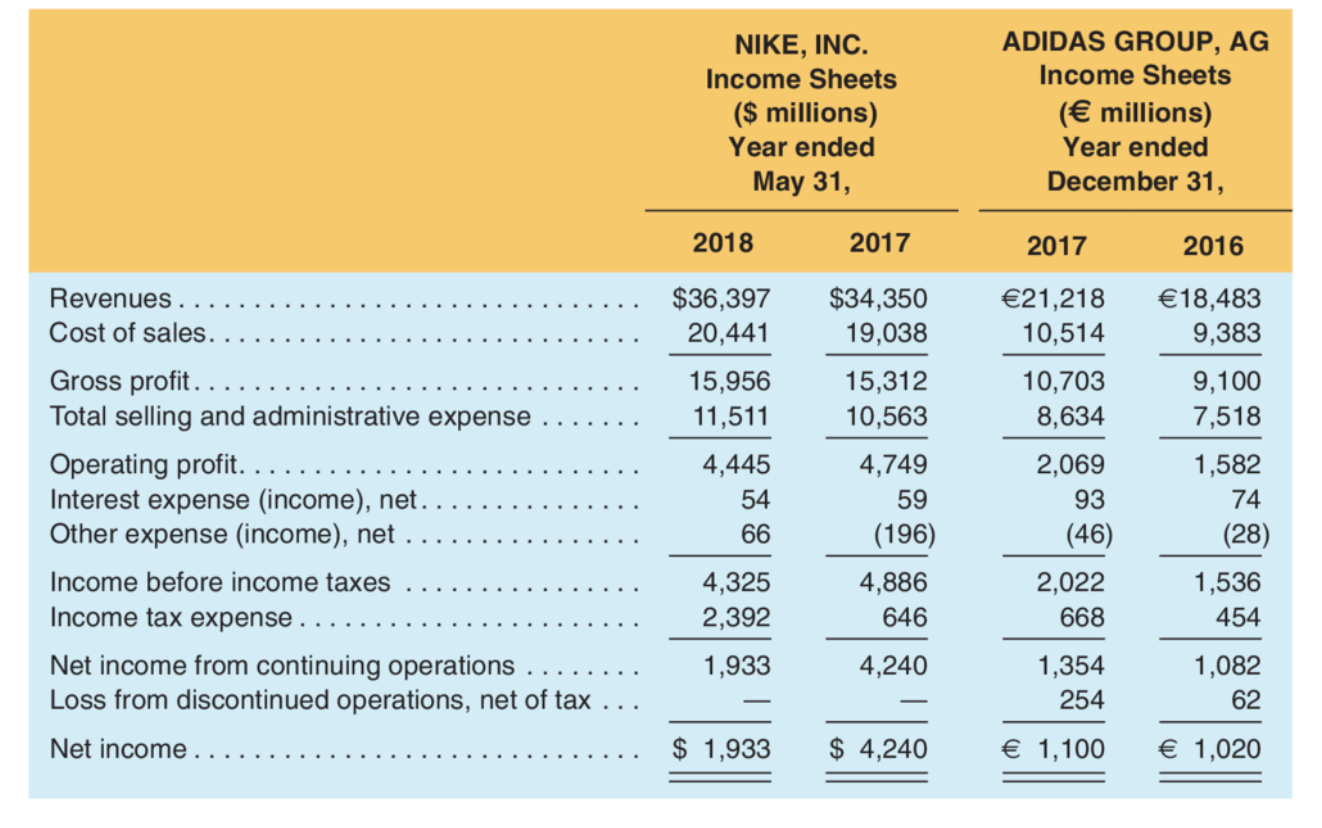

Solved E D Compute The Accounts Receivable Turnover Ar Chegg Com

Solved E D Compute The Accounts Receivable Turnover Ar Chegg Com

Basic And Diluted Eps Common Stock Informative Basic

Basic And Diluted Eps Common Stock Informative Basic

Acquisition And Disposition Of Property Plant And Equipment

Acquisition And Disposition Of Property Plant And Equipment

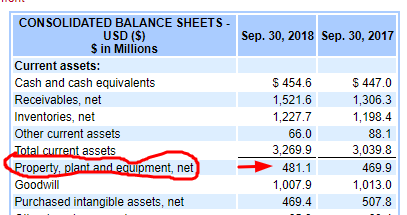

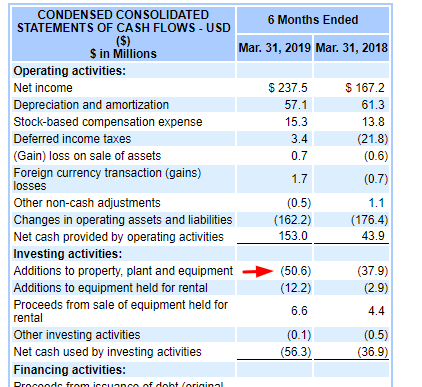

Maintenance Capital Expenditures The Easy Way To Calculate It

Maintenance Capital Expenditures The Easy Way To Calculate It

Trial Balance In Accounting With 3 Golden Rules In English Simple Tutorial And Easy To Understand Trial Balance Accounting Golden Rule

Trial Balance In Accounting With 3 Golden Rules In English Simple Tutorial And Easy To Understand Trial Balance Accounting Golden Rule

Ias 40 Video 2 Eng Measurement Journal Entries Investing Measurements

Ias 40 Video 2 Eng Measurement Journal Entries Investing Measurements

An Investors Perspective On Ifrs 16 Investors International Accounting Perspective

An Investors Perspective On Ifrs 16 Investors International Accounting Perspective

Solved E D Compute The Accounts Receivable Turnover Ar Chegg Com

Solved E D Compute The Accounts Receivable Turnover Ar Chegg Com

Acquisition And Disposition Of Property Plant And Equipment

Acquisition And Disposition Of Property Plant And Equipment

Acquisition And Disposition Of Property Plant And Equipment

Maintenance Capital Expenditures The Easy Way To Calculate It

Maintenance Capital Expenditures The Easy Way To Calculate It

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home