Personal Property Tax Receipt Kansas City Missouri

You may click on this collectors link to access their contact information. For residents of Kansas City real and personal property taxes other than for railroads and utilities are included on the county property tax bill.

Property Personal Property Tax Receipt

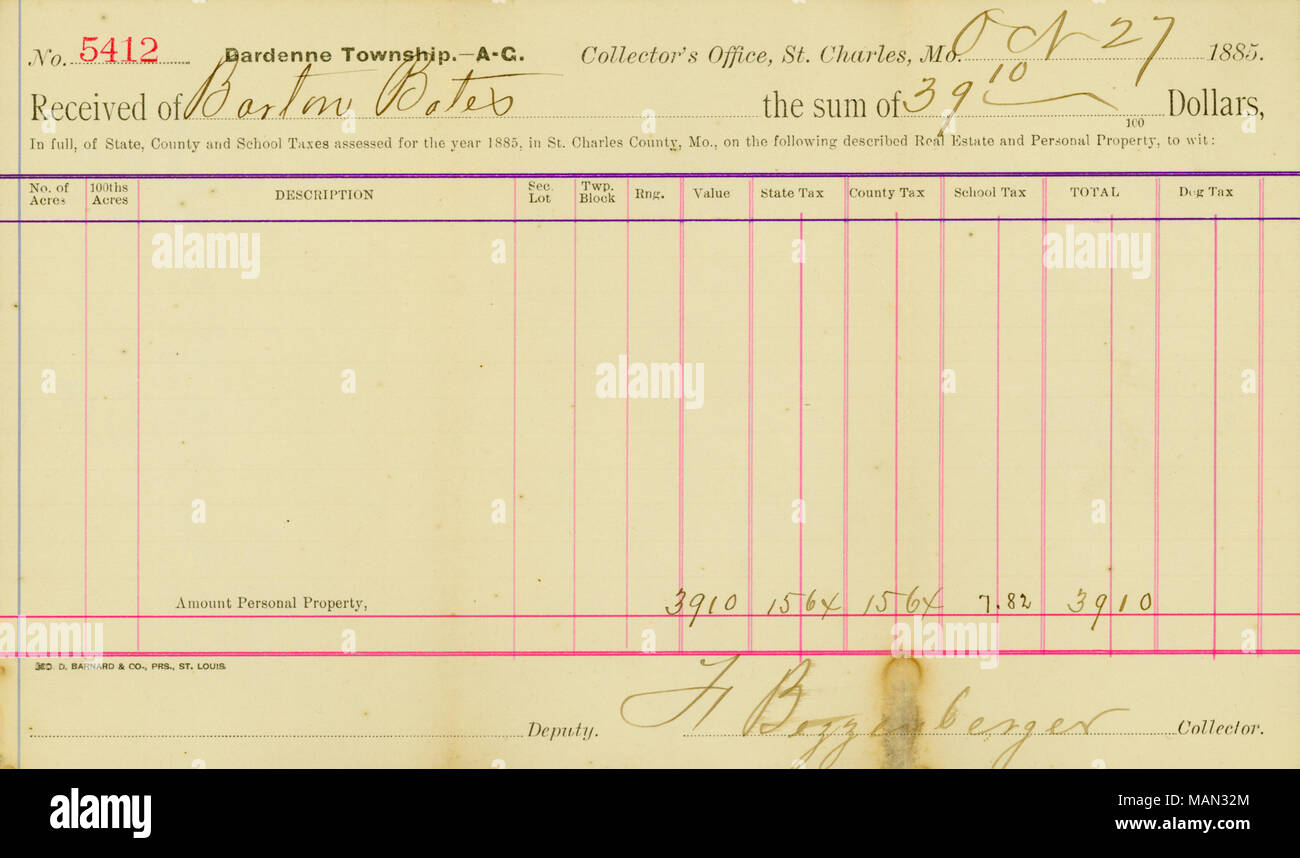

Obtaining a property tax receipt.

Personal property tax receipt kansas city missouri. Duplicate personal property tax receipts are available online or in person at the Collectors of Revenue Office. The fee office will charge 1 for this service. CLAY COUNTY MISSOURI TAX Clay County Missouri Tax 2021-02-24T123745-0500.

Property Tax Receipts are obtained from the county Collector or City Collector if you live in St. You may want to check with the fee office in your area to verify office personnel can access your information before. Chapter 79 Article 51 motor vehicles.

Maintaining values for KSA. You may also obtain a duplicate of your original property tax receipt from our offices. The Collectors Office mails tax bills during November.

If you did not file a Personal Property Declaration with your local assessor and did not receive a Personal Property bill you will need to file with your. Louis City in which the property is located and taxes paid. Personal property 33 13 percent.

Residential property is assessed at 115 of fair market value. Motorized vehicles boats recreational vehicles owned on January 1st of that year. Local Department of Revenue fee offices can access those records on their computers.

Taxes not paid in full on or before December 31 will accrue interest penalties and fees. No separate billing for these taxes comes from the City. You may obtain a duplicate of your original property tax receipt for free online.

A mill is one dollar in tax for every 1000 in assessed property value. State statutes require a penalty to be added to your personal property tax bill. Your assessment list is due by March 1st of that year.

Once your account is displayed you can select the year you are interested in. Online tax receipt can be used at the Missouri Department of Revenue license offices when licensing your vehicle. How Can We Help You.

The Cole County Collectors office provides regular updated records of paid personal property tax information to the Missouri Department of Revenue. Platte County makes every effort to produce and publish the most current and accurate information possible. The Personal Property Sections responsibilities include.

Personal property tax is collected by the Collector of Revenue each year on tangible property eg. Why do I need a real estate property tax receipt. The first half tax must be paid on or before December 20th.

If a tax bill is not received by December 1 contact the Collectors Office at 816-881-3232. In Kansas various types of property are assessed at different rates of their fair market value. Can the Department of Revenue find out if my taxes were paid without a receipt.

If the first half taxes are paid in December the second half is due on or before May 10th. Second half unpaid personal property taxes are sent to the Sheriff for. Tax rate is measured in mills.

So a house which sells for 100000 would be assessed for tax purposes at 11500. How to Print Tax Receipts. What Are Personal Property Taxes.

Missouri Department of Revenue. Maintaining guidelines for the valuation and taxation of personal property. This data is provided as is without warranty or any representation of accuracy timeliness or completeness.

816-380-8375 Hours Monday. Missouri law requires that property be assessed at the following percentages of true value. The Department collects or processes individual income tax fiduciary tax estate tax returns and property tax credit claims.

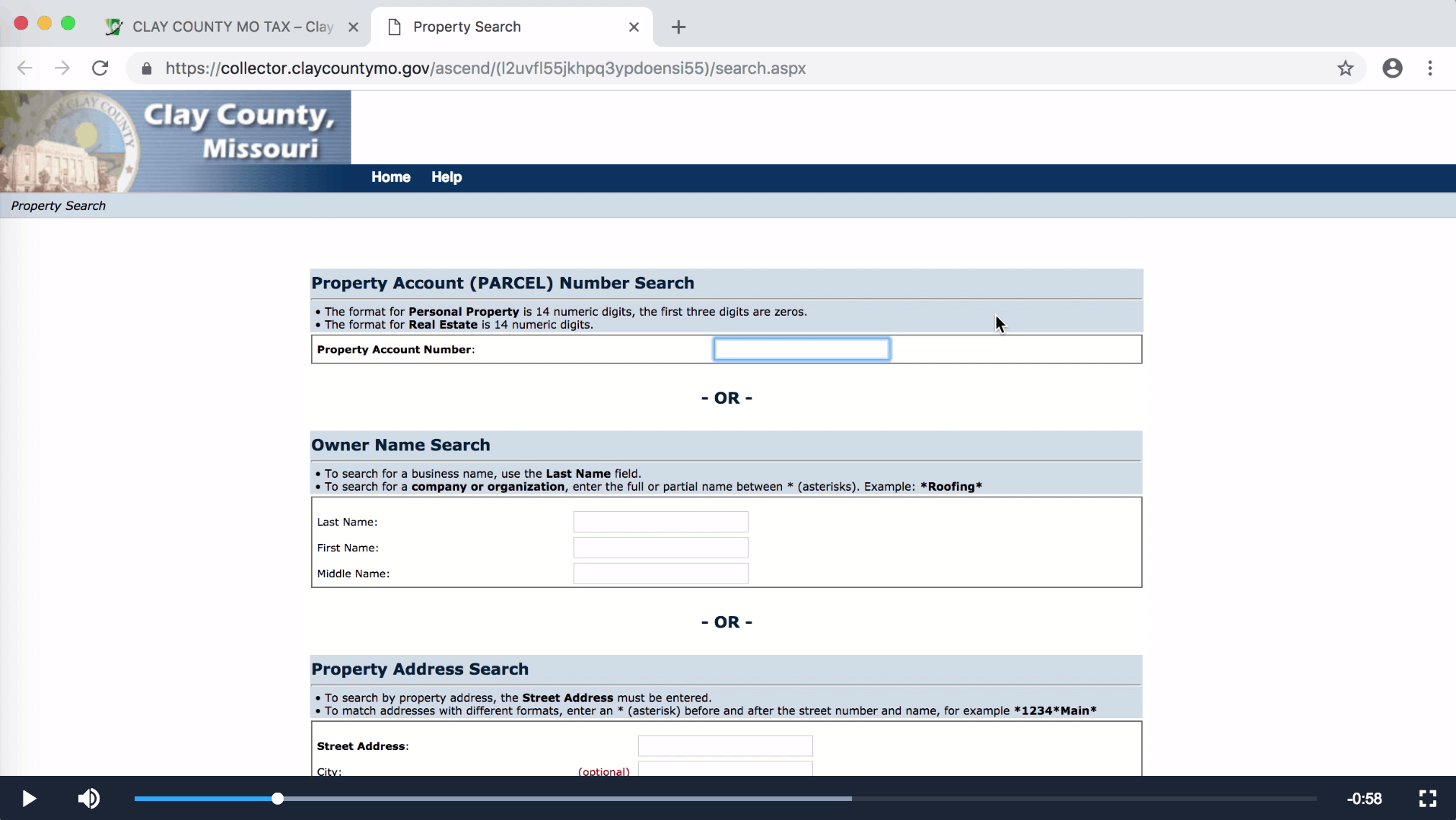

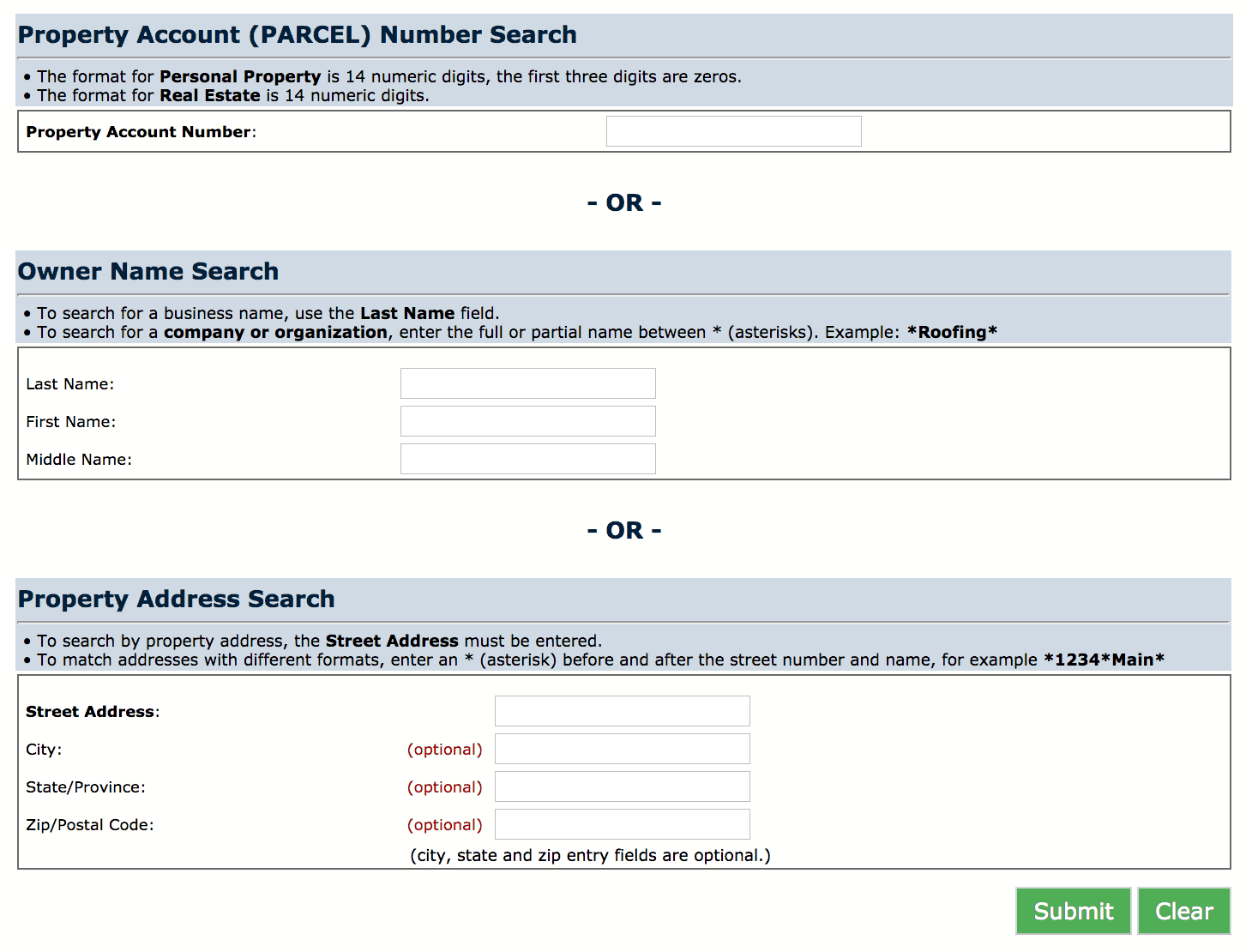

ClayCountyMotax is a joint resource provided and maintained by Lydia McEvoy Clay County Collector and Cathy Rinehart Clay County Assessor. Search for your account by account number address or name and then click on your account to bring up the information. The burden for determining accuracy completeness timeliness merchantability and fitness for or the appropriateness for use rests solely on the requester.

Browse our site for helpful articles or see our Frequently Asked Questions. Failure to receive a tax bill does not relieve the obligation to pay taxes and applicable late fees. Full unpaid personal property taxes are sent to the Sheriff for collection in March.

Please note that personal property account numbers begin with the letter I like in. Personal property is assessed valued each year by the Assessors Office. Why do I need a personal property tax receipt.

There is a 1 fee for each duplicate receipt. Chris Molendorp Collector of Revenue Email 2725 Cantrell Road Harrisonville MO 64701 Ph. After that date the full amount of Personal Property taxes are due plus interest.

Information and online services regarding your taxes. Holding workshops for counties and other interested parties. To obtain your property tax receipt visit the Online Payment Program.

Personal Property Tax Receipt Missouri Page 1 Line 17qq Com

Personal Property Tax Receipt Missouri Page 1 Line 17qq Com

Personal Property Tax Receipt Missouri Page 1 Line 17qq Com

Personal Property Tax Receipt Missouri Page 1 Line 17qq Com

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

Download Print Tax Receipt Clay County Missouri Tax

Download Print Tax Receipt Clay County Missouri Tax

Personal Property Tax Receipt Missouri Page 1 Line 17qq Com

Personal Property Tax Receipt Missouri Page 1 Line 17qq Com

How To Use The Property Tax Billing Portal Clay County Missouri Tax

How To Use The Property Tax Billing Portal Clay County Missouri Tax

Property Personal Property Tax Receipt

Property Personal Property Tax Receipt

Paying Your Taxes Online Jackson County Mo

Paying Your Taxes Online Jackson County Mo

Personal Property Tax Receipt Missouri Page 1 Line 17qq Com

Personal Property Tax Receipt Missouri Page 1 Line 17qq Com

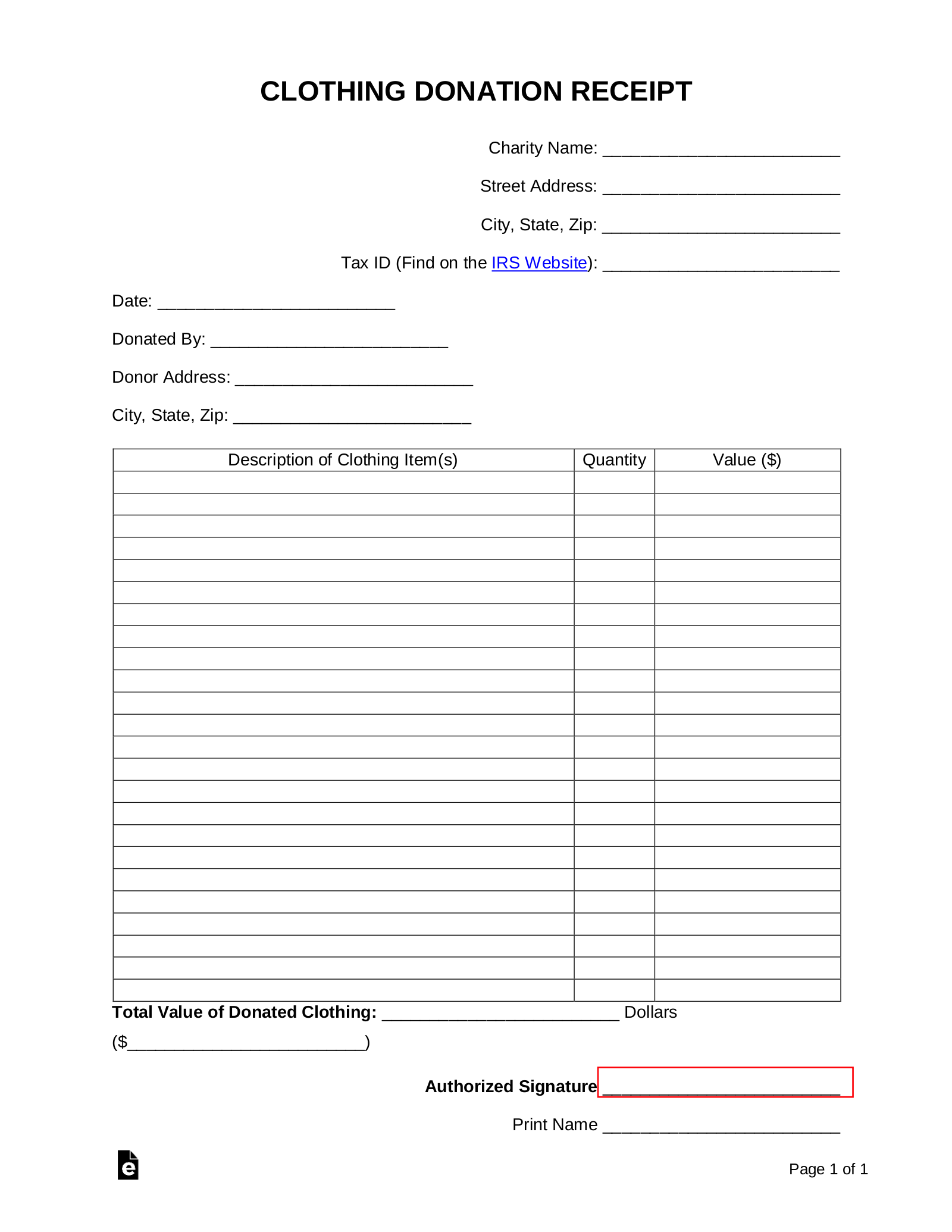

Free Clothing Donation Tax Receipt Word Pdf Eforms

Free Clothing Donation Tax Receipt Word Pdf Eforms

Real Estate And Personal Property Tax Johnson County Kansas

Real Estate And Personal Property Tax Johnson County Kansas

Property Personal Property Tax Receipt Missouri

Personal Property Tax Receipt Missouri Page 1 Line 17qq Com

Personal Property Tax Receipt Missouri Page 1 Line 17qq Com

Https Dor Mo Gov Forms 426 Pdf

In Kind Personal Property Donation Receipt Template Eforms

In Kind Personal Property Donation Receipt Template Eforms

Checklist For Lease Options And Leases Lease Option Real Estate Checklist Rental Property Management

Checklist For Lease Options And Leases Lease Option Real Estate Checklist Rental Property Management

Personal Property Tax Receipt Missouri Page 1 Line 17qq Com

Personal Property Tax Receipt Missouri Page 1 Line 17qq Com

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home