New Hampshire Property Tax Rates By Town 2019

Comparison of Full Value Tax Rates Alpha Order PDF Comparison of Full Value Tax Rates. In Laconia the largest city in the county the mill rate is 2085 mills.

Property Tax Bills Town Of New London Nh

Property Tax Bills Town Of New London Nh

240 rows In New Hampshire the real estate tax levied on a property is calculated by multiplying the.

New hampshire property tax rates by town 2019. Town of Bow just received their tax rate from the Department of Revenue. The table above shows the fifty states and the District of Columbia ranked from highest to lowest by annual property taxes as a percentage of the median home value. New Hampshire has one of the highest average property tax rates in the country with only two states levying higher property taxes.

We feel any extension to the April 15 2021 due date even by one month risks causing confusion and does not offer meaningful relief to taxpayers who will still need to complete their 2020 tax return in order to calculate the estimated tax payment that continues to be due on April. After much consideration and review the tax deadline for the State of New Hampshire will remain April 15 2021. 2020 NH Real Estate Tax Rates 2020 Massachusetts Real Estate Taxes Connecticut Tax Rates Vermont Education Property Taxes 2020 Taxes for Towns and Boroughs in New Jersey Rhode Island Property Tax Rates New Hampshire DMV Locations Middlesex County MA Property Tax Rates Essex County Massachusetts Property Taxes 2019 New Hampshire Property Tax.

Belknap County which runs along the western shores of Lake Winnipesaukee has among the lowest property tax rates in New Hampshire. Total Rate New Hampshire Department of Revenue Administration Completed Public Tax Rates 2018 Municipality Date Valuation w Utils Total Commitment 642808718 579 107 197 2073 2956 8836550 605 600 248 243 000 372765440 650 191 229 1483 2553. Tax Rates PDF Tax Rates Excel Village Tax Rates PDF.

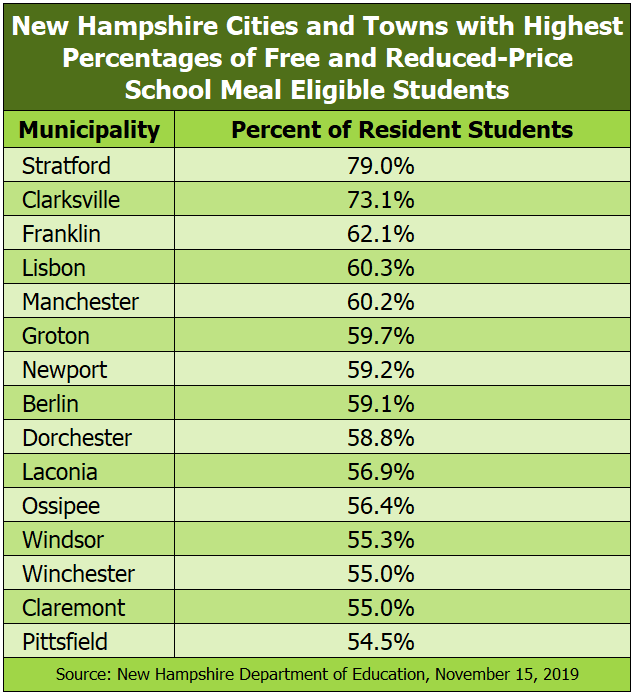

Tax amount varies by county. When combining all local county and state property taxes these towns have the highest property tax rates in New Hampshire as of September 2018. Taxpayers are able to access property tax rates and related data that are published annually which is provided by the New Hampshire Department of Revenue Administration.

The average effective property tax rate in Cheshire County is 274. Online Property Tax Payments Please visit the Property Tax Payments website. 236 rows Town Total 2020 Tax Rate Change from 2019.

Valuation Municipal County State Ed. Claremont 4266 Berlin 3919 Keene 3722 Charlestown 3650 Northumberland 3518. New Hampshire Department of Revenue Administration Completed Public Tax Rates 2019 Municipality Date Valuation w Utils Total Commitment Alstead 110619 163042993 4512141 Alton 110519 1750226594 21548778 Alexandria 103119 197038051 4661699 Allenstown 110619 295309596 9060367 Acworth 110819 98419656 2845175.

Property - Equalization 2019. Tax Year 2019 Due Dates. For example the personal owners of a house in Concord valued at 100000 dollars would have a higher tax bill than the owners of a home with the same value in Manchester NH.

The New Hampshire Department of Revenue Administration is releasing 2019 tax rates for communities. Taxpayers are able to access equalization reports that were published for a specific tax year provided by the New Hampshire Department of Revenue Administration. Not all towns and cities have had their tax rates calculated yet however.

In New Hampshire the real estate tax levied on a property is calculated by multiplying the assessed value of the property by the real estate tax rate of its location. Town Town Tax Rate County Tax Rate State School Tax Rate Local School Tax Rate. Tax bills will be going out sometime around December 18 th.

If you need an income tax deduction you need to pay your taxes by 123120. In smaller towns however the rate is far lower. Counties in New Hampshire collect an average of 186 of a propertys assesed fair market value as property tax per year.

The median property tax in New Hampshire is 463600 per year for a home worth the median value of 24970000. The 2018 equalization rate was set at 938. Taxes will be due in January 30 days after the bills go out.

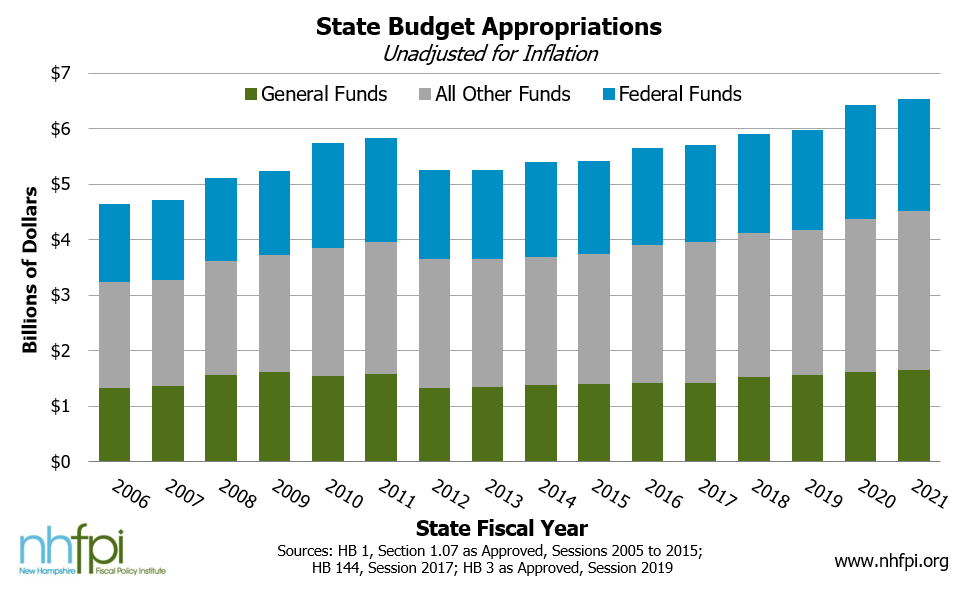

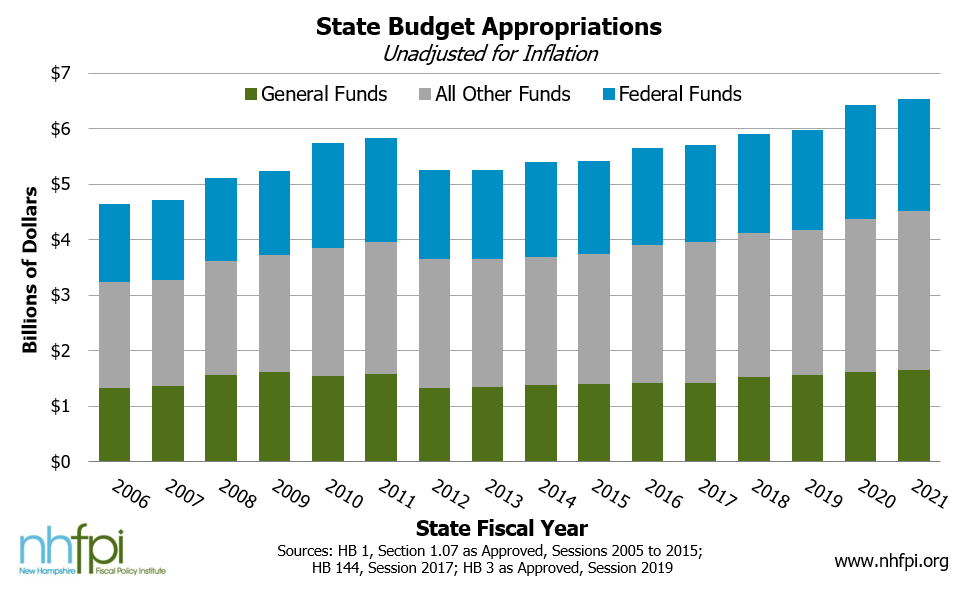

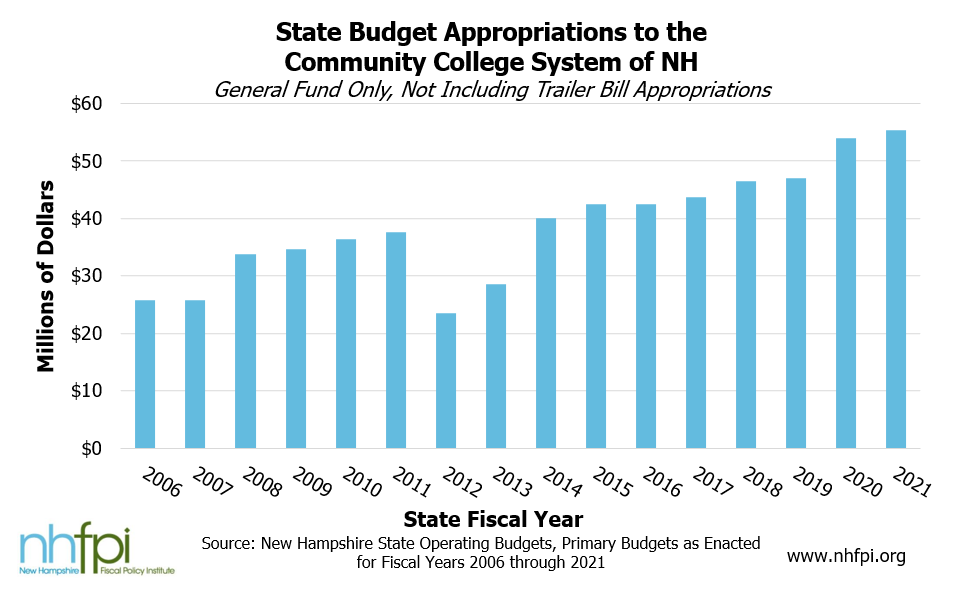

The State Budget For Fiscal Years 2020 And 2021 New Hampshire Fiscal Policy Institute

The State Budget For Fiscal Years 2020 And 2021 New Hampshire Fiscal Policy Institute

Property Tax Information Town Of Exeter New Hampshire Official Website

Property Tax Information Town Of Exeter New Hampshire Official Website

The State Budget For Fiscal Years 2020 And 2021 New Hampshire Fiscal Policy Institute

The State Budget For Fiscal Years 2020 And 2021 New Hampshire Fiscal Policy Institute

Mark Fernald Why Your Property Taxes Are So High

New Hampshire Property Tax Calculator Smartasset

New Hampshire Property Tax Calculator Smartasset

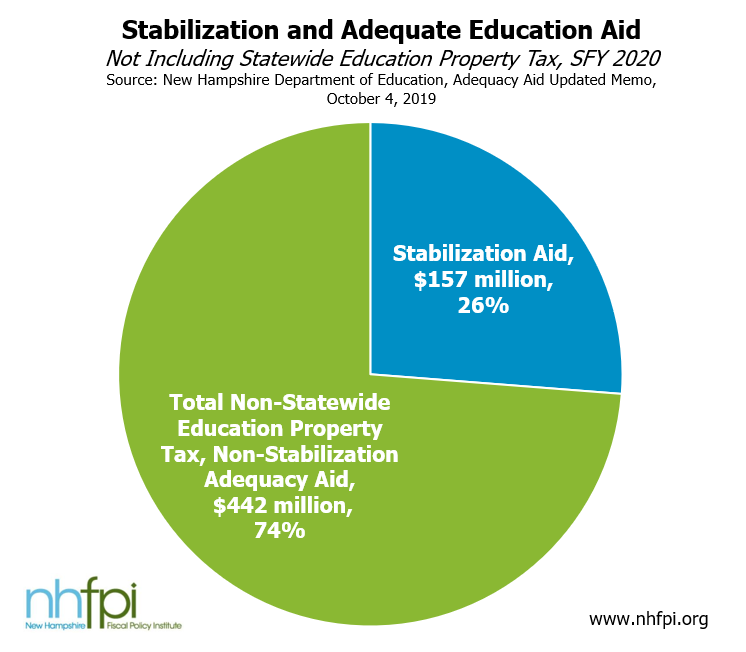

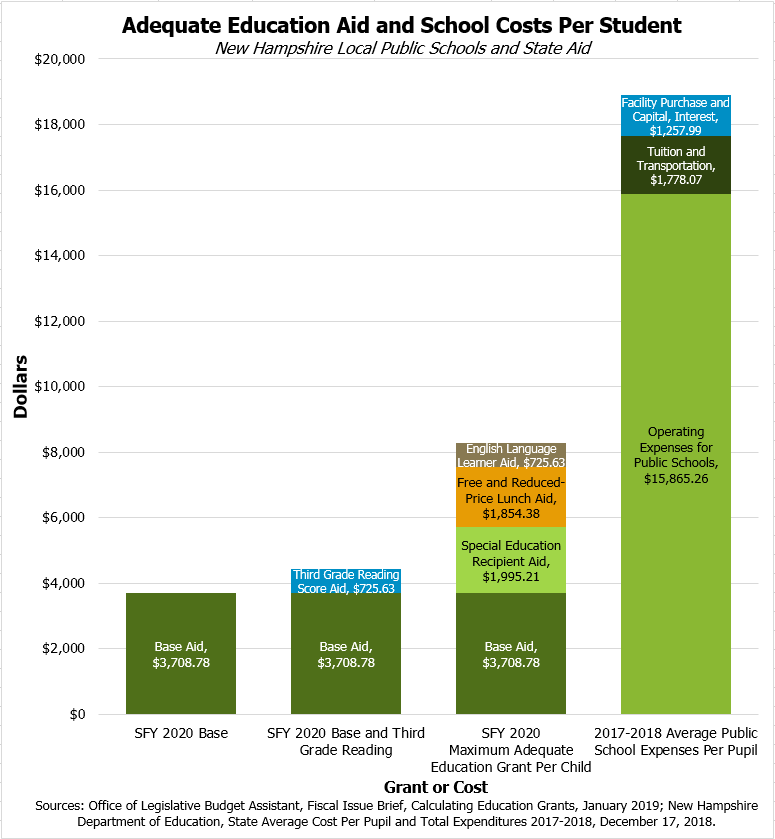

Education Funding In The House Budget New Hampshire Fiscal Policy Institute

Education Funding In The House Budget New Hampshire Fiscal Policy Institute

Nh Where Rich Towns Like Rye Get Richer And Poor Ones Like Berlin Need Help Indepthnh Orgindepthnh Org

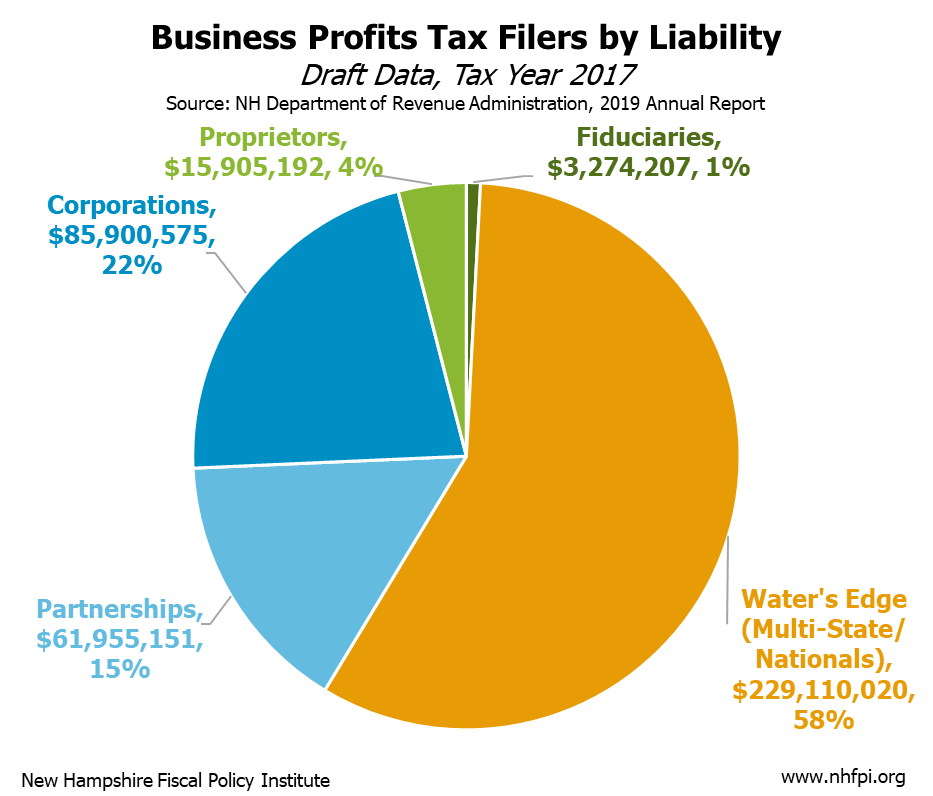

Understanding New Hampshire Taxes Free State Project

Understanding New Hampshire Taxes Free State Project

The State Budget For Fiscal Years 2020 And 2021 New Hampshire Fiscal Policy Institute

The State Budget For Fiscal Years 2020 And 2021 New Hampshire Fiscal Policy Institute

The State Budget For Fiscal Years 2020 And 2021 New Hampshire Fiscal Policy Institute

The State Budget For Fiscal Years 2020 And 2021 New Hampshire Fiscal Policy Institute

My Property Taxes Are What Understanding New Hampshire S Property Tax Milestone Financial Planning

My Property Taxes Are What Understanding New Hampshire S Property Tax Milestone Financial Planning

How We Fund Public Services In New Hampshire New Hampshire Municipal Association

How We Fund Public Services In New Hampshire New Hampshire Municipal Association

Mark Fernald Why Your Property Taxes Are So High

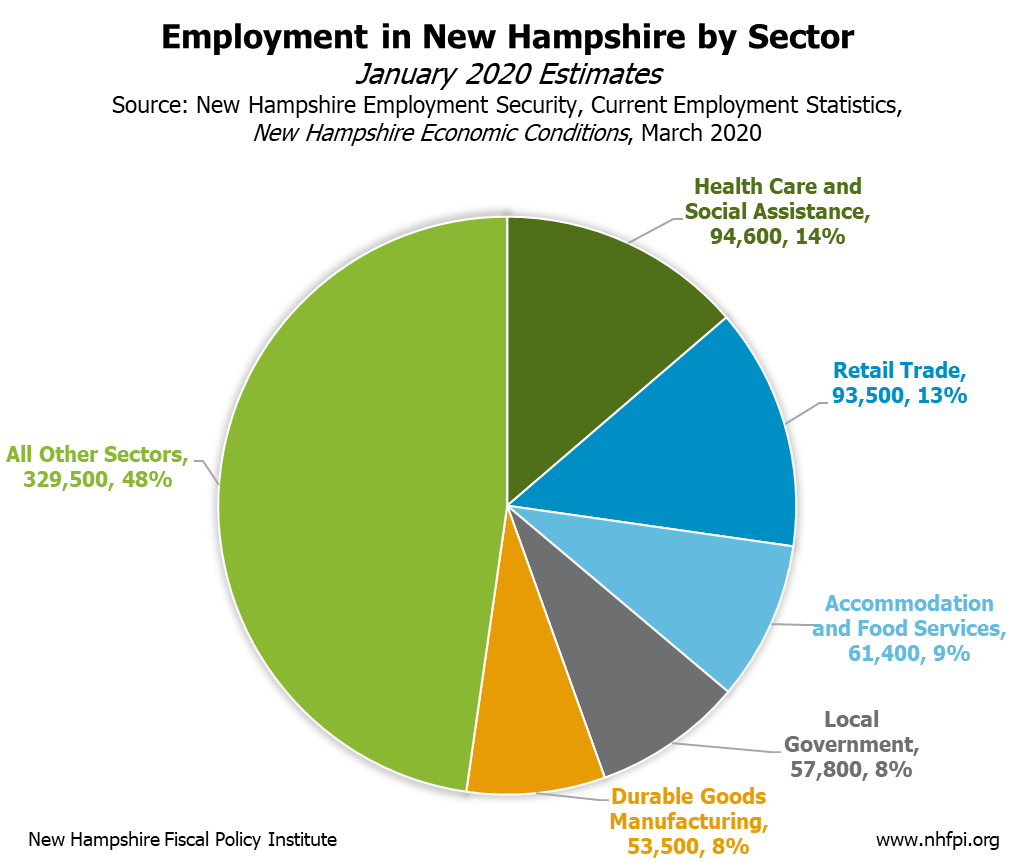

The Covid 19 Crisis In New Hampshire Initial Economic Impacts And Policy Responses New Hampshire Fiscal Policy Institute

The Covid 19 Crisis In New Hampshire Initial Economic Impacts And Policy Responses New Hampshire Fiscal Policy Institute

What You Should Know About Moving To Nh From Ma

What You Should Know About Moving To Nh From Ma

The Covid 19 Crisis In New Hampshire Initial Economic Impacts And Policy Responses New Hampshire Fiscal Policy Institute

The Covid 19 Crisis In New Hampshire Initial Economic Impacts And Policy Responses New Hampshire Fiscal Policy Institute

Mark Fernald Why Your Property Taxes Are So High

Understanding New Hampshire Taxes Free State Project

Understanding New Hampshire Taxes Free State Project

Nh Has A Revenue Problem The Property Tax Nh Business Review

Nh Has A Revenue Problem The Property Tax Nh Business Review

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home