Mississippi Property Tax Exemptions For Veterans

Disabled veterans or their unremarried surviving spouses are 100 exempt from paying property tax in Mississippi. Not limited to veterans only the ad valorem tax break.

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

The State of Mississippi offers special benefits for its military Service members and Veterans including Tax Exemptions on Military Pay and.

Mississippi property tax exemptions for veterans. Our app can generate a property guide that gives you tailor-made. A disabled veteran in Mississippi may receive a property tax exemption on hisher primary residence if the assessed value is 7500 or less and the veteran is 100 percent disabled as a result of service. Resides in Mississippi solely to live with the Service member Spouse.

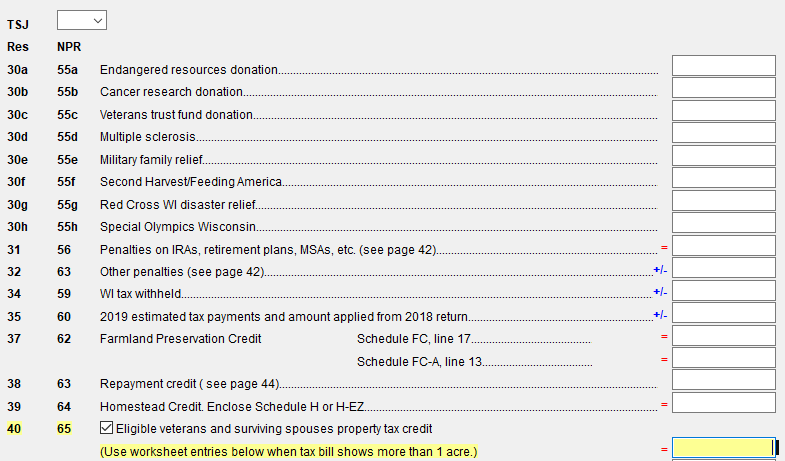

The exemption is from all ad valorem taxes assessed to property limited to the first seven thousand five hundred dollars 7500 of assessed value and limited to three hundred dollars 300 of actual exempted tax dollars. What Should You Do To Claim a Mississippi Property Tax Exemption. The application for exemption must be filed with the individual county on or before April 1.

States With No Property Tax for Disabled Veterans. The state of Mississippi provides several veteran benefits. Veterans who make under 21000 may also qualify for additional.

Arkansas Property Tax Exemptions. The state of domicile claimed by the Service member and Spouse must be the same. Certain conditions may need to be fulfilled so its best to check with your state and county.

Persons who are 65 years of age and older or who are disabled upon application and proof of eligibility are exempt from all ad valorem taxes up to 750000 of assessed value. This is an exemption of up to a 4000 reduction in the taxable value of a Veterans primary residence for county property taxation purposes. The amount of exemption is determined from tables that are provided by law.

TITLE 27 - TAXATION AND FINANCE. 34 rows Veterans with a full 100 disability rating are fully exempt from property taxes. The regular exemption is given to all eligible taxpayers.

Alaska Property Tax Exemption. Mississippi State Veteran Financial Benefits Military Retirement Pay Tax Exemption. The Service member Spouse is in the state of Mississippi in compliance with military orders.

Exemptions for persons over 65 years of age and disabled. Alabama Ad Valorem Tax Exemption Tax Break for Specially Adapted Housing For Veterans. Ad Valorem Homestead Tax Breaks for Veterans.

Military retirement pay is not subject to State of Mississippi income tax. The most common tax exemption eligibility factor for veterans is disability. Claiming a property tax exemption can be a tricky and complicated process but DoNotPay can help you pay your property taxes with the answers you need.

The state of Mississippi offers many veteran benefits for service members and Veterans that have served in the Armed Forces of the United States of America. The State of Mississippi offers a homestead tax exemption to any Veteran. Arizona Property Tax Exemption.

The most popular state benefit available to New Mexicos 154000 Veterans according to the New Mexico Department of Veterans Services is the Veterans State Property Tax Exemption. 1 Each qualified homeowner under sixty-five 65 years of age on January 1 of the year for which the exemption is claimed and who is not. Chapter 33 - Ad Valorem Taxes - Homestead Exemptions.

Veterans certified as 100 percent totally and permanently disabled by the VA from service-related causes receive an exemption on all ad valorem taxes for a. Summary of Mississippi Military and Veterans Benefits. Also an unmarried surviving spouse of this Veteran or a Veteran receiving benefits for specially adapted housing under 38 USC 2101 may be eligible for a.

For veterans without a disability there is a basic 1000 property tax exemption. This page explains those benefits. Property Tax Exemptions For Disabled Veterans By State.

Up to 45000 in tax value may be excluded for service connected permanently disabled and honorably discharged Veterans. Mississippi operates four state veterans homes in Collins Jackson Kosciuskoand Oxford. 27-33-67 - Exemptions for persons over 65 years of age and disabled.

Currently resides in Mississippi. These benefits include income and property tax exemptions financial exemptions education and training programs hunting and fishing licenses vehicle registrations and assistance with employment. Check out some states that dont charge property tax to disabled veterans in the list below.

Read more »