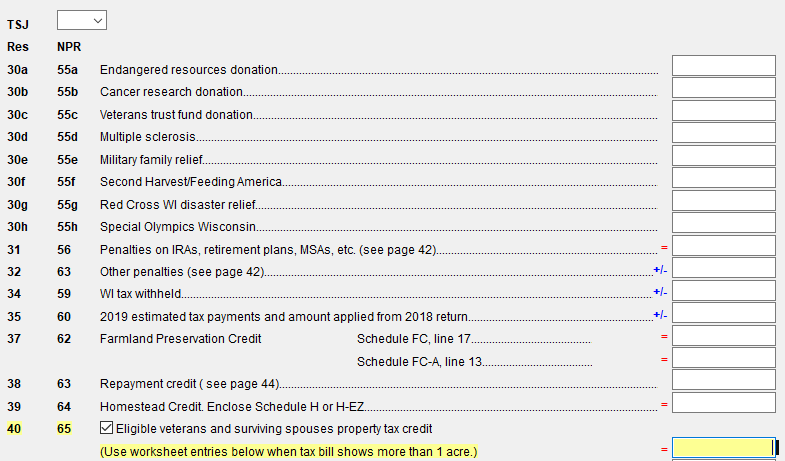

Veterans Property Tax Credit Wisconsin

The credit is claimed on the Wisconsin income tax return. If your income is over 9000 the credit is figured using the worksheet in the instructions.

Bar Chart Showing The Distribution Of Student Loan Borrowers By Balance Student Loan Debt Student Loans Refinancing Student Loans

Bar Chart Showing The Distribution Of Student Loan Borrowers By Balance Student Loan Debt Student Loans Refinancing Student Loans

Additional Tax Credits Available.

Veterans property tax credit wisconsin. Box 7843 Madison WI. Wisconsin Veterans Property Tax Credit 2135 Rimrock Road PO. For more information on property tax credits listed on the property tax bill contact us at Submit a Question or 608 266-9457.

WDVA provides grants and a variety of services to eligible Wisconsin veterans and their families. State Grant Programs Funded by the Coronavirus Relief Fund That Are Excluded From Wisconsin Income. Requester Name Print Date of Birth Address Social Security Number.

This credit amount is listed on the property tax bill below the Net Assessed Value Rate box. 30 W Mifflin Street. Individuals Press Releases Tax Pro.

Property Tax Credit for Veterans and Surviving Spouses. This benefit is given in recognition of veterans sacrifices for our country. All taxable real property in Wisconsin qualifies for the School Levy Tax Credit.

Before claiming the credit the veteran or surviving spouse must obtain verification of his or her eligibility for the credit from the Wisconsin Department of. The Property Tax Credit is administered by the Wisconsin Department of Revenue and Certification of Eligibility for the program is administered by the Wisconsin Department of Veterans Affairs Eligibility Under s. You claimed the veterans and surviving spouses property tax credit of 3000 which was refunded to you when you filed your Wisconsin income tax return in 2021.

Veterans Affairs works on behalf of Wisconsins veteran community veterans their families and their survivors in recognition of their service and sacrifice to our state and nation. Mail this application and the appropriate supporting documents to. PROPERTY TAX CREDIT - Wisconsin Veterans and Surviving Spouses The Racine County Treasurer would like to remind qualified disabled veterans and surviving spouses about the recent expansion of the refundable property tax credit via the State Income Tax form.

If you paid 3000 in property taxes for the year you would be able to claim 2000 of property taxes for the veterans and surviving spouses property tax credit. Wisconsin veterans groups are sharply criticizing a move by lawmakers to curtail and strip disabled veterans of property tax credit benefits. The Wisconsin Veterans Surviving Spouses Property Tax Credit provides eligible veterans and unremarried surviving spouses a refundable property tax credit for their primary in-state residence and up to one acre of land.

Wisconsin Department of Veterans Affairs. Programs included in the departments mission are the. This credit is automatically calculated by the program.

School Levy Tax Credit. Your total itemized deductions were 14100. Box 7843 Madison WI 53707-7843.

Applicable Laws and Rules This document provides statements or interpretations of the following laws and regulations enacted as of January 20 2021. Property Tax Credit program provides a refundable property tax credit for the primary residence instate and up to one acre of land via the state income tax form for eligible veterans as certified by the Wisconsin Department of Veterans Affairs. If your Wisconsin income is 9000 and below the credit is equal to your tax.

Sections 71076e and 7303 Wis. Wisconsin Department of Revenue. Eligible Veteran means a veteran who is verified by the Wisconsin Department of Veterans Affairs as meeting all of the following.

The Wisconsin Veterans Surviving Spouses Property Tax Credit gives eligible veterans and unremarried surviving spouses a property tax credit for their primary residence. 135 Rimrock Road PO. You deducted the 3000 as a federal itemized deduction on your 2020 federal Schedule A.

The veterans and surviving spouses property tax credit is a credit equal to the amount of property taxes paid during the year on an eligible veterans or surviving spouses principal dwelling. 71076e1 the Wisconsin Veterans and Surviving Spouses Property Tax Credit program provides a refundable property tax credit for the primary residence. Wisconsin Veterans Property Tax Credit 2.

Of Veterans Affairs Attn. You do not need to make any entries.

20 Off Excluisve Wish Promo Code 2019 Extra Free Shipping S W Promo Codes Wish App Promo Codes Coupon

20 Off Excluisve Wish Promo Code 2019 Extra Free Shipping S W Promo Codes Wish App Promo Codes Coupon

Stop Making Your Landlord Rich Mortgages Realestate Nomorerent Homeownership Being A Landlord Power Work Credit Score

Stop Making Your Landlord Rich Mortgages Realestate Nomorerent Homeownership Being A Landlord Power Work Credit Score

Wisconsin Fha Loan Mortgage Requirements And Guidelines Loan Fha Loans Real Estate Articles

Wisconsin Fha Loan Mortgage Requirements And Guidelines Loan Fha Loans Real Estate Articles

Prices Surge As Drought Stunts Corn Crop Corn Crop Drought Stunts

Prices Surge As Drought Stunts Corn Crop Corn Crop Drought Stunts

What Is The Disability Property Tax Exemption Millionacres

What Is The Disability Property Tax Exemption Millionacres

Effort To Lower Property Taxes For Disabled Military Vets Won T Be Passed This Legislative Session Local News Journaltimes Com

Effort To Lower Property Taxes For Disabled Military Vets Won T Be Passed This Legislative Session Local News Journaltimes Com

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Unique Features Of Wheda Loans Economic Development Helping People Loan

Unique Features Of Wheda Loans Economic Development Helping People Loan

Wi Veterans And Surviving Spouses Credit

Wi Veterans And Surviving Spouses Credit

Masshousing Is Based In Massachusetts And Functions As An Independent Quasi Public Agency To Help State Residents Find Home Loans Massachusetts Home Ownership

Masshousing Is Based In Massachusetts And Functions As An Independent Quasi Public Agency To Help State Residents Find Home Loans Massachusetts Home Ownership

Veteran Benefits For Wisconsin Veterans Guardian Va Claim Consulting

Veteran Benefits For Wisconsin Veterans Guardian Va Claim Consulting

When Buying A Home Keep In The Mind The Closing Costs You Don T Want To End Up Needing Money You Were Mortgage Interest Rates Closing Costs Mortgage Interest

When Buying A Home Keep In The Mind The Closing Costs You Don T Want To End Up Needing Money You Were Mortgage Interest Rates Closing Costs Mortgage Interest

Eagle Park Apartments Will Be A 67 Unit Community Which Will House Low Income Veterans And Households Earning Affordable Housing Silicon Valley Financial News

Eagle Park Apartments Will Be A 67 Unit Community Which Will House Low Income Veterans And Households Earning Affordable Housing Silicon Valley Financial News

Main Hallway In Community Choice Credit Union Convention Center Air Walls Open Up To Allow One Big Room Used To Be Fl Convention Centre Event Center Property

Main Hallway In Community Choice Credit Union Convention Center Air Walls Open Up To Allow One Big Room Used To Be Fl Convention Centre Event Center Property

Spring Forward The Difference An Hour Makes Infographic Texas Key Real Estate Keeping Current Real Estate Marketing Real Estate Articles Selling Rea

Spring Forward The Difference An Hour Makes Infographic Texas Key Real Estate Keeping Current Real Estate Marketing Real Estate Articles Selling Rea

2017 Update On The Homestead Tax Credit And Wisconsin Renter S And Homeowner S School Property Tax Credit Steve Brown Apartments

2017 Update On The Homestead Tax Credit And Wisconsin Renter S And Homeowner S School Property Tax Credit Steve Brown Apartments

10 Options To Avoid Foreclosure Avoid Foreclosure Foreclosures Janesville Wisconsin

10 Options To Avoid Foreclosure Avoid Foreclosure Foreclosures Janesville Wisconsin

How To Fill Out Irs Form 1040 For 2018 Irs Forms Irs Tax Forms

How To Fill Out Irs Form 1040 For 2018 Irs Forms Irs Tax Forms

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home