Lowest Property Tax In Wisconsin

The list is sorted by median property tax in dollars by default. Its worth noting that Sibley County with a population of almost 15000 also has the.

States With The Highest And Lowest Property Taxes Property Tax Tax States

States With The Highest And Lowest Property Taxes Property Tax Tax States

The exact property tax levied depends on the county in Wisconsin the property is located in.

Lowest property tax in wisconsin. The states average effective property tax rate is 168 good for eighth-highest in the US. This interactive table ranks Wisconsins counties by median property tax in dollars percentage of home value and percentage of median income. That rate is unlikely to increase much in coming years however.

Unfortunately all states have property taxes. In order to determine the states with the highest and lowest property taxes WalletHub compared the 50 states and the District of Columbia by using US. Counties examined in the report.

For example the municipality with the highest tax rate is the tiny village of Brokaw in Marathon County that taxes at a rate of 4719 per thousand in equalized value. 4272 163 States with the. This credit amount is listed on the property tax bill below the Net Assessed Value Rate box.

21 rows Vehicle Property Tax. We examined data for cities and counties collectively accounting for at. 5407 172 Rhode Island.

Dane County levied the states highest average property tax in dollars 4279 and ranked 61st among all US. But we can break down the states with the lowest taxes based on tax type. But the median home there valued at 385500 raises 3104 in property taxes.

You can sort by any column available by clicking the arrows in the header row. For more information on property tax credits listed on the property tax bill contact us at Submit a Question or 608 266-9457. The data contained some interesting though perhaps not surprising revelations about Wisconsins property taxes.

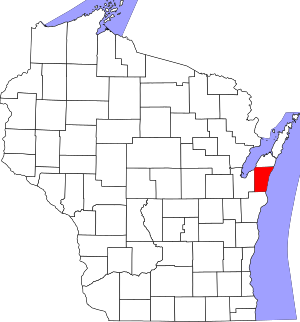

Ranked by median yearly property tax View county map View bar chart State Summary Tax Assessors Wisconsin has 72 counties with median property taxes ranging from a high of 414900 in Dane County to a low of 152000 in Iron County. Census Bureau data to determine real-estate property tax rates and applying assumptions based on national auto-sales data to determine vehicle property tax rates. 73 rows Wisconsin.

2689 173 New York. Median property tax is 300700. DOR Deadline - Municipalities with population 2500 and counties e-filed Municipal Financial.

As for the lowest property tax bills for Twin Cities homeowners Sibley County is the winner. The ten states with the lowest property tax rates are. Wisconsin passed a law that strictly limits increases in total property tax revenue collected by cities towns counties and school districts.

Wisconsin Department of Revenue. To Wisconsins south the eye-catching fact is Illinois lowest-in-the-country flat tax on paychecks - at 3 its less than half of Wisconsins top rate. Dane County collects the highest property tax in Wisconsin levying an average of 414900 18 of median home value yearly in property taxes while Iron County has the lowest property tax in the state collecting an average tax of 152000 142 of median home value per year.

Luckily 28 states have property tax rates below 100. All taxable real property in Wisconsin qualifies for the School Levy Tax Credit. For example property tax in one state may be much lower but personal income tax may be much higher.

But in California the tax rate is much lower at 081 the 34th lowest in the US. The state is a bottom 10 spender. There the median property tax bill is 1606 according to our review of Census Bureau data.

Read more »