Property Tax Credit For Disabled Veterans

Service-Connected Injury Illness or Disability. Ramps grab bars widening doorways and other improvements to enhance the independence of individuals with disabilities.

All Veteran Property Tax Exemptions By State And Disability Rating Tax Exemption Property Tax Tax

All Veteran Property Tax Exemptions By State And Disability Rating Tax Exemption Property Tax Tax

Disabled Veteran Tax Credit.

Property tax credit for disabled veterans. RSA 7235 Tax Credit for Service-Connected Total Disability. Disabled Veterans and Unremarried Surviving Spouses Property Tax Credit program provides a refundable property tax credit for the primary residence instate and up to one acre of land via the state income tax form for eligible veterans as certified by the Wisconsin Department of Veterans Affairs. The veterans and surviving spouses property tax credit is a credit equal to the amount of property taxes paid during the year on an eligible veterans or surviving spouses principal dwelling.

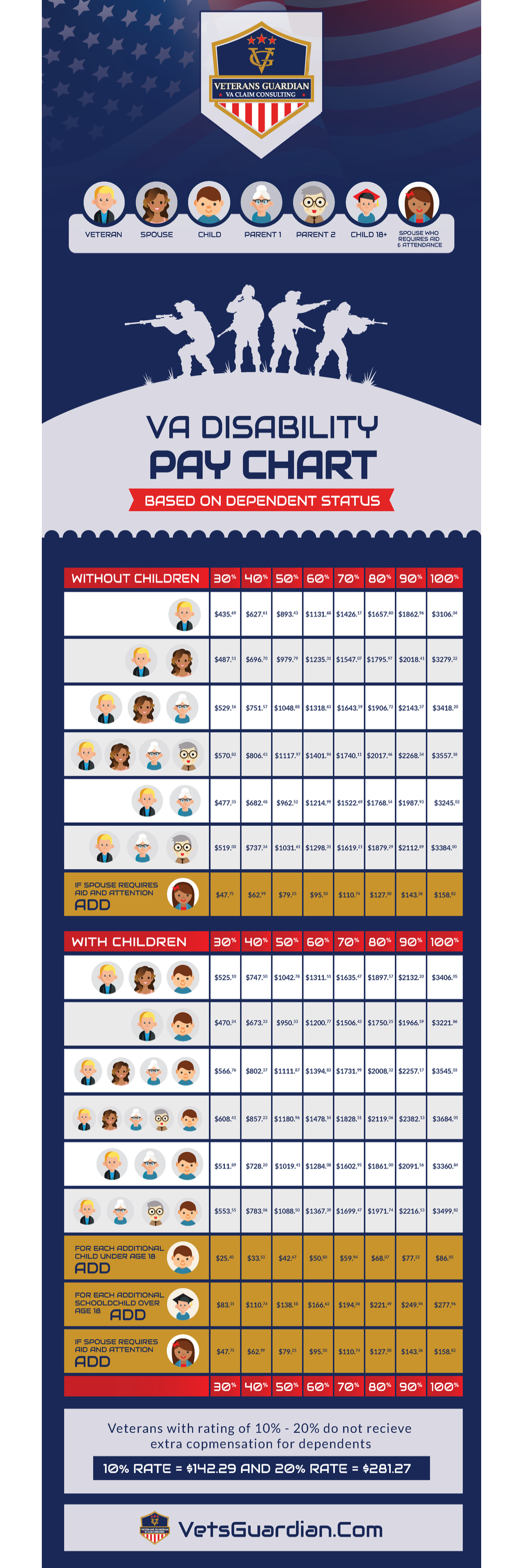

RSA 7228 Standard and Optional Veterans Tax Credit. Disabled Veteran Tax Credit Requirements. See ND State Century Code 57-02-088 for complete requirements Veteran must have honorable discharge or be retired from the armed forces.

Disabled veterans may be eligible to claim a federal tax refund based on. Continuing ApplicationChange in Residency. What is the Homestead Exemption for Disabled Veterans.

Veterans Tax Credits. Honorably discharged veterans with a 100 disability rating certified by the Department of Veterans Affairs may be eligible for expanded Homestead tax relief up to 50 thousand of the assessed value of their primary residential home from property. More Homestead Exemption for Surviving Spouses of Public Service Officers Killed in the Line of Duty.

Indicating that the veteran is 100 permanently and totally disabled or 100 permanently unemployable. Find discounts and incentives for state parks and recreational activities. If a veteran is notified of a change to the ratings of the disability or combination of disabilities or the rate of compensation thereforthat change must be reported on the DTE Form 105B.

Ohio Homestead Property Tax Exemption For Disabled Veterans. Eligible Veteran means a veteran. A new law in the Property Tax Code 35 ILCS 20010-23 will provide a property tax break to veterans and persons with disabilities who make accessibility improvements to their residences.

RSA 7228-c Optional Tax Credit for Combat Service. Enacted in 2009 by the North Dakota State Legislature the disabled veterans credit is a property tax credit that is available to veterans of the United States armed forces with a disability of 50 or greater. That a disability may improve.

Department of Veterans Affairs VA or a document from the VA. The homestead exemption provides a reduction in property taxes to qualified disabled veterans or a surviving spouse on the dwelling that is that individuals principal place of residence and up to one. The credit is claimed on the Wisconsin income tax return.

To apply veterans must meet all eligibility requirements and file an application with the local assessor or county director of tax. Property Tax Exemption for Disabled Veterans Additional Information Principal Residence Exemption PRE for Active Duty Military Personnel You may qualify to retain your PRE while on active duty in. Persons who received a homestead exemption on any property within the state for.

The actual credit is based on the amount of real estate taxes or rent paid and total household income taxable. Include disability effective date. Maryland Annotated Code Tax-Property Article 7-208 Attach a copy of the most recent rating decision of the veteran by the US.

161 of 2013 a property tax exemption for 100 Disabled Veterans. RSA 7228-b All Veterans Tax Credit. RSA 7232 Veterans of Allied Forces.

This program assists veterans with a total 100 disability rating by providing tax savings on the real estate or manufactured home taxes. Learn about pension resources available to permanently and totally disabled veterans age 65 and. If eligible the credit may reduce the taxable value of the homestead.

An increase in the veterans percentage of disability from the Department of Veterans Affairs which may include a retroactive determination or the combat-disabled veteran applying for and being granted Combat-Related Special Compensation after an award for Concurrent Retirement and Disability. Veterans must have service connected disability of 50 or greater or extra-schedular rating that brings the total disability rating to 100. Ohio veterans and families.

The Missouri Property Tax Credit Claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid for the year. Before claiming the credit the veteran or surviving spouse must obtain verification of his or her eligibility for the credit from the Wisconsin Department of. Accessibility improvements may include.

The credit is for a maximum of 750 for renters and 1100 for owners who owned and occupied their home. Learn about tax relief and other tax-related information for Ohio veterans and their families.

Read more »