Nevada Property Tax For Disabled Veterans

The surviving spouse of a disabled veteran who was eligible for this exemption at the time of his or her death may also be eligible to receive this exemption. Veterans must have served during wartime to qualify this includes service during the conflicts in the Persian Gulf Afghanistan and Iraq.

Veteran Tax Exemptions By State

Veteran Tax Exemptions By State

The amounts of exemption that are or will be available to disabled veterans varies from 6250 to 20000 of assessed valuation depending on the percentage of disability and the year filed.

Nevada property tax for disabled veterans. The permanently disabled veteran with a 60 to 100 disability receives an exemption ranging from 14000 to 28000 assessed value. The 201920 fiscal year amounts will be as follows. 60 to 79 disabled - 14400 assessed value approx.

To qualify the veteran. The surviving spouse may. The State of Nevada offers partial tax exemptions to widows widowers veterans disabled veterans and blind persons who meet certain requirements.

If found to be eligible they are asked to select how they wish to apply their exemption either to their vehicles governmental service tax or property taxes. When property becomes eligible after the lien date new acquisition or occupancy of a previously owned property or. These exemptions can be applied to real or personal property taxes or the vehicle government services privilege tax.

The amount of exemption is dependent on the degree of disability incurred. 514 property or up to 576 vehicle 80 to 99 disabled - 21600 assessed value approx. The amount of exemption is dependent upon the degree of disability incurred.

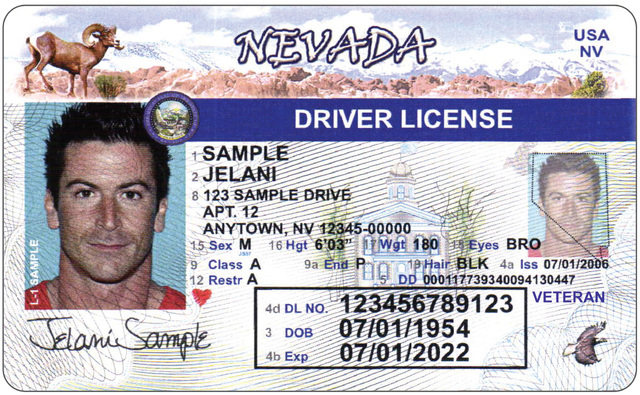

The Nevada State Disabled Veterans Exemption is offered to qualifying veterans with a permanent service-connected disability of at least 60. The State of Nevada Surviving Spouse Property Tax Exemption is for those with a valid Nevada Drivers License or Nevada. See all Nebraska Veterans Benefits.

Upon a veterans disability rating or death. 1028 property or up to 1152 vehicle. To enroll and receive this exemption veterans or their surviving spouses are asked to contact their County Assessors office to determine their eligibility for this benefit.

The 20202021 fiscal year amounts for disabled veterans are. The dollar exemption will vary depending on the taxing district. To qualify the Veteran must have an honorable separation from the service and be a resident of Nevada.

The State of Nevada Disabled Veterans Exemption is available for qualifying veterans with a VA-rated disability of 60. What Are The Requirements For A Veterans Exemption The Veterans exemption is applicable to an honorably discharged veteran of the Armed Forces of the United States who is a bona fide resident of the State of Nevada and. When used this exemption reduces the amount owed and the savings can be kept by the veteran surviving spouse or donated to the Nevada State Veterans.

Disabled Veterans Exemption The Disabled Veterans Exemption is provided for veterans who have a permanent service connected disability of at least 60. 34 rows A disabled veteran in Nevada may receive a property tax exemption of up to 20000 of the. 60-79 disabled - 14400 of assessed value 80-99 disabled -21600 of assessed value.

Nevada offers a property tax exemption to any honorably discharged resident veteran with a service-connected disability of 60 or more. The exemption amount may be applied to next years tax bill on real property the veteran. Disabled Veteran Tax Exemption Nevada offers a property tax exemption to any veteran with a service-connected disability of 60 or more.

The amount of exemption is dependent upon the degree of disability incurred. Your County Assessor can tell you what the amount of your exemption will be. A property tax exemption is available to any Veteran with a service-connected disability of 60 or more.

Surviving Spouse Blind. The disabled Veterans Exemption is provided for veterans who have a permanent service-connected disability of at least 60. 771 property or up to 864 vehicle 100 disabled - 28800 assessed value approx.

This further provides for the termination of the exemption on the date of sale or transfer of a property to a third party who is not eligible for the exemption or on the. A Has served a minimum of 90 continuous days on active duty who was assigned to active duty at some time between April 21 1898 and June 15 1903 or between April 6. Nevada Property Tax Exemption.

Nevada Disabled Veteran Property Tax Exemption. Veterans who are residents of Nevada can get a tax exemption for property taxes or the vehicle privilege tax. The Disabled Veteran Exemption amount will depend upon the percentage of permanent service-connected disability.

This property tax program provides for the cancellation or refund of taxes paid. Surviving Spouse Veteran. The amount of exemption varies from 10000.

60 - 79 disabled - 14400 assessed value approximately 465 property or up to 576 vehicle per fiscal year.

On Your Side Nevada Law Doesn T Offer Tax Exemption For All Vets Krnv

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Veteran Tax Exemptions By State

Veteran Tax Exemptions By State

Nevada Military And Veterans Benefits The Official Army Benefits Website

Nevada Military And Veterans Benefits The Official Army Benefits Website

Disabled Veterans Property Tax Exemptions By State

Disabled Veterans Property Tax Exemptions By State

What Is The Disability Property Tax Exemption Millionacres

What Is The Disability Property Tax Exemption Millionacres

Nevada Military And Veterans Benefits The Official Army Benefits Website

Nevada Military And Veterans Benefits The Official Army Benefits Website

Nevada Military And Veterans Benefits The Official Army Benefits Website

Nevada Military And Veterans Benefits The Official Army Benefits Website

Http Doc Nv Gov Uploadedfiles Docnvgov Content Home Features Clark County Veterans Tax Exemptions Online Dmv Kiosks Pdf

Nevada Military And Veterans Benefits The Official Army Benefits Website

Nevada Military And Veterans Benefits The Official Army Benefits Website

Veteran Disability Exemptions By State Va Hlc

Veteran Disability Exemptions By State Va Hlc

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

What Is The Disability Property Tax Exemption Millionacres

What Is The Disability Property Tax Exemption Millionacres

Nevada Military And Veterans Benefits The Official Army Benefits Website

Nevada Military And Veterans Benefits The Official Army Benefits Website

Https Www Elkocountynv Net Departments Assessor1 Affidavit Of Disabled Veteran1 Pdf

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home