Pay Nevada Property Tax Online

Select the criteria you wish to use from the search by dropdown menu. Registering to file and pay online is simple if you have your current 10 digit taxpayers identification number TID a recent payment amount and general knowledge of your business.

Property Tax Costs Official Website Surprise Arizona

Register File and Pay Online with Nevada Tax.

Pay nevada property tax online. You may pay in person in the Clerk-Treasurers Office at the Pershing County Administrative Building 398 Main Street. Semi-annually 2 times a year. Treasurer Online Services 1262.

Other Tax Payment Options 1714. Please use the link above to make your payment. The Tax Roll is prepared and maintained by the County Assessor.

Skip to main content. Frequently Asked Questions 1032. Payment is due on.

To make an online payment you will need to use a different browser such as Google Chrome which can be downloaded for free. View or Pay Taxes Online Click Here. Click Here for details.

July 1 October 1 January 1 and April 1. Please click on the link below 245 for card payments and 150 for electronic check payments. If you bought property in the last part of the fiscal year the former owner may receive the statement.

All property tax payments paid online or over the phone are handled by Heartland Payment Systems. E-check payments are accepted without a. Clark County Tax Rate Increase - Effective January 1 2020.

Real Property Tax Payment Options. Quarterly 4 times a year. Pay-by-Phone IVR 1-866-257-2055.

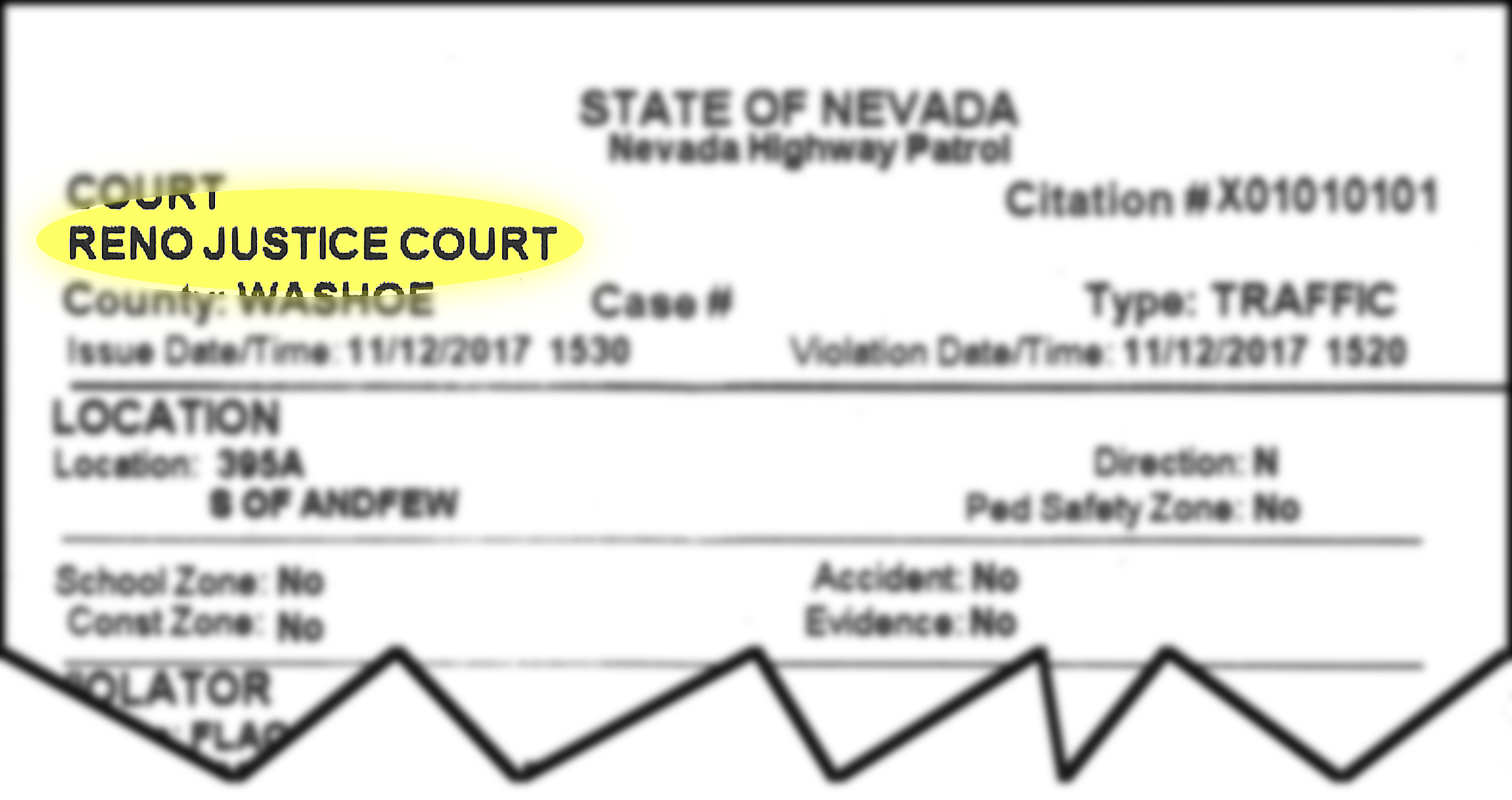

The total overlapping tax rate subject to approval by the Nevada Tax Commission for the City of Reno is 3660615 per 100 of assessed valuation. When the page loads select the correct year from roll year dropdown menu. A 25 fee will be applied to all credit card payments with a minimum charge of 200.

Payments may be made payable and mailed to. Review filing payment history. Online payments are available for most counties.

July 1 and January 1. Property Tax Bills Payment Information Tax Rates Requirement to Pay by Electronic Funds Transfer EFT Requirement Due Dates Overdue Balances. Ask the Advisor Workshops.

Over the phone by credit or debit card. Please visit this page for more information. You can use our website any time to pay online for.

Paying Your Property Taxes 2468. Pay Property Taxes Online Clark County Official Site The Clark County Treasurer provides an online payment portal for you to pay your property taxes. The online or pay-by-phone service 1-877-445-5617.

800 am - 500 pm Monday through Friday Phone. NOTICE TO TAXPAYERS OF DOUGLAS COUNTY NEVADA The fourth installment of the 2020-2021 property tax is due and payable on March 1 2021. The Property Tax Statement is mailed around the middle of July each year to the assessed owner as their name and mailing address are listed on the Tax Roll as of July 1st.

To ensure accurate posting please include the appropriate payment stub for each parcel or. Property Tax Calculator 6137. Option 1 For Paying Your Taxes.

24-7 drop box located in the rood center parking lot. Therefore we are unable to accept payments by telephone. Enter your Nevada Tax Pre-Authorization Code.

The statewide property tax deadline is October 15. PAY ONLINE You may also pay with a credit card through our third party provider- Velocity. A 395 fee will be applied for Visa Signature Debit payments.

State Property SalesAuctions Information 1919. There is a service fee of 219 charged by our third-party service provider for all credit card transactions. Enter the search term in the box and click the search button.

Click here to schedule an appointment. Be sure to pay before then to avoid late penalties. Want to avoid paying a 10 late penalty.

Tax payers may also take advantage of this service to view tax bills associated with their properties. File and Pay Online. A 150 fee will be applied for all E-check payments.

Pay Property Tax Online 16990. Send payment with timely postmark through the us. Rood center lobby drop box available 8-5 m-f.

Because this is a convenience offered by a third party a service fee. We value the security of your financial information. Payment is due on.

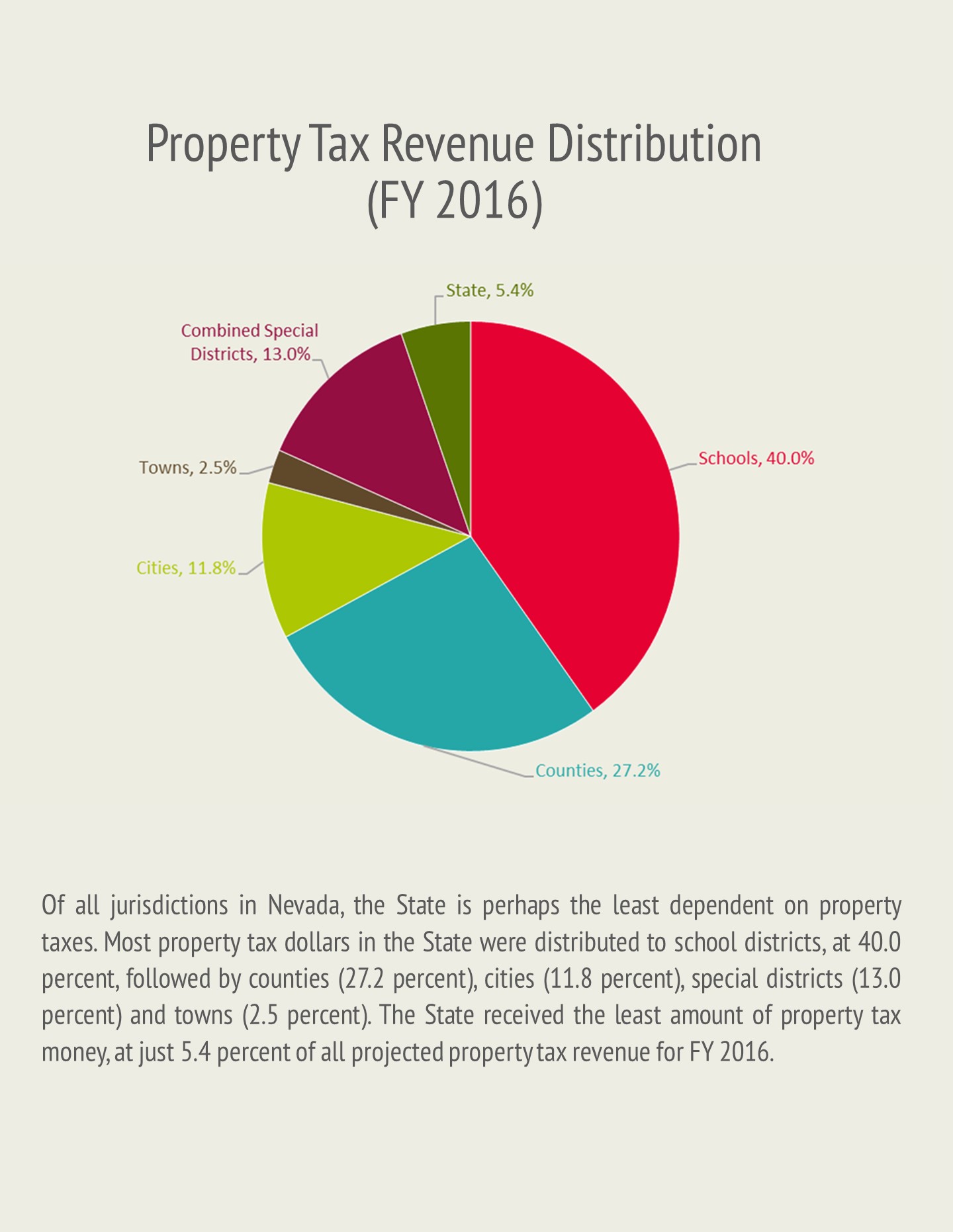

Please specify on your envelope if you require a receipt and include email address or mailing info. We are encouraging everyone to pay property taxes by utilizing the below payment methods. Elements and Applications Property Tax Rates for Nevada Local Governments Redbook NRS 3610445 also requires the Department to post the rates of taxes imposed by various taxing entities and the revenues generated by those taxes.

Real Estate Property Tax. Therefore a home which has a replacement value of 100000 will have an assessed value of 35000 100000 x 35 and the home owner will pay approximately 1281 in property taxes 35000 x 3660615. Online Treasurer Web You may pay with a credit card using Visa MasterCard or Discover.

Property Taxes click to make payment Personal Property click to make payment WaterSewer click to make payment. Click the pay online here link to locate your tax bill. Locate your county on the map or select from the drop-down menu to find ways to pay your personal property tax.

Read more »