Nevada County Property Tax Exemptions

Through either selection veterans and surviving spouse can also donate all or a portion of their exemption to the Nevada State Veterans Homes in Boulder City and Sparks. Clark county nevada property tax senior discount.

Https Www Capropeforms Org Counties Nevada

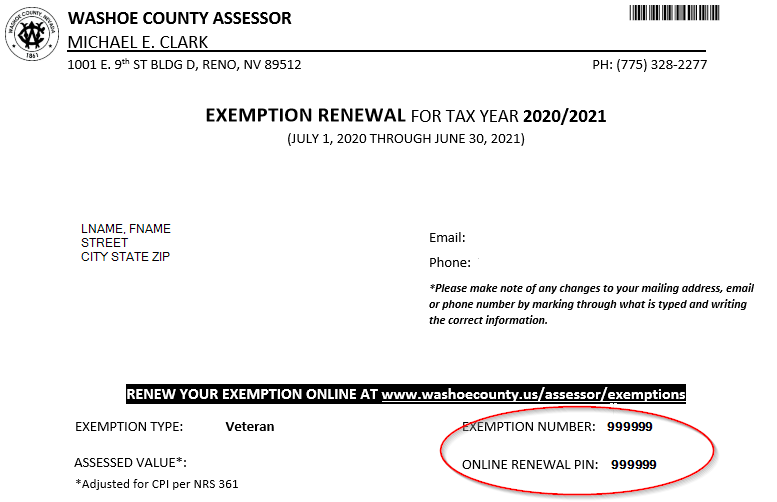

Clark County Veterans May Now Claim Tax Exemptions Online and at Kiosks LAS VEGAS - Nevada veterans in Clark County may now claim their annual property tax exemption during a vehicle registration renewal online or at one of the DMVs self-service kiosks.

Nevada county property tax exemptions. Arkansas disabled veterans who have been awarded special monthly compensation by the Department of Veterans Affairs for the loss of or the loss of use of one 1 or more limbs for total blindness in one 1 or both eyes or for service-connected one hundred percent 100 total and permanent disability shall be exempt from payment of all state taxes on the homestead and personal property. To determine the exemption value multiply the 1000 x the tax rate035 3500. The most important Nevada property exemptions for the average individual in Nevada are the following-Homestead Exemption of 550000 must be the individuals actual residence and the Homestead Declaration must be recorded in the County where the real estate is located-Retirement Savings Exemption for a maximum amount of 500000 for any of the following plans.

Search By Time All Past 24 Hours Past Week. Exemptions can be used on Personal Property between July 1 2018 and June 30 2019. This exemption is not granted automatically.

Some of these include veterans disabled veterans surviving spouses blind persons and property owned by. Nevada County Assessors All County Assessors in Nevada grant Governmental Services Tax exemptions for veterans with certain dates of service disabled veterans surviving spouses and the blind. These exemptions can be applied to real or personal property taxes or the vehicle government services privilege tax.

The 201920 fiscal year amounts will be as follows. An exemption may be applied to real property tax and personal property tax which includes business personal property and manufactured housing. 60 - 79 disabled - 14400 assessed value approximately 465 property or up to 576 vehicle per fiscal year 80 - 99 disabled - 21600 assessed value approximately 700 property or up to 864 vehicle per fiscal year.

Mobile Homes Business Personal Property Aircraft and licensed vehicles are considered Personal Property. Your exemption will then appear on your 20182019 tax bill. Claim for Welfare Exemption PDF Community Libraries.

If you have any questions regarding Real Property Transfer Tax please contact the Clark County. To use your exemption on Real Property you must return your card by June 15 2018. PROPERTY TAX EXEMPTION PROGRAMS.

Please call and speak with a member of the audit team if you have any question as to the taxability of a transfer. The Nevada Legislature provides for property tax exemptions to individuals meeting certain requirements. Per their guidance a transfer to any other type of trust may be taxable.

The State of Nevada offers partial tax exemptions to widows widowers veterans disabled veterans and blind persons who meet certain requirements. The dollar exemption will vary depending on the taxing district. They include in abbreviated form.

The exemption amount will vary each year depending on the Consumer Price Index and the tax rates throughout the County. Here you can view download and print the Property Tax Exemption Form. TRANSFER TAX EXEMPTIONS.

Nevada County Update COVID-19 Updates Information. A mere change of identity form or place of organization if the affiliated corporation has identical common ownership. Exemptions may be used to reduce vehicle Governmental Services Taxes or personal property taxes.

Up until now veterans in Clark County could renew only by mail or in person at a DMV office. The Nevada Tax Commission may exempt from taxation that personal property for which the annual taxes would be less than the cost of collecting those taxes. This exemption can be used for either their vehicle registrations Governmental Service Tax Fee or to reduce their property taxes.

Lets assume an exemption after the adjusted CPI is 1000 assessed value and the tax rate is 350 per hundred of assessed value. Property Tax Exemptions The Nevada Legislature NRS 361 provides for property tax exemptions to individuals who meet certain criteria. All Off Off Free Delivery.

All Off Off Free Delivery Filter Search. If such an exemption is provided the Nevada Tax Commission shall annually determine the average cost of collecting property taxes in this state which must be used in determining the applicability of the exemption. Without consideration are exempt under NRS 3750907.

All Off Off Free Delivery Filter Type. List Of Websites About Nevada Property Tax Senior Discount. Homestead and Personal Property Tax Exemption.

There are 14 possible exemptions to the imposition of the Real Property Transfer Tax NRS 375090. The Disabled Veteran Exemption amount will depend upon the percentage of permanent service-connected disability.

How To File A Nevada Homestead Declaration Law Office Of Michael R Cahill

How To File A Nevada Homestead Declaration Law Office Of Michael R Cahill

Http Doc Nv Gov Uploadedfiles Docnvgov Content Home Features Clark County Veterans Tax Exemptions Online Dmv Kiosks Pdf

What Is A Homestead Exemption California Property Taxes

What Is A Homestead Exemption California Property Taxes

Https Tax Nv Gov Localgovt Policypub Active Publications Elements And Applications 2013 Nevada Property Tax Elements And Application

Nevada County Resource Conservation District About Us

Orange County Homestead Declaration Form Unique Questions Linger Over Orange County Property Appraiser Rick Singh S Models Form Ideas

Orange County Homestead Declaration Form Unique Questions Linger Over Orange County Property Appraiser Rick Singh S Models Form Ideas

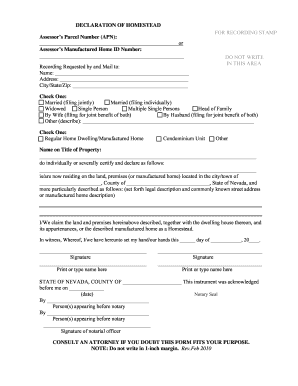

Declaration Of Homestead Nevada Fill Online Printable Fillable Blank Pdffiller

Declaration Of Homestead Nevada Fill Online Printable Fillable Blank Pdffiller

State Of Nebvada Declaration Of Value Form Fill Online Printable Fillable Blank Pdffiller

State Of Nebvada Declaration Of Value Form Fill Online Printable Fillable Blank Pdffiller

Homestead Declaration Fill Out And Sign Printable Pdf Template Signnow

Homestead Declaration Fill Out And Sign Printable Pdf Template Signnow

Https Www Mynevadacounty Com Documentcenter View 24527 Nevada County Cannabis Nop Pdf

Http Www Leg State Nv Us Session 79th2017 Exhibits Assembly Tax Atax1294p Pdf

Orange County Homestead Declaration Form Unique Questions Linger Over Orange County Property Appraiser Rick Singh S Models Form Ideas

Orange County Homestead Declaration Form Unique Questions Linger Over Orange County Property Appraiser Rick Singh S Models Form Ideas

How To Fill Out Nevada Homestead Form Fill Online Printable Fillable Blank Pdffiller

How To Fill Out Nevada Homestead Form Fill Online Printable Fillable Blank Pdffiller

Clark County Gift Deed Form Nevada Deeds Com

Clark County Gift Deed Form Nevada Deeds Com

Clark County Gift Deed Form Nevada Deeds Com

Clark County Gift Deed Form Nevada Deeds Com

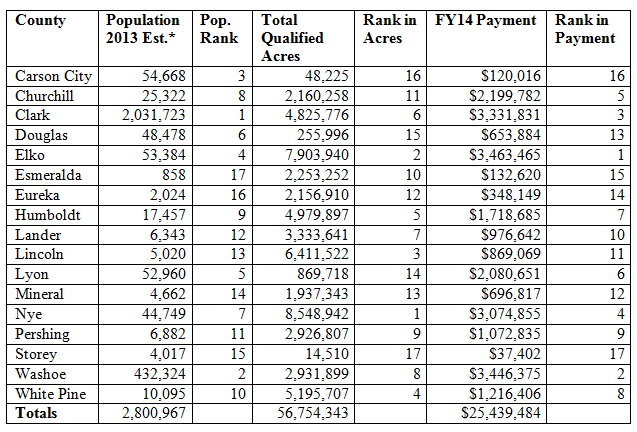

How Does The Federal Government Compensate Nevada For Lost Property Taxes On Federal Land Guinn Center For Policy Priorities

How Does The Federal Government Compensate Nevada For Lost Property Taxes On Federal Land Guinn Center For Policy Priorities

State Of Nevada Homestead Forms Fill Out And Sign Printable Pdf Template Signnow

State Of Nevada Homestead Forms Fill Out And Sign Printable Pdf Template Signnow

Labels: county, exemptions, nevada, property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home