How Do I Know If I Have A Tax Levy

The representative will not be able to tell you who the debt is with or how much of your refund will be applied to the debt. Youll get to keep a certain amount of your paycheck.

Tips To Getting Rid Of An Irs Tax Levy Irs Taxes Irs Tax Debt Relief

Tips To Getting Rid Of An Irs Tax Levy Irs Taxes Irs Tax Debt Relief

To request the release of a levy due to a coronavirus hardship please contact your revenue officer point of contact or fax 855-796-4524 following these instructions.

How do i know if i have a tax levy. Hi I would like to know is there any resources that would help you find out if you have a bank levy. Businesses may contact us at 1-800-829-4933. You will be able to pay your taxes if the levy is released.

How do I know a tax levy is coming. The collections period ended before the levy was issued. Next the IRS will send Notice of Levy on Wages Salary and Other Income generally Form 668ACDO to your bank.

A lien secures the governments interest in your property when you dont pay your tax debt. Information about wage levies. If you receive an IRS bill titled Final Notice Notice of Intent to Levy and Your Right to A Hearing contact the IRS right away.

Call the number on your billing notice or individuals may contact the IRS at 1-800-829-1040. In the case of a bank levy funds in the account are frozen as of the date and time the levy is received. If your employer did not include child support in your exempt amount you should contact the IRS at the phone number listed on the Form 668-WcDO Form 668-WICS.

An IRS levy permits the legal seizure of your property to satisfy a tax debt. 2 Or in the case of a tax levy the IRS will have sent a bill for payment allowed you to neglect or refuse to pay then sent a. The employer must continue to deduct the specified amount from your net wages until the amount of the levy is paid.

If your bill remains unpaid and no other arrangement has been made the IRS then sends you a Notice of Intent to Levy and Notice of Your Right to a Hearing. At this point you have an additional 21 days to resolve the situation otherwise the bank will remit the funds. I wanna know before I do next years taxes so I can pay it.

Figuring out if you have a tax lien against your property is often a simple process since youll likely be notified by a government agency. Step 2 Contact the agency to which you owe the debt and inquire as to whether they have submitted a request to the IRS for your refund to be intercepted. Before the IRS seizes your property they must meet certain requirements under most circumstances.

Report Inappropriate Content. Tax levies can include penalties such as garnishing wages or seizing assets and. The preceding list how you can perform a.

0 1 503 Reply. If you dont pay or make arrangements to settle your tax debt the IRS can levy seize and sell any. You paid the amount you owe.

I was included as signature on the bank account of my elderly mother to help her pay her bills. Even if you think you do not owe the tax bill you should contact the IRS. If a levy has already been issued see.

The first is a yearly imposition in which residents receive notification of the coming years tax levy in early spring. The IRS will release from levy the amount you need to pay court ordered child support that the court ordered before the levy was received by your employer. The IRS sends a demand for payment and then mails the notice of federal tax lien after the lien has been filed.

A levy shouldnt be a surprise. Your bank must comply and freeze the funds. A creditor cant levy your bank account without first winning a lawsuit judgment against you and then obtaining a court order to levy your bank account.

Residents then have between six and nine months to put aside the money to. The date and time of delivery of the levy is the time when the levy is considered to have been made. A worksheet is provided to the employer to determine the amount to be withheld.

The first is assessing the tax you owe and sending you a Notice and Demand for Payment letter. However there are cases where you may be living at a different address or your notices simply do not make it to you. Normally the levy does not affect funds you add to your bank account after the date of the levy.

If you cant pay the full amount you owe payment options are available to help you settle your tax debt over time. A single action levy allows us to take only the amount of funds you have access to at the time the financial institution receives the levy. A lien is not a levy.

The IRS can take some of your paycheck. Notification is provided to you of the amount owed at least 10 days before a wage levy is sent to your employer. When the IRS issues a levy it will send a notice to your employer IRS Form 668-W requiring the business to send part of your paycheck to the IRS.

I just recently had 2 checking accounts that have levys on them and before i pay this account off i would like to know if i have any moreI have seen a link on this site but I have been looking for a couple of days now and i cant seem to find it. How do I know if I have a tax levy. While your account is frozen you wont be able to withdraw the money.

Email to a Friend. It can garnish wages take money in your bank or other financial account seize and sell your vehicle s real estate and other personal property. A levy actually takes the property to pay the tax debt.

If the funds you have access to are not sufficient to pay the amount listed in full the DOR would have to issue another levy to attach to amounts deposited after the bank received the first levy. A tax levy is the seizure of property to pay taxes owed. Level 15 June 6 2019 625 AM.

The IRS must release a levy if. Subscribe to RSS Feed.

As You Can See Releasing A Tax Lien Has A Multitude Of Nuances And Variables To Consider The Actions And Strategies Are Dependent Tax Debt Debt Debt Reduction

As You Can See Releasing A Tax Lien Has A Multitude Of Nuances And Variables To Consider The Actions And Strategies Are Dependent Tax Debt Debt Debt Reduction

So How Do Tax Liens And Tax Levy Differ Independent Reading Activities Word Wall Vocabulary Words

So How Do Tax Liens And Tax Levy Differ Independent Reading Activities Word Wall Vocabulary Words

What Is A Wage Garnishment Or Tax Levy On Taxes Owed Overdue Taxes

What Is A Wage Garnishment Or Tax Levy On Taxes Owed Overdue Taxes

National Internet Tax Solutions Solutions National Internet

National Internet Tax Solutions Solutions National Internet

What Is A Wage Garnishment Or Tax Levy On Taxes Owed Overdue Taxes

What Is A Wage Garnishment Or Tax Levy On Taxes Owed Overdue Taxes

The Irs Notice 1058 Is The Irs Telling You Their About To Levy Your Bank Account S If You Ve Gotten This Letter I Letter Templates Lettering How To Find Out

The Irs Notice 1058 Is The Irs Telling You Their About To Levy Your Bank Account S If You Ve Gotten This Letter I Letter Templates Lettering How To Find Out

Stop An Irs Tax Levy And Tax Levy Help From Flat Fee Tax Service Irs Taxes Debt Relief Programs Debt Relief

Stop An Irs Tax Levy And Tax Levy Help From Flat Fee Tax Service Irs Taxes Debt Relief Programs Debt Relief

What Is A Wage Garnishment Or Tax Levy On Taxes Owed Overdue Taxes

What Is A Wage Garnishment Or Tax Levy On Taxes Owed Overdue Taxes

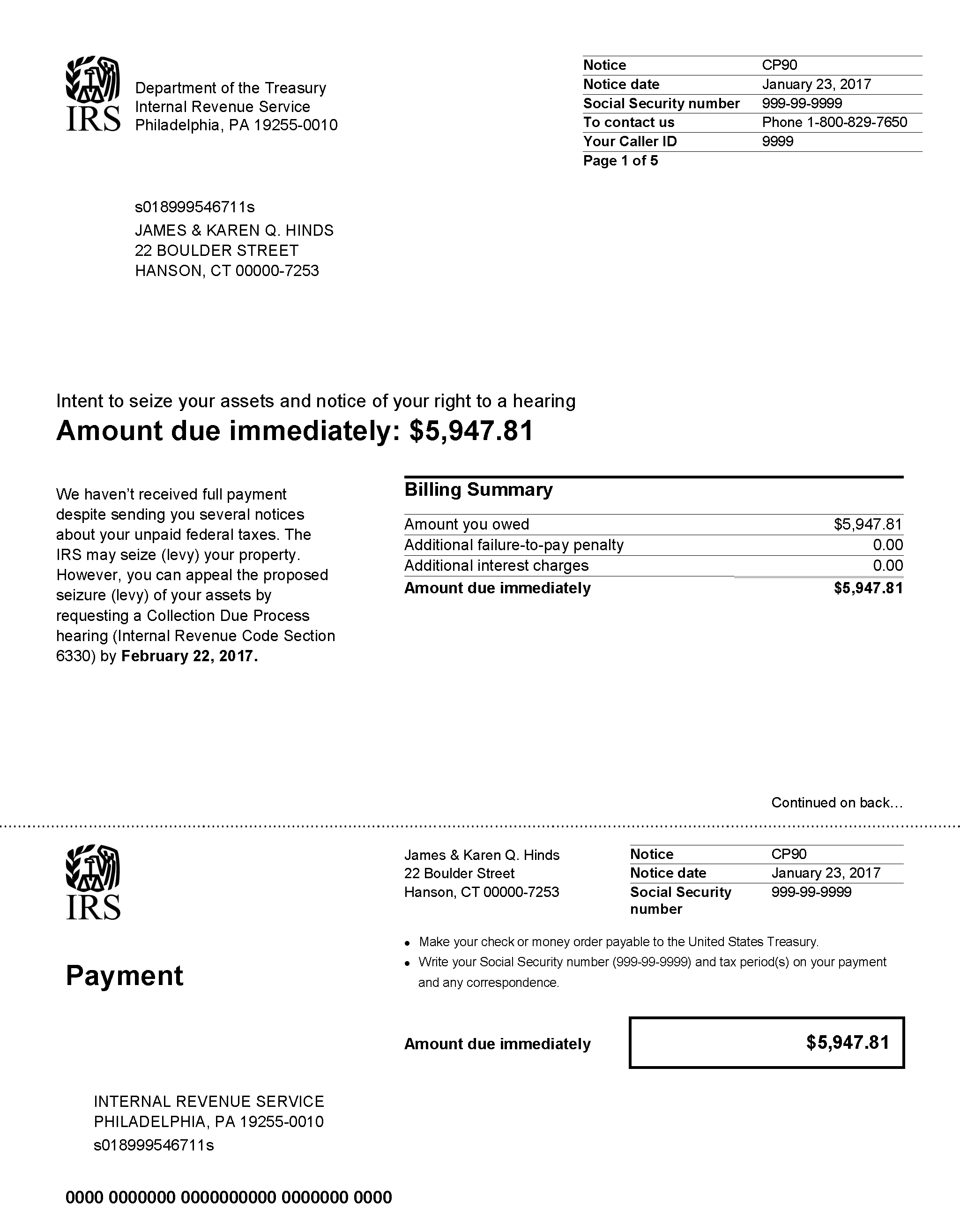

Irs Notice Cp90 Final Notice Of Intent To Levy And Your Right To A Hearing H R Block

Irs Notice Cp90 Final Notice Of Intent To Levy And Your Right To A Hearing H R Block

What Is A Wage Garnishment Or Tax Levy On Taxes Owed Overdue Taxes

What Is A Wage Garnishment Or Tax Levy On Taxes Owed Overdue Taxes

Irs Bank Levy About California Tax Levy Laws Procedure Tax Relief Help Debt Relief Programs Irs

Irs Bank Levy About California Tax Levy Laws Procedure Tax Relief Help Debt Relief Programs Irs

Flat Fee Irs Tax Relief Affordable Irs Levy Help Stop Irs Tax Levy Irs Wage Garnishment Flat Fee Tax Service Provides Af Tax Debt Debt Help Tax Services

Flat Fee Irs Tax Relief Affordable Irs Levy Help Stop Irs Tax Levy Irs Wage Garnishment Flat Fee Tax Service Provides Af Tax Debt Debt Help Tax Services

How Do You Know If You Should Have An Alarm System Commercial Insurance Hertfordshire Alarm Systems For Home

How Do You Know If You Should Have An Alarm System Commercial Insurance Hertfordshire Alarm Systems For Home

Tips Tricks And Products That Are Not Too Taxing You Know Because Your Taxes Are Due April 18 Tax Help Business Tax Money Management

Tips Tricks And Products That Are Not Too Taxing You Know Because Your Taxes Are Due April 18 Tax Help Business Tax Money Management

Irs Tax Relief Irs Tax Attorneys Offer In Compromise Settlements Irs Tax Relief What Is A Tax Levy Irs Taxes Debt Relief Programs Tax Attorney

Irs Tax Relief Irs Tax Attorneys Offer In Compromise Settlements Irs Tax Relief What Is A Tax Levy Irs Taxes Debt Relief Programs Tax Attorney

Tax Lien Help Greensboro Ga 30642 M M Financial Blog Debt Relief Programs Irs Taxes Tax Debt Relief

Tax Lien Help Greensboro Ga 30642 M M Financial Blog Debt Relief Programs Irs Taxes Tax Debt Relief

What Is A Tax Lien Credit Karma Tax

What Is A Tax Lien Credit Karma Tax

What Is A Wage Garnishment Or Tax Levy On Taxes Owed Overdue Taxes

What Is A Wage Garnishment Or Tax Levy On Taxes Owed Overdue Taxes

Labels: levy

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home