How To Calculate Tax Return In Bangladesh

Income tax submission in Bangladesh Income Tax Return in Bangladesh. A tax return calculator takes all this into account to show you whether you can expect a refund or not and give you an estimate of how much to expect.

Relief On Itr Verification Of Last Five Years Will Now Be Able To Verify Till 30th September Income Tax Return Income Tax Tax Advisor

Relief On Itr Verification Of Last Five Years Will Now Be Able To Verify Till 30th September Income Tax Return Income Tax Tax Advisor

How to calculate Advance tax by using NEW Excel Formula IFVLOOKUP this video is in bengali.

How to calculate tax return in bangladesh. We BDLC Legal and Associates Bangladesh Legal Consulting Firm are providing services to both resident and non-resident to calculate the tax liability and file the return and submit the. It includes the latest updates announced on the budget for FY 2020-21. Translate the description back to Bangla Bangladesh Income Tax Calculator is a free app to calculate tax from salary according to the guideline provided by NBR and Income Tax Ordinance 1984 Bangla.

Do you want to calculate your own tax and prepare tax return by yourself. Calculate your take home pay in Bangladesh thats your salary after tax with the Bangladesh Salary Calculator. Before submitting Income Tax Return in Bangladesh an assignee must obtain e-TIN 12-digit electronic tax identification number from tax.

In Bangladesh individual income tax return filing is mandatory for both resident and non-resident Bangladeshi imposed by The National Board of Revenue NBR. Tax Deductions and Tax Credits Explained Remember that a tax deduction reduces your taxable income cutting your tax bill indirectly by reducing the income thats subject to a marginal tax rate. In Bangladesh individual income tax return filing is mandatory for both resident and non-resident Bangladeshi imposed by The National Board of Revenue NBR.

Today in this article I will discuss with you the steps need to follow to calculate tax liability and return preparation. After end of the income year and within the tax return due date every resident assignee must submit tax return for the period from 1 July to 30 June or the period delegate stays. And by that time you will have to update your employment property and income tax data through a form.

By adding all output tax and supplementary duty and all increasing adjustment payable during the tax period and deducting from the sum total all input tax and all decreasing adjustment during the tax period. You may already know that if taxable income exceeds BDT 300000 then he shall be eligible to pay tax. The Bangladesh tax calculator assumes this is your annual salary before tax.

Now if your actual investment at the end of the income year stands at below BDT 238000 then you will be eligible to get tax rebate on that amount. You will calculate Net Tax in accordance with the following method. A branch company shall withhold tax at the rate of 20 while remitting profit to Head Office.

However in cases where dividend is payable to a shareholder resident in a country with which Bangladesh has signed a tax treaty the rate mentioned in the tax treaty will apply subject to certification from National Board of Revenue NBR. At first we will calculate the total investment allowance based on total taxable amount ie. If you wish to enter you monthly salary weekly or hourly wage then select the Advanced option on the Bangladesh tax calculator and change the Employment Income and Employment Expenses period.

Many people search online Bangladesh income tax calculator income tax calculator bd Bangladesh income tax calculator excel taxation in Bangladesh book pdf etc. At first we need an income tax return form bd and Bangladesh income tax rate to prepare a return file of income tax Bangladesh 2020-2021. To make the IT return form user friendly tax calculator would be a tool which leads to the taxpayers to reach their total income in steps and auto calculation of net tax amount to be paid.

The Bangladesh Tax Calculator is a diverse tool and we may refer to it as the Bangladesh wage calculator salary calculator or Bangladesh salary. So by using this free tool you can calculate your tax which will help you to prepare your income tax return file. We FM Consulting International are providing services to both resident and non-resident to calculate the tax liability and file the return and submit the return.

This is the amount of salary you are paid. 13 Tax Rate on Winning Referred to in Section 1913 10 14 Person Liable to Submit Income Tax Return 10 15 Time to Submit Income Tax Return Tax Day 10 16 Assessment Procedures 11 17 Income Subject to Deduction at Source TDS 11-21 18 The Time Limit for Payment of Tax Deducted at Source Rule 13 21 19 Submission of Withholding Tax Return 21. A quick and efficient way to compare salaries in Bangladesh review income tax deductions for income in Bangladesh and estimate your tax returns for your Salary in Bangladesh.

So your investment allowance will be BDT 238000 BDT 954000X25. The income tax return is something that people are required to submit each year by November 30. AHM Belal Chowdhury Financial Lead of FM Consulting International speaks about Tax Assessment Fillings in BangladeshThis video is about a brief descripti.

The National Board of Revenue NBR is the apex authority for tax administration in Bangladesh. It was established by the father of the nation Bangabandhu Sheikh Mujibur Rahman under. As a part of Digital Bangladesh.

The tool will help the taxpayers to calculate income tax and prepare the IT return is more easily and accurately.

Pin By California Tax Education Counc On Taxpayers Tax Preparation Wix Website Fraud

Pin By California Tax Education Counc On Taxpayers Tax Preparation Wix Website Fraud

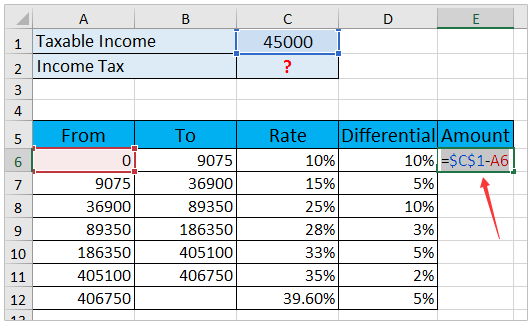

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

Tax Season Today For Apr 15 Share Makelifelesstaxing Taxbot Tax Season Paying Taxes Irs Forms

Tax Season Today For Apr 15 Share Makelifelesstaxing Taxbot Tax Season Paying Taxes Irs Forms

Bigha To Acre Acre To Bigha Conversion By Region Certified Public Accountant Tax Services Accounting Firms

Bigha To Acre Acre To Bigha Conversion By Region Certified Public Accountant Tax Services Accounting Firms

Income Tax Bangladesh With Calculation Income Income Tax Online Earning

Income Tax Bangladesh With Calculation Income Income Tax Online Earning

How Much Does A Small Business Pay In Taxes

How Much Does A Small Business Pay In Taxes

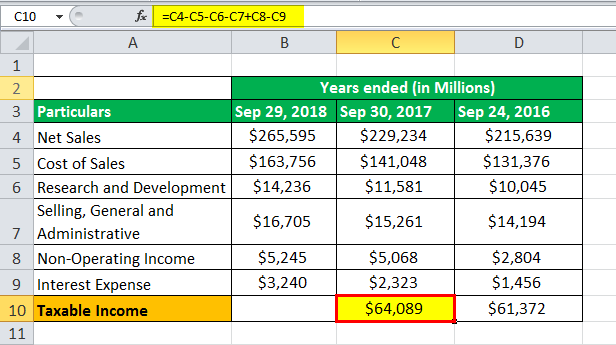

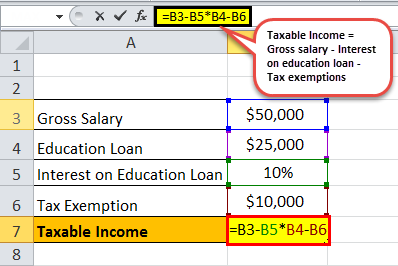

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income Formula Examples How To Calculate Taxable Income

Income Tax Calculator Bd 3 Taboos About Income Tax Calculator Bd You Should Never Share On T Income Tax Personal Financial Statement Income

Income Tax Calculator Bd 3 Taboos About Income Tax Calculator Bd You Should Never Share On T Income Tax Personal Financial Statement Income

How To Calculate Net Income 12 Steps With Pictures Annual Income Net Income Income Calculator

How To Calculate Net Income 12 Steps With Pictures Annual Income Net Income Income Calculator

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income Formula Examples How To Calculate Taxable Income

File Income Tax Return Ay 2020 21 Demo Income Tax Calculator 2020 21 Income Tax Calculation Youtube

File Income Tax Return Ay 2020 21 Demo Income Tax Calculator 2020 21 Income Tax Calculation Youtube

How To Correct When Irs Rejected Tax Form Tax Return Rejection Accounting Services

How To Correct When Irs Rejected Tax Form Tax Return Rejection Accounting Services

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

From Above View Of 2017 Irs Form 1040 On Wooden Desk Irs Forms Tax Preparation Federal Income Tax

From Above View Of 2017 Irs Form 1040 On Wooden Desk Irs Forms Tax Preparation Federal Income Tax

How To Become A Tax Filer In Pakistan In 2020 Income Tax Return Income Tax Tax Return

How To Become A Tax Filer In Pakistan In 2020 Income Tax Return Income Tax Tax Return

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income Formula Examples How To Calculate Taxable Income

New Tax Calculator Shows Taxpayers Their Tax Bill Under Many Scenarios Tax Foundation

New Tax Calculator Shows Taxpayers Their Tax Bill Under Many Scenarios Tax Foundation

Bd Income Tax Calculator App Will Help You To Calculate Your Tax Income Tax Calculator App Tax

Bd Income Tax Calculator App Will Help You To Calculate Your Tax Income Tax Calculator App Tax

Labels: bangladesh, calculate, property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home