Can I Claim Home Office Expenses During Covid

If you are working from home during COVID can you take a home-office deduction. You must meet the eligibility criteria - Temporary flat rate method to claim your home office expenses.

How Working From Home In Pandemic Impacts Taxes What You Can Deduct

How Working From Home In Pandemic Impacts Taxes What You Can Deduct

If you are working from home you cant claim.

Can i claim home office expenses during covid. Prior to the COVID-19 pandemic an employee could claim home office expenses if they were contractually required to maintain a home office they were not reimbursed for and met one of the following two conditions. The ability to write off home office expenses like utilities property taxes and maintenance costs went away in 2018 for federal tax returns. After tax reform became law at the end of 2017 employees lost the ability to deduct expenses related to maintaining a home office.

Due to COVID-19 CRA introduced simplified forms T777-s and T2200-s to claim the home office expenses only. This amount will be your claim for 2020 up to a maximum of 400 per individual. The home office is the place where the employee principally performed their employment duties.

The cost of coffee tea milk and other general household items your employer may have provided for you at work. These forms allow you to claim a wide range of expenses including home office expenses vehicle expenses other expenses and GST rebate. Working on your couch wont help on your taxes but if you have a separate office where you meet clients you may be.

You still might be able to. Fill in the form Count the total number of days you worked from home in 2020 due to the COVID-19 pandemic and multiply that by 2 per day. This year CRA is allowing employers to reimburse employees for up to 500 worth of expenses including home office furniture tax-free.

If your office is 10 of your homes total square footage you can deduct 10 of indirect costs such as. You worked from home in 2020 due to the COVID-19 pandemic or your employer required you to work from home you worked more than 50 of the time from home for a period of at least four consecutive weeks in 2020. Although certain costs including the use of the home can be deducted as employee business expenses Ortiz Soto warned that the classification was severely restricted for certain employees in.

In order to arrive at the correct amount you would like to claim back for you will need a record of all your business-related costs and Make sure that you have all supporting invoices to back up your home office expense claims should SARS require the proof notes local accounting tax and advisory firm Smith Rossi. Temporary flat rate method. WASHINGTON During Small Business Week September 22-24 the Internal Revenue Service wants individuals to consider taking the home office deduction if they qualify.

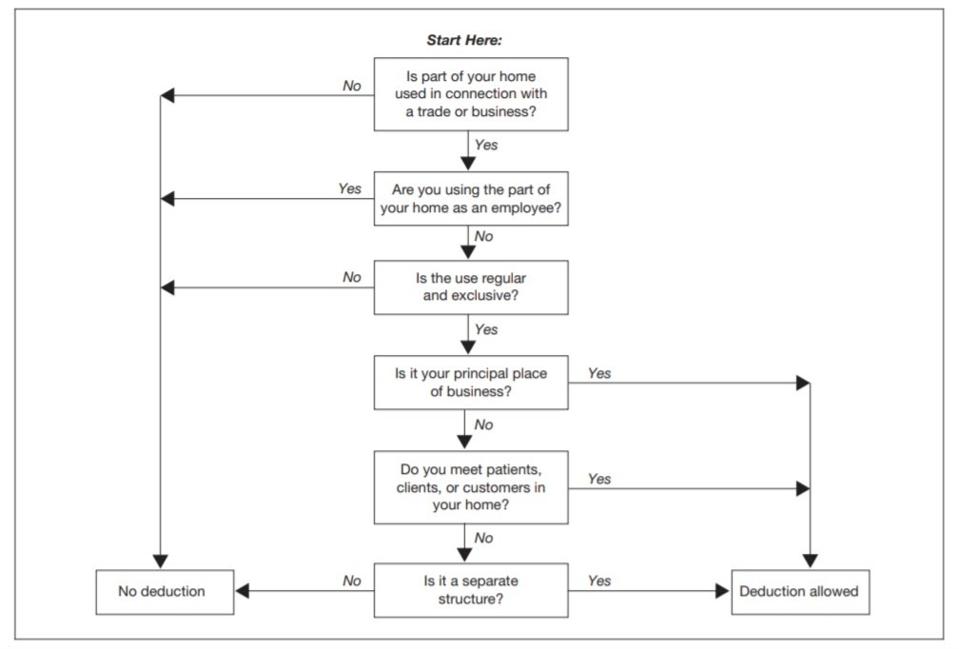

Thats 2000 more per person than the 7000 upper limit announced in. The home office deduction was misused in the past which made it an audit red flag. If you meet those guidelines youll be able to deduct the expenses for your home office.

To calculate your home office expenses you can use one of two methods. 1 day agoThe situation is different for salary workers whom in order to claim any home office expenses the below stringent requirements must be met. Expenses you cant claim.

Costs related to children and their education including setting them up for online learning teaching them at home or buying equipment such as iPads and desks. Qualifying expenditure under Covid work from home. You are eligible to claim a deduction for home office expenses for the period you worked from home if you meet all of the criteria.

In light of the coronavirus pandemic the IRS will most likely have a. If a relative of yours died from COVID-19 you may be able to get reimbursed up to 9000 for funeral expenses. The benefit may allow taxpayers working from home to deduct certain expenses on their tax return.

What Is Irs Form 8829 Expenses For Business Use Of Your Home Turbotax Tax Tips Videos

What Is Irs Form 8829 Expenses For Business Use Of Your Home Turbotax Tax Tips Videos

Working From Home Your Home Offices Expenses Are Probably Not Tax Deductible

Working From Home Your Home Offices Expenses Are Probably Not Tax Deductible

How To Claim Work Expenses On Your 2021 Taxes Cnet

How To Claim Work Expenses On Your 2021 Taxes Cnet

Home Office Deduction Pointers For Federal Taxes Credit Karma

Home Office Deduction Pointers For Federal Taxes Credit Karma

.png) Quiz Do I Qualify For The Home Office Deduction

Quiz Do I Qualify For The Home Office Deduction

Home Office Tax Deduction Block Advisors

Home Office Tax Deduction Block Advisors

Working From Home Your Home Offices Expenses Are Probably Not Tax Deductible

Working From Home Your Home Offices Expenses Are Probably Not Tax Deductible

Working From Home Your Home Offices Expenses Are Probably Not Tax Deductible Remote Work Home Office Expenses Working From Home

Working From Home Your Home Offices Expenses Are Probably Not Tax Deductible Remote Work Home Office Expenses Working From Home

Home Office Deductions In The Covid 19 Era Mlr

Home Office Deductions In The Covid 19 Era Mlr

How To Keep Up With Income And Expenses For Business The Right Way Atkins E Corp Small Business Tax Business Tax Deductions Business Tax

How To Keep Up With Income And Expenses For Business The Right Way Atkins E Corp Small Business Tax Business Tax Deductions Business Tax

In Case You Were Wondering Workfromhome Taxes Https Www Marketwatch Com Story Ive Been Working At Home Dur Leadership Coaching Working From Home Workplace

In Case You Were Wondering Workfromhome Taxes Https Www Marketwatch Com Story Ive Been Working At Home Dur Leadership Coaching Working From Home Workplace

Quiz Do I Qualify For The Home Office Deduction

Quiz Do I Qualify For The Home Office Deduction

Deducting Home Office Expenses As An Employee In 2020 Wolters Kluwer

Deducting Home Office Expenses As An Employee In 2020 Wolters Kluwer

Everything About The Work From Home Tax Deduction

Everything About The Work From Home Tax Deduction

Running Your Business From Home Here S How To Get A Tax Deduction Business Tax Deductions Deduction Education Templates

Running Your Business From Home Here S How To Get A Tax Deduction Business Tax Deductions Deduction Education Templates

Home Office Tax Deduction Block Advisors

Home Office Tax Deduction Block Advisors

How People Working From Home Can Claim A Home Office Tax Deduction

How People Working From Home Can Claim A Home Office Tax Deduction

How People Working From Home Can Claim A Home Office Tax Deduction

How People Working From Home Can Claim A Home Office Tax Deduction

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home