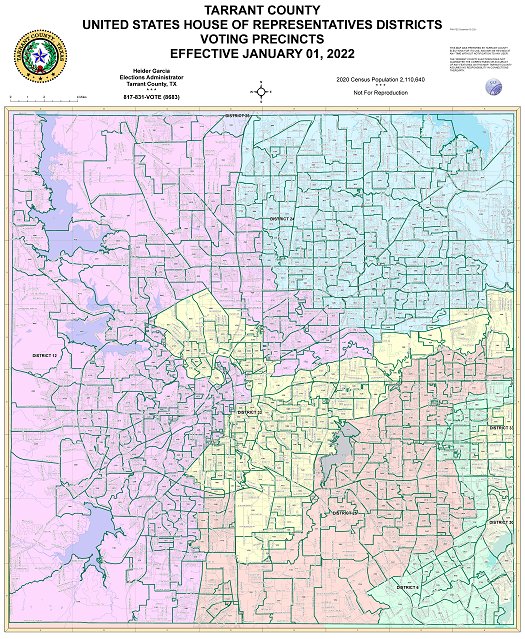

Property Tax Office Tarrant County

Plan for In-Person and Remote Contact with TAD for 2021 Appraisal Year. Tarrant County Tax Office collects property taxes on behalf of the entities listed below.

Tarrant County Property Tax Anderson Advisors Asset Protection Tax Advisors

Tarrant County Property Tax Anderson Advisors Asset Protection Tax Advisors

Our primary focus is on taking care of citizens.

Property tax office tarrant county. Truth in Taxation Information Taxing Unit Tax Rate Calculation Worksheets 2020. The Tarrant County Treasurer and Tax Collectors Office is part of the Tarrant County Finance Department that encompasses all financial functions of the local government. Tarrant County has the highest number of property tax accounts in the State of Texas.

WELCOME TO TARRANT COUNTY PROPERTY TAX DIVISION. Account numbers can be found on your Tarrant County Tax Statement. Fort Worth TX 76196.

County Telephone Operator 817-884-1111. About the Tarrant County Assessor Office Assessor Offices in Tarrant County TX are responsible for assessing the values of all taxable property within their jurisdictions. Assessors appraise values of all land and commercial property real property and business fixed asset personal property.

The back of the property tax statement provides the required comparison of taxes. In keeping with our Mission Statement we strive for excellence in all areas of property tax collections. For tax related questions regarding these entities please contact the Tarrant County Tax Office at.

Tarrant County provides the information contained in this web site as a public service. Secure Drop Boxes are located inside and outside at this location. 1 All other locations are open.

Links to information about each taxing entity is on our website. Every effort is made to ensure that information provided is correct. Eligible providers of free assistance are.

Each jurisdiction sets its tax rate to provide for police and fire protection public schools roads and streets district courts water. Northwest corner outside the Tarrant County Administration Building. 2 real estate.

Was your property damaged by the recent winter storm. 817-884-1100 or e-mail us at. There will be a cost of 10 to cover the cost of issuing the statement.

The Tarrant County Assessors Office located in Fort Worth Texas determines the value of all taxable property in Tarrant County TX. Property records requests for Tarrant County TX Looking up property owners by name and address. Fort Worth Texas Tarrant County Administration Building first floor.

Who can I contact regarding changes to property tax values exemptions owner name and owner address. County Telephone Operator 817-884-1111. You may contact the Tarrant County Tax Collector for questions about.

Every effort is made to ensure that information provided is correct. Ownership changes address changes value information and exemptions. The Tax Office located at 1400 Main Street Suite 110 in Southlake is temporarily closed beginning Monday March 15 due to an extensive construction project.

Property assessments performed by the Assessor are used to determine the Tarrant County property taxes. Drop Box for Property Tax Special Inventory Tax and Motor Vehicle Transactions. Click here for information.

Taxable property includes land and commercial properties often referred to as real property or real estate and fixed assets owned by businesses often referred to as personal property. TARRANT COUNTY TAX ASSESSOR-COLLECTOR 100 E. 1 real estate brokers or sales agents licensed under Chapter 1101 of the Texas Occupations Code.

TAD is responsible for property tax appraisal and exemption administration for over seventy jurisdictions within Tarrant County. Tarrant County provides the information contained in this web site as a public service. To obtain this authorization you must go to the Tarrant County Tax Assessor-Collectors Office 100 E Weatherford St.

2nd Floor at top of stairs. The Texas Property Tax Code allows the Chief Appraiser to maintain a list of individuals available here and updated weekly who designate themselves as providers of free assistance to owner occupants of a residential homestead property. Enter owners last name followed by a space and the first name or initial.

Motor Vehicle Only Drop Box. If you do not know the account number try searching by owner name address or property location.

Read more »