Personal Property Tax Nevada Mo

General Information Tax Year 2020 Personal Property Penalty and Interest Waiver - Executive Order No. The Finance Department provides fiscal leadership for the City focused on long-term financial health while respecting.

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Which Texas Mega City Has Adopted The Highest Property Tax Rate

The interests of its residents.

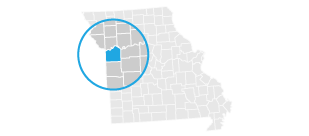

Personal property tax nevada mo. Vernon County Assessor County Courthouse 100 W Cherry Suite 1 Nevada MO 64772 Voice. The Vernon County Treasurer is required to. Visa Debit charge 395.

State statutes require a penalty to be added to your personal property tax bill if. Personal Property Real Estate Taxes. Personal property is assessed valued each year by the Assessors Office.

Information and online services regarding your taxes. Personal Property and Real Estate Taxes may be paid. Nebraska Personal Property Return must be filed with the County Assessor on or before May 1.

Elements and Applications Property Tax Rates for Nevada Local Governments Redbook NRS 3610445 also requires the Department to post the rates of taxes imposed by various taxing entities and the revenues generated by those taxes. 2017-2018 Personal Property Manual Final 20160628 rev 20161114. I am your Treasurerex-Officio Collector Brent Banes.

The Department collects or processes individual income tax fiduciary tax estate tax returns and property tax credit claims. Taxes are assessed on personal property owned on January 1 but taxes are not billed until November of the same year. The Missouri Department of Revenue received more than 238000 electronic payments in 2020.

Nevada Tax - File Pay. The Assessors office assesses property both real estate and personal property. In Person at the Vernon County Collectors Office.

County Assessor address and contact information. Please visit this page for more information. Cash management public finance investments and administration of taxes fees.

This incurs a fee of 25 or 150 whichever is greater. 20-17 Personal Property Changes Guidance Bulletin Personal. The County Clerk uses their assessed values and the taxing district levies to calculate the tax bills.

Provides the Citys real estate and personal property taxes will be included on the County tax bills. John Wiemann R-OFallon is congratulated as he. Motorized vehicles boats recreational vehicles owned on January 1st of that year.

The four main components are. The cost to the City for this service will be 381400 for the 2020 tax year. We collect over a quarter of a billion dollars each year and distribute the collections to nearly 40 local taxing districts such as schools.

Personal property tax is collected by the Collector of Revenue each year on tangible property eg. Median Property Taxes No. Vernon County Property Tax Payments Annual Vernon County Missouri.

0 featured_button_text State Rep. Permit Search - Report Tax Evasion. DO NOT mail personal property returns to the Department of Revenue.

2017-18 Personal Property Manual NOD 20160627. According to Nevada Revised Statutes all property that is not defined or taxed as real estate or real property is considered to be personal property Taxable personal property includes manufactured homes aircraft and all property used in conjunction with a business. Welcome to the Office of the Treasurer for Vernon County Missouri.

The Clark County Treasurer provides an online payment portal for you to pay your property taxes. Median Property Taxes Mortgage 884. Taxes not paid in full on or before December 31 will accrue interest penalties and fees.

The County will deduct one and one-quarter percent 125 from the Citys real estate. The Collectors office then sends out the bills. General Information about Personal Tax Electronic Filing and Paying.

Missouris personal property tax back in legislative crosshairs Kurt Erickson Apr 7 2021 Apr 7 2021. The taxation of business personal property has been in effect since Nevada. Your assessment list is due by March 1st of that year.

Filing and paying taxes electronically is a fast growing alternative to mailing paper returns and payments. Taxes are due for the entire amount assessed and billed regardless if property is no longer owned or has been moved from Jackson County. Personal property is taxable whether it is owned leased rented loaned or otherwise made available to the business.

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Texas Real Estate Property Power Of Attorney Power Of Attorney Form Texas Real Estate Power Of Attorney

Texas Real Estate Property Power Of Attorney Power Of Attorney Form Texas Real Estate Power Of Attorney

Do I Have To Worry About A Nevada Inheritance Tax No Nevada Is Among The Majority Of States That Does Not Impose An Inh Inheritance Tax Nevada Inheritance

Do I Have To Worry About A Nevada Inheritance Tax No Nevada Is Among The Majority Of States That Does Not Impose An Inh Inheritance Tax Nevada Inheritance

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Solar Property Tax Exemptions Explained Energysage

Solar Property Tax Exemptions Explained Energysage

Chart 2 Louisiana State And Local Tax Burden By Type Of Tax Fy 1950 To 2016 Jpg Types Of Taxes Tax Burden

Chart 2 Louisiana State And Local Tax Burden By Type Of Tax Fy 1950 To 2016 Jpg Types Of Taxes Tax Burden

Business Personal Property Tax How To Maximize Your Efficiency

Business Personal Property Tax How To Maximize Your Efficiency

Jackson County Mo Property Tax Calculator Smartasset

Jackson County Mo Property Tax Calculator Smartasset

Celebrate Tax Day With 9 Of Our Favorite Tax Maps Property Tax Tax Day Filing Taxes

Celebrate Tax Day With 9 Of Our Favorite Tax Maps Property Tax Tax Day Filing Taxes

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Last Minute Dash When Where How To File Those Last Minute Tax Returns Tax Return Tax Last Minute

Last Minute Dash When Where How To File Those Last Minute Tax Returns Tax Return Tax Last Minute

Chart 2 Indiana Tax Burden By Type Of Tax Fy 1950 To 2015 Jpg Types Of Taxes Low Taxes Burden

Chart 2 Indiana Tax Burden By Type Of Tax Fy 1950 To 2015 Jpg Types Of Taxes Low Taxes Burden

Sample Printable Nevada Sellers Real Property Disclosure Form Form Real Estate Forms Legal Forms Real Estate Contract

Sample Printable Nevada Sellers Real Property Disclosure Form Form Real Estate Forms Legal Forms Real Estate Contract

5 States With No Property Tax In 2018 Mashvisor

5 States With No Property Tax In 2018 Mashvisor

Oklahoma Property Tax Calculator Smartasset

Oklahoma Property Tax Calculator Smartasset

Chart 1 Mississippi State And Local Tax Burden Fy 2015 Jpg South Dakota State Tax Kentucky State

Chart 1 Mississippi State And Local Tax Burden Fy 2015 Jpg South Dakota State Tax Kentucky State

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home