How To File For Homeowners Exemption In Illinois

Property tax exemptions are provided for owners with the following situations. The assessors office says the new homebuyer SHOULD get the homeowner exemption automatically and if you go to the Cook County Assessors Office Exemption Form page you.

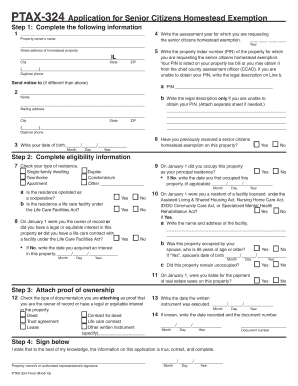

2017 2021 Form Il Ptax 324 Fill Online Printable Fillable Blank Pdffiller

2017 2021 Form Il Ptax 324 Fill Online Printable Fillable Blank Pdffiller

Proof of age and ownership is required with the application.

How to file for homeowners exemption in illinois. Submit a copy of their drivers license or state ID along with a copy of your drivers license or state ID. You will be able to apply for the exemption as of January. Filing requirements vary by county.

For information on how to apply for property tax relief available through homestead exemptions contact your chief county assessment office. Contact information for the assessors office is available from this online list of Illinois assessors. Cook County homeowners may take advantage of several valuable property-tax-saving exemptions.

You will need to apply for the homeowner exemption. Copy of your recorded deed. Exemptions reduce the Equalized Assessed Value EAV of your home which is multiplied by the tax rate to determine your tax bill.

Application may be made at the Township Assessors office or the Supervisor of Assessments office. This will allow you to identify the correct parcel for your owner occupied primary residence. More information and applications for this exemption are available from the County Assessments Office or from your local Township Assessor.

You may be able to apply for exemptions online in some counties through the county assessors website. You dont have to file a homestead declaration. Copy of current Tax Bill or PIN.

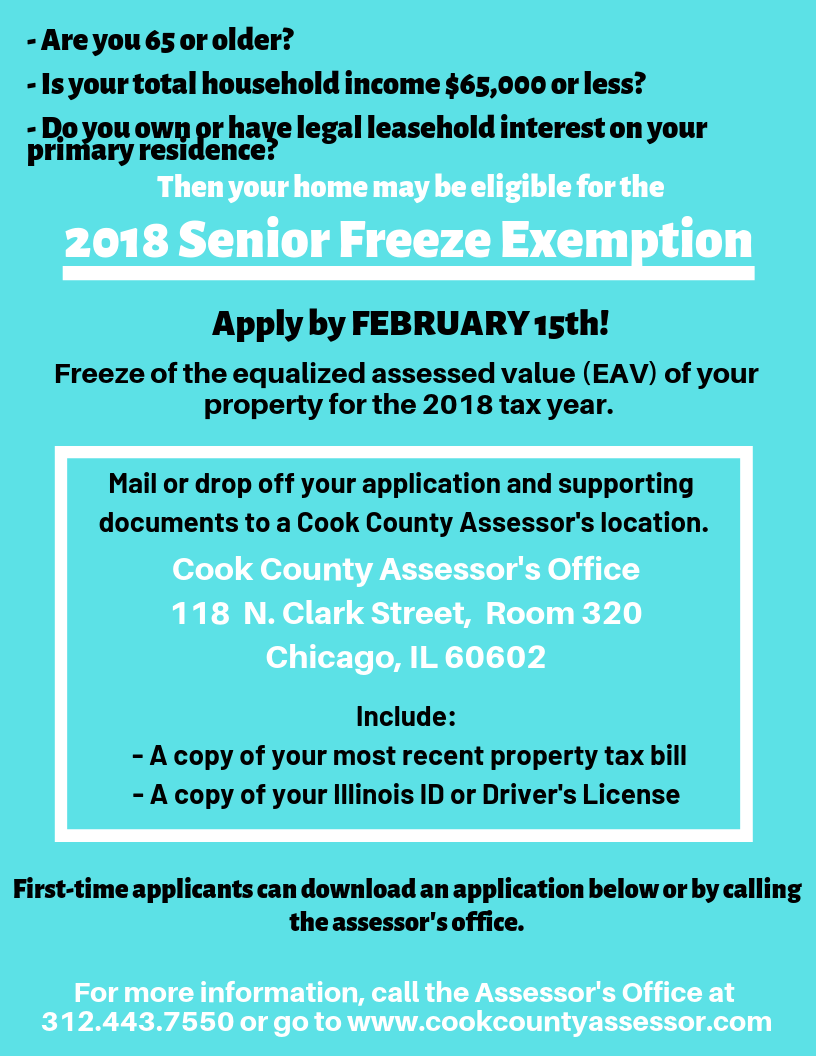

To file for a Senior Citizen Homestead Exemption you will need. Illinois veterans or their spouses should contact their local Veteran Service Officer for information to apply for the specially-adapted housing property tax and mobile home tax exemption benefits. Homeowners must have lived in the home and reached 65 years of age during the tax year.

To qualify for this exemption a person must be 65 years of age or older during the taxable year for which application is made and must be the owner of record or person with equitable interest in the property. Copy of your Birth Certificate Illinois Drivers License or Illinois State ID. You will need to have occupied the residence as of January 1 of the tax year in question.

No Need to File a Homestead Declaration in Illinois. Exemptions are reflected on the Second Installment tax bill. In order to print the Homestead Homestead Improvement or Senior Citizen Homestead Exemption form you will be redirected to the Property Tax website.

Although Illinois state law creates property tax exemptions you apply for exemptions through your county assessors office. There are currently four exemptions that must be applied for or renewed annually. Contact your local tax assessor for complete details on these and other Illinois property tax exemptions including any required forms you need to complete and the deadline for filing those forms.

Some counties require an initial Form PTAX-324 Application for Senior Citizens Homestead Exemption or a Form PTAX-329 Certificate of Status Form for Senior Citizens Homestead Exemption annual renewal application to be filed with the Chief County Assessment Office. You can download the form at the Cook County Assessor website under forms exemption forms Q. Once there please enter your parcel number or search by address or owners name.

If I bought my property in June of 2018 can I apply for the homeowners exemption. Exemption forms may be filed online or you can obtain one by calling one of the Assessors Office locations or your local township assessor. If you have never received a Homeowner Exemption on your home you will need to file an initial application.

The Homeowner Exemption Senior Citizen Homestead Exemption Senior Citizen Assessment Freeze Exemption and the Home Improvement Exemption. In Illinois the homestead exemption is automatic. Provide a copy of the death certificate.

Homeowner Exemption reduces the EAV of your home by 10000 starting in Tax Year 2017 payable in 2018. Link to obtain further information about the various exemptions that are offered the documents and filing process required for each exemption to be claimed and answering questions about each exemption. Disabled Persons Homestead Exemption.

So visiting your county assessors website is a good first step in learning how to apply for an exemption. Sign your parents name on the application and in parenthesis write deceased and Underneath it write your name and in parenthesis write sondaughter.

2017 2021 Form Il Ptax 324 Fill Online Printable Fillable Blank Pdffiller

2017 2021 Form Il Ptax 324 Fill Online Printable Fillable Blank Pdffiller

The Illinois Homestead Exemption Breaking Down Five Faqs

The Illinois Homestead Exemption Breaking Down Five Faqs

Form Ptax 324 Download Fillable Pdf Or Fill Online Application For Senior Citizens Homestead Exemption Illinois Templateroller

Form Ptax 324 Download Fillable Pdf Or Fill Online Application For Senior Citizens Homestead Exemption Illinois Templateroller

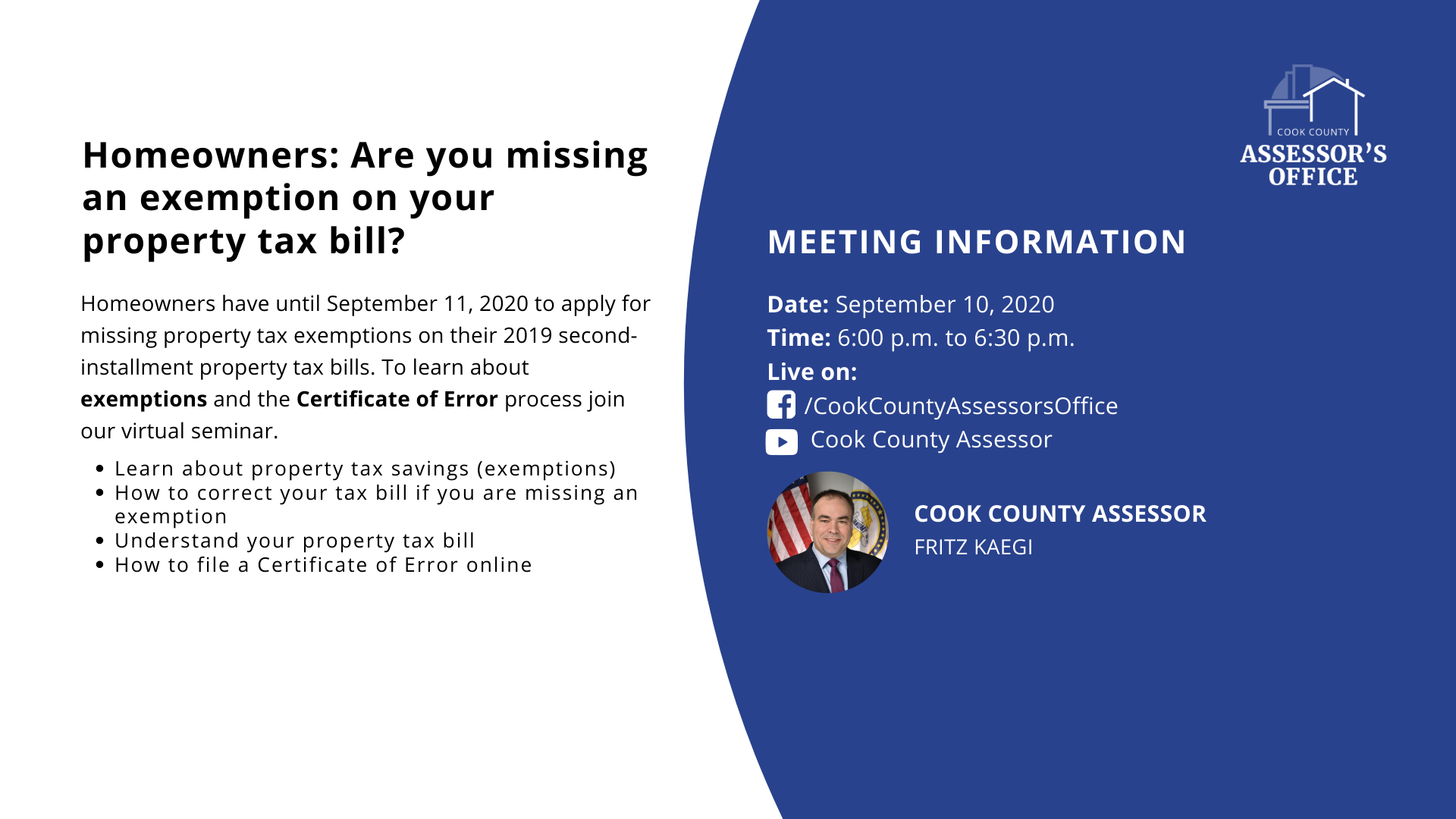

Homeowners Are You Missing An Exemption On Your Property Tax Bill Cook County Assessor S Office

Homeowners Are You Missing An Exemption On Your Property Tax Bill Cook County Assessor S Office

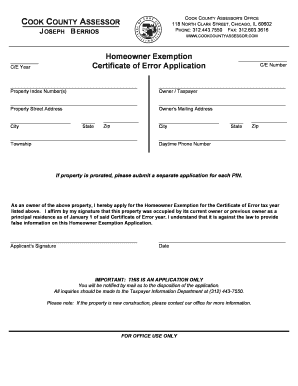

Homeowner Certificate Of Error Application Fill Online Printable Fillable Blank Pdffiller

Homeowner Certificate Of Error Application Fill Online Printable Fillable Blank Pdffiller

Our Office Can Assist You With

Senior Ze Ze Fill Online Printable Fillable Blank Pdffiller

Senior Ze Ze Fill Online Printable Fillable Blank Pdffiller

Deadline Extended For Property Tax Exemptions Alderman Tom Tunney 44th Ward Chicago

Deadline Extended For Property Tax Exemptions Alderman Tom Tunney 44th Ward Chicago

Illinois Disabled Veterans Exemption Fill Online Printable Fillable Blank Pdffiller

Illinois Disabled Veterans Exemption Fill Online Printable Fillable Blank Pdffiller

Overlooked Exemption Could Lower Property Taxes For Some Long Time Homeowners Mount Prospect News Photos And Events Triblocal Com

Homeowner Exemption Cook County Assessor S Office

Homeowner Exemption Cook County Assessor S Office

Deadline Extended For Property Tax Exemptions Alderman Tom Tunney 44th Ward Chicago

Deadline Extended For Property Tax Exemptions Alderman Tom Tunney 44th Ward Chicago

Get Tax Relief From The Cook County Homeowner Exemption

Get Tax Relief From The Cook County Homeowner Exemption

Longtime Homeowner Exemption Cook County Assessor S Office

Longtime Homeowner Exemption Cook County Assessor S Office

Homeowners Are You Missing Exemptions On Your Property Tax Bills Cook County Assessor S Office

Homeowners Are You Missing Exemptions On Your Property Tax Bills Cook County Assessor S Office

Home Improvement Exemption Cook County Assessor S Office

Home Improvement Exemption Cook County Assessor S Office

Assessor Kaegi Reminds Property Owners That Many Exemptions Will Auto Renew This Year Due To Covid 19 Cook County Assessor S Office

Assessor Kaegi Reminds Property Owners That Many Exemptions Will Auto Renew This Year Due To Covid 19 Cook County Assessor S Office

Labels: homeowners

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home