How To Claim Homeowners Property Tax Exemption

Applications for property tax exemptions are typically filed with your local county tax office. If a county collects a special tax for farm-to-market roads or flood control a residence homestead owner is allowed a 3000 exemption for this tax.

8 Easy Mistakes Homeowners Make On Their Taxes Homeowner Taxes College Finance Financial Advice

8 Easy Mistakes Homeowners Make On Their Taxes Homeowner Taxes College Finance Financial Advice

New property owners will automatically receive a Claim For Homeowners Property Tax Exemption.

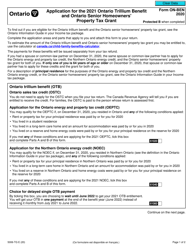

How to claim homeowners property tax exemption. If you own a home and occupy it as your principal place of residence on January 1 you may apply for an exemption of 7000 from the homes assessed value which reduces your property tax bill. If a claim is filed between February 16 and 5 pm. The claim form BOE-266 Claim for Homeowners Property Tax Exemption is available from the county assessor.

The first thing to do for the application contact the property tax authority in order to find what is available in your location. There is no charge for filing for the Homeowner Exemption. The general deadline for filing an exemption application is before May 1.

On December 10 80 percent of the exemption is available. This exemption will reduce your annual tax bill by at least 70. If you own and occupy your home as your principal place of residence you may be eligible for an exemption of up to 7000 off the propertys assessed value resulting in a property tax savings of approximately 70 to 80 annually.

A homeowners property tax exemption is a dollar amount that can be deducted from a propertys assessed value. Application for the Homeowners Tax Exemption One more time homeowners tax exemptions changeable depending on your location. As mentioned above specific exemptions and the rules can be applied to the specific area.

If you own a home and it is your principal place of residence on January 1 you may apply for an exemption of 7000 from your assessed value. If you wish to claim the exemption you must mail this back to the assessor within the designated time frame. Appraisal district chief appraisers are responsible for determining whether or not property qualifies for an exemption.

New property owners will usually receive an exemption application within 90 days of recording a deed. If you have never received a Homeowner Exemption on your home you will need to file an initial application. Applications for property tax exemptions are filed with appraisal districts.

Apply for 7000 Homeowners Exemption. Additional Tax Exemptions for Homeowners. The Assessors Office estimates that nearly 400000 homeowners are still eligible but fail to take advantage of these savings.

If the county grants an optional exemption for homeowners age 65 or older or disabled the owners will receive only the local-option exemption. The Homeowners Exemption applies to homes that serve as a principal place of residence and amounts to a 7000 deduction from the homes assessed value saving taxpayers approximately 70 per year. If you acquired the property more than 90 days ago and have not received an application please call 714-834-3821 for an application.

So if your home is worth 150000 and you are granted an exemption of 10000 you will only be taxed on 140000. Exemption forms may be filed online or you can obtain one by calling one of the Assessors Office locations or your local township assessor. If you own a home and occupy it as your principal place of residence on January 1 you may apply for a Homeowners Exemption.

Late filed exemptions will. The assessors office should then apply the exemption to your property tax bill automatically each year reducing the total sum that youre required to pay. The home must have been the principal place of residence of the owner on the lien date January 1st.

While most states offer basic exemptions for those that qualify your county may offer more. If you build or acquire a home and there was no exemption on the annual tax roll you may apply for a Homeowners Exemption on the supplemental tax roll. The Assessor-County Clerk-Recorders Office will mail a Claim for Homeowners Property Tax Exemption application as a courtesy whenever there is a purchase or transfer of residential property.

To claim the exemption the homeowner must make a one-time filing with the county assessor where the property is located. New property owners will automatically receive an exemption application in the mail. Exemptions from property tax require applications in most circumstances.

Homeowners Exemptions may also apply to a supplemental assessment if the prior owner did not claim the exemption. The full exemption is available if the filing is made by 5 pm. In order to qualify you must be a property owner co-owner or a purchaser named in a contract of sale.

Read more »Labels: claim, homeowners, property

/GettyImages-77332455-577f3a8c5f9b5831b5dd010f.jpg)