How Much Is The Ontario Senior Homeowners Property Tax Grant

Senior couples with 250 or more in property taxes in 2008 and an income up to 45000 will receive the maximum of 250. To qualify for the maximum amount in 2021 your adjusted family net income for the 2020 tax year has to be 35000 or less singles or 45000 or less couples.

Ontario Senior Homeowners Property Tax Grant Qualifications Canadian Budget Binder

Ontario Senior Homeowners Property Tax Grant Qualifications Canadian Budget Binder

Properties assessed over 1625000 may receive a partial grant.

How much is the ontario senior homeowners property tax grant. Depending on your adjusted family net income you may receive up to 500 yearly. If your income is over 45000 your grant will be reduced by 333 of your income over 45000. Energy Conservation Assistance Program.

You do not qualify for the grant if your adjusted family net income is 60000 or more. Were a resident of Ontario and. You may also be eligible for the 2015 Ontario energy and property tax credit OEPTC if.

You or your spouse paid Ontario property tax in the previous year. You can claim up to 500 depending on your adjusted family income in the Ontario Senior Homeowners Property Tax Grant OSHPTG if. You meet the income requirements and.

The Ontario Senior Homeowners Property Tax Grant is a yearly grant provided to senior homeowners in the Province of Ontario to help seniors who have low incomes to moderate incomes offset taxes on their property. The maximum grant is 500 each year. For more information about the grant see the instructions for line 462 in the guide to the income tax return TP-1G-V or those given on form TP-1029TM-V Grant for Seniors to Offset a Municipal Tax Increase.

The Seniors Home Safety Tax Credit would be a fully refundable tax credit for the 2021 tax year worth 25 of up to 10000 in eligible expenses to make homes safer and more accessible Expenses would be eligible if they are paid or become payable in 2021. For all other areas of the province the total grant amount for seniors aged 65 or older is 1045. Were 64 years of age or older.

You or your spouse paid Ontario property tax in the previous year. Find out more at Senior Homeowners Property Tax Grant program. The maximum grant is 500 for 2010 and later years.

Alberta Foreclosure LIVE Training 2016. The age amount is a tax credit available to an individual who is 65 or older on December 31 and has a net income of less than 82353 2015. If you are a senior you can receive a reduction of 845 for a primary residence valued up to 16 million in the Capital Regional District Greater Vancouver Regional District and the Fraser Valley and a reduction of 1045 in all other areas.

You must pay at least 100 in property taxes before claiming the home owner grant to help fund services such as road maintenance and police protection. If you already receive full property tax relief through the Ontario Tax Credits you will continue to do so through the. Ontario Senior Homeowners Property Tax Grant.

Most eligible seniors will receive more property tax relief than under the current system. As of December 31 of the previous year you. The Ontario senior homeowners property tax credit OSHPTG helps low- to moderate-income seniors with offsetting the cost of their property taxes.

The Province of Ontario gives a grant to help low income seniors with their property taxes. You can claim up to 500 in Ontario Senior Homeowners Property Tax Grant if. You could get 500 if your adjusted family net income for the previous year was 45000 or less.

As of December 31 of the previous year you. View your property tax bill. If your income is 35466 or less you can claim the full 7033 which will result in a 105495 non-refundable tax credit.

The maximum grant was 250 for 2009. Find out more about this grant on the Ministry of Finance website or call them at 1-866-668-8297 between 830 am. You meet the income requirements and.

Ontario Senior Homeowners Property Tax Grant You may also qualify for this grant of up to 500 if you are a senior homeowner with a lower income. Those with incomes of 45000 to 60000 will receive a proportionately lower amount. And 5 pm Monday to Friday.

What is the Ontario Senior Homeowners Property Tax Grant. Were 64 years of age or older. The Ontario senior homeowners property tax grant payment will be issued approximately four to eight weeks after your notice of assessment or reassessment is issued.

Were a resident of Ontario and.

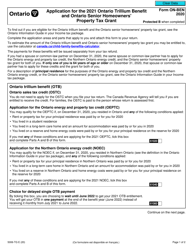

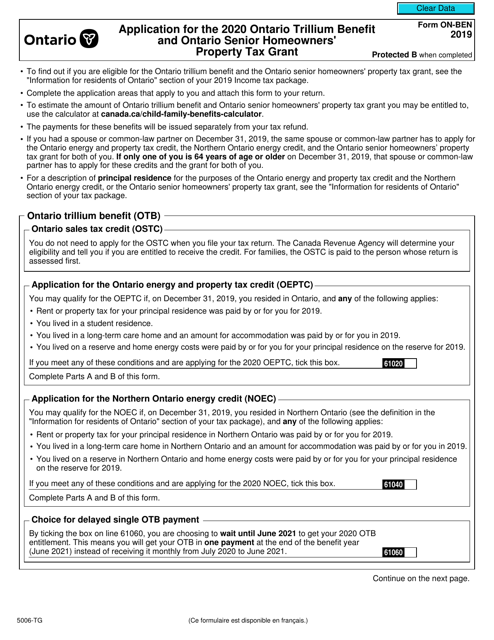

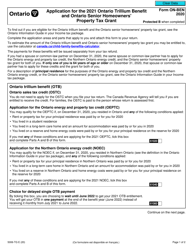

Form On Ben 5006 Tg Download Fillable Pdf Or Fill Online Application For The 2020 Ontario Trillium Benefit And Ontario Senior Homeowners Property Tax Grant 2019 Canada Templateroller

Form On Ben 5006 Tg Download Fillable Pdf Or Fill Online Application For The 2020 Ontario Trillium Benefit And Ontario Senior Homeowners Property Tax Grant 2019 Canada Templateroller

Ontario Senior Homeowners Property Tax Grant Taxable Property Walls

Ontario Senior Homeowners Property Tax Grant Taxable Property Walls

Ontario Senior Homeowners Property Tax Grant Taxable Property Walls

Ontario Senior Homeowners Property Tax Grant Income Requirements Property Walls

Ontario Senior Homeowners Property Tax Grant Income Requirements Property Walls

Form On Ben 5006 Tg Download Fillable Pdf Or Fill Online Application For The 2020 Ontario Trillium Benefit And Ontario Senior Homeowners Property Tax Grant 2019 Canada Templateroller

Form On Ben 5006 Tg Download Fillable Pdf Or Fill Online Application For The 2020 Ontario Trillium Benefit And Ontario Senior Homeowners Property Tax Grant 2019 Canada Templateroller

Ontario Senior Homeowners Property Tax Grant Taxable Property Walls

Ontario Senior Homeowners Property Tax Grant Taxable Property Walls

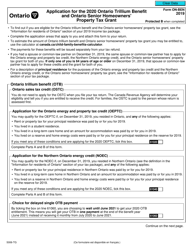

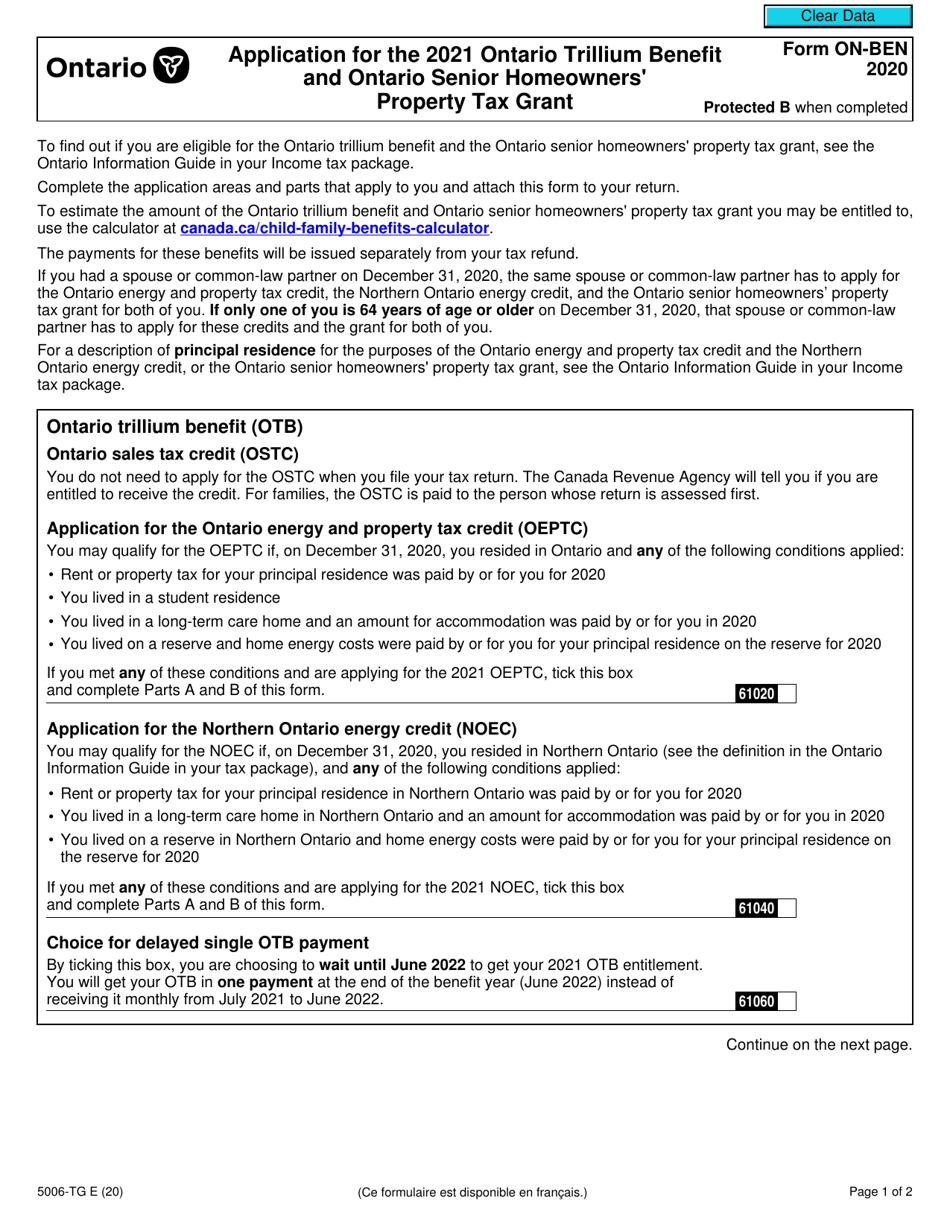

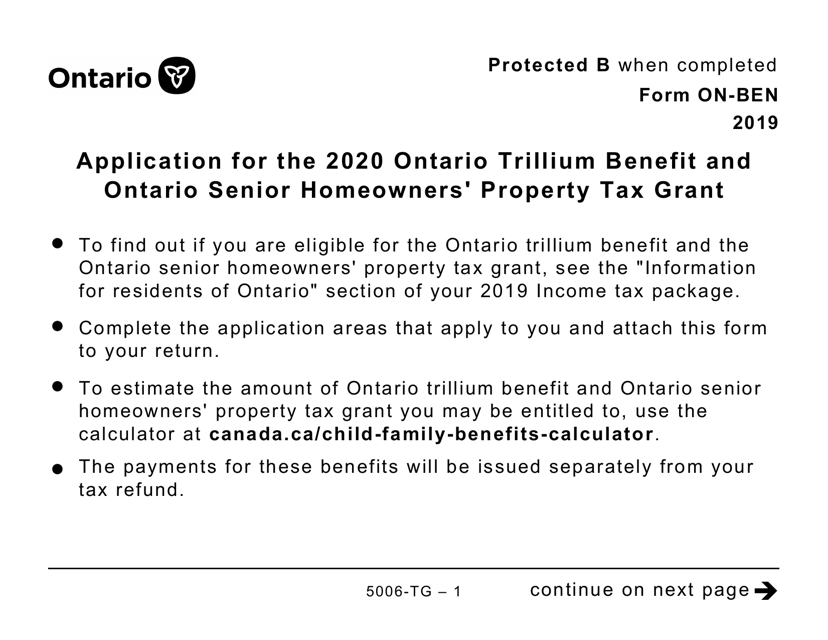

Form 5006 Tg On Ben Download Fillable Pdf Or Fill Online Application For The Ontario Trillium Benefit And Ontario Senior Homeowners Property Tax Grant 2020 Canada Templateroller

Form 5006 Tg On Ben Download Fillable Pdf Or Fill Online Application For The Ontario Trillium Benefit And Ontario Senior Homeowners Property Tax Grant 2020 Canada Templateroller

Fillable Online Application For The 2018 Ontario Trillium Benefit And Ontario Senior Homeowners Property Tax Grant Fax Email Print Pdffiller

Fillable Online Application For The 2018 Ontario Trillium Benefit And Ontario Senior Homeowners Property Tax Grant Fax Email Print Pdffiller

Ontario Senior Homeowners Property Tax Grant Qualifications Canadian Budget Binder

Ontario Senior Homeowners Property Tax Grant Qualifications Canadian Budget Binder

Form 5006 Tg On Ben Download Fillable Pdf Or Fill Online Application For The Ontario Trillium Benefit And Ontario Senior Homeowners Property Tax Grant 2020 Canada Templateroller

Form 5006 Tg On Ben Download Fillable Pdf Or Fill Online Application For The Ontario Trillium Benefit And Ontario Senior Homeowners Property Tax Grant 2020 Canada Templateroller

Ontario Senior Homeowners Property Tax Grant Taxable Property Walls

Ontario Senior Homeowners Property Tax Grant Taxable Property Walls

Form On Ben 5006 Tg Download Printable Pdf Or Fill Online Application For The 2020 Ontario Trillium Benefit And Ontario Senior Homeowners Property Tax Grant Large Print 2019 Canada Templateroller

Form On Ben 5006 Tg Download Printable Pdf Or Fill Online Application For The 2020 Ontario Trillium Benefit And Ontario Senior Homeowners Property Tax Grant Large Print 2019 Canada Templateroller

Fillable Online 0n479 Pdf Fillable Form Fax Email Print Pdffiller

Fillable Online 0n479 Pdf Fillable Form Fax Email Print Pdffiller

Fillable Online Bapplicationb For The B2016b Ontario Trillium Benefit And Ontario Senior Bb Fax Email Print Pdffiller

Fillable Online Bapplicationb For The B2016b Ontario Trillium Benefit And Ontario Senior Bb Fax Email Print Pdffiller

Form On Ben 5006 Tg Download Printable Pdf Or Fill Online Application For The 2020 Ontario Trillium Benefit And Ontario Senior Homeowners Property Tax Grant Large Print 2019 Canada Templateroller

Form On Ben 5006 Tg Download Printable Pdf Or Fill Online Application For The 2020 Ontario Trillium Benefit And Ontario Senior Homeowners Property Tax Grant Large Print 2019 Canada Templateroller

Ontario Senior Homeowners Property Tax Grant Income Requirements Property Walls

Form 5006 Tg On Ben Download Fillable Pdf Or Fill Online Application For The Ontario Trillium Benefit And Ontario Senior Homeowners Property Tax Grant 2020 Canada Templateroller

Form 5006 Tg On Ben Download Fillable Pdf Or Fill Online Application For The Ontario Trillium Benefit And Ontario Senior Homeowners Property Tax Grant 2020 Canada Templateroller

Labels: homeowners, ontario, senior

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home