Do You Have To Pay Property Tax On Leased Car

In some states such as Ohio you pay sales tax up. Here is a link for your information.

Do You Pay Sales Tax On A Mobile Home Purchase Mhvillager Blog In 2021 Sales Tax Mobile Home Buying A Manufactured Home

Do You Pay Sales Tax On A Mobile Home Purchase Mhvillager Blog In 2021 Sales Tax Mobile Home Buying A Manufactured Home

The Internal Revenue Service requires that these deductible ad valorem taxes be based on the value of the car and be charged by the state every year.

Do you have to pay property tax on leased car. This means you only pay tax on the part of the car you lease not the entire value of the car. Who is liable for paying local taxes on leased cars in Connecticut the other New England states and New Jersey and New York. VAT-registered companies can reclaim up to 100 of the tax on vehicle payments on a business lease and on any maintenance package chosen.

SalesUSE Tax in MA is Based on a 625 Rate Throughout the state and is billed into your monthly payment on a lease. If you are leasing the vehicle than you would pay sales tax on the monthly payment of lease. Be sure to note each cars estimated residual.

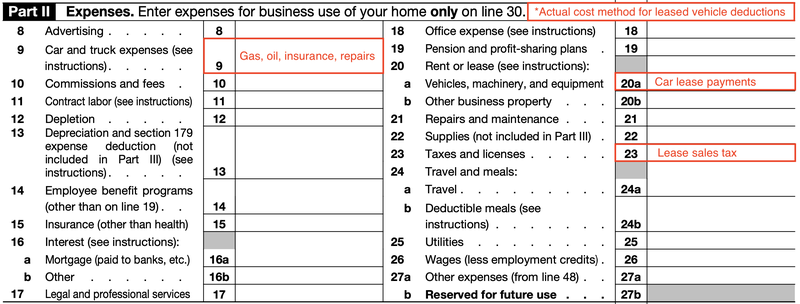

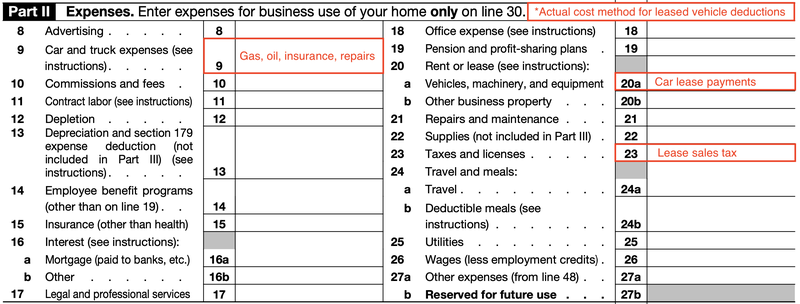

The standard tax rate is 625 percent. If you pay personal property tax on a leased vehicle you can deduct that expense on your federal tax return. The monthly rental payments will include this additional cost which will be spread across your contract.

Once youve found a car that you wish to lease in South Carolina you will need to pay vehicle property tax obtain insurance register and title your newly leased vehicle. In some states such as Oregon and New Hampshire theres no. Visit a car dealership and identify vehicles that you are interested in leasing.

SUMMARY People leasing cars in the selected states that levy local motor vehicle taxes and fees generally pay them unless the lease agreement requires otherwise. Virtually all US. Leased and privately owned cars are subject to property taxes.

If you purchase the vehicla outright than sales tax is on purchase price. Registering Your Leased Vehicle. The leased vehicle will be titled in the name of the lessor owner.

Whether or not you have to pay an annual property tax on your vehicle depends on the state the vehicle is registered and used in. Depending on where you live leasing a car can trigger different tax consequences. All applicable fees are due at the time of titling by the lessor such as the 15 title fee and the motor vehicle sales and use tax.

Instead sales tax is added to your monthly lease payment. All leased vehicles with a garaging address in Texas are subject to property taxes. Then research information about those vehicles.

If youre leasing a car as a private individual through a personal lease you will be required to pay VAT value-added tax at a fixed rate of 20. ExciseProperty tax is different from SalesUSE Tax on a lease. Credit will be given for.

In order to properly plan and save for these costs it is important to understand the details of each vehicle tax you may owe. Chances are you have already paid at least some sales tax on the car so its highly unlikely you need to pay taxes on the original price of the. When a vehicle is leased in another state and the lessee brings it to Texas for public highway use the lessee as the operator owes motor vehicle use tax based on the price the lessor paid for the vehicle.

Since the leasing company owns the vehicle you are leasing they are responsible for these taxes however the cost is usually passed on to the lessee. The leasing agreement may require the lessee to make these payments. The most common method is to tax monthly lease payments at the local sales tax rate.

Therefore it wont have a big impact on your wallet compared to purchasing a car. The taxing process for motor vehicles is the same for other taxable property in Connecticutthe tax rate of the property is assessed at 70 of fair market value which is determined by a local assessor. Bonus and Feedback will be highly appreciated.

SalesUSE tax in Massachusetts is not calculated on the whole value of the vehicle but. Let me know if you have any question. Heres how it works.

The amount of tax you may owe is generally based on the value of the vehicle. In some states you do not have to pay the tax on the price or value of the car. Monthly lease payments are often lower than a monthly financed payment would be on that same car as your money is going toward just the expected depreciation during the lease agreement in addition to taxes on that amount fees and a rent charge.

Typically this sales tax is charged on the down-payment amount but there are some states Georgia Illinois Minnesota New York Ohio and Texas that require lessors to pay a sales tax on the entire price of the vehicle at the beginning of a lease. For example if your local sales tax rate is 5 simply multiply your monthly lease payment by 5 and add it to the payment amount to get your total payment figure. States require a sales tax to be paid on a leased vehicle.

Who Pays The Personal Property Tax On A Leased Car

Who Pays The Personal Property Tax On A Leased Car

What Does An Nnn Lease Mean Finance Guide Lease Being A Landlord

What Does An Nnn Lease Mean Finance Guide Lease Being A Landlord

How To Write Off A Car Lease For Your Business In 2021 The Blueprint

How To Write Off A Car Lease For Your Business In 2021 The Blueprint

Rent Payment Receipt Pdf Property Management Rental Agreement Templates Management

Rent Payment Receipt Pdf Property Management Rental Agreement Templates Management

Who Pays The Personal Property Tax On A Leased Car

Who Pays The Personal Property Tax On A Leased Car

Is It Better To Buy Or Lease A Car Taxact Blog

Is It Better To Buy Or Lease A Car Taxact Blog

Is It Better To Buy Or Lease A Car Taxact Blog

Is It Better To Buy Or Lease A Car Taxact Blog

Is It Better To Buy Or Lease A Car Taxact Blog

Is It Better To Buy Or Lease A Car Taxact Blog

Is It Better To Buy Or Lease A Car Taxact Blog

Is It Better To Buy Or Lease A Car Taxact Blog

How To Apply For An Apartment With A Cpn Best Guide How To Fix Credit Improve Credit Score Renting A House

How To Apply For An Apartment With A Cpn Best Guide How To Fix Credit Improve Credit Score Renting A House

What Does An Nnn Lease Mean Moneymink Com In 2020 Nnn Lease Finance Guide Lease

What Does An Nnn Lease Mean Moneymink Com In 2020 Nnn Lease Finance Guide Lease

Compare Car Iisurance Compare Auto Lease Vs Purchase Car Lease Compare Cars Lease

Compare Car Iisurance Compare Auto Lease Vs Purchase Car Lease Compare Cars Lease

Is It Better To Buy Or Lease A Car Taxact Blog

Is It Better To Buy Or Lease A Car Taxact Blog

Tenant Rules And Regulations Pdf Being A Landlord Rental Property Management Property Management

Tenant Rules And Regulations Pdf Being A Landlord Rental Property Management Property Management

Lease Agreement Template Woodwork Plans Residential Lease Agreement Template Lease Agreement Rental Agreement Templates Room Rental Agreement

Lease Agreement Template Woodwork Plans Residential Lease Agreement Template Lease Agreement Rental Agreement Templates Room Rental Agreement

Pin On Buying Or Leasing A Vehicle

Pin On Buying Or Leasing A Vehicle

Flow Chart Should You Buy Or Lease A Car Car Buying Buy Used Cars Stuff To Buy

Flow Chart Should You Buy Or Lease A Car Car Buying Buy Used Cars Stuff To Buy

How To Write Off Taxes On Rental Property Tax Relief Center In 2021 Rental Property Rental Property Investment Real Estate Investing Rental Property

How To Write Off Taxes On Rental Property Tax Relief Center In 2021 Rental Property Rental Property Investment Real Estate Investing Rental Property

Who Pays The Personal Property Tax On A Leased Car Property Tax Personal Property Budgeting Money

Who Pays The Personal Property Tax On A Leased Car Property Tax Personal Property Budgeting Money

Labels: property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home