Property Tax Rate Reno Nv

Federal income taxes are not included Property Tax Rate. Under current law the maximum tax rate could go up to 366.

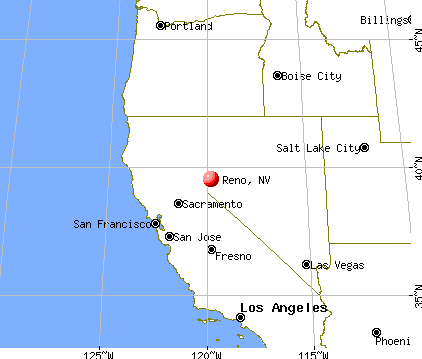

Reno Nevada Nv Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Reno Nevada Nv Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Property taxes are due on the third Monday in August.

Property tax rate reno nv. The median property tax in Nevada is 174900 per year for a home worth the median value of 20760000. 873 The property tax rate shown here is the rate per 1000 of home value. Of course your own effective property tax rate will vary by county as average county rates In Nevada range from 044 to 104.

Taxes on a 1000000 is approximately 6000. Room D140 Reno NV 89512-2845 Phone 7753282510. Compared to the 107 national average that rate is quite low.

738 The total of all sales taxes for an area including state county and local taxes Income Taxes. If the tax rate is 1400 and the home value. Tax bills are prepared and mailed out by August 1st of each year.

As an example a home valued at 200000 would be assessed at 35 of that value or 70000 and. With an effective Reno property tax rate of 34959 Reno residents pay slightly higher rates than their southern neighbors in Clark County enjoy. If the tax rate is 1400 and the home value is 250000 the property tax would be 1400 x 2500001000 or 3500.

Counties cities school districts special districts such as fire protection districts etc. Elements and Applications Property Tax Rates for Nevada Local Governments Redbook NRS 3610445 also requires the Department to post the rates of taxes imposed by various taxing entities and the revenues generated by those taxes. Nevada is ranked number twenty four out of the fifty states in order of the average amount of property taxes collected.

784 The property tax rate shown here is the rate per 1000 of home value. The yearly cap on taxes is 3. However the project is also subject to the tax abatement afforded under NRS 3614722 which limits tax dollar increases to no more than 8 per year.

Homeowners in Nevada are protected from steep increases in property tax bills by Nevadas property tax abatement law which limits annual increases in property tax bills to a maximum of 3 for homeowners. 550 Creighton Way Reno NV 89503-1634 is a single-family home listed for-sale at 500000. Property Tax Rate.

PO Box 30039Reno NV 89520-3039 Physical Address1001 E 9th Street. Ninth Street Reno NV 89512. On average effective rates in Nevada are 053.

000 The total of all income taxes for an area including state county and local taxes. If that amount is greater than a 3 to 8 increase over the prior years taxes an abatement may be applied to limit the increase. The outbreak of COVID-19 caused by the coronavirus may have impacted vacation rental tax filing due dates in Nevada.

Reno Nevada 89502 Phone. 775 688-1303 STEVE SISOLAK LAS VEGAS OFFICEGovernor JAMES DEVOLLD Chair Nevada Tax Commission. Nevada taxes will stay the same through the end of the fiscal year.

Counties in Nevada collect an average of 084 of a propertys assesed fair market value as property tax per year. NRS 361453 1 further limits the combined tax rate to 364 per 100 of assessed valuation. Tax Rates for Reno NV.

Home is a 4 bed 30 bath property. Tax Rates Property Taxes Personal Property Tax Sales Personal Property Business Personal Property and Aircraft Mobile Manufactured Homes Special Assessments Tax Rates Utilities. Please consult your local tax authority for specific details.

Typically taxes on Incline Village properties run6 of 1 of the value of the home. However taxes may be paid in installments if the taxes on a parcel exceed 10000. Property taxes are calculated by taking the current year tax rate and multiplying it by the assessed value.

The Nevada Constitution limits the total ad valorem property tax levied to an amount not to exceed 500 per 100 of assessed valuation. Property Tax Rates Tammi Davis Washoe County Treasurer HOW THE TAX RATE IS DETERMINED The property tax rates are proposed in April of each year based on the budgets prepared by the various local governments. This is the effective tax rate.

That means the average homeowner pays annual property taxes equal to 053 of their homes market value. 29 rows The total overlapping tax rate subject to approval by the Nevada Tax Commission for the. The states average effective property tax rate is just 053.

Find 24 photos of the 550 Creighton Way home on Zillow. Show maximum allowed tax rates for property taxes which may be used in the event your jurisdiction is considering an increase in the tax rate. Be aware however the preliminary revenue projection.

Prior to the budget hearings the County will publish a newspaper ad which identifies any. Tax rates are set in June of each year. The Department also used the 2019-20 tax rate of 25017 per hundred 0025017 for Tax District 100 without further adjustment.

For more information visit our ongoing coverage of the virus and its impact on sales tax compliance. View more property details sales history and Zestimate data on Zillow.

2340 Roanoke Trl Reno Nv 89523 Realtor Com

2340 Roanoke Trl Reno Nv 89523 Realtor Com

Reno Nevada Nv Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Reno Nevada Nv Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Reno Nevada Nv Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Reno Nevada Nv Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

9755 Silver Sky Pkwy Reno Nv 89506 Realtor Com

9755 Silver Sky Pkwy Reno Nv 89506 Realtor Com

1851 Steamboat Pkwy Reno Nv 89521 Realtor Com

1851 Steamboat Pkwy Reno Nv 89521 Realtor Com

Reno Nevada Nv Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Reno Nevada Nv Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Reno Nevada Nv Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Reno Nevada Nv Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

950 Nutmeg Pl Reno Nv 89502 Realtor Com

950 Nutmeg Pl Reno Nv 89502 Realtor Com

3300 Skyline Blvd Reno Nv 89509 Realtor Com

3300 Skyline Blvd Reno Nv 89509 Realtor Com

432 Socorro Ct Reno Nv 89511 Realtor Com

432 Socorro Ct Reno Nv 89511 Realtor Com

7000 Mae Anne Ave Reno Nv 89523 Realtor Com

7000 Mae Anne Ave Reno Nv 89523 Realtor Com

Consulting Tax Group Tax Preparation In Reno Nevada Payroll Humor Tax Quote Taxes Humor

Consulting Tax Group Tax Preparation In Reno Nevada Payroll Humor Tax Quote Taxes Humor

Reno Nevada Nv Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Reno Nevada Nv Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

990 Yori Ave Reno Nv 89502 Realtor Com

990 Yori Ave Reno Nv 89502 Realtor Com

10411 Silver Rush Ct Reno Nv 89521 Realtor Com

10411 Silver Rush Ct Reno Nv 89521 Realtor Com

The 25 Best Performing Large Cities In The Us Milken Institute City Performance Create Jobs

The 25 Best Performing Large Cities In The Us Milken Institute City Performance Create Jobs

9415 Baldacci Rd Reno Nv 89521 Realtor Com

9415 Baldacci Rd Reno Nv 89521 Realtor Com

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home