How Can I Lower My Property Taxes In Nyc

Reduce your propertys assessment. The Tax Commission cant raise a propertys assessments and filing a challenge is free if the propertys assessed value is under 2 million.

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

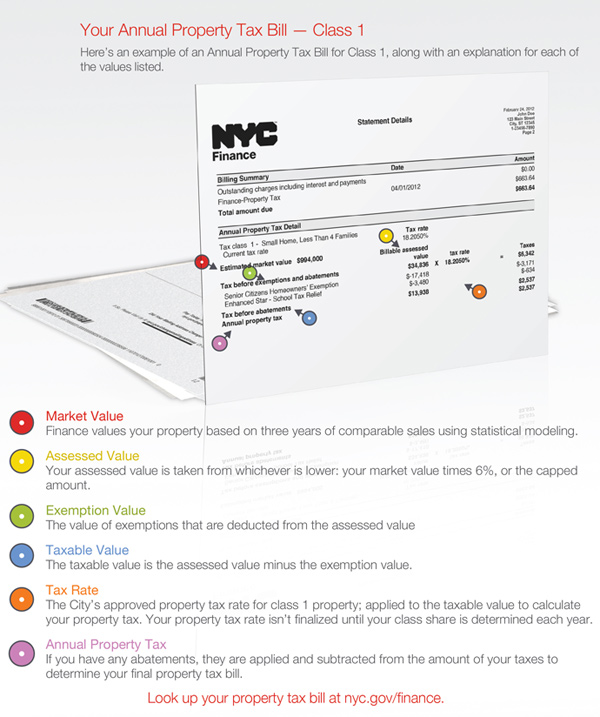

The first step in attempting to lower your property taxes is to challenge the Assessed Value.

How can i lower my property taxes in nyc. To be eligible for SCHE you must be 65 or older earn no more than 58399 for the last calendar year and the property must be your primary residence. New York has exemptions for senior citizens veterans and the disabled. An appeal has to be made to the NYC Tax Commission for this to occur.

Tentative Roll Date is May 1 in most communities but confirm the date with your assessor - also see our Property tax calendar. The request must be made no later than 15 days prior to Tentative Roll Date. The DOF administers several benefits in the form of tax exemptions abatements and money-saving programs.

Exemptions lower the amount of tax owed by reducing a propertys assessed value. If its worth over 2 million the fee is 175. Before filing with the Tax Commission review your Notice of Property Value NOPV.

Local governments and school districts in New York State can opt to grant a reduction on the amount of property taxes paid by qualifying persons with disabilities. The assessor must mail the information to you no later than five days. This is the amount shown on the line.

New York law permits local governments to allow different exemptions. The Senior Citizen Homeowners Exemption SCHE provides a reduction of 5 to 50 on New York Citys real property tax to seniors age 65 and older. How can I lower my property taxes in NYC.

Here you would pay only 3000 annually on a property valued at 250000 at a 3 tax rate. You can pre-pay what you owe for the next payment period. You can file a written request for a list of your property the assessed value and the time and place for hearing grievances.

To qualify your household income must be under 200000 and you must have been resident in the city all of 2019. The City and State of New York offer a number of Property Tax Exemption and Abatement Programs to qualified residential property owners. To qualify persons with disabilities generally must have certain documented evidence of their disability and meet certain income limitations and other requirements.

Look for local and state exemptions and if all else fails file a tax appeal to lower your property tax bill. All owners must be 65 or older by the end of the calendar year in which the exemption begins unless they are the spouse or sibling of an owner who is 65 or older by that time. Change its tax class.

Anchorage Alaska offers a dollar amount exemption to seniors150000 off the appraised value of your home as of 2020. If a bank or mortgage lender pays your property tax you will not receive a Property Tax Bill in the mail unless you are responsible for paying other charges such as sidewalk or emergency repairs. Property tax exemptions reduce the assessment of your propertys value which is what your property tax bill is based on when your local rate is applied to it.

NY has the Enhanced STAR property tax exemption. 250000 less 150000 comes out to 100000 times 3. If you disagree with your Assessed Value You can challenge your Assessed Value by appealing with the NYC Tax Commission an independent agency.

STAR is New York States School Tax Relief Program that includes a school property tax rebate program and a partial property tax exemption from school taxes. If it has a line called Effective. You will get a discount if you pay your property taxes for the entire tax year in advance.

The exemption must be renewed every two years. However before the owner takes that step NYCgov advises that the owner review their Notice of Property Value NOPV. NYC enhanced real property tax credit Renters who have lived in the same apartment or house for at least six months can get a credit of up to 500 based on your income and the amount you paid in rent last year.

The Tax Commission can. Lower Your Assessment through Exemptions The easiest way to lower your assessment is to apply for a STAR exemption.

How Real Estate Property Taxes Work Brownstone Vintage New York Nyc

How Real Estate Property Taxes Work Brownstone Vintage New York Nyc

Should You Get Home Inspection Before Making Offer Hauseit Home Inspection Inspect Offer

Should You Get Home Inspection Before Making Offer Hauseit Home Inspection Inspect Offer

Homes For Sale Real Estate Listings In Usa Property Tax Real Estate Buying Investment Property

Homes For Sale Real Estate Listings In Usa Property Tax Real Estate Buying Investment Property

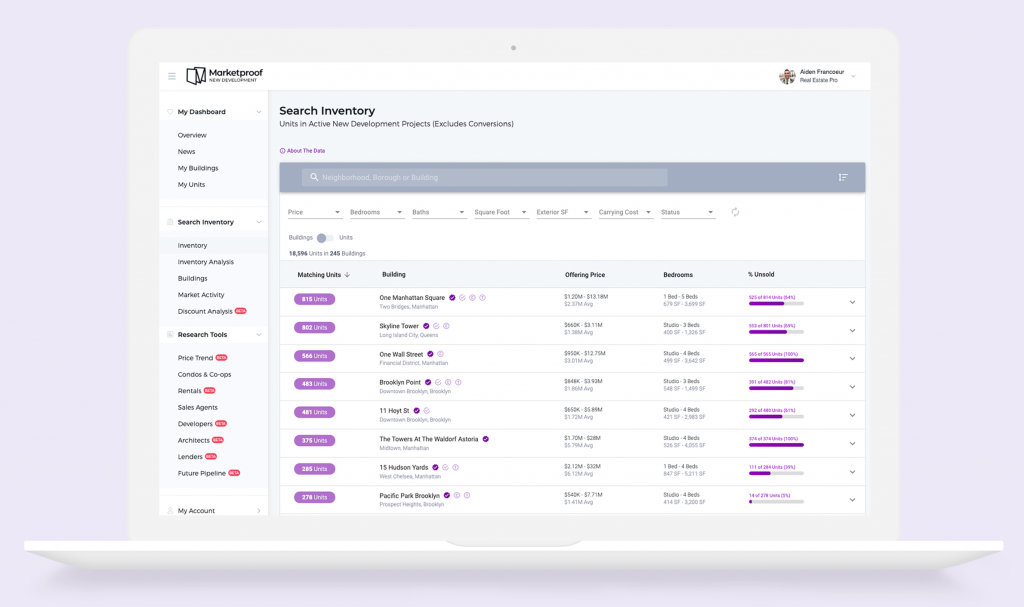

Nyc Property Taxes All You Need To Know Blocks Lots

Nyc Property Taxes All You Need To Know Blocks Lots

Nyc 1031 Exchange Rules In Nyc Hauseit Capital Gains Tax Investing Capital Gain

Nyc 1031 Exchange Rules In Nyc Hauseit Capital Gains Tax Investing Capital Gain

Pin By Bobbie Persky Realtor On Finance Real Estate Property Tax Tax Attorney Debt Relief Programs

Pin By Bobbie Persky Realtor On Finance Real Estate Property Tax Tax Attorney Debt Relief Programs

Nyc Property Taxes All You Need To Know Blocks Lots

Nyc Property Taxes All You Need To Know Blocks Lots

Nyc Mansion Tax Calculator For Buyers Interactive Hauseit

Nyc Mansion Tax Calculator For Buyers Interactive Hauseit

Nyc Mansion Tax Of 1 To 3 9 2021 Overview And Faq Hauseit

Nyc Mansion Tax Of 1 To 3 9 2021 Overview And Faq Hauseit

Nyc Submit Offer Form Hauseit Nyc Offer Saving Money

Nyc Submit Offer Form Hauseit Nyc Offer Saving Money

Nyc How Long Does It Take To Close On A House Hauseit Nyc Closing On House Purchase Contract

Nyc How Long Does It Take To Close On A House Hauseit Nyc Closing On House Purchase Contract

What Is The Nyc Senior Citizen Homeowners Exemption Sche Senior Citizen Property Tax Nyc

What Is The Nyc Senior Citizen Homeowners Exemption Sche Senior Citizen Property Tax Nyc

Nyc Mansion Tax Of 1 To 3 9 2021 Overview And Faq Hauseit

Nyc Mansion Tax Of 1 To 3 9 2021 Overview And Faq Hauseit

Ucc Financing Statement For A Coop In Nyc Hauseit Finance Nyc Statement

Ucc Financing Statement For A Coop In Nyc Hauseit Finance Nyc Statement

Why Are Buyer Closing Costs In Nyc Lower For Co Ops Than Condos Infographic Portal Closing Costs Real Estate Infographic Condo

Why Are Buyer Closing Costs In Nyc Lower For Co Ops Than Condos Infographic Portal Closing Costs Real Estate Infographic Condo

What Is The 421g Tax Abatement In Nyc Hauseit Nyc Lower Manhattan Tax

What Is The 421g Tax Abatement In Nyc Hauseit Nyc Lower Manhattan Tax

Rental Rules For Condo In Nyc Hauseit Condo Buying A Condo Nyc Condo

Rental Rules For Condo In Nyc Hauseit Condo Buying A Condo Nyc Condo

Labels: property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home