Home Carer Tax Credit Year Of Marriage

You qualify if you pay more tax for the year as two single people than you would if you had been jointly assessed. Qualifying for Home Carer Tax Credit.

Mytaxrebate Ie My Tax Rebate Twitter

Mytaxrebate Ie My Tax Rebate Twitter

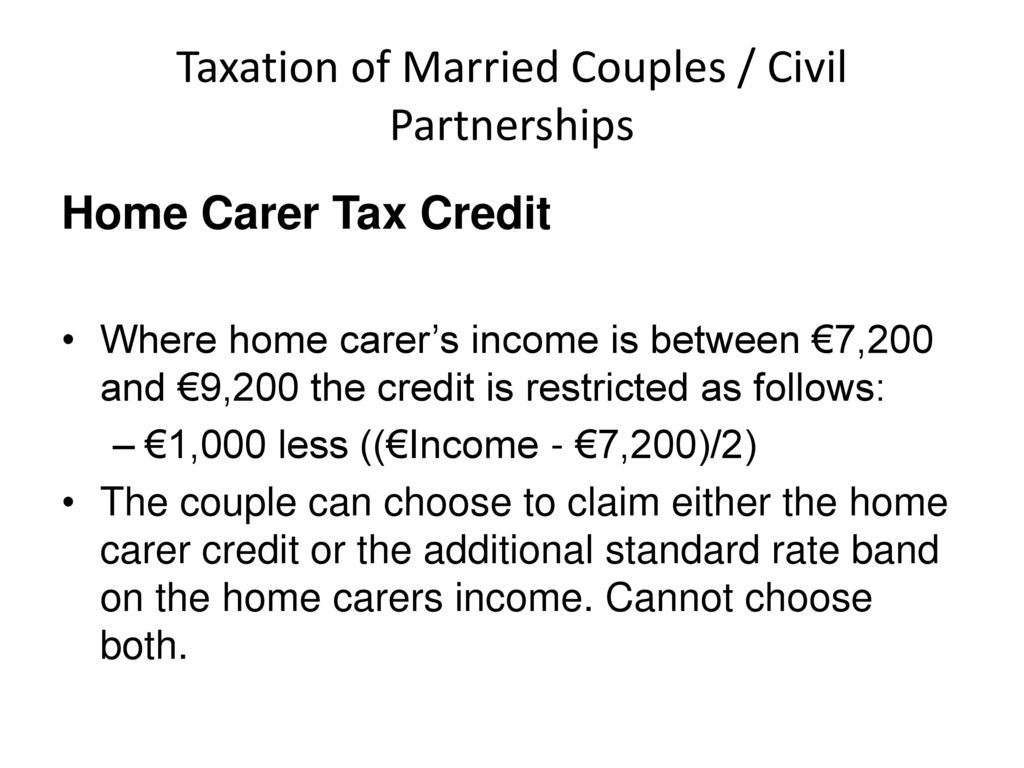

The couple should be in a marriage or civil partnership and jointly assessed for tax Home carer must care for one or more dependents Home carers income should not exceed 7200 for the tax year.

Home carer tax credit year of marriage. The following table lists the home carers tax credit for different levels of income. Turbo Tax does calculate the Premium Tax Credit when you got married during the year. Alternative Calculation for Year of Marriage.

A full Home Carer Tax Credit can be claimed when. If a taxpayer got married during the tax year and their new tax family includes an individual with marketplace health insurance who received APTC an optional calculation the Alternative Calculation for Year of Marriage can be elected that may. The calculation uses your joint income and does not account for your spouses specific income prior to marriage.

The case involves yet another marriage penalty in the tax law. No the taxpayer does not owe self-employment tax on amounts reported on the 1099-MISC she received from the insurance company if she is not engaged in a trade or business of providing care giving services as appears to be the case in this situation. These credits returned sizeable amounts of money to working families.

Newlyweds should know how saying I do can affect their tax situation. Use Premium Tax Credit Form 8962 alternative calculation for year of marriage. Marriage Allowance lets you transfer 1260 of your Personal Allowance to your husband wife or civil partner.

The home carers own income is under 7200. In this case a mid-November marriage ended up forcing Christina Fisher to repay over 4400 of advance premium tax credit PTC that had been used to reduce her Exchange purchased health care premiums for the year. Caring for a disabled spouse can be a financial strain but you do have opportunities to reduce the burden.

Married couples have to file a joint tax return in order to qualify for a premium tax credit. If your joint income is close to or above 8590k or more an Advanced Credit for more than half the year is likely to cause a large payback. Two federal refundable tax credits the EITC and the Child and Dependent Care credit lifted 83 million people out of poverty in 2017.

As for that itemized tax deduction for state and local taxes the SALT deduction the TCJA caps this at 10000 for every taxpayer whether theyre single or. 2 If you get married mid-year your premium tax credit eligibility is. The taxpayer must report the full amount of the payment on line 7a Other Income of Form.

Home carers are only entitled to the full rate for a given tax year if their income is 7200 or less during that year. Getting married or divorced can affect tax credits based on filing status. Refunds are only due from the date of marriage and will be calculated after the following 31 December.

You can claim the refund of the difference after 31 December of the year. However when people marry during the tax year the IRS offers an alternative way of calculating household income that for many reduces the excess premium tax credit they have to. You can only claim one credit regardless of the number of people you care for.

You can claim the Home Carer Tax Credit if you are married or in a civil partnership and you care for one or more dependent persons. The Right at Home 2014 Caregiver of the Year Hartsock spoke at a June 2016 congressional briefing on The Value of Home Care report. Generally Advance Premium Tax Credit APTC received in excess of what the taxpayer is allowed needs to be repaid.

One spousecivil partner works in the home caring for one or more dependents can work part-time The home carers income is less than 5080 2015 or 7200 2016-2019 reduced tax credit if income is slightly over these amounts. Where it exceeds this amount then the credit will be reduced. The briefing also highlighted a bill supported by the HCAOA and Right at Home to provide a tax credit for family members caring.

A reduced tax credit applies if the carers income is between 7200 and 10400. Youre marriedin a civil partnership and jointly assessed for tax. The married couple or civil partners are jointly assessed for tax.

Claiming Home Carers Tax Credit. If you are due a refund it will only be given from the date of marriage or registration of civil partnership. You cannot claim this credit if the dependent person is your spouse or civil partner.

Carers with an income higher than 7200 but less than 9400 qualify for a reduced tax credit. The full rate for the home carers tax credit for 2017 is 1100. More married couples may be eligible for these credits in 2021 even if their joint income was too high in previous years.

This reduces their tax by up to 252 in the tax year 6 April to 5 April the next. IRS Tax Tip 2020-118 September 14 2020 Marriage changes a lot of things and taxes are on that list. So for example if you get married in 2021 any tax refund due to.

The Ohio EITC is 10 percent of a filers federal EITC amount. One spouse or civil partner works in the home caring for one or more dependent people. There are many tax credits and other tax breaks available for disabled individuals and their caretakers.

Among the most common are the Tax Credit for the Elderly or Disabled the Child or Dependent Care Credit and the Medical Expenses tax deduction. This can help you adjust tax credits and ensure you avoid repaying extra credits or missing out on claiming additional ones.

Tax Implications And Rewards Of Grandparents Taking Care Of Grandchildren The Cpa Journal

Home Carer Tax Credit Claim Your Entitlements Today

Home Carer Tax Credit Claim Your Entitlements Today

Are You A Home Carer Claim Your Tax Refund Irish Tax Reabtes

Home Carer Tax Credit Crowleys Dfk Accountants Cork Dublin

Home Carer Tax Credit Crowleys Dfk Accountants Cork Dublin

Ireland Selected Issues Ireland Selected Issues

Ireland Selected Issues Ireland Selected Issues

Tax Refund Ireland Tax Refund Tax Services Tax Preparation

Tax Refund Ireland Tax Refund Tax Services Tax Preparation

Online Tax Returns Delerue Taxation

Online Tax Returns Delerue Taxation

Are You A Home Carer Claim Your Tax Refund Irish Tax Reabtes

Stay Spend Scheme Ireland Tax Refund Tax Ireland

Stay Spend Scheme Ireland Tax Refund Tax Ireland

Home Carer Tax Credit Claim Your Entitlements Today

Home Carer Tax Credit Claim Your Entitlements Today

Budget Families Little Change On The Personal Tax Front

Budget Families Little Change On The Personal Tax Front

Are You Missing Out On This Tax Credit Familyfriendlyhq Ie

Are You Missing Out On This Tax Credit Familyfriendlyhq Ie

Home Carers Tax Credit Can Help To Make Ends Meet

Home Carers Tax Credit Can Help To Make Ends Meet

Taxation Of Married Couples Civil Partnerships Ppt Download

Taxation Of Married Couples Civil Partnerships Ppt Download

What Is The Home Carer Tax Credit Am I Owed A Tax Rebate And How Do I Claim It Here S Everything You Need To Know

What Is The Home Carer Tax Credit Am I Owed A Tax Rebate And How Do I Claim It Here S Everything You Need To Know

Taxation Of Married Couples Civil Partnerships Ppt Download

Taxation Of Married Couples Civil Partnerships Ppt Download

What Is The Home Carer Tax Credit Am I Owed A Tax Rebate And How Do I Claim It Here S Everything You Need To Know

What Is The Home Carer Tax Credit Am I Owed A Tax Rebate And How Do I Claim It Here S Everything You Need To Know

What Is The Home Carer Tax Credit Am I Owed A Tax Rebate And How Do I Claim It Here S Everything You Need To Know

What Is The Home Carer Tax Credit Am I Owed A Tax Rebate And How Do I Claim It Here S Everything You Need To Know

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home