Property Tax Relief Bucks County Pa

The maximum standard rebate is 650 but supplemental rebates for qualifying homeowners can boost rebates to 975. Application must be filed with the Bucks County Assessment Appeals office by March 1 2020.

In-depth Bucks County PA Property Tax Information.

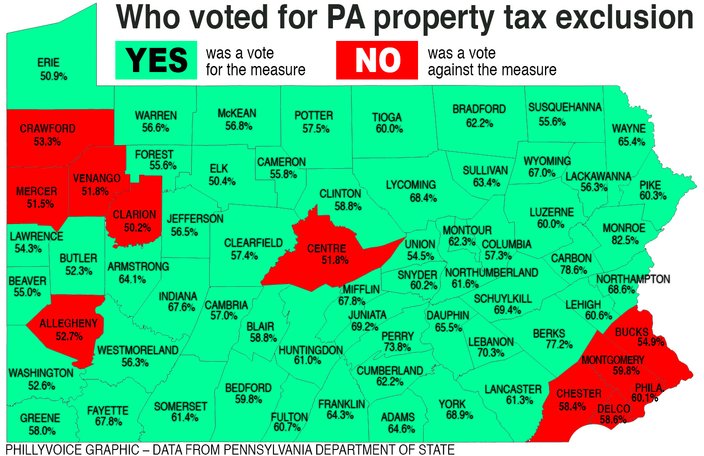

Property tax relief bucks county pa. In November of 1997 Pennsylvania voters approved a change in the Commonwealth constitution to allow a method of real property tax relief called a homestead exclusion to be implemented in Pennsylvania. Up-to-date tax rates can be found on the Middletown Township Tax Collectors website. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property.

Bucks County Website BOA Website Tax Collector List Department of Revenue Website Request for Certification IRS Website. The Property TaxRent Rebate Program is one of five programs supported by the Pennsylvania Lottery. The rebate program also receives funding from slots gaming.

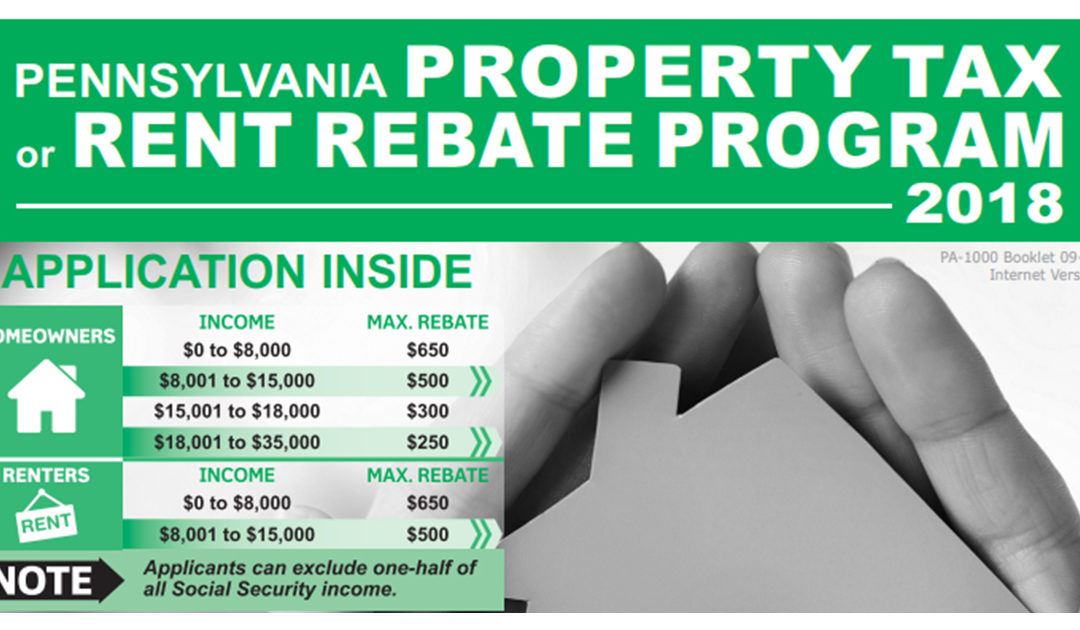

The second depends on whether you meet certain qualifications. We can help you evaluate and appeal your large parcel. Taxpayers or their spouses older than age 65 plus widows and widowers older than 50 may be eligible for the Property Tax and Rent Rebate Program.

2020-2021 Fiscal Year Pennsylvania will continue its broad-based property tax relief in 2020-21 based on Special Session Act 1 of 2006. The information provided herewith is solely for your own use and cannot be sold. As required by law the Commonwealths Budget Secretary certified on April 15 2020 and again on June 1 2020 that 7397 million in state-funded local tax relief will be available in 2020-21.

If the applicant is a homeowner who earns 35000 per year or less--excluding half of his Social Security benefit--he may earn a rebate of up to 650. A home-stead exclusion provides real property also known as real estate or property tax relief to homeowners. 215-515-0499 Dont Lose Your House To Tax Sale.

The Taxpayer Relief Act provides for property tax reduction allocations to be distributed by the Commonwealth to each school district. Behind in taxes Bucks County PA We offer solutions in Bucks County The Property Tax Relief Group Call Us. The Real Estate Tax is calculated by multiplying the appropriate millage by the assessed value as determined by the Bucks County Board of Assessment.

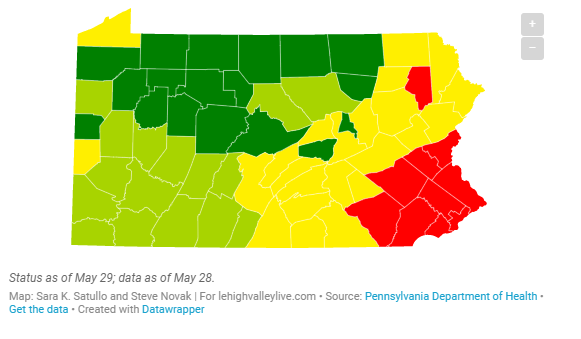

The County Board for the Assessment and Revision of Taxes will grant the tax exemption. Pennsylvania has 67 different counties. Since the programs 1971 inception older adults and adults with disabilities have received 48 billion in of property tax and rent rebates.

Search for a specific property by parcel number. Property Tax Online Inquiry Property Search Step 1. If you do you can seek tax relief using both methods.

Select a Search Method. If you own a large parcel over 10 acres you can reduce your land assessment by filing an application under Act 319 Clean Green. Since the programs 1971 inception older and disabled adults have received more than 69 billion in property tax and rent relief.

Senior renters can earn 650 in rebates with incomes not to exceed 8000 or 500 with incomes of up to. This law eases the financial burden of home ownership by providing school districts the means to lower property taxes to homeowners especially senior citizens via the funding provided by gaming revenue. The Property TaxRent Rebate Program is one of five programs supported by the Pennsylvania Lottery.

In addition to Act 319 large parcels also have annual right to an assessment appeal. Appeal the Pennsylvania Tax Assessment of Your Home. You might know that the Pennsylvania authorities compute your property tax by multiplying your homes taxable value by the tax rate.

July 1 2020 - June 30 2021 Property Tax Relief Bucks County Application for Homestead and Farmstead Exclusions Please read all instructions before completing application. Property tax reduction will be through a homestead or farmstead exclusion. Cases that have been granted tax exemption will be reviewed every 5 years to determine continued need for exemption from certain real estate property taxes.

A second potential discount for older homeowners and renters is Pennsylvanias Property TaxRent Rebate program. The total Real Estate Tax rate for the 2021 calendar year is 17570 mills of assessed valuation. The Taxpayer Relief Act Act 1 of Special Session 1 of 2006 was signed into law on June 27 2006.

Special Session Act 1 of 2006 the Taxpayer Relief Act was signed on June 27 2006 and modified in June 2011 by Act 25 of 2011. The County of Bucks makes no representations or warranties as to the suitability of this information for your particular purpose and that to the extent you use or implement this information in your own setting you do so at your own risk. About The Taxpayer Relief Act.

Homeowners over age sixty-five 65 and widowswidowers age fifty 50 and older who have a household income of less than 35000 may be eligible for this program. What would you like to do.

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home