Do 100 Disabled Veterans Pay Property Tax In Ga

To do so the disabled veteran will need to file the amended return Form 1040X Amended US. Individual Income Tax Return to correct a previously filed Form 1040 1040A or 1040EZ.

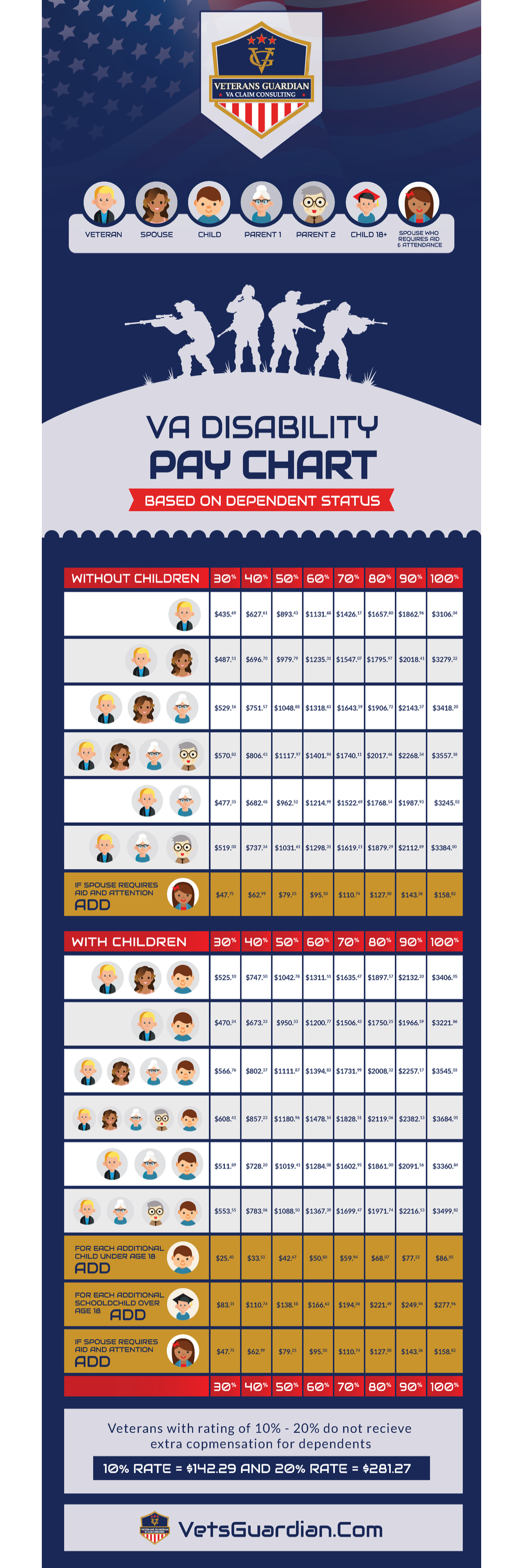

2020 Va Disability Pay Rates Veterans Guardian Va Claim Consulting

2020 Va Disability Pay Rates Veterans Guardian Va Claim Consulting

100 disabled veterans those getting VA disability for loss of vision or limbs and their surviving unremarried spouses may be exempt from property tax on their homes.

Do 100 disabled veterans pay property tax in ga. One disability rated at 100 percent either by the rating schedule or individual unemployability and. Starting March 17 2014 veterans who have a VA compensation rating of 100 permanent and total PT may receive expedited processing of applications for Social Security disability benefits. Deservedly the state and federal government provide special discounts or assistance to our disabled warriors one such benefit being a property tax exemption.

Department of Veterans Affairs VA considers you to be a permanently and totally service-connected disabled veteran receiving 100 percent benefits or compensated as such. Any qualifying disabled veteran may be granted an exemption of 60000 plus an additional sum from paying property taxes for county municipal and school purposes. See all Florida Veterans Benefits.

2 loss or permanent loss of use of one or both hands. This exemption is for veterans who are verified by VA to be 100 percent totally and permanently service-connected disabled and veterans rated unemployable who are receiving or who are entitled to receive statutory awards from VA for. Vehicle Property Tax Exemption.

1 loss or permanent loss of use of one or both feet. The basic program commonly referred to as RH Insurance insures eligible Veterans for. Another unrelated disability rated at 60 percent or higher.

Disabled Georgia vets with qualifying disabilities 100 VA ratings loss or loss of use of hands feet eyesight etc may receive a property tax exemption up to 60000 for a primary residence. Georgia State Sales Tax Exemption for Vehicle Purchase Or Modification. You may be eligible for additional savings if the US.

The combat-disabled veteran applying for and being granted Combat-Related Special Compensation after an award for Concurrent Retirement and Disability. It can be used for either the annual property tax or the title tax where applicable. As a result of their service some Veterans are wounded or disabled in the line of duty.

The bill also increases the amount of the regular disabled veterans exemption for veterans who have a disability rating of 30 50 or 70. Property Tax Exemptions If you are a homeowner and lived in your house on January 1st you are eligible for a basic homestead exemption. A disabled veteran in Georgia may receive a property tax exemption of 60000 or more on hisher primary residence if the veteran is 100 percent disabled depending on a fluctuating index rate set by the US.

Property in excess of this exemption remains taxable. All veterans who are declared permanently and totally disabled are eligible for a property tax waiver. Harris County Appraisal District recently sent applications for the new exemption in a letter to all current recipients of the disabled veterans exemption.

3 loss of sight in one or both eyes. The additional sum is determined according to an index rate set by United States Secretary of. A vehicle tax exemption is available to veterans who are found to be 100 disabled by the VA due to service-connected disabilities or who are entitled to VA compensation due to.

What do I need to know about the VA and Social Security programs. The Disabled Veterans Exemption reduces the property tax liability on the principal place of residence of qualified veterans who due to a service-connected injury or disease have been rated 100 disabled or are being compensated at the 100 rate due to unemployability. Both Social Security and VA pay disability.

The Disabled Veterans Life Insurance program is a VA program that provides insurance for disabled veterans who have a service-connected disability rating from 0 to 100. Any qualifying disabled Veteran may be granted an exemption of 60000. Georgia Homestead Tax Exemption for Disabled Veteran Surviving Spouse or Minor Children.

The maximum exemption which. The current amount is 85645. Actual loss or permanent loss of use of one or both feet.

Georgia Property Tax Exemptions. Qualifying disabled veterans with VA grants for buying and modifying a vehicle to be more accessible are. This bill provides for a 100 exemption for the residence homestead of qualified disabled veterans.

Actual loss or permanent loss of use of one or both hands. Secretary of Veterans Affairs. Or 4 permanent impairment of.

Those rated 10 percent disabled will receive at least 14005 a month depending on their marital and dependent status while 100 percent disabled veterans get.

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Georgia Disabled Veteran License Plate Tag Ebay

Georgia Disabled Veteran License Plate Tag Ebay

Georgia Veteran S Benefits Military Benefits

Georgia Veteran S Benefits Military Benefits

What Is The Disability Property Tax Exemption Millionacres

What Is The Disability Property Tax Exemption Millionacres

State Veteran S Benefits Military Benefits

State Veteran S Benefits Military Benefits

Disabled Veterans Can Fly Space Available Flights For Free Gold Coast Veterans Foundation

Disabled Veterans Can Fly Space Available Flights For Free Gold Coast Veterans Foundation

Ssdi Benefits For Veterans With Disabilities Military Benefits

Ssdi Benefits For Veterans With Disabilities Military Benefits

Georgia The Official Army Benefits Website

Georgia The Official Army Benefits Website

States With Property Tax Exemptions For Veterans Veterans

States With Property Tax Exemptions For Veterans Veterans

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

What Does It Mean To Be 100 Disabled By The Va Cck Law

What Does It Mean To Be 100 Disabled By The Va Cck Law

Disabled Veterans Property Tax Exemptions By State

Disabled Veterans Property Tax Exemptions By State

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

60 Va Disability Benefits Explained Va Claims Insider

60 Va Disability Benefits Explained Va Claims Insider

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

2021 Va Service Connected Disability Compensation Rate Charts

2021 Va Service Connected Disability Compensation Rate Charts

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home