New York Property Tax Rates By Zip Code

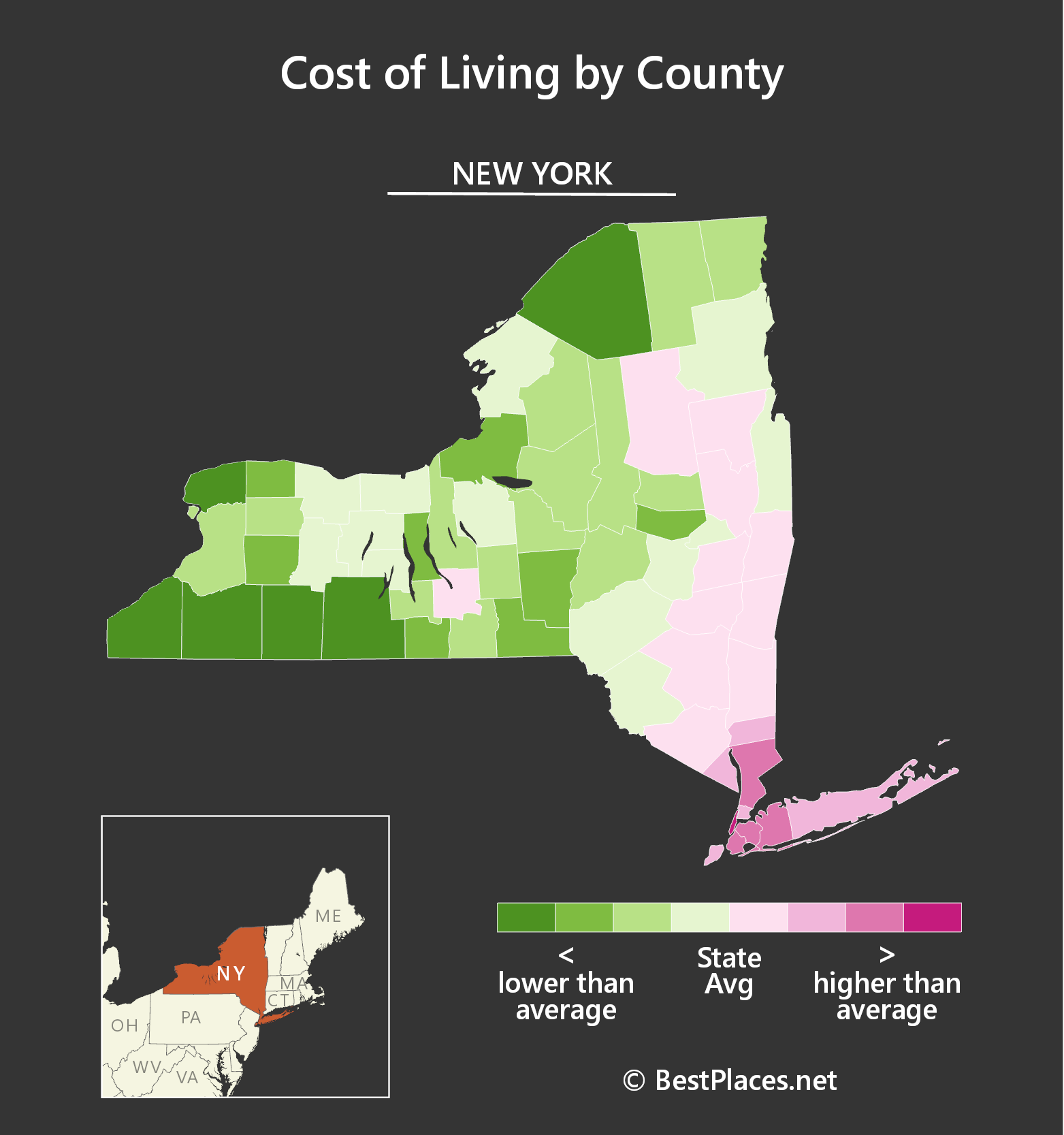

For New York City tax rates reflect levies for general city and school district purposes. Click any locality for a full breakdown of local property taxes or visit our New York sales tax calculator to lookup local rates by zip code.

Opinion Can You Break The Pull Of A Zip Code Most Can T Inequality School Teacher Middle School English

Opinion Can You Break The Pull Of A Zip Code Most Can T Inequality School Teacher Middle School English

The rate is an amount applied to every 1000 of a.

New york property tax rates by zip code. If you need access to a database of all New York local sales tax rates visit the sales tax data page. When taking those exemptions into account effective property tax rates in New York City are around 088. The Department of Finance DOF administers business income and excise taxes.

The tax rates are listed below. Class 4 - 10694. Keep in mind that sales tax jurisdiction rules can sometimes be too complicated to.

DOF also assesses the value of all New York City properties collects property taxes and other property-related charges maintains property records administers exemption and abatements and collects unpaid property taxes and other property-related charges through annual lien sales. An additional sales tax rate of. Search our database of tax rates in every municipality in New York state.

In Manhattan New York County the rate is 095. New York City and Nassau County have a 4-class property tax. Class 3 - 12826.

New York has one of the highest average property tax rates in the country with only three states levying higher property taxes. The lowest effective tax rate in the state was 393 per 1000. Multiply Taxable Value by the Tax Rate example Class 1 X 20385 20385 Your Taxes.

Property Tax Rates for Tax Year 2020. However if you disagree with the code assigned to your property you. Class 1 - 21045.

To break it down further in Brooklyn Kings County the rate is just 066 less than half the state average. Property Tax Calculator - Estimate Any Homes Property Tax. School property tax rates vary wildly depending on where you live.

Highest property taxes in America. Assessors assign a code to each property on an assessment roll. Property Tax Rates for Tax Year 2021.

In Queens the rate is 088. The SalesTaxHandbook Sales Tax Calculator is a free tool that will let you look up sales tax rates and calculate the sales tax owed on a taxable purchase for anywhere in the United States. Tax levy and tax rate data for cities and villages is obtained from the Constitutional Tax Limit forms filed by localities with this office.

Enter the Taxable Value from the Notice. Class 1 - 21167. The sales tax jurisdiction jurisdiction code and tax rate on sales or purchases of utilities or utility services.

Just enter the ZIP code of the location in which the purchase is made. County town and special district information is obtained from Schedules of Real Property Taxes and Assessments MA-144 filed by counties with this office. A new Tax Policy Center study looks at the average annual property tax burdens in more than 3000 counties across the country.

Learn how to Calculate Your Annual Property Tax. Class 2 - 12473. Property Business Excise Tax Professionals Forms Select Tax Bills and Payments Data and Lot Information Dividing Merging Lots Assessments Tax Rates Guides.

There are four tax classes. The median property tax in New York is 375500 per year for a home worth the median value of 30600000. Class 2 - 12267.

Property taxes in New York rose on average 42 between 2005 and 2012 a report this month by. We made a searchable database of property tax rates per 1000 of a homes value for every school district county city village and town in New York. The table above shows the fifty states and the District of Columbia ranked from highest to lowest by annual property taxes as a percentage of the median home value.

New York State developed property class codes to provide a statewide uniform classification system for assessment administration. Download New York Sales Tax Rates By ZIP Code County and City Do you need access to sales tax rates for every ZIP code county and city in New York. Counties in New York collect an average of 123 of a propertys assesed fair market value as property tax per year.

The combined sales and use tax rate equals the state rate currently 4 plus any local tax rate imposed by a city county or school district. Tax rates in each county are based on combination of levies for county city town village school district and certain special district purposes. JURISDICTIONRATE LOOKUP BY ADDRESS.

Enter City and State or Zip Code. The property class code should not directly impact the amount of your assessment. Your property tax rate is based on your tax class.

Clark Com Advice You Can Trust Money In Your Pocket Tax Extension Tax Services Filing Taxes

Clark Com Advice You Can Trust Money In Your Pocket Tax Extension Tax Services Filing Taxes

Top 25 Most Expensive Chicago Area Zip Codes In 2019 Propertyshark Real Estate Blog

Top 25 Most Expensive Chicago Area Zip Codes In 2019 Propertyshark Real Estate Blog

New York Bill Of Sale Form Download The Free Printable Basic Bill Of Sale Blank Form Template Or Employer Identification Number Bill Of Sale Template New York

New York Bill Of Sale Form Download The Free Printable Basic Bill Of Sale Blank Form Template Or Employer Identification Number Bill Of Sale Template New York

Illegal Apartment Rentals You Might Be Living In Right Now Rental Apartments Apartment Rental

Illegal Apartment Rentals You Might Be Living In Right Now Rental Apartments Apartment Rental

Areacode516 Is A Code Of New York City It Is A Telephone Code Of New York And Serves The Nassau Country Portion Of All Area Codes Harbor Freight Tools Coding

Areacode516 Is A Code Of New York City It Is A Telephone Code Of New York And Serves The Nassau Country Portion Of All Area Codes Harbor Freight Tools Coding

Best Places To Live In Beacon Zip 12508 New York

Best Places To Live In Beacon Zip 12508 New York

Don T Expect Home Sales To Slow Down In 2021 Experts Say Homebuyers Won T Stop For Anything Housingwire Housingmarket Fintech Real Estate Tips How Much Snow

Don T Expect Home Sales To Slow Down In 2021 Experts Say Homebuyers Won T Stop For Anything Housingwire Housingmarket Fintech Real Estate Tips How Much Snow

Massachusetts Has 9 Richest Zip Codes In The Us With Weston Ranked Top In The Commonwealth And 11 In The Country Boston Real Estate Times

Massachusetts Has 9 Richest Zip Codes In The Us With Weston Ranked Top In The Commonwealth And 11 In The Country Boston Real Estate Times

States With Highest And Lowest Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

Massachusetts Has 9 Richest Zip Codes In The Us With Weston Ranked Top In The Commonwealth And 11 In The Country Boston Real Estate Times

Massachusetts Has 9 Richest Zip Codes In The Us With Weston Ranked Top In The Commonwealth And 11 In The Country Boston Real Estate Times

12 Irs Non Stimulus Tax Rules You Ll Need This Year Tax Rules Irs Tax Questions

12 Irs Non Stimulus Tax Rules You Ll Need This Year Tax Rules Irs Tax Questions

Oklahoma Property Tax Calculator Smartasset

Oklahoma Property Tax Calculator Smartasset

12 03 07 Hometurf Homeowner Selling House Mortgage Companies

12 03 07 Hometurf Homeowner Selling House Mortgage Companies

The Entire Property Which Covers Five Acres Is Lined With Oak And Magnolia Trees Compass California Homes Real Estate Expensive Houses

The Entire Property Which Covers Five Acres Is Lined With Oak And Magnolia Trees Compass California Homes Real Estate Expensive Houses

Search Chicago Real Estate By Zip Code By Chicago Zip Code Map Chicago Real Estate Chicago Map Zip Code Map

Search Chicago Real Estate By Zip Code By Chicago Zip Code Map Chicago Real Estate Chicago Map Zip Code Map

Top 25 Most Expensive Chicago Area Zip Codes In 2019 Propertyshark Real Estate Blog

Top 25 Most Expensive Chicago Area Zip Codes In 2019 Propertyshark Real Estate Blog

How Does Your Neighborhood Get Its Power Find Out With This Map Power Plant Map Power Map

How Does Your Neighborhood Get Its Power Find Out With This Map Power Plant Map Power Map

Easyknock South Carolina Property Tax Rate A Complete Guide

Easyknock South Carolina Property Tax Rate A Complete Guide

Top 25 Most Expensive Chicago Area Zip Codes In 2019 Propertyshark Real Estate Blog

Top 25 Most Expensive Chicago Area Zip Codes In 2019 Propertyshark Real Estate Blog

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home