What Is The Maine Homestead Property Tax Exemption

A homestead generally refers to the primary residence owned and occupied by a person or family. Homestead exemptions reduce property taxes for all homeowners by sheltering a certain amount of a homes value from tax.

Brewer Homestead Exemption Application The City Of Brewer Maine

Brewer Homestead Exemption Application The City Of Brewer Maine

Tax reductions under homestead exemptions are usually a fixed discount on taxes.

What is the maine homestead property tax exemption. While some are applied at a local level others may be applied for through the Income Tax Division. Homestead exemptions vary by state including how it is applied and how much protection it offers against creditors. A homestead exemption can also protect a homeowner in distress from onerous property taxes with built-in mechanisms that either reduce those taxes or remove them altogether.

Homestead exemptions are a progressive approach to property tax reliefthat is the largest tax cuts as a share of income go to lower- and middle income taxpayers. Thus homestead exemptions can provide asset protection from creditors for at least some of the value in the homestead. Homestead Exemption What is Maines Law on Homestead Exemption.

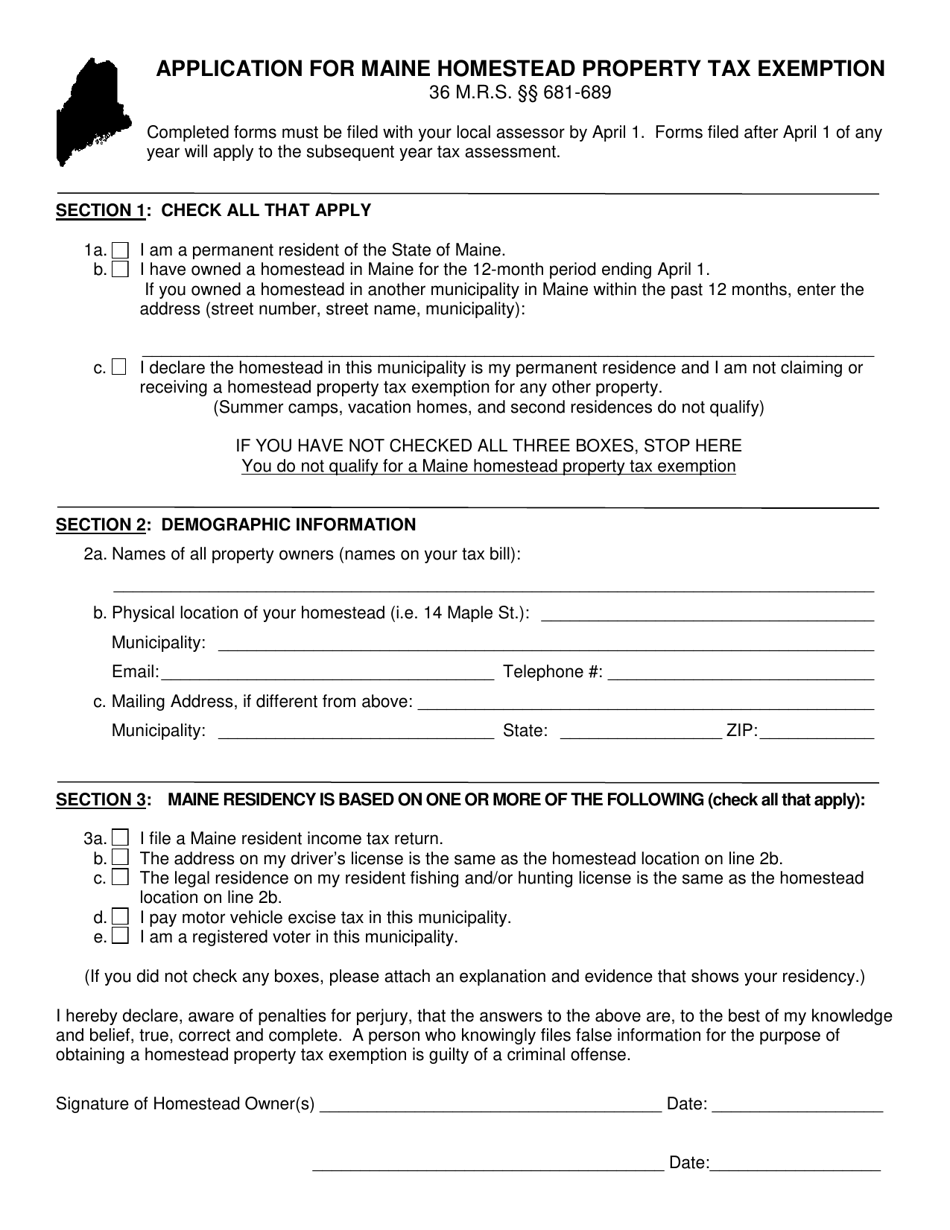

If you have moved during the year and owned a homestead in Maine prior to your move enter the address of the homestead you moved from on line 1b1. This bill increases the state reimbursement for the property tax revenue lost by a municipality due to the Maine resident homestead property tax exemption to 100 beginning with property tax years beginning on or after April 1 2022. For example a home valued at 150000 using a 50000 homestead exemption will be taxed on 100000 of assessed value.

Introduction The Maine Homestead Exemption may lower your property tax bill. If a county collects a special tax for farm-to-market roads or flood control a residence homestead is allowed to receive a 3000 exemption for this tax. Property owners would receive an exemption of 25000.

If you did not check all boxes. The Maine Legislature enacted the Homestead Exemption in 1998 and further amended it effective April 1 2017. Municipal Property Tax.

If you have moved during the year and owned a homestead in Maine prior to your move enter the address of the homestead you moved from on line 1b. So a homestead exemption is a legal provision designed to protect the value in a principal dwelling place. You just have to show you owned a home for the 12 month period.

More exemptions exist for veterans that are paraplegic and for spouses with certain circumstances. In Maine up to 10000 of the homestead of a permanent resident who has owned a homestead in Maine for the last 12 months is exempt from taxation 36 MRS 683This is known as the homestead exemption. For example through the homestead exemption a home with a market value of.

Your ownership of a homestead must have been continuous for the 12-month period ending on April 1. The Maine homestead property tax exemption. Additional exemptions are available for veterans the blind renewable energy and business equipment.

The State of Maine provides a measure of property tax relief through different programs to qualified individuals. Unfortunately high property taxes make home ownership difficult for many. The homestead exemption provides a reduction of up to 25000 in the value of your home for property tax purposes.

It makes it so the town wont count 20000 of value of your home for property tax purposes. Veterans with our without service-connect disabilities and their surviving spouses in Maine may receive a property tax exemption of up to 6000 on their primary residence if the veteran is 62 years or older or is 100 percent disabled. The exemption which takes the form of a credit on property tax bills allows qualifying homeowners to exempt up to 25000 of the market value of their homes from all local property taxes.

Homestead Exemptions by State and Territory. A recent study from the Maine Municipal Association revealed that of Maines three major taxes income sales and property most residents said property. About the Maine Homestead Exemption Program.

You can qualify if you have owned your home in Maine for at least 12 months. Qualifying homeowners residing in Maine for at least 12 months can get a 25000 exemption for their primary residence by April 1. Homestead Exemption -This program provides a measure of property tax relief for certain individuals that have owned homestead property in Maine for at least 12 months and make the property they occupy on April 1 their permanent residence.

Certain individuals that have owned a residence in Maine for at least 12 months including mobile homes and make the property they occupy on April. Your ownership of a homestead must have been continuous for the 12-month period prior to application. It doesnt matter if you sold one home and moved to another.

For the Maine homestead property tax exemption. Blind homeowners can receive a 4000 exemption while veterans who are receiving 100 disability are eligible for up to 6000. Maine boasts the highestage of home ownership in the United States.

We administer the real estate transfer tax commercial forestry excise tax controlling interest transfer tax and telecommunications business equipment tax and we determine annually the amount of tax reimbursement to each town for veteran homestead and animal waste facility exemptions and tree growth tax loss reimbursement. Below is a list of the different categories and their links. If the county grants an optional exemption for homeowners age 65 or older or disabled the owners will receive only the local-option exemption.

Maine has a variety of property tax exemptions for disabled homeowners. To qualify you must be a permanent resident of Maine the home must be your permanent residence you must have owned a home in Maine for the twelve months prior to applying and an application must be filed on or before April 1.

Maine Property Tax Calculator Smartasset

Maine Property Tax Calculator Smartasset

Maine Homestead Exemption Act April 1st Deadline Ourkittery

Maine Homestead Exemption Act April 1st Deadline Ourkittery

Equestrian Estate For Sale In Harris County Texas The Acreage Is Setup As Ag Exempt Main House Is Spacious 4 Equestrian Estate Horse Facility Maine House

Equestrian Estate For Sale In Harris County Texas The Acreage Is Setup As Ag Exempt Main House Is Spacious 4 Equestrian Estate Horse Facility Maine House

Homestead Exemption Faqs Property Tax Mrs Property Tax Homesteading Faq

Homestead Exemption Faqs Property Tax Mrs Property Tax Homesteading Faq

Https Www Brunswickme Org Documentcenter View 3373

Horse Property For Sale In Lake County Illinois 2 Houses 1 Barn With 2 Horse Stalls And 35 Acres Of Rolling Country Lan Maine House Horse Property Property

Horse Property For Sale In Lake County Illinois 2 Houses 1 Barn With 2 Horse Stalls And 35 Acres Of Rolling Country Lan Maine House Horse Property Property

Maine Application For Maine Homestead Property Tax Exemption Download Fillable Pdf Templateroller

Maine Application For Maine Homestead Property Tax Exemption Download Fillable Pdf Templateroller

Speaker Gideon S Property Tax Relief Bill Passes House With Bipartisan Support

Speaker Gideon S Property Tax Relief Bill Passes House With Bipartisan Support

Thousands Of Mainers Will Get 104 Check In The Mail From The State No It S Not A Scam Wgme

Thousands Of Mainers Will Get 104 Check In The Mail From The State No It S Not A Scam Wgme

Https Oobmaine Com Assessing Files Oob Property Tax Assistance Program Application

112 Dixmont Road Troy Maine Real Estate Listing Mls 1444444

112 Dixmont Road Troy Maine Real Estate Listing Mls 1444444

Real Estate Taxes The Maine Homestead Exemption Penobscot Financial Advisors

Real Estate Taxes The Maine Homestead Exemption Penobscot Financial Advisors

Maine Homestead Property Tax Exemptions Gray Me

Maine Homestead Property Tax Exemptions Gray Me

Https Www Mecep Org Wp Content Uploads 2017 02 Mecep Homestead Exemption Brief Pdf

Balsam Fir Red Box Paines Incense Balsam Fir Balsam Incense

Balsam Fir Red Box Paines Incense Balsam Fir Balsam Incense

Maine Homeowner Tax Exemptions Maine Source Homes Realty Maine Source Homes Realty

Maine Homeowner Tax Exemptions Maine Source Homes Realty Maine Source Homes Realty

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home