Nj Property Tax Credit Eligibility

This mapping tool helps access eligibility using census-based criteria from the 2011-2015 and 2006-2010 American Community Surveys. This benefit is administered by the local municipality.

Nj Division Of Taxation Homestead Benefit Program How Homestead Benefits Are Calculated Tax Refund Benefit Program Business Tax

Nj Division Of Taxation Homestead Benefit Program How Homestead Benefits Are Calculated Tax Refund Benefit Program Business Tax

You were domiciled and maintained a primary residence as a homeowner or tenant in New Jersey during the tax year.

Nj property tax credit eligibility. Either census database may be used to evaluate eligibility through a transition period ending October 31 2018. You are eligible for a property tax deduction or a property tax credit only if. NJEITC is a cash-back tax credit that puts money back into the pockets of working families and individuals including the self-employed who earn low- to moderate-income.

And Your primary residence whether owned or rented was subject to property taxes that were paid either as actual property taxes or through rent. And seniors or disabled people werent eligible for. Was your principal residence a unit in a multiunit property you owned.

NJ Income Tax Property Tax DeductionCredit for Homeowners and Tenants. There are 1520 property owners in Kearny that will be receiving this credit totaling 80328347. You can read more about that here.

Annual Property Tax Deduction for Senior Citizens Disabled Persons. Eligible homeowners likely will receive. For Tax Year 2020 eligible NJ residents will receive 40 of the federal EITC.

To be eligible for the NJEITC you must. Almost 25 of eligible New Jerseyans never apply for NJEITC. See Eligibility Requirements.

Be a resident of this state who works or earns income. Homeowners and tenants who pay property taxes on a primary residence main home in New Jersey either directly or through rent may qualify for either a deduction or a refundable credit when filing an Income Tax return. You have only one domicile although you may have more than one place to live.

You can deduct your property taxes. Certain senior or blinddisabled residents who are not required to file a tax return can use the Property Tax Credit Application Form NJ-1040-HW to apply for the credit. For example if you own a and occupy one of the units as your principal residence answer Yes However if you own a condominium unit or a unit in a co-op or continuing care retirement community answer No You are not considered to be living in a multiunit property.

Eligible seniors or disabled people with New Jersey gross income of up to 100000 would get a credit worth 5 of their 2006 property taxes. Other Property Tax Benefits. Adjusted tax bills have been mailed.

For most homeowners the benefit is distributed to your municipality in the form of a credit which reduces your property taxes. To be eligible you must be a New Jersey resident and owned and occupied a home in New Jersey that was your principal residence on Oct. Unlike the regular tax bills this is a small single sheet which.

You may claim only one of the benefits. Have a qualifying child or. Residents of New Jersey that pay property tax on the home they own or rent may qualify for a refundable tax credit or a deduction on their return.

This latest increase will put an average of 882 back into taxpayers pockets. The Homestead Benefit program provides property tax relief to eligible homeowners. Other Property Tax Benefits.

The property tax deduction reduces your taxable income. 1 real estate tax bills a state treasury official said Wednesday. Eligibility requirements include age residency home ownership property tax payment history and income limits.

Based on the information provided you are eligible to claim a property tax deduction or credit for Tax Year 2020. The Kearny Finance Department has applied the Homestead Benefit Property Tax Credit to the May 2021 tax quarter for eligible property owners. Claim and be allowed or would claim and be allowed if you met the age limit a federal Earned Income Tax Credit for the same tax year.

Annual deduction of up to 250 from property taxes for homeowners 65 or older or disabled who meet certain income and residency requirements. Your gross income must be more than 20000 10000 if filing status is single or marriedCU partner filing separate return OR you and or your spousecivil union partner if filing jointly were 65 or older or blind or disabled on the last day of the tax year. Property Tax DeductionCredit Eligibility Property Tax DeductionCredit Eligibility Domicile is the place you consider your permanent home the place where you intend to return after a period of absence eg vacation business assignment educational leave.

Department of the Treasury Division of Taxation PO Box 281 Trenton NJ 08695-0281. Those making over 100000 up to 150000 could get a 25 credit. See the tax return instructions for information on calculating your deductioncredit.

The deduction will reduce the taxable income used to. NJ Income Tax Property Tax DeductionCredit for Homeowners and Tenants. The deadline to file the latest Homestead Benefit application for Tax Year 2017 was December 2 2019.

New Jersey homeowners will not receive Homestead property tax credits on their Nov. Your project may be eligible for the Program based on its location in a qualified census tract. Property Tax DeductionCredit Eligibility.

Energy Storage Tax Credits Explained Energysage

Energy Storage Tax Credits Explained Energysage

Determining Eligibility For The Solar Investment Tax Credit Geoscape Solar

Determining Eligibility For The Solar Investment Tax Credit Geoscape Solar

Calculating Your Solar Tax Credit 2021 Rec Solar

Calculating Your Solar Tax Credit 2021 Rec Solar

Federal Solar Tax Credit How Does It Work Sunpro Solar

Federal Solar Tax Credit How Does It Work Sunpro Solar

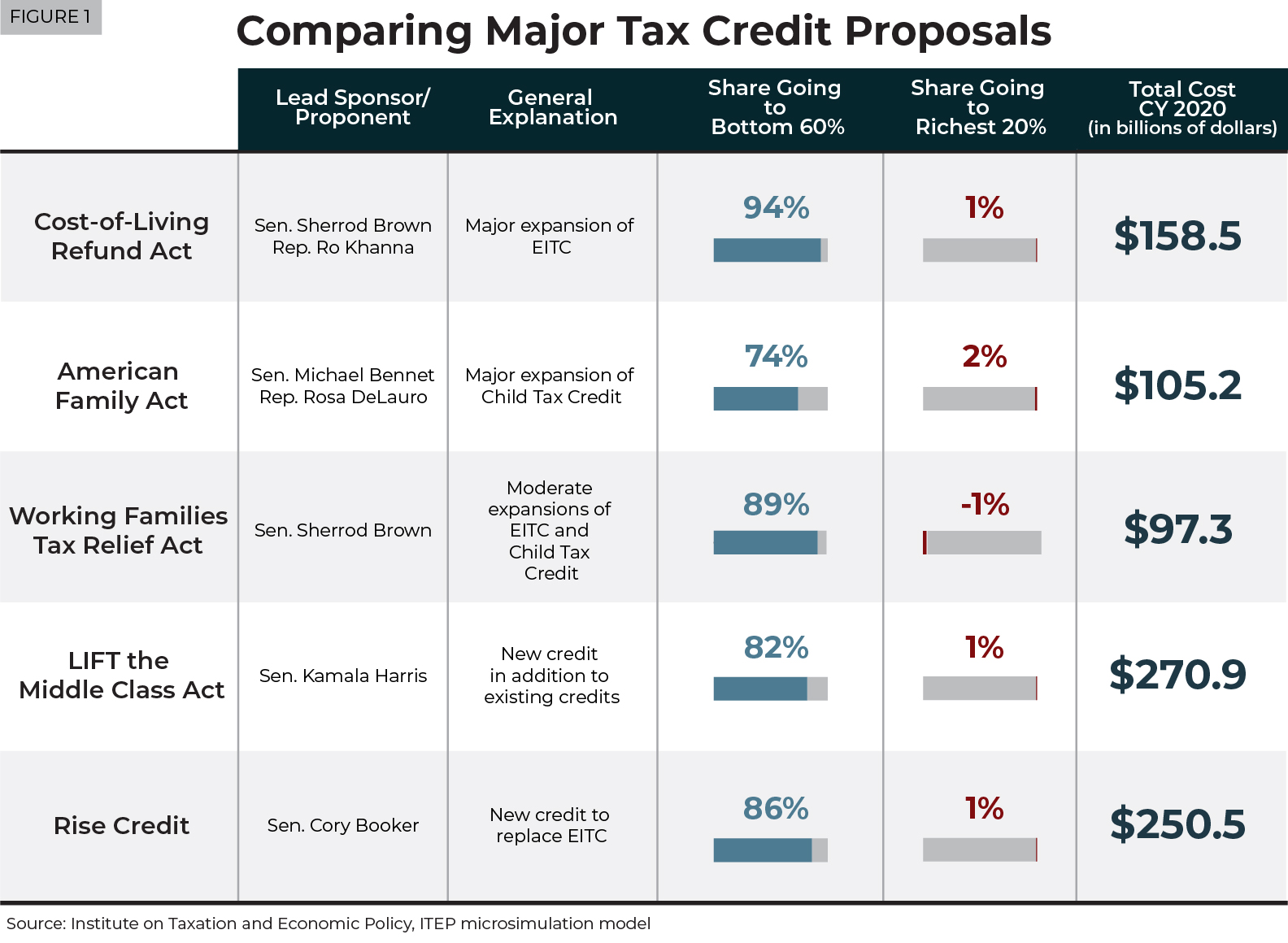

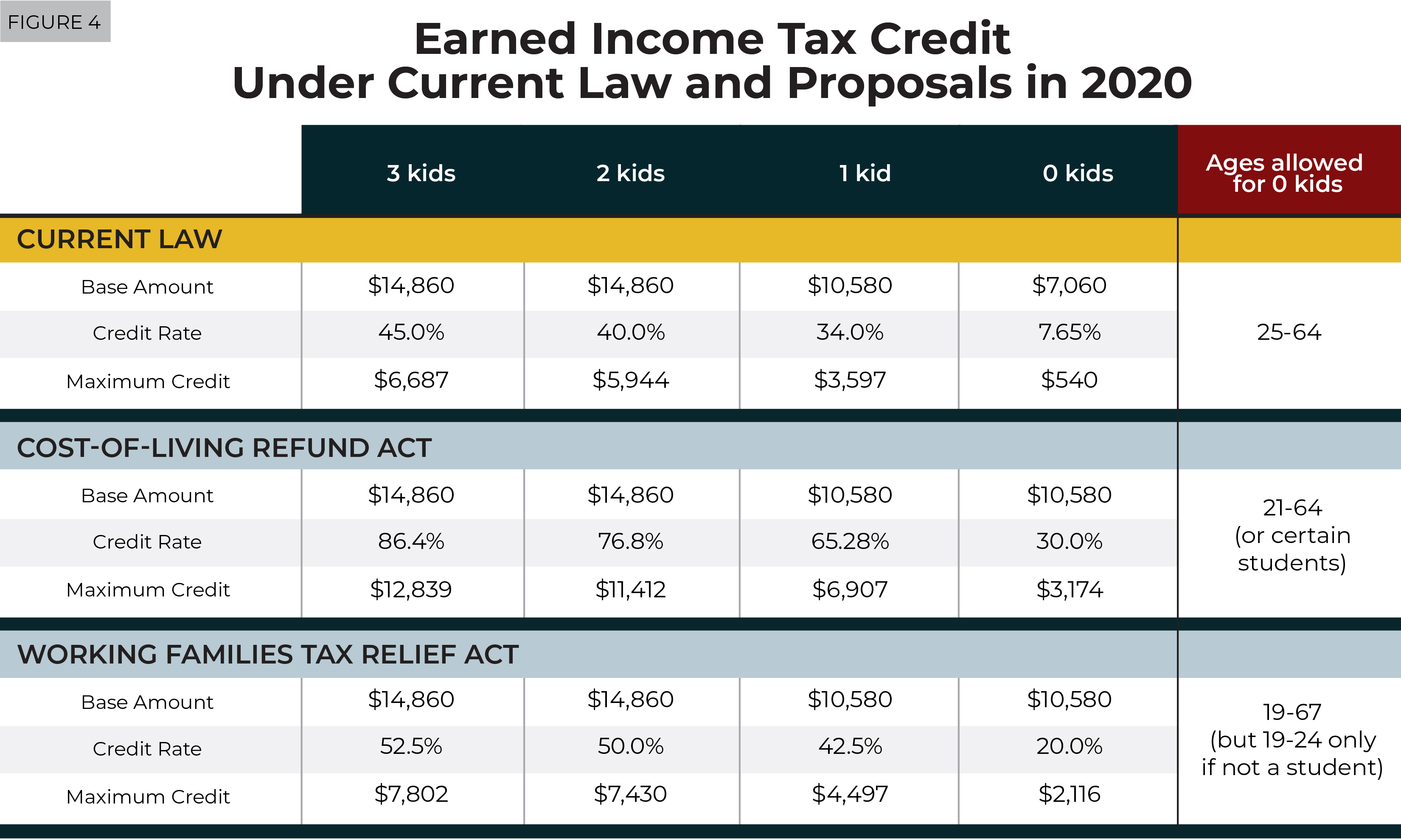

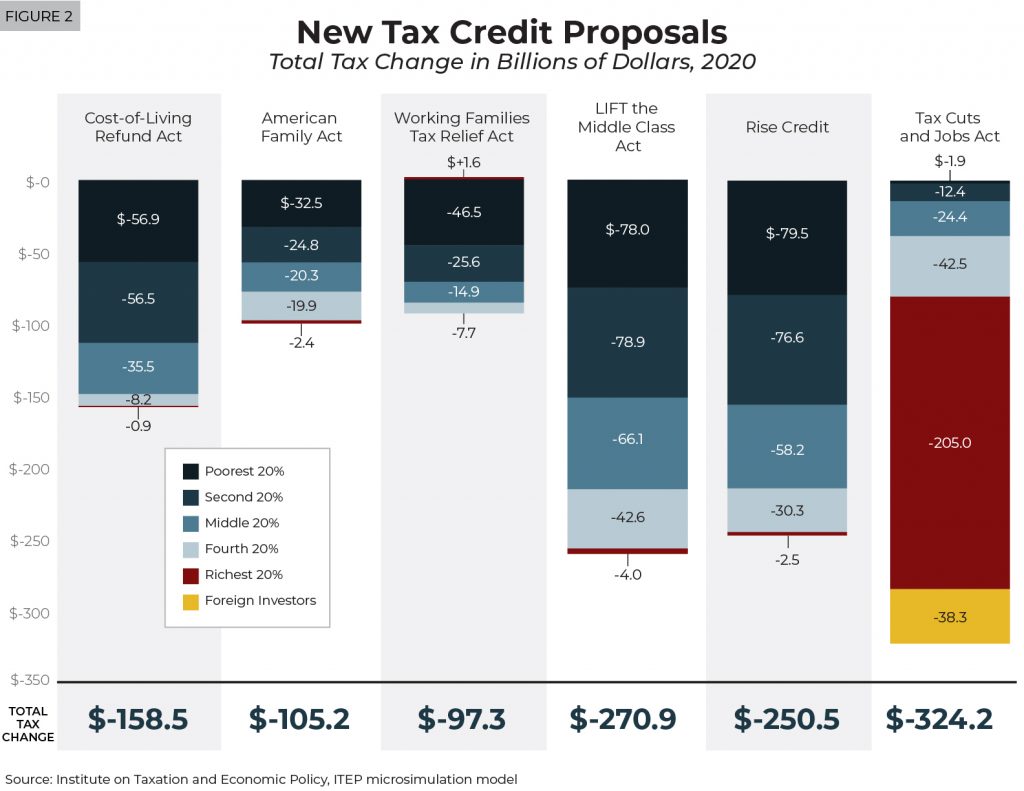

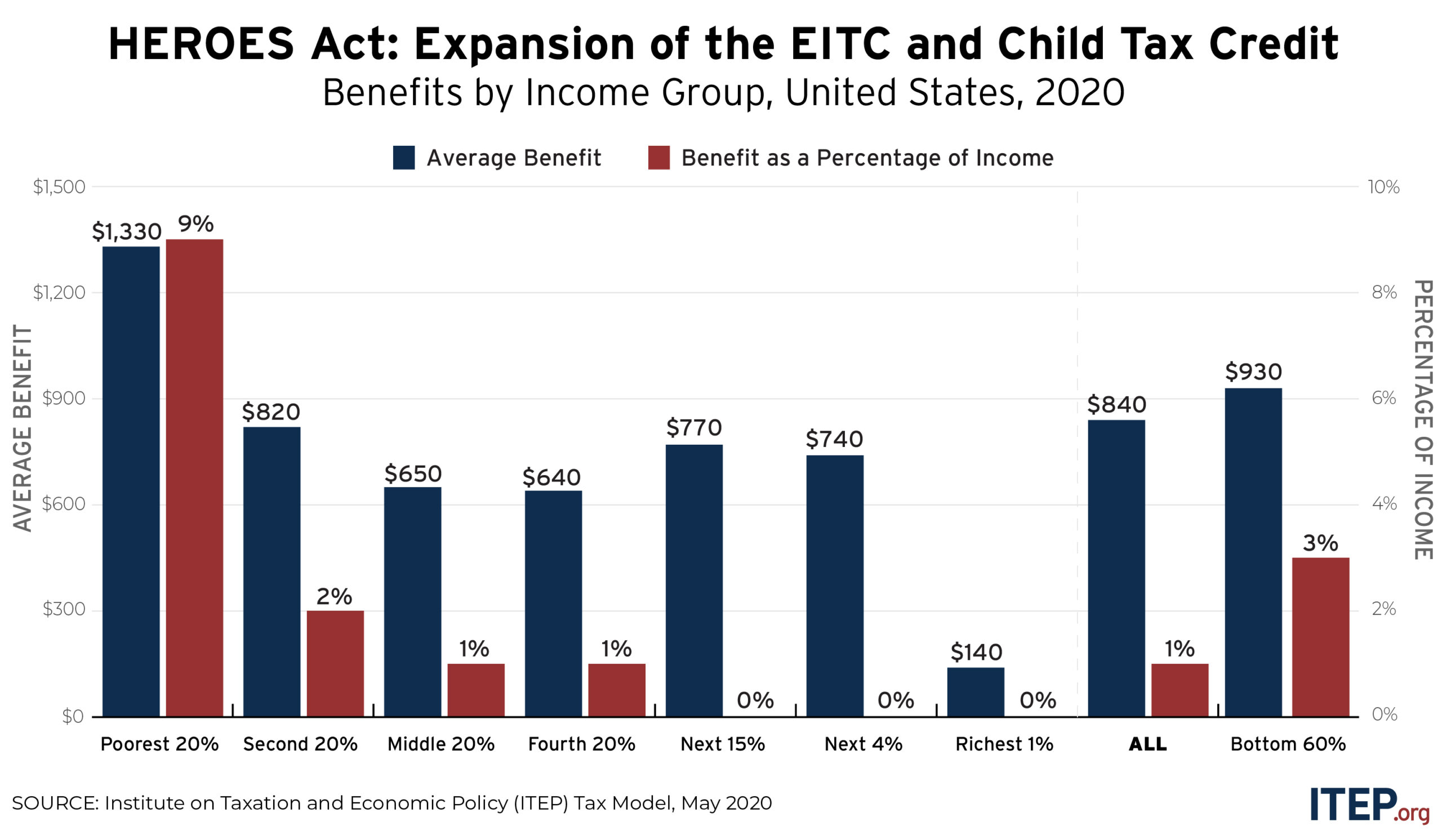

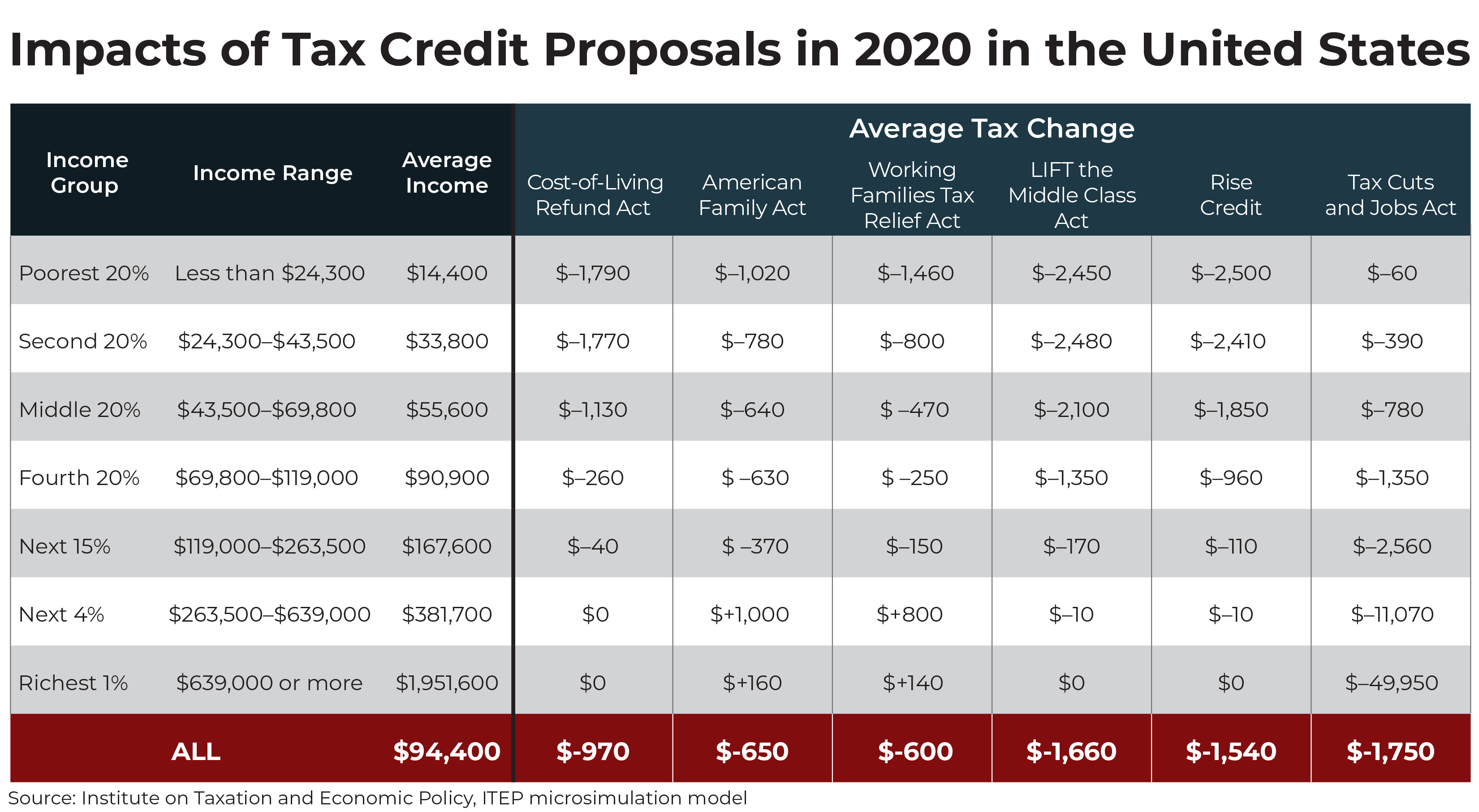

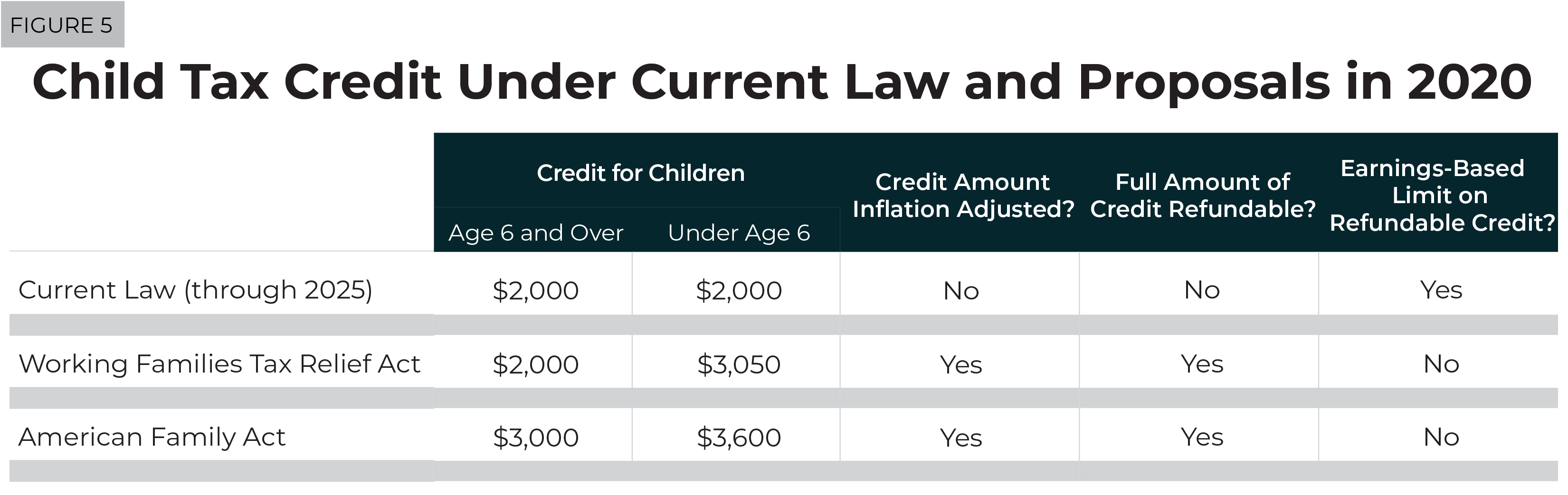

Understanding Five Major Federal Tax Credit Proposals Itep

Understanding Five Major Federal Tax Credit Proposals Itep

The Federal Geothermal Tax Credit Your Questions Answered

The Federal Geothermal Tax Credit Your Questions Answered

Finding Small Business Energy Tax Credits Constellation

Finding Small Business Energy Tax Credits Constellation

Publication 590 A 2018 Contributions To Individual Retirement Arrangements Ira Social Security Benefits Social Security Disability Benefits Social Security

Publication 590 A 2018 Contributions To Individual Retirement Arrangements Ira Social Security Benefits Social Security Disability Benefits Social Security

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Understanding Five Major Federal Tax Credit Proposals Itep

Understanding Five Major Federal Tax Credit Proposals Itep

Why The Solar Tax Credit Extension Is A Big Deal In 2020 Energysage

Why The Solar Tax Credit Extension Is A Big Deal In 2020 Energysage

New Jersey Solar Incentives Nj Solar Tax Credit Sunrun

New Jersey Solar Incentives Nj Solar Tax Credit Sunrun

Understanding Five Major Federal Tax Credit Proposals Itep

Understanding Five Major Federal Tax Credit Proposals Itep

National And State By State Estimates Of House Passed Improvements In Tax Credits For Workers And Children Itep

National And State By State Estimates Of House Passed Improvements In Tax Credits For Workers And Children Itep

Nj Property Tax Relief Program Updates Access Wealth

Nj Property Tax Relief Program Updates Access Wealth

Understanding Five Major Federal Tax Credit Proposals Itep

Understanding Five Major Federal Tax Credit Proposals Itep

The Federal Insulation Tax Credit Program Has Been Reinstated Through The End Of 2020 Profoam

Understanding Five Major Federal Tax Credit Proposals Itep

Understanding Five Major Federal Tax Credit Proposals Itep

Labels: eligibility, property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home