California Property Tax By Zip Code

How Property Taxes in California Work. And remember property taxes vary from county to county and from property to property.

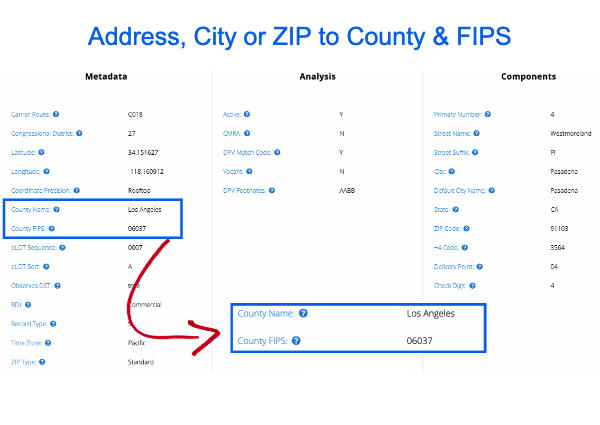

Los Angeles County Property Tax Records Los Angeles County Property Taxes Ca

Los Angeles County Property Tax Records Los Angeles County Property Taxes Ca

The tax rate given here will reflect the current rate of.

California property tax by zip code. 6 rows The tax data is broken down by zip code and additional locality information location. On top of the state sales tax there may be one or more local sales taxes as well as one or more special district taxes each of which can range between 01 percent and 1 percent. Contact a property tax professional.

California ZIP code map and California ZIP code list. The median property tax in California is 283900 per year for a home worth the median value of 38420000. The publication begins with a brief history of Proposition 13 which since 1978 has been the foundation of Californias property tax system.

Rancho Park Los Angeles 9500. The money collected is generally used to support community safety schools infrastructure and other public projects. 1788 rows Rancho California.

In that same year property taxes accounted for 46 percent of localities revenue from their own sources and 27 percent of overall local. It is designed to give readers a general understanding of Californias property tax system. Code Search Text Search.

In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller. Sellers are required to report and pay the applicable district taxes for. View all zip codes in CA or use the free zip code lookup.

Again there is no comprehensive platform for finding current property taxes by zip code. In fiscal year 2016 property taxes comprised 315 percent of total state and local tax collections in the United States more than any other source of tax revenue. The average effective property tax rate in California is 073.

California Law Code. 2021 Best ZIP Codes to Buy a House in California About this List Explore the best ZIP Codes to buy a house based on home values property taxes home ownership rates. So when you buy a home the assessed value is equal to the purchase price.

PROPERTY TAXATION 50 - 5911 DIVISION 2. California property taxes are based on the purchase price of the property. The best advice you could listen to is that of a property tax professional.

Those district tax rates range from 010 to 100. Type an address above and click Search to find the sales and use tax rate for that location. This compares well to the national average which currently sits at 107.

The median property tax on a 38420000 house is 284308 in California. Please ensure the address information you input is the address you intended. Counties in California collect an average of 074 of a propertys assesed fair market value as property tax per year.

OTHER TAXES 6001 - 61050. Property Tax Calculator - Estimate Any Homes Property Tax. California Property Tax provides an overview of property tax assessment in California.

Overview of Property Taxes. Some areas may have more than one district tax in effect. California first adopted a general state sales tax in 1933 and since that time the rate has risen to 725 percent.

Just enter the ZIP code of the location in which the purchase is made. Rancho Palos Verdes 9500. California Constitution - CONS Business and Professions Code - BPC Civil Code - CIV Code of Civil Procedure - CCP Commercial Code - COM Corporations Code - CORP Education Code - EDC Elections Code - ELEC Evidence Code - EVID Family Code - FAM.

This estimator is based on median property tax values in all of Californias counties which can vary widely. Property taxes are an important tool to help finance state and local governments. Revenue and Taxation Code - RTC GENERAL PROVISIONS.

Keep in mind that sales tax jurisdiction rules can sometimes be too complicated to describe rate areas by zip code so this calculator is provided for reference purposes only. The undersigned certify that as of June 28 2019 the internet website of the California State Board of Equalization is designed developed and maintained to be in compliance with California Government Code Sections 7405 and 11135 and the Web Content Accessibility Guidelines 21 or a subsequent version June 28 2019 published by the Web. California has one of the highest average property tax rates in the country with only nine states levying higher property taxes.

The median property tax on a 38420000 house is 403410 in the United States. Property taxes in America are collected by local governments and are usually based on the value of a property.

Read more »