Property Tax Calculator Jackson County Missouri

Tax bills are mailed once a year with. Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local option use tax information.

Jackson County Mo Property Tax Calculator Smartasset

Jackson County Mo Property Tax Calculator Smartasset

Tax Due Dates Based on the January 1 2019 ownership taxes are due and payable the following year in two equal installments.

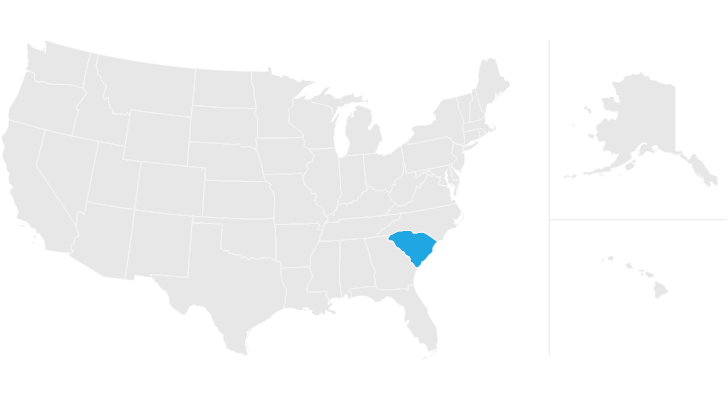

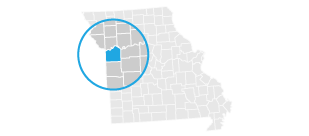

Property tax calculator jackson county missouri. Our Jackson County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Texas and across the entire United States. Jackson County has one of the highest median property taxes in the United States and is ranked 674th of the 3143 counties in order of median. Click Link Account and Pay Property Tax.

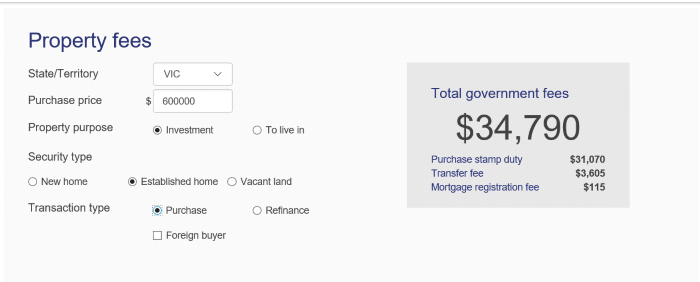

If you want to. The median property tax also known as real estate tax in Jackson County is 164700 per year based on a median home value of 12990000 and a median. Your real estate property tax is calculated by dividing the taxable value of the property by 100 and then multiplying that value by the levy rate for your area.

Jackson County collects on average 127 of a propertys assessed fair market value as property tax. The Jackson County Sales Tax is collected by the merchant on all qualifying sales made within Jackson County. King County Washington Property Tax Calculator Show 2015 Show 2016 Show 2017 Show 2018 Show 2019 Show 2020 Places Receiving the Most Value for Their Property Taxes.

The Billing History is displayed. Overview of Jackson County MO Taxes In Jackson County Missouri residents pay an average effective property tax rate of 135. That rate is the second-highest in the state after St.

Motor Vehicle Trailer ATV and Watercraft Tax Calculator. Our Jackson County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Georgia and across the entire United States. Enter the required information for your selection.

The 2020 Jackson County property tax due dates are May 10 2021 and November 10 2021. Jackson County Assessors Office Services. The taxable value of your property is listed on your tax bill.

Jackson County Courthouse 415 E 12th Street Kansas City MO 64106 Phone. Yearly median tax in Jackson County. The median property tax on a 12990000 house is 118209 in Missouri.

Insurance Information Permits Vehicle Safety Inspections. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Jackson County. 816 881 3530 Phone The Jackson County Tax Assessors Office is located in Kansas City Missouri.

Jackson County Courthouse 415 E 12th Street Kansas City MO 64106 Phone. The median property tax on a 12990000 house is 164973 in Jackson County. The median property tax in Jackson County Missouri is 1647 per year for a home worth the median value of 129900.

When the linked parcel is displayed click Im Done. The Jackson County Tax Assessor is the local official who is responsible for assessing the taxable value of all properties within Jackson County and may establish the amount of tax due on that property. The median property tax on a 12990000 house is 136395 in the United States.

You pay tax on the sale price of the unit less any trade-in or rebate. The City benefits by receiving 1 of the tax dollars collected for acting as an agent for Jackson County. 116 rows The median annual property tax in Boone County is 1754.

Real Estate Property Tax. The Jackson County Missouri sales tax is 560 consisting of 423 Missouri state sales tax and 138 Jackson County local sales taxesThe local sales tax consists of a 125 county sales tax and a 013 special district sales tax used to fund transportation districts local attractions etc. Louis County and is 042 above Missouris state average effective property tax rate of 093.

The value of the property is determined by the county assessor. Our Jackson County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Mississippi and across the entire United States. From the Dashboard select the account you want a receipt for.

The Department collects taxes when an applicant applies for title on a motor vehicle trailer all-terrain vehicle boat or outboard motor unit regardless of the purchase date. Get driving directions to this office. Download all Missouri sales tax rates by zip code.

Property Tax Jackson County personal property business and real estate tax bills can be paid at Treasury located in the lobby of City Hall.

Read more »Labels: calculator, county, missouri